Leveraging Insights in Digital Banking

Engage with customers on a new level, offering them a brighter financial future. Put personal finance management at the heart of digital banking, giving smart and personalized recommendations and advice.

Features

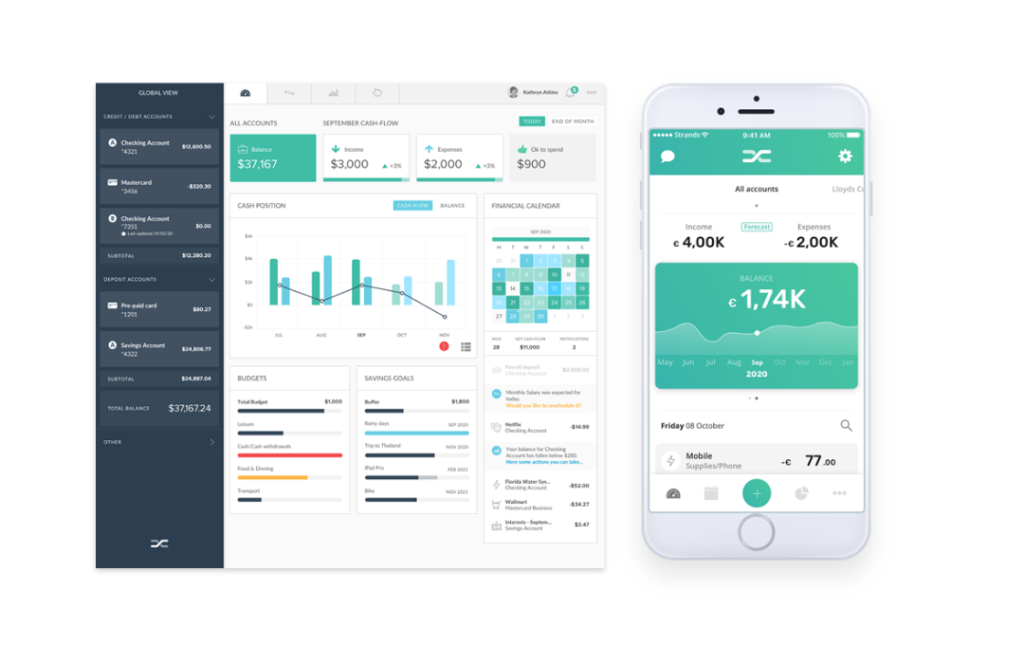

Users can easily create a personalized 360° “bird’s eye view” over their personal finances.

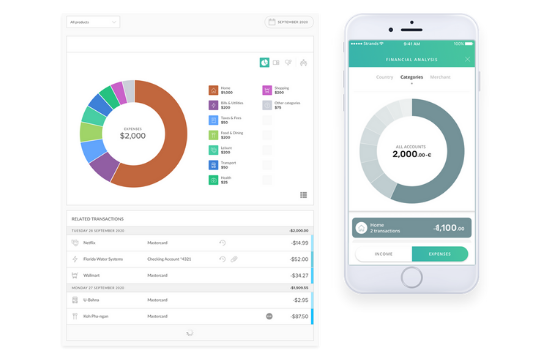

This feature is the foundation of PFM: all historical transactions are automatically categorized and then organized into interactive visualizations. Tracking income and expenses is more fun when using a variety of data infographics such as a planet, doughnut, bubble chart, or treemap. The view can be customized by period, account and category lThe Financial Analysis widget shows the user’s expenses and income in the selected time range and accounts, according to categories and sub categories. It displays the overall breakdown of spending and income into main and subcategories. Keep customers updated with real time information thanks to our categorisation engine.

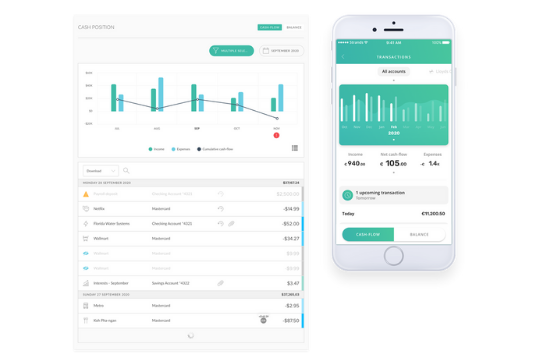

Provides a visual analysis of cash flow over time by tracking historic, actual and forecasted inflows & outflows. An account selector gives users a range of analysis options. To help with planning ahead, this widget also provides forward-looking insights based on forecasted spending patterns.

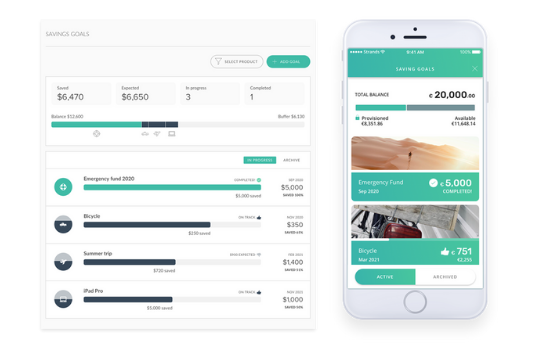

Allow users to save money without effort. From perfect holidays to long term savings, this feature helps users to reach their financial goals.

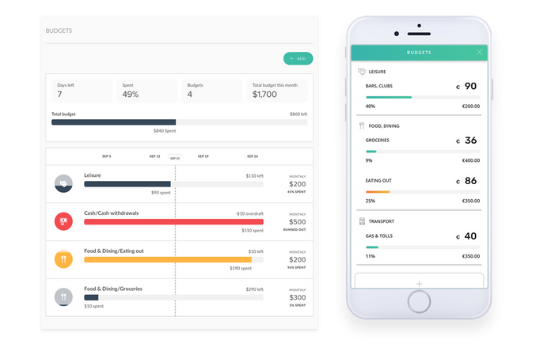

Users can create monthly budgets for all their spending categories and sub-categories. All budgets are tracked, updated automatically and visually illustrated in a bar chart. Budget setting is facilitated by automatic budget amount suggestion based on past spending patterns

The budgeting module makes users aware of their current month discretionary spending, and helps them to stay within limits. Budgets are shown in a bar. The bar colour indicates the progress of the budget.

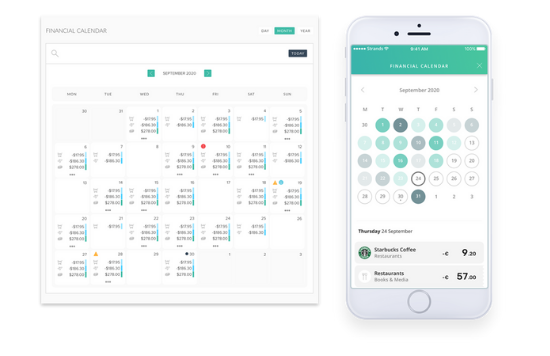

An alternative visualization of past and upcoming income & expenses in a calendar layout. Clicking on a day shows a clear breakdown of all its transactions & events. The status of daily cash flows are shown via smart heat map. A built-in pattern recogniAn alternative visualization of past and upcoming income & expenses in a calendar layout. Clicking on a day shows a clear breakdown of all its transactions & events. A built-in pattern recognizer enables forecasting of upcoming expenses & account balances, so users can stay on top of their payments.zer enables forecasting of upcoming expenses & account balances, so users can stay on top of their monthly payments. The widget is designed to work with electronic billing, direct debit orders & payment systems.

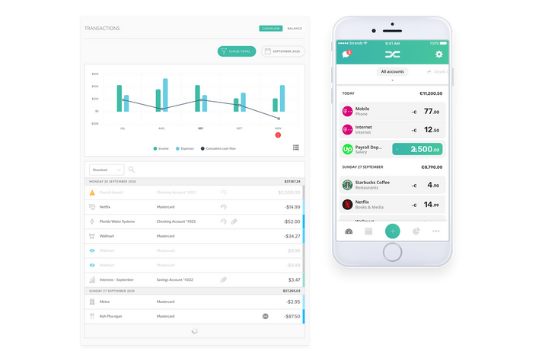

Users can view, filter, search, rename, split and add tags to their transactions. Users can also create their own categories and rules to further personalize and fine-tune the categorization of their transactions.

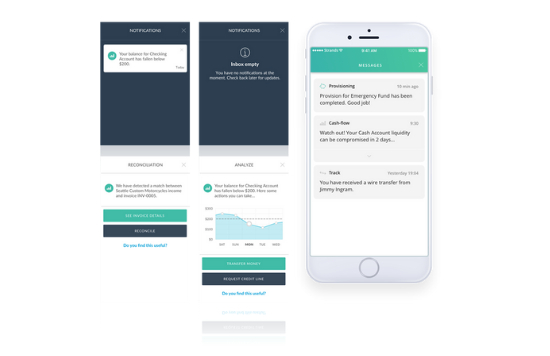

Users can set personalized alerts to stay up to date with their personal finances. Alerts can be set for events or widget activity including cash flow, balance, budgets, transactions, Safe-to-Spend, or Financial Calendar. Various delivery channels can be used such as email, online and mobile (via SMS or push notifications).