End-to-End Business Banking

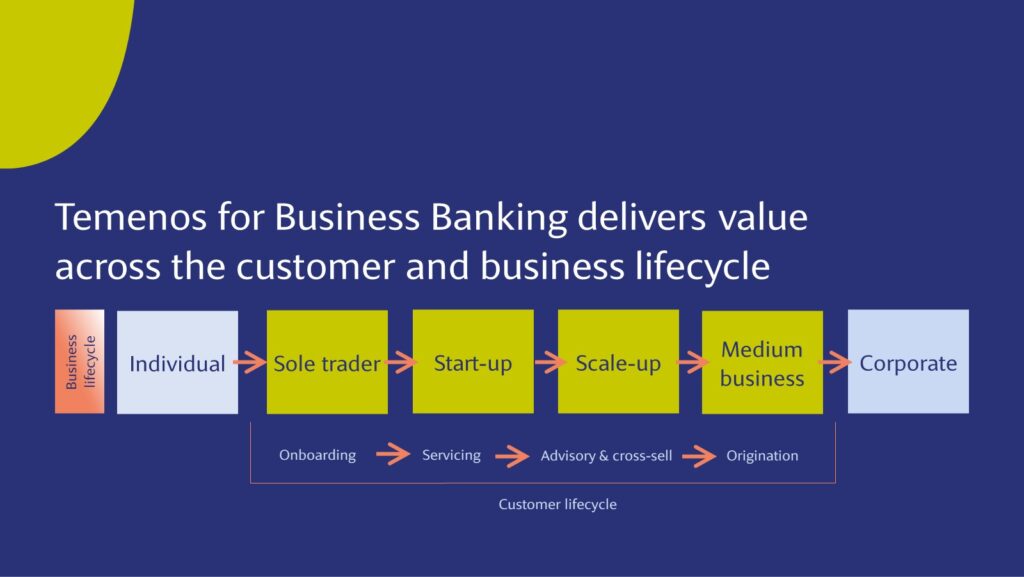

A cloud-first, cloud-agnostic front to back solution that enables financial institutions to deliver tangible value to small and medium businesses from onboarding to origination, digital and face to face servicing, advisory and cross-sell for accounts, lending and asset finance.

Connected Business Banking

A componentized front to back solution for business or universal banks to gain fast time-to-market, increase revenue, optimize conversions and innovate at speed. Deliver seamless customer experiences across channels while delivering propositions to small and medium business customers.

Specialized solutions

Temenos Smart Banking Advisor

Put the power back into the hands of small and medium business owners with access to smart business banking. Enable growth with optimized cash flow management, tailored services and personalized recommendations powered by data, analytics and AI.

Today’s customers expect simple and consistent omnichannel banking experiences. Purpose-built for business, Temenos Business Banking provides a complete front-to-back solution to deliver engaging customer journeys that immerse businesses in a unique buying experience with first-class services. Optimize conversions, improve customer satisfaction and long-term loyalty, and empower financial institutions to go beyond banking and innovate at speed.

Measurable success

62%

Improvement in accounts opened online – $24B AUM bank with Temenos onboarding

$ 2M /mo

in new cross-sell revenue – $2.2B credit union

20%

average time reduction on admin tasks by front office staff using Temenos Origination

*Comparison from Temenos Value Benchmark between banks live with Temenos Enterprise Solutions and Services and those who are not.

Temenos Business Banking Demo

This 5-minute wow demo provides customers and prospects with an overview of the value and benefits of Temenos Business Banking. In this persona-based demo, Teya Wilson, Head of Business Banking at Finity Bank, has the challenge of providing a comprehensive end-to-end solution that could be deployed and configured at speed while covering the entire business banking lifecycle and providing innovative solutions based on the latest technologies. Teya explores setting up an online business account, onboarding their business via the website and more, by showcasing our end-to-end business banking demo.

Frequently asked questions

Banks generate $850 billion in revenue, around $14 billion in accounting profit and $10 billion per year in economic gain from the small and medium business sector. Nearly $92 billion additional revenue in Embedded Finance and a sector set to grow by approximately 7% growth annually over the next seven years, this sector is one of the largest, lowest-risk profit pools in the entire industry.

Source: McKinsey & Company, Accenture, Oliver Wyman

One of the key challenges for businesses is funding, where financial institutions have not been able to lend due to a lack of information, the process was too slow, or the business needs were sometimes outside the bank’s risk tolerance. Considered high-risk with little potential to grow, small businesses have also been turned away from many banks due to onerous onboarding processes. Additionally, as businesses have diverse and complex needs, banks have struggled to service this market segment offering them a blend of retail and corporate solutions that do not fit their evolving needs.

Businesses are hungry for advice and insight, but financial institutions don’t always have the specialist knowledge to be able to help the business to start and grow:

Building a full business credit report for a small to medium business is a manual and time consuming, with 2 to 8 hours average time for credit file preparation*

On a scale of 1 – 10, businesses do not trust big banks to act in their best interests, with only a 2.26 rating of trust extended to their current primary lender*

Increased competition from tech-first Fintech and non-bank entrants, 43-32% of small to medium businesses are considering switching to a challenger bank or Fintech*

* Source: Bain & Co, Judo Bank, Revolut Business, Deloitte

Small and medium businesses are often faced with challenges such as:

• Time: not having enough time

• Growth: need for knowledge to define the best strategy to grow

• Cashflow: and get access to resources as they need them

Achieving this change requires institutions to stop selling banking and start selling embedded finance. This translates into embedding their products into a small business’s workflow and enhancing their data analytics offering with third-party data. To be game-changing requires delivering intelligent finance through AI and machine learning (ML). Financial institutions able to apply AI/ML at scale to personalize their services and deliver prescriptive analytics will realize a sustainable competitive advantage:

• Think beyond banking

• Digitalize key processes

• Partner with small business specialists

• Implement agile, modern and open payments infrastructure

Find out more

about end-to-end Business Banking with Temenos

We wanted to find a vendor that was as committed to innovation as we are – and Temenos delivered exactly that.

Azfar Karimuddin

Vice President of Information Services

The platform offered all the core functionality we needed to move to market quickly. We also drew confidence from the fact that many leading Asian banks use Temenos solutions, while their international expertise will be especially useful as we scale operations beyond Singapore.

Mr. Kuang Mi

CEO of Lianqi Cloud, and the Head of IT at Greenland

Going live so quickly was a great achievement, especially with the disruption caused by the pandemic. Temenos managed the entire process remotely and communicated exceptionally well throughout the implementation. Normally, we would expect a new solution to need some reworking and fine-tuning following the go-live, but with Temenos everything worked from day one.

Ajith Nayak

Head of Operations

AI Ain Finance

Our enhanced services and online experience have led to excellent client feedback. We have seen a 100% increase in our satisfaction ratings since Temenos was installed, with clients valuing the greater flexibility that we now offer. While banking online in a totally secured environment, self-directed customer transactions including internal transfers can be achieved in minutes.”

Claire Robinson

Senior Compliance and Risk Officer, Hamilton

See more success stories

Enable business growth through our Asset Financing solution

Give your business customers the flexibility they need to finance their business assets. Enable growth & business expansion by defining & creating tailored Asset Finance Products such as Hire Purchase, Finance Lease or Operating lease while ensuring an up to date compliance and regulatory framework.

Personalize business services

Deliver modern, convenient business services across all channels by leveraging data and AI for a frictionless and hyper-personalized customer experience with Temenos Infinity Business Banking. Purpose-built for business, financial intuitions can accelerate their digital business transformation initiatives, increase agility and speed to market to better serve the entire customer lifecycle and go beyond banking from a single, cloud-native and core-agnostic platform.

Create smart customer journeys

Turn prospects into customers by creating a consistent, human banking experience across all channels, from seamless onboarding to streamlined origination. A comprehensive, SaaS-first solution with the ability to leverage the best-of-breed partner ecosystem and integrated external data sources helps banks deliver differentiated servicing and product offers while gaining trust

Cutting edge core banking

Operate on next-generation cloud-native and cloud-agnostic banking technology, enabling financial institutions to innovate in minutes with new products drawn from multiple sectors and launch in days while continuing to produce relevant services and offers to improve customer acquisition and loyalty. Temenos Transact is a customer-centric core banking solution with an extensive and rich set of business banking capabilities.

Next-generation payments

Accelerate business growth, increase process efficiencies, and enhance service innovations with SaaS-first, next-generation payments technology. Our solution capabilities cover the complete payments lifecycle from order intake to clearing and settlement. These solutions are designed to work successfully both separately or together, via SaaS, cloud, or on-premise, providing the flexibility to tailor payment solutions to suit simple, complex and diverse needs of business customers.

AI-driven smart banking advice

Become your customer’s trusted partner by unlocking business growth, managing risk and driving engagement of small and medium business customers throughout their business with Temenos Smart Banking Advisor. Powered by AI to offer personalized business banking advice, tailored services, rich insights and process automation, it provides intelligent insights, AI enriched simulation, and automated fulfilment that drives funding innovation and cash optimization.

Harness the power of data and analytics

Financial institutions face multiple challenges from digital evolution, low-interest-rate environments, changing customer behaviors, high operating costs, and the erosion of profits margins. Temenos’s comprehensive Reporting, Analytics, and Business Intelligence solution allow banks to overcome these challenges and make smarter decisions, improve efficiencies, enable business agility, drive innovation and ultimately beat the competition.

Business Banking Innovations

Explore our latest and upcoming innovations in platform and technology, retail and business banking, wealth management and payments.

Temenos Recognized as a Leader in Digital Banking Engagement Report

Temenos is a good choice for banks looking for state-of-the-art business capabilities, forward-looking architecture, and a vendor willing to co-design with them,’ states the report

IBS Recognizes Temenos as the #1 Best-Selling Software in Nine Categories

Temenos’ cloud-native, AI-powered technology was recognized for leadership in nine categories, up from six last year

Six touchpoints to create emotional SME connections

Explore ways that banks can start to better support SMEs across multiple touchpoints, all through the lens of a business owner’s journey from idea to enterprise.