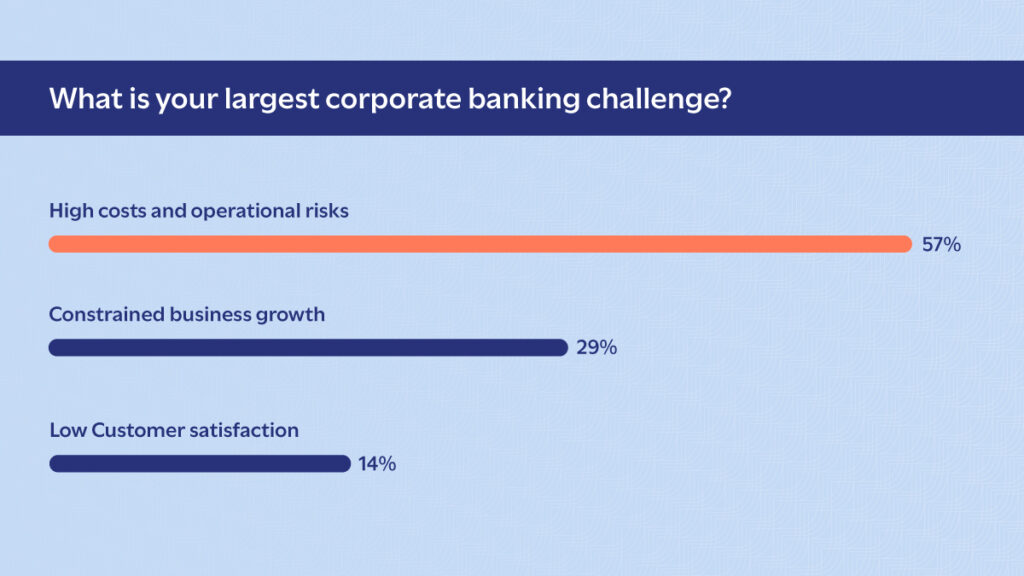

Over 23% of banking revenue comes from corporate banking, and 50% of this comes from corporate lending, yet despite this success it’s a sector sometimes mired in trouble. The corporate banking sector in general, and corporate lending specifically, is facing major disruption due to geopolitical unpredictability, poor portfolio monitoring, fragmented systems, low automation, slow time to market, technological change, threats like cybercrime and increasing customer demands, all leading to higher costs and operational risk for corporate banks.

A recent audience poll indicated these were the two largest challenges banks face. But corporate lending systems today are often incapable of tackling these market threats, with perpetuating challenges like insufficient automation, data silos, fragmented systems, , expensive services, poor customer service, and subpar credit portfolio management. The implications are wide-ranging.

By investing in digital transformation and modernizing outdated technology, banks can provide a solid foundation to combat these issues.

Client expectations have evolved, requiring a complete overhaul to provide streamlined, superior solutions. To do so, banks must modernize their corporate lending products and services, while transforming their legacy technology. Bottom line: Banks need to change. Legacy systems simply don’t cut it. A centralized dashboard is pivotal for banks looking to modernize, housing a one-stop shop of corporate credit information for corporate loan growth reigning in high costs of operations.

By adopting a functionality-rich solution based on modern technology to serve the high-growth area of corporate lending, banks can increase revenue, streamline processes, and renovate legacy technology with an effective solution.

Banks need to offer more flexible, cross-product solutions with integrated pricing and credit management. Irrespective of the outcome, banks need to rebuild from the ground up to offer a modern corporate lending solution to meet the new expectations of a disrupted market.

Advantages of the right corporate lending solution

With a corporate banking and credit system that has adaptable components and covers all areas of corporate credit with front-to-back-end capabilities, including corporate loans and trade finance, as well as supporting capabilities such as payments, liquidity management, data analytics, and compliance, the right technology provider lays the groundwork for success.

Banks can be more cost-efficient by leveraging operational business dashboards and data collected from central hubs rather than repeating it from silo to silo. This eliminates the risk of data reconciliation and overheads. This gives banks access to a single dashboard of data for their corporate portfolios. By providing a seamless front-end-to-back-end solution, banks advance their corporate banking objectives.

Corporate lending is one of the most important revenue streams in banking. Thanks to the corporate dashboard, you have one source of truth to navigate the corporate banking experience.”

Maurya Murphy, Senior Product Director, Corporate Banking, Temenos

To achieve straight-through processing, automation is necessary. Corporate lending requires continual transactional handholding for customers and staff. Therefore, banks need flexible and adjustable process alternatives that fit the way they do business. Without a centralized system, it’s impossible to search for expansion, product uniformity, and automation. ESG is also the North Star. It’s essential for AI to be explainable for informed decision-making. A corporate lending solution requires unsurpassed capabilities to target the full spectrum of the product line.

UBL: Leading the way for corporate lending in Pakistan

For 60 years, UBL has been a market leader in Pakistan. From SME to corporate to multinational, UBL services all types of business. UBL seeks to set the standard for digital banking and just unveiled the nation’s first digital Islamic accounts, as well as a cutting-edge mobile payment program.

Previously, UBL dealt with fragmented systems, slow turnaround times, and compromised data. Further, UBL needed to solve their problems in an ESG-friendly manner to adhere to UN standards. UBL’s corporate lending was compromised because the quality of the data was not adequate. Thanks to the right corporate lending solution, UBL’s customers now have choices with standardized resources and a single dashboard. With one dashboard as the basis of truth, UBL now engages more with their customers to provide an exceptional streamlined customer journey.

UBL developed a seamless online experience across the entire customer lifecycle, from origination and onboarding to account management, to respond to changing customer preferences and requirements. They also targeted a more agile operating model and a modern, flexible digital banking infrastructure thanks to the corporate banking solution. UBL modernized its corporate lending services using deep analytics and next-generation expertise with all the necessary front-end-to-back-end capabilities. This delivered fluid customer service, quality control over data, and operational risk reduction at scale, which allowed UBL to achieve their objectives.

The Path to Seamless Client Experience in Corporate Lending

Banks should embrace digital transformation by modernizing their outdated technology if they want to continue providing effective services to the corporate banking sector. This offers a real chance to increase efficiency and deliver a seamless client experience through a single dashboard. An adaptable operating model, innovative digital banking infrastructure, and front-to-back-end capabilities are all features of the ideal corporate lending solution.

Corporate Lending offers an excellent opportunity for revenue growth for banks. To capitalize on this, however, banks need to address the problems around system, data and process fragmentation and to replace the legacy technology which creates this problem. A strong business and technology banking platform is the key foundation for success, allowing for future adaption and engagement with emerging market needs.

Temenos at Sibos 2023

18 – 21 Sep, 2023

Stand D30, MTCC Toronto