Market trends – observing the compliance costs through the Temenos Value Benchmark (TVB)

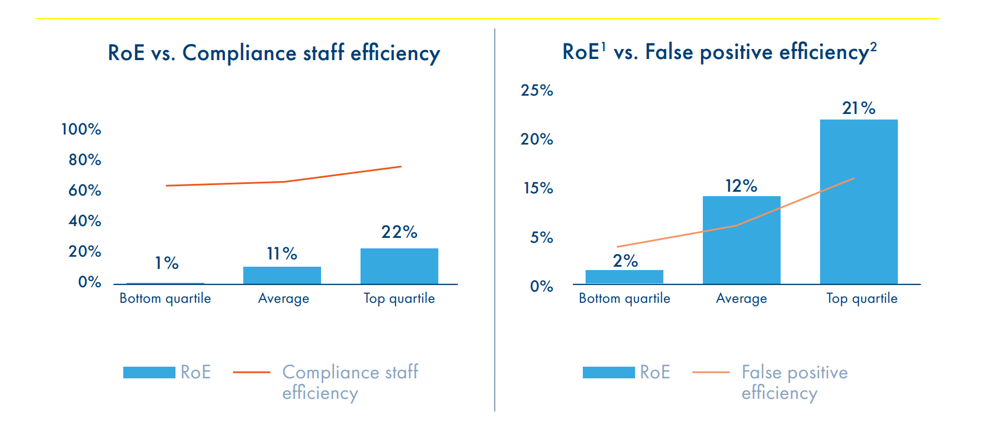

At face value, compliance spending is perceived as a necessary cost of doing business in the banking industry. However, the Temenos Value Benchmark (TVB) indicates that maintaining an efficient compliance function contributes positively to a bank’s financial performance. As illustration, the Compliance Staff efficiency, measured by the percentage of time spent by employees on non-administrative tasks, has a positive correlation with the Return on Equity ratio. The same relation to profitability is also observable from the percentage of false-positive alerts generated by compliance systems, where TVB data directly correlates the Return on Equity ratio and the accuracy of the compliance system calibration.

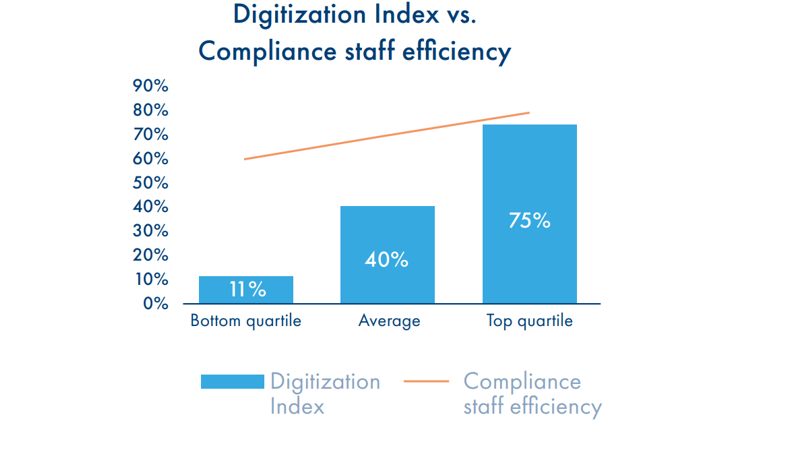

These correlations are driven by multiple factors, among which is the overall bank digitization. As visually evident from the below chart, when ranked by their digitization index, one can observe that the efficiency of the compliance staff tends to follow the Digitization index.

Digitization being a driver of the compliance function’s performance, it is also an essential enabler of other good practices. Indeed, risk and compliance information availability or the use of predictive and prescriptive analytics capabilities as part of the day-to-day activities are examples of good practices. The TVB report positively correlates these with the compliance function’s performance and is facilitated mainly by an effective bank.

Regulators and governments are issuing new rules all the time to avoid future crises and coming down hard on banking organizations that do not conform. As a result, today’s average business is confronted with a profusion of cross-industry regulations, each consisting of hundreds of requirements and rules. Dealing with these requirements in a traditional manner is no longer cost-effective or efficient. It requires a renewed business model that analyzes compliance requirements, prioritizes their importance to the business, applies the appropriate control and monitors the system consistently.

To strengthen their compliance risk program, the banks need an efficient solution for conducting compliance processes, identifying & assessing risks, implementing & monitoring controls and mitigating/eliminating the gaps across multi-country operations.

Managing compliance risk has become a core skill that every bank must-have in today’s highly regulated industry. A consolidated-or enterprise-wide approach to compliance risk management has become mission-critical for large, complex banking organizations.

Risk management and compliance management have been traditionally treated as separate disciplines. Risk managers dealt with risk identification and mitigation, while compliance managers dealt with compliance auditing. However, according to McKinsey, this approach is no longer cost-effective or efficient. Increasing compliance requirements call for a strategy that is integrated with risk management and corporate objectives.

Visionary companies have achieved this goal by adopting a risk-based approach. Risk-based compliance management allows compliance managers to first identify the most significant compliance risks, and then propose controls to mitigate those risks. This way, the focus is only on the risks and compliance regulations that matter to banking institutions. Managers can also tailor the compliance program to meet the specifics of their business. The result is improved compliance management.

Further, basing a compliance management program on risk management can be an effective communication tool. Managers who may be averse to “compliance” may respond much more readily to “risk.” Therefore, this approach may provide banks with an effective means of getting management to understand and give appropriate attention to compliance priorities.

What is required for a successful Compliance Risk Management?

A successful compliance-risk management program, which is essential for a sound and vibrant banking system, contains the following elements: Active board and senior management oversight, effective policies and procedures, Compliance risk analysis and comprehensive controls. Banking organizations should use appropriate tools in compliance risk analysis like self-assessment, risk maps, process flows, key indicators and audit reports, which enables establishing an effective system of internal controls.

With its advanced Model Bank capability, Temenos can help banks dramatically lower their operational and IT costs on regulation through the ability to adapt to new regulation and enter new regulatory jurisdictions and new business lines quickly and easily without major customization.

Temenos provides a comprehensive user-friendly self-service portal for all business users. Advanced descriptive, diagnostic as well as predictive, prescriptive analytics are based on a solid centralized data foundation with embedded automated data traceability, lineage and provenance, and enterprise metadata management and cataloguing, to help banks get the most out of their analytics capability. The more we examine compliance the more evident it is that doing it right is just good business.

Read more about Compliance as a Driver of Banking Performance and discover the insights from the Temenos Value Benchmark Whitepaper.