Both Traditional and Challenger Banks Must Compete on Customer Experience to Survive

In a new research report sponsored by Temenos, The Economist Intelligence Unit (EIU) analyzed over 10 million personal finance conversations in order to better understand consumer preferences around retail banking

We found a few important takeaways for both traditional and challenger banks as consumers become increasingly digital-first while still retaining some of the brand loyalty and trust their parents and grandparents have passed on. The most important? That both traditional and challenger banks must make banking customer experience a priority in order to survive.

Fintech Popularity Driven by Financial Empowerment

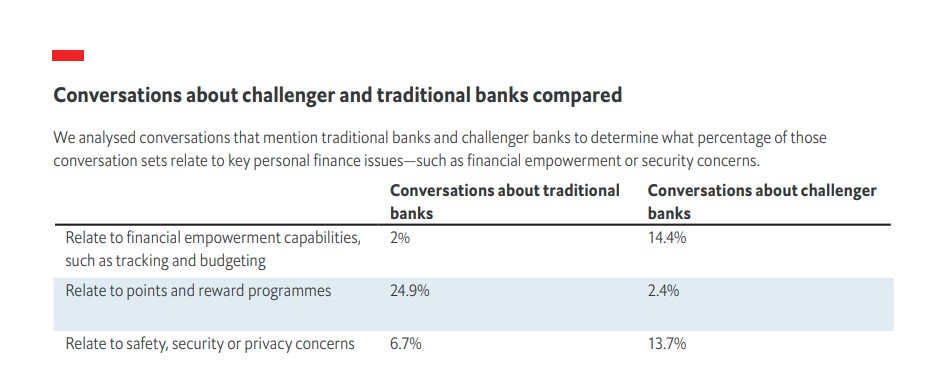

Fintechs have enjoyed unprecedented customer growth in the past few years. The EIU found that this is driven primarily by the promise of financial empowerment: 14% of conversations that discuss challenger banks included topics like tracking and budgeting compared to just 2% of conversations discussing traditional banks.

Points and Rewards are a Big Opportunity for Challenger Banks

While fintechs have a big lead when it comes to financial empowerment, traditional banks still dominate conversations around points and rewards programs due to their existing relationships built over years and experience. TheEIU predicts that in the future, these loyalty programs will shift to the customer experience domain as banks are able to capture and utilize better data and analytics about customer preferences and behaviors. For fintechs, their greatest challenge to competing in the loyalty rewards game is having a strong enough brand to form partnerships that will yield competitive programs.

The good news is that some challenger banks are already succeeding. U.S. challenger bank Point offers cash-redeemable points for groceries and services like Netflix and Spotify, Current gives points on transactions from merchants like Subway and Rite Aide, and Tally rewards points for saving money which can then be redeemed for gift cards from Amazon and Target.

Safety, Security, and Stability Still Concerns for Challenger Banks

The Economist report found that 13.7% of conversations around challenger banks included concerns about safety, security, and privacy compared to only 6.7% of conversations about traditional banks. For years, fintechs have touted their open APIs and integrations with 3rd party apps and data sources as a main differentiator from traditional banks, but this comes with the added risk of hacks and platform outages Also, because many of these fintechs are venture-funded and in the pre-profit stage, there are lingering concerns about their long-term survival which puts downward pressure on demand as consumers stall on shifting primary wealth management and building in the hands of newer institutions.

Customer Experience Still the Top Priority, and Differentiator, for Banks

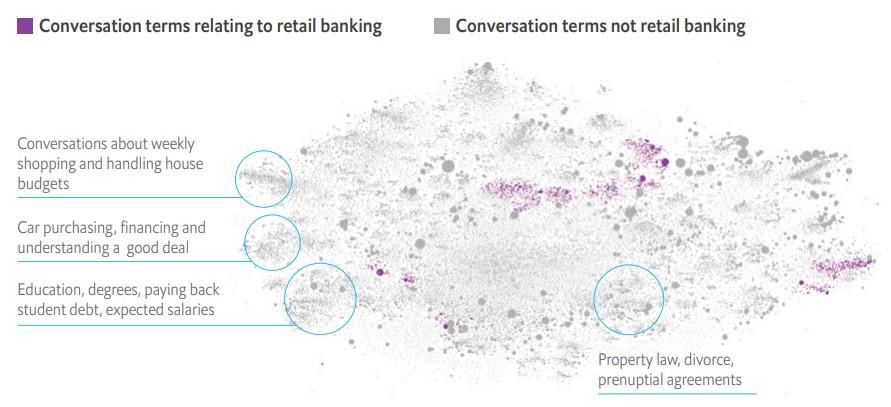

As part of this same research report, the EIU found that improving customer experience and engagement is the top strategic priority for banks through 2025. Banks continue to see their core financial services commoditized, and price competition is not enough to drive significant customer growth. Banks shouldn’t be asking their customers “what would you like us to build?” Instead they should be asking them about issues they face in their daily lives, and then look to help solve those problems for them. Unfortunately, banks are mentioned in only 18% of conversations related to personal finance, which suggests that banks have a big opportunity to associate themselves in decisions like car purchasing and student debt.

Millie Gillon, global head of retail banking customer experience at Standard Chartered Bank, had this to say to the EIU:

“In an ideal world, there will be a combination where fintechs and established banks can play together. Then you have the winning combination of speed, drive, innovation, a willingness to experiment, sound risk management, trust and the learning that comes from more established companies.”

Check out the full report to learn more or contact us to learn how Temenos can help your bank or fintech transform customer experience in 2021 and beyond.