Temenos SaaS

Powering massive scalability, invigorating innovation, and delivering the broadest set of banking capabilities to accelerate your bank’s growth.

Explore what SaaS delivers for your bank

Get access to the broadest set of proven banking capabilities and grow your business through Temenos SaaS.

The trusted SaaS for financial services

Our clients demand the highest standards risk, data, regulation, ESG and security management. Temenos SaaS service delivers on these stringent needs to any financial institution in the world, while providing access to broad and deep market leading banking capabilities to compose exceptional banking experiences.

Temenos Enterprise Services

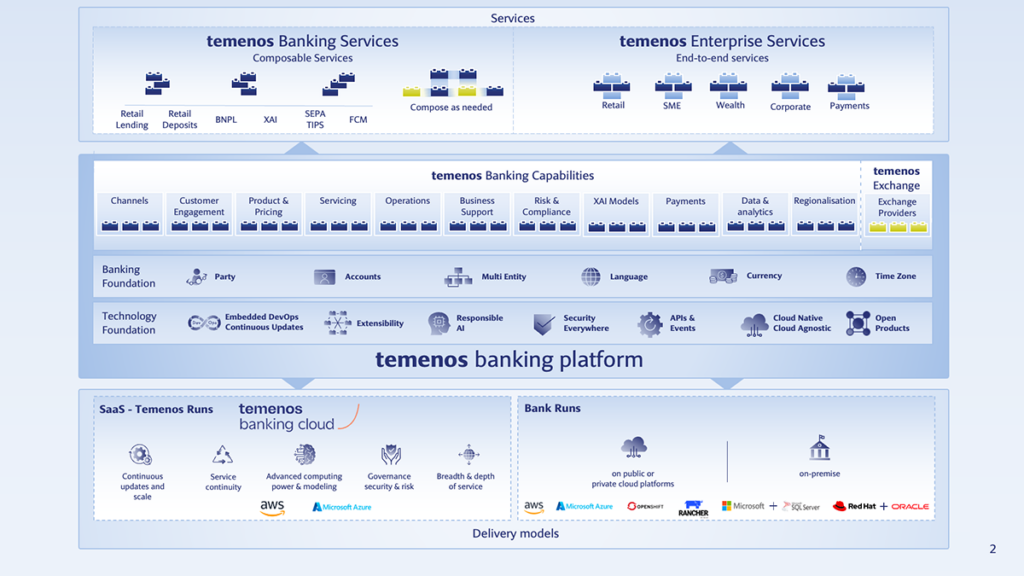

Get immediate access to pre-packaged, pre-configured, and end-to-end capabilities to support and continuously improve end-to-end banking experiences from a single service. On Temenos SaaS we currently provide Enterprise Services for Retail Banking, Business & Corporate Banking, and Wealth.

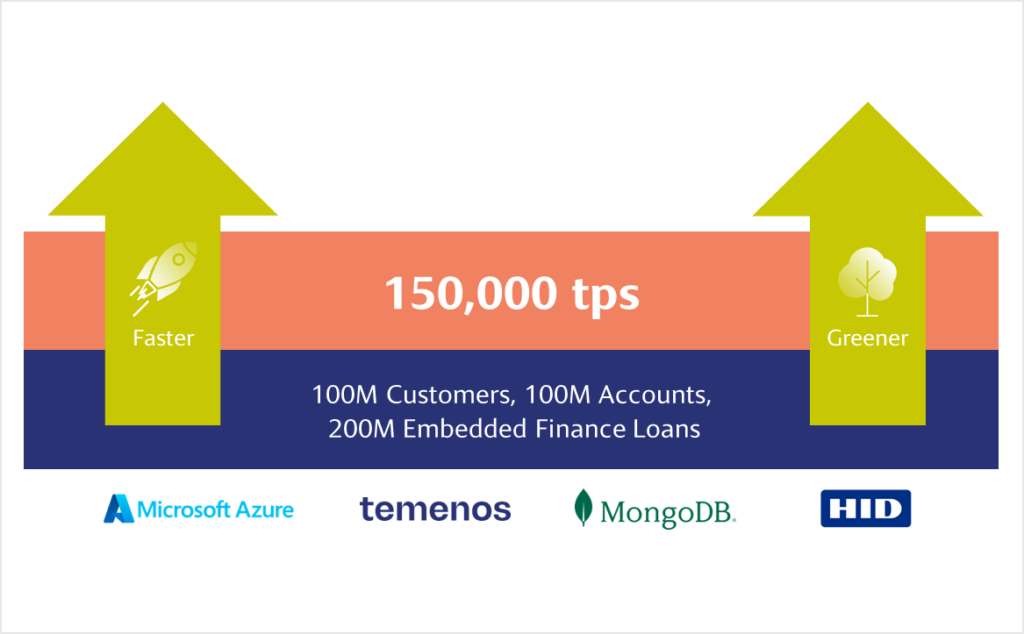

Up to 95% lower carbon footprint with SaaS banking

Temenos SaaS delivers on the growing sustainability needs of all financial institutions. Powered by hyperscalers, our clients create 92-98% annual savings in MTCO2e emissions, compared to on-premise alternatives.

Explore Temenos SaaS

Cloud partners

AWS

Temenos is an AWS Partner. Amazon Web Services (AWS) is the global cloud platform, offering over 200 fully featured services from data centers globally. Millions of customers are using AWS to lower costs, become more agile, and innovate faster.

Microsoft Azure

Microsoft commits to banking with bank-grade security, fast time to delivery, dynamic scale, and resiliency through the Azure datacenters. Get our eBook and learn about the dedicated support for the financial industry, as Azure helps banks to navigate through more than 60 regions worldwide.

Aligned to industry standards and regulation

Aligned to industry standards and global regulations. Temenos dedicates time and investment to comply with the latest standards impacting cloud banking. Learn why Alpian, Switzerland first digital private bank has chosen for the trusted SaaS of Temenos.

Massive scalability

Scale elastically to the right size, at the right time, at the right cost for your business growth. Elastic scalability, as benchmarked by Temenos, guarantees minimal environmental impact and extreme performance when demanded.

Progressive Banking Modernization supported by Temenos SaaS

For banks, it is critical to support and manage existing technology portfolios and reap the benefits of the cloud at the same time. Through the SaaS services of Temenos SaaS, our clients can access the market-leading breadth of modular capabilities across banking segments to support a progressive modernization path to the cloud.

Continuous upgrades

Temenos offers automated annual upgrades to all Temenos SaaS customers. In this video EQ Bank share the power of continuous updates and SaaS banking innovations.

Extensibility

All services and capabilities are extensible in a no-code and low code way. Our extensibility framework allows you to extend business processes, workflows, rules, data models or banking products easily and safely. Including with additional capabilities from Temenos and the Temenos Exchange.

Pre-assembled banking services

Build on our well-known banking services that are pre-composed, pre-wired and pre-tested. Launch proven SaaS banking services into your sandbox in a matter of minutes and introduce new services rapidly to your clients.

Broadest set of banking capabilities

Temenos SaaS offers the broadest set of SaaS services across multiple banking segments ranging from front and middle to back-office functions. These are built and tested by Temenos and formed from granular banking capabilities that are headless and open to enable business agility.

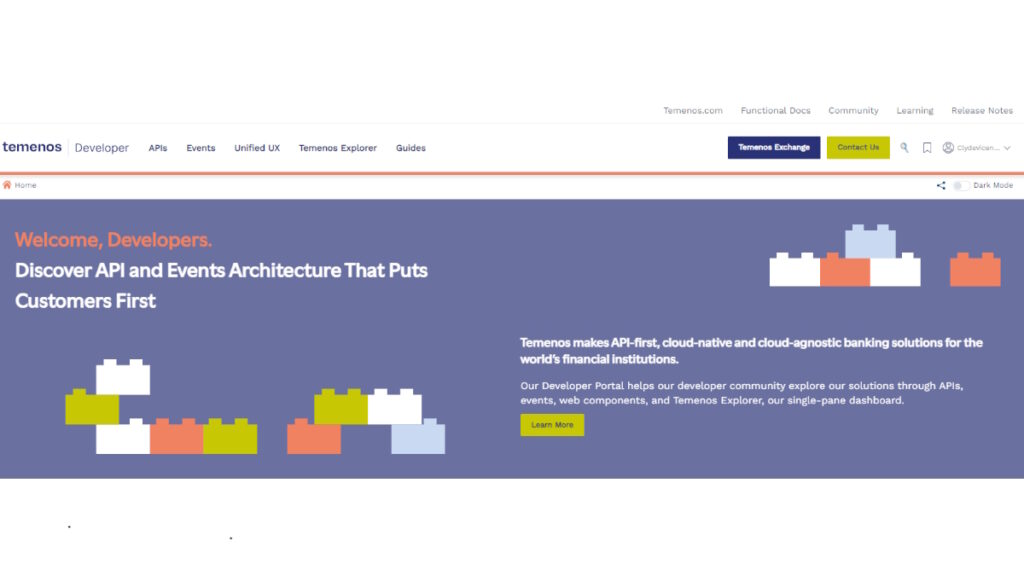

Developer community

Join the Temenos Community – Base Camp to connect with our product experts, and other bank developers to share ideas and explore innovation.

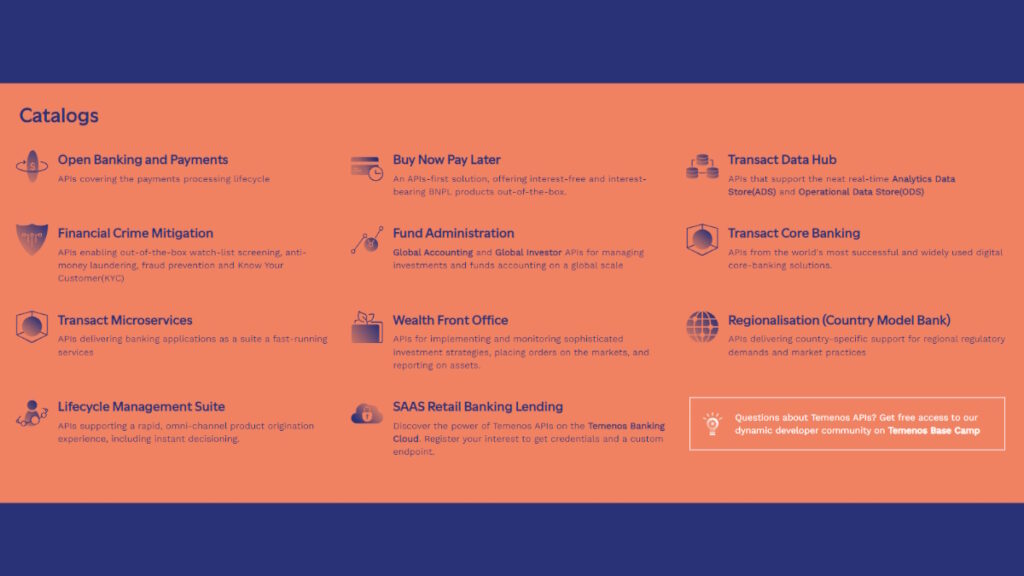

Access the API catalogue

Discover the power of our APIs on Temenos SaaS, providing, flexible functionality for leading financial services. Get instant access to our APIs nd select from a wide range of endpoints to accelerate innovation across our banking services.

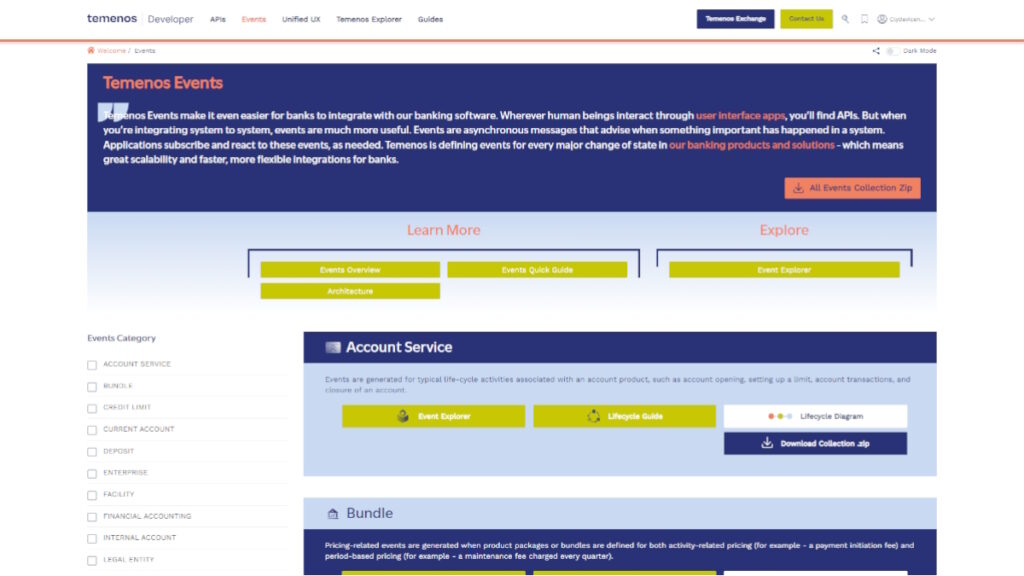

Temenos Events

Temenos Events make it even easier for banks to integrate with our banking software. We define events for every major change of state in our SaaS banking products and solutions – which means great scalability and faster, more flexible integrations for you.

Temenos Exchange

Our open banking marketplace offers an extensive selection of pre-integrated and certified services that help banks to accelerate the creation of new offerings.

Frequently Asked Questions

Temenos SaaS is the next generation in SaaS for financial services, . building on over 10 years of cloud leadership, $1 billion in R&D investment and the experience of over 700 SaaS customers ranging from global banks to over 70 challengers. It combines the industry’s most complete banking services, covering all segments and all geographies, with a sandbox for fast innovation and Temenos Exchange for Fintech collaboration. The service is powered by A to drive banks’ business growth and accelerates time to market. With Temenos SaaS, banks now have the power to self-provision always-on SaaS banking services and scale instantly and securely while dramatically reducing the cost of operations to 10% of legacy systems.

Temenos SaaS helps banks utilize the Temenos Banking Platform through an end-to-end SaaS offering. The Temenos Banking Platform offers over 60 independently deployable and upgradeable banking capabilities, 1,800+ prebuilt banking processes packaged for Retail, Business, and Corporate Banking, and Wealth Management that can be used out of the box, covering the full value chain of banking – front, middle, and back office. With Temenos SaaS, we deliver SaaS services that enable banks to deploy pre-configured solutions easily and quickly per segment, supporting new business opportunities that require seamless scalability, hardened resilience, leading security, and solid governance.

SaaS enables banks to use innovative and proven banking solutions, delivered as-a-service, to reduce and remove the management and maintenance of technology, and provide access to unrivalled security, performance and scalability offered by Temenos and our hyperscalers. Combined with far-reaching efficiencies to manage total cost of ownership and to reach important ESG goals, currently 700+ banks are building their future on Temenos SaaS.

Temenos SaaS is for all banks of all sizes across all geographies. It offers instant access to the industry’s leading front-to-back SaaS banking services with localized functionality from over 150 countries, covering all banking segments including retail banks, corporate banks, business banks, challengers, private banks and wealth managers, credit unions, and Fund administrators.

A free 21-day trial is available Temenos SaaS Sandbox and to discover our newly released solutions. Within this period you’ll have access to Temenos cloud services and/or our software product(s) via a web-enabled sandbox. Register your interest on this page to access the Sandbox.

Find out more

about Temenos SaaS for your SaaS needs.

Temenos is a great partner for us to help that rapid cycle of products iteration, gaining insights and be able to continue to deliver solutions that solve real pain points for consumers.”

Colin Walsh

Founder and CEO, Varo

“We realized that moving to a cloud-based core banking solution would offer multiple advantages. First, it would mean a lower cost of ownership. More than this, a cloud platform would mean that we relied less on internal resources to manage and maintain infrastructure and applications. In addition, we felt the scalability of cloud would facilitate expansion into new markets and faster launch of new products.”

Richard Marshall

Head of IT at ANSA Merchant Bank

“Temenos SaaS allowed Virgin Money Australia to focus time and energy on the areas where we need to differentiate”

Chris Sozou

General Manager PP&A at Virgin Money Australia

“We realized that a cloud-first model would unlock benefits in terms of scalability, reliability, and security. Plus, we knew the cloud would help with product development and give us more time to think about digital innovation rather than infrastructure management.”

Daniel Broten

Chief Technology Officer at EQ Bank

We selected Temenos as our platform partner because of their hyper-efficient and secure open-cloud capabilities, which align with and support our goals to provide exceptional, scalable solutions to our customers and partners. This is a critical component of our mission to seamlessly connect people to their money, both directly through our digital bank and products like GO2bank, and through our valued partners.”

Dan Henry

President and CEO, Green Dot

With Temenos we have efficiently built WeLab Bank from scratch, free from any legacies, with innovative features that proactively help customers to take control of their money and their financial journey.”

Adrian Tse

CEO, WeLab

See more success stories

Progressive Banking Modernization Webinar

Introducing Progressive Banking Modernization – Why it makes a difference to remain successful.

Temenos Highwater Benchmark

As banks are expected to seamlessly perform huge transaction volumes around the clock, the Temenos Banking Platform proves it’s massive scalability once again.

Leveraging SaaS to innovate

In this webinar, join EQ Bank from Canada as they tell us about how they began their SaaS journey, their growth in the Canadian market since their launch and their plans to scale in the future.

SaaS Modernization for Growth, Costs, Trust and ESG

By leveraging Cloud and SaaS capabilities, banks embrace a whole new world of opportunities otherwise inaccessible to them, seamlessly delivering mission critical banking activities and navigating the challenges they face in a competitive market space.

Byte-sized banking: Can banks create a true ecosystem with embedded finance?

As payments, technology and e-commerce disruptors compete against banks with embedded finance solutions, banks must harness emerging technologies to create their own digital ecosystems and remain at the center of the banking universe.

Maximising Efficiency with Cloud and SaaS Banking Software

Learn about the benefits of Cloud and SaaS solutions for financial institutions in our latest blog post from Temenos’ Chief Architect.