Integrated Data Output

Design, customize, and generate your own report, from multiple data sources. Are you looking for an easy solution to design and generate customized reports? We have the right solution for you. Our Output Management solution is a powerful free-form report designing business tool, to create custom template layouts at will. The solution provides customers with the capability of designing, formatting, editing, and generating reports and templates quickly and easily, interfacing with Microsoft Office. This is possible through our partnership with Windward, a provider of template design tools.

Features

Our state-of-the-art solution allows you to create report templates in Microsoft Office. The interface permits you to:

- Select only the data you wish to view on your report with simple drag and drop actions, using the XML file generated as data source.

- Add calculations and text fields

- Repeat parts and include conditional parts of the document

- Sort the data in any desired manner

- I-DO design tool comes as an Office plugin, it adds a ribbon to Word, Excel, PowerPoint…

- I-DO design tool is user friendly: no need for experienced developers to design an output

IMS IDO Rules Engine will provide:

- The ability to set parametric conditions on each report

- The ability to print locally in each branch

- The ability to set rule-based printing actions by report, including but not limited to:

- Method of printing

- Ability to invoke more than one report based on the data provided by T24

- Ability to group more than one output file from T24 into one document to be printed

- The ability to hold or suspend the printing of a document based on details available within the data provided

- Maintaining document security and regulatory compliance by implementing rules that can prevent confidential documents from being printed or inform the user when they are printed

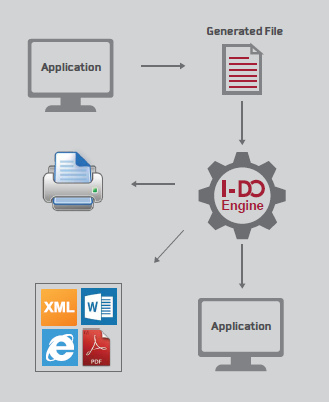

I-DO integrates with T24 or any other software application installed using common integration interfaces.

- I-DO works using multiple data source formats utilizing several integration types: Directory based, Web services, Database Listeners, etc.

- I-DO acts as a listener for one or several applications at the same time.

After the report is generated in the desired format, it can be delivered by various means:

- I-DO generates reports in many formats such as PDF, DOCX, XLSX, PPTX

- I-DO can then store and print reports

I-DO is a fully-automated tool

- I-DO will be triggered automatically and will deliver the output at runtime in a glance

I-DO helps you transform your complex reports into charts and graphs.

- With I-DO, users and clients can easily analyze significant patterns, trends, and correlations that might go undetected in text-based or tabular formats

- Users can easily use the generated graphs to compare data and to track changes over time

The below features classify I-DO as your right solution:

- E-Statement

- Customer Independence: Client does not need to revert back to vendor while developing reports

I-DO is in constant growth! Below are our upcoming features:

- Interactive E-Statement

- Additional Plug and Play templates

- API to retrieve statistical data on the executes jobs by I-DO