Three Takeaways from Temenos Regional Forum Malaysia

By Saujatya Guin, Country Director – Malaysia, Temenos

The global banking landscape is changing fast. The digital revolution has made consumers more demanding. They want banking on their terms; when and where it is most convenient. And disruptive technology like cloud, AI and APIs is making this a reality. Evidently so in Malaysia, where the nation have emerged from the pandemic to a transformed global banking landscape. Digitization continues to shape the financial services landscape in Malaysia, and as Bank Negara Malaysia continues on the journey to accelerate this move with the announcement of the Malaysia Financial Sector Blueprint 2022-26, Temenos held a thought leadership industry forum on the theme of “Everyone’s Banking Platform”. The event explored how market forces, global economic dynamics, as well as intelligent technology practice adoptions such as Cloud, AI, Open & Composable Banking can benefit in building a implementing robust, innovative and future-ready digital finance infrastructure for the Nation.

Our regional forum engaged the global and regional banks, Fintechs, and hyperscalers in a discussion on how the banking industry should not only respond, but also reposition themselves to ride on the waves of change to gain a competitive advantage, as Malaysia continues to rise to become a critical economic force in Asia. Here are some key takeaways from the Temenos Regional Forum in Malaysia.

Our regional forum engaged the global and regional banks, Fintechs, and hyperscalers in a discussion on how the banking industry should not only respond, but also reposition themselves to ride on the waves of change to gain a competitive advantage, as Malaysia continues to rise to become a critical economic force in Asia. Here are some key takeaways from the Temenos Regional Forum in Malaysia.

Composable Banking and Open Banking, a Platform for Everyone

For the Malaysian banker, what this means is a need for unprecedented business agility. Malaysian bankers need to be able to compose new banking solutions. They need to be able to deconstruct the traditional legacy banking offerings, distil the crucial components that value add to customers, and then recompose them into cutting edge, agile value propositions for tomorrow’s Malaysians. This makes it all the more critical for the Malaysian banker to consider some critical factors while evaluating a technology platform for the bank. The platform must allow the bankers to build granular banking capabilities from scratch or from its basic building blocks, like a personalized sandbox. Such a platform needs to be able to be integrated with third party solutions in today’s rapidly evolving fintech ecosystems or allow Malaysian bankers to consume, information and technology products or services however they want, on premise, or on any private or public cloud.

It is a platform where services can be built and consumed by everyone, both existing and new to bank customers, for any banking business segment, whether as a licensed bank or a licensed digital lender. Such a platform empowers the Malaysian bankers to dream, to build, and then to scale. And such a platform is now available in Malaysia. That’s why all of us at Temenos are always talking about Everyone’s Banking Platform.

Banking doesn’t just have to happen in a bank anymore, it can happen anywhere. Open and collaborative business models like Banking-As-A-Service are transforming banking. Banking and Finance is getting embedded in the day of a life of the everyday Malaysian. The future of banking has no borders or boundaries, and to facilitate that, Malaysian banks need an open to eco-system, highly secure, cloud-native platform, that can create endless opportunities for Malaysians, wherein people can interchangeably play the role of a provider and consumer of new and innovative services.

Banking doesn’t just have to happen in a bank anymore, it can happen anywhere. Open and collaborative business models like Banking-As-A-Service are transforming banking. Banking and Finance is getting embedded in the day of a life of the everyday Malaysian. The future of banking has no borders or boundaries, and to facilitate that, Malaysian banks need an open to eco-system, highly secure, cloud-native platform, that can create endless opportunities for Malaysians, wherein people can interchangeably play the role of a provider and consumer of new and innovative services.

What does this mean from a technological perspective? We at Temenos, pioneer the cause to make banking services more composable. By Composable Banking we mean that instead of relying on legacy models and processes, bankers can compose, or build, products and services based on what their specific customer’s needs. Composable banking capabilities would lead to hyper-personalization of products and services that in turn would ensure loyal customers.

Customers’ expectations are increasing – they want the ‘Amazon experience in banking’. And now we have the disruptive technology like AI, Cloud, APIs to make this possible. The combination of these customer expectations and disruptive technology is leading to the banking value chain being split between the manufacturing and the distribution of financial products. This is arranging banking into smaller clusters, with fierce competition across multiple areas between traditional banks and new players, with the emergence of new banking business models. While this increases competition, it is also opening up doors of opportunity for the prepared Malaysian banker.

For the Malaysian banker, what this means is a need for unprecedented business agility. Malaysian bankers need to be able to compose new banking solutions. They need to be able to deconstruct the traditional legacy banking offerings, distil the crucial components that value add to customers, and then recompose them into cutting edge, agile value propositions for tomorrow’s Malaysians. This makes it all the more critical for the Malaysian banker to consider some critical factors while evaluating a technology platform for the bank. The platform must allow the bankers to build granular banking capabilities from scratch or from its basic building blocks, like a personalized sandbox. Such a platform needs to be able to be integrated with third party solutions in today’s rapidly evolving fintech ecosystems or allow Malaysian bankers to consume, information and technology products or services however they want, on premise, or on any private or public cloud.

It is a platform where services can be built and consumed by everyone, both existing and new to bank customers, for any banking business segment, whether as a licensed bank or a licensed digital lender. Such a platform empowers the Malaysian bankers to dream, to build, and then to scale. And such a platform is now available in Malaysia. That’s why all of us at Temenos are always talking about Everyone’s Banking Platform.

Next-Generation Digital Banking in Malaysia

The APAC region, including Malaysia, is poised to be the next battleground for digital banks, with existing players stepping up their expansion plans in addition to the entrance of new players. Trends like the hybrid banking model, the gig economy, and financial inclusion is opening the pathway for new financial services needs in Malaysia. To address the changing expectations of today’s Malaysians, digital banks have emerged providing financial services to address these market trends and segments who have not been adequately served before.

From left: Swapnil Deshmukh, Regional Director for Infinity Digital Banking at Temenos, and Rafiza Ghazali, Director of Digital Banking at KAF Investment Bank

One of the hot trends in the digital space is the rise of embedded finance. Specifically, digital banks are looking to partner with other FinTech’s to deliver superior user experiences while also in parallel improving on the cost-to-income ratios. The key to a successful partnership lies in the partners’ ability to scale rapidly, and to provide that seamless user experience that Malaysians today and tomorrow and looking for. For example, KAF is looking at capabilities to empower their customers to not only purchase a car, but also to complete their financing process for the car in parallel, all in one platform, using data analytics to provide the best optimum financial offerings for their customers. Such a collaboration embeds the finance experience into everyday lives of Malaysians, pushing financial services to the forefront of the banking application, creating a paradigm shift in what “banking-as-a-service” could be.

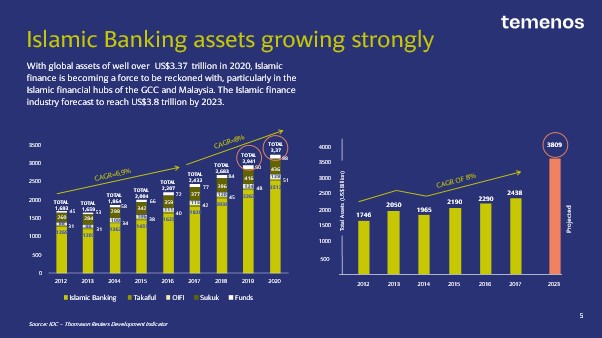

Digital Islamic Banking for an Islamic Banking Malaysia

Top of the mind for the Malaysian bankers is also how Malaysia could position itself as the leading Islamic Banking hub in Asia. Key to this pivot, would be how Islamic Banking can tap on the existing capabilities that modern technology can provide, even offering traditional Islamic Banking financial services in a fresh digital experience. As Malaysia continues to be one of the leading markets for Islamic Finance, seeing a 71% increase in Islamic loans in 2021, the key to successful Islamic Banking for Malaysia lies in product innovation.

The core challenge on Islamic banking is around a delay in adoption of technological advancements and innovation compared to the rest finance industry. Still, this can be converted to an opportunity for Islamic Finance. The incorporation of technological developments in AI and Big Data will help banks to make their institution competitive profitable, scalable and diverse.

The roadmap to addressing this challenge involves a strategic alignment by institutions of technology with growth, and robust partnerships. To do so they need to:

- Leverage third-party software: Existing institutions should work with technology providers where the cost of investment and development is prohibitively high and outside the product scope but essential to operations.

- Develop innovation capabilities: Banks must understand the innovations occurring and develop internal capabilities to launch technology-driven initiatives, such as Mobile Banking, and A.I.

- Collaborate with fintech players: Banks cannot fully incorporate all innovations — collaboration within the eco-system is key to accessing new market opportunities, as well as developing new products.

Conclusively, considering the key insights of a) Composable Banking, b) Next-Generation Digital Banking, and c) Digital Islamic Banking, the Temenos Regional Forum Malaysia indeed reshaped the perspectives of the Malaysian banking community on what’s possible, as Malaysia emerges out of the pandemic and continues to establish itself as an economic powerhouse in the region.

With the right perspectives and framework today’s technologies can crave out a way for the Malaysian banks. Temenos Regional Forum endeavors to be that industry forum where the latest ideas, business models, and capabilities are exchanged and discussed, so that the financial services of tomorrow can be enabled, today. Our Temenos ecosystem of solutions enable engaging banking customers, growing market share, or scaling banking operations. We’re empowering everyone to build tomorrow’s banks, today. That’s why we’re Everyone’s Banking Platform.

See you at Temenos Regional Forum 2023!