Corporate & Commercial

Banking

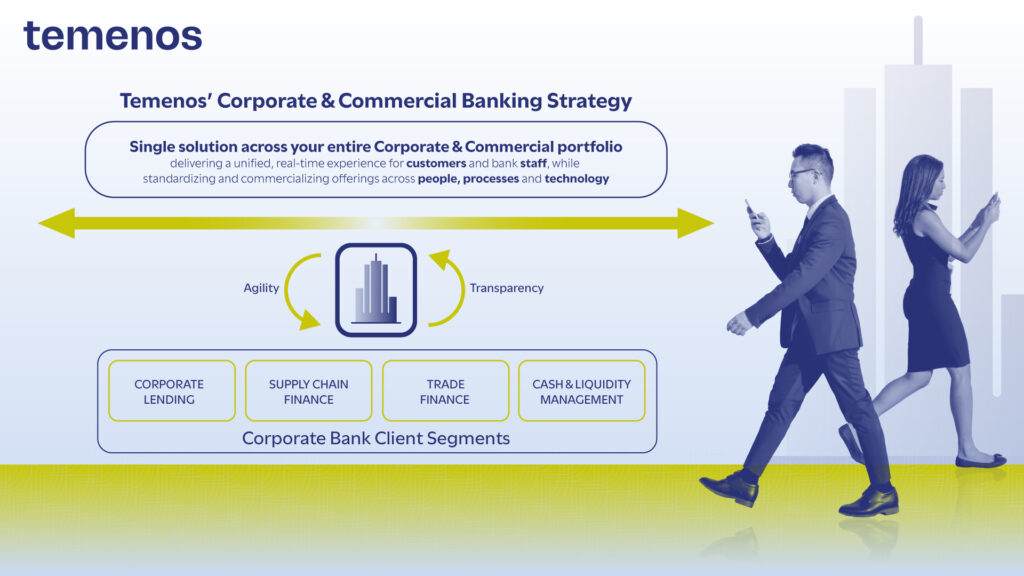

Deliver a unified, real-time experience for customers and bank staff, while standardizing and commercializing offerings across people, processes and technology with a single solution across your entire corporate and commercial portfolio.

Trusted corporate banking capabilities

Empower your corporate banking with our comprehensive solution featuring an integrated core banking system and deployable components, including Corporate Lending, Supply Chain Finance, Trade Finance, and Cash & Liquidity Management. This unified solution provides you with the tools to quickly introduce new products and services, increase operating margins, and reduce capital allocations—freeing up resources and investment for greater innovation and improved customer service.

Designed to meet the needs of corporate businesses of all sizes, our solution enables you to stay ahead of evolving corporate sector expectations by offering more agile, cross-product solutions with integrated pricing. Built around an integrated core banking system with deployable components that cover all areas of corporate banking, Temenos Corporate & Commercial Banking enables seamless transaction initiation across trade finance, lending, payments, supply chain finance, and cash sweeping. It also addresses the critical need for automation, enabling banks to create tailored services while reducing operational costs and risks, ensuring greater efficiency.

Measurable success

2x

more digital products launched – corporate banks on Temenos Transact*

17%

less time spent on admin tasks – corporate banks on Temenos Analytics*

44%

more of IT spend on growth and innovation

*Comparison from Temenos CEO Navigator between banks live with Temenos Enterprise Solutions and Services and those who are not.

Explore the solution overview

to learn more about our integrated solution for corporate banking.

During our selection process, Temenos demonstrated a clear understanding of our business objectives and how to achieve these with its proven technology. With the flexibility of the new platform, we will be able to respond to market needs and create new value-added products and services as we grow.”

Eblein Frangie

CEO, Finabank

The new platform sets us free, opening up new possibilities to improve the service to customers and deliver outstanding digital experiences. This is a big step forward in our strategy to be the leader in digital banking.”

Margus Simson

Chief Digital Office, Komerční banka

Disruptive technologies are having a profound impact on clients and their relationships with their banking counterparties. Clients want instantaneous services and faster payments, for instance.”

Patrick Nolan,

Global Head of Corporate Banking

HSBC

See more success stories

Supply Chain Finance

Banks can benefit from new or improved revenue streams, attract new clients and optimize capital usage through short-term, self-liquidating transactions. With Temenos Supply Chain Finance, banks can facilitate early payments to suppliers and extend payment terms for buyers, supporting liquidity needs, improving cash flow and working capital efficiency with real-time visibility and control across the entire supply chain.

Corporate lending

Unify your corporate lending operations by consolidating corporate and commercial loan portfolios through standardized workflows and templates to drive faster decisions and time to market for new products. With Temenos Corporate Lending, banks can efficiently manage a wide range of loan types, from high-volume bilateral loans to complex corporate loans, lowering total cost of ownership while enhancing their corporate customer experience.

Trade finance

Temenos Trade Finance is designed to support banks and their clients in managing and automating trade finance operations throughout their entire life cycle, including Letters of Credit, Guarantees, and Documentary Collections. By streamlining processes and reducing both risk and operational costs, it enhances processing efficiency while providing security, flexibility, and scalability to meet the latest market standards.

Cash and liquidty management

Temenos Cash & Liquidity Management helps banks optimize cash flow and concentrate liquidity through advanced pooling structures. It supports payables, receivables and liquidity management operations, including multi-hybrid cash pools offering notional, physical, balance netting, and virtual account structures. By automating treasury processes, it frees skilled staff from manual, repetitive tasks, enhancing operational efficiency.

Next-generation payments

Accelerate growth, increase process efficiencies, and enhance service innovations with SaaS-first, next-generation payments technology. Our solution capabilities cover the complete payments lifecycle from order intake to clearing and settlement. Our solutions are designed to work successfully both separately or together, via SaaS, cloud, or on-premise, providing the flexibility to tailor payment solutions to suit simple, complex and diverse needs.

Video: Why without technology, there would be no banks

Hear from Hamilton Reserve Bank and Temenos experts on how to meet the growing expectation of customers seeking a closer link between banking and technology, as corporate clients demand more personalization, more choice and more sustainability in their products.

Success Story: Allied Irish Banks (AIB)

AIB chose Temenos because of the referenceability of its core banking in the marketplace, the functionality, and the very rich and very flexible product capability that would work to bridge any gaps. The first phase of the 4 years modernization project is related to the business and corporate accounting.

Article: Corporate Banking Modernization – Why Now?

Exciting developments are underway in the world of corporate banking. Discover how modernization is transforming this critical sector, enhancing operational efficiencies, and leveraging advanced technologies. Read the full article and gain insights into the transformative journey of corporate banking.