Temenos Announces Very Strong Q3 Results, Full Year Guidance Raised

GENEVA, Switzerland, 17 October 2018 – Temenos AG (SIX: TEMN), the banking software company, today reports its third quarter 2018 results.

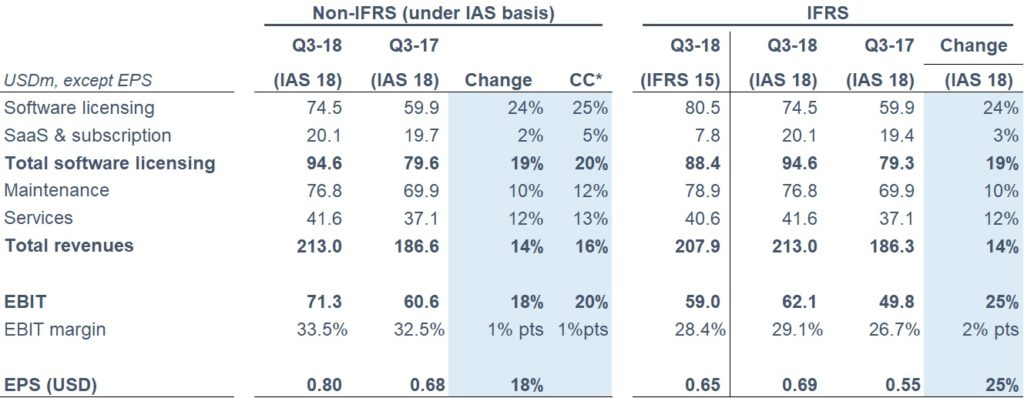

* Constant currency (c.c.) adjusts prior year for movements in currencies

Please note that non-IFRS numbers are under IAS 18 and comparable to the prior periods. IFRS numbers are under IFRS 15 and a full reconciliation is provided in the appendix.

Q3 2018 highlights

- Outstanding quarter driven by broad based demand across geographies and tiers

- 17 new customer wins including challenger banks in the US, Asia and Europe

- Very strong quarter in the US

- Broad based growth in Europe across client tiers

- Strong performance in Australia, tier 1 bank signed

- Significant increase in appetite for cloud adoption and SaaS

- 2018 guidance raised on back of sales momentum and increased revenue visibility

- Structural drivers and strong pipeline provide confidence for medium term

Q3 2018 financial summary (non-IFRS, IAS 18)

Non-IFRS total software licensing revenues up 20% c.c.

Non-IFRS maintenance growth of 12% c.c.

Non-IFRS total revenue growth of 16% c.c.

Non-IFRS EBIT up 20% c.c., LTM non-IFRS EBIT margin of 30.8%

Non-IFRS EPS increase of 18%

Operating cash flow up 31%, cash conversion at 116%

DSOs down 10 days Y-o-Y to 114 days

Commenting on the results, Temenos CEO David Arnott said:

“We continued the momentum from the first half of the year into Q3, with a significant number of deals signed across all geographies. We have seen increased demand across all tiers, from top tier incumbent banks right through to new challenger bankers, which demonstrates our products are capable of supporting the most innovative new entrants to financial services.

In Q3 we were named as a Leader in the Forrester Wave: Global Digital Banking Platforms, which reflects our relentless investment in R&D and aggressive innovation roadmaps that make our software product the best digital banking platform in the market.

With the robust levels of activity across tiers and geographies and continued growth in our pipeline, we remain confident in our ability to deliver long term value for all of our stakeholders.”

Commenting on the results, Temenos CFO and COO Max Chuard said:

“Q3 was an outstanding quarter, with total software licensing growth of 20% and total revenue growth of 16%.

We saw broad based demand across geographies, with a very strong quarter in the US, Australia continuing to perform very well and Europe also delivering strong growth.

Given our sales momentum and the increased revenue visibility at this point in the year, we have raised our guidance for 2018. We are now guiding for total software licensing growth of 15% to 20%, up from 13.5% to 18.5%, and total revenue growth of 12% to 14%, up from 10% to 13%.”

Revenue

IFRS (IFRS 15) revenue for the quarter was USD 207.9m.

IFRS (IAS-18) revenue were USD 213.0m, an increase of 14% vs. Q3 2017. Non-IFRS (IAS 18) revenue was USD 213.0m for the quarter, an increase of 14% vs. Q3 2017.

IFRS (IFRS 15) total software licensing revenue for the quarter was USD 88.4m.

IFRS (IAS 18) total software licensing revenue for the quarter was USD 94.6m, an increase of 19% vs. Q3 2017. Non-IFRS (IAS 18) total software licensing revenue was USD 94.6m for the quarter, an increase of 19% vs. Q3 2017.

EBIT

IFRS (IFRS 15) EBIT was USD 59.0m for the quarter.

IFRS (IAS 18) EBIT was USD 62.1m for the quarter, an increase of 25% vs. Q3 2017. Non-IFRS (IAS 18) EBIT was USD 71.3m for the quarter, an increase of 18% vs. Q3 2017. Q3 2018 non-IFRS (IAS 18) EBIT margin was 33.5%, up 1% point vs. Q3 2017.

Earnings per share (EPS)

IFRS (IFRS 15) EPS for the quarter was USD 0.65.

IFRS (IAS 18) EPS was USD 0.69 for the quarter, an increase of 25% vs. Q3 2017. Non-IFRS (IAS 18) EPS was 0.80 for the quarter, an increase of 18% vs. Q3 2017.

Operating cash flow

IFRS (IFRS 15) operating cash was an inflow of USD 52.7m in Q3 2018 compared to USD 40.1m in Q3 2017. For LTM to September 2018, operating cash was USD 344.5m representing a conversion of 116% of IFRS (IAS 18) EBITDA into operating cash.

IFRS 15

Temenos has implemented IFRS 15 for reporting period 1st January 2018 onwards using the modified retrospective method. Under the modified retrospective method the 2017 and prior results will not be restated under IFRS 15. The reporting of the results for 2018 will be provided under IAS 18 and under IFRS 15, which will allow for comparability against 2017 and prior periods. From 2019, the reporting of results will be provided only under IFRS 15. For more information on the impact of IFRS 15, please visit the Temenos Investor Relations website.

Revised 2018 guidance

Our guidance for 2018 is in constant currencies and under IAS 18. The revised guidance is as follows:

- Non-IFRS total software licensing growth at constant currencies of 15% to 20% (implying non-IFRS total software licensing revenue of USD 366m to USD 382m), up from 13.5% to 18.5%

- Non-IFRS revenue growth at constant currencies of 12% to 14% (implying non-IFRS revenue of USD 832m to USD 847m), up from 10% to 13%

- Non-IFRS EBIT at constant currencies of USD 262m to 264m, (implying non-IFRS EBIT margin of c. 31%), up from USD 255m to 260m

- 100%+ conversion of EBITDA into operating cash flow

- Expected FY 2018 tax rate of 15% to 16%

Currency assumptions for 2018 guidance

In preparing the 2018 guidance, the Company has assumed the following:

- USD to Euro exchange rate of 0.868;

- USD to GBP exchange rate of 0.755; and

- USD to CHF exchange rate of 0.990.

Conference call

At 18.30 CET / 17.30 GMT / 12.30 EST, today, 17 October 2018, David Arnott, CEO, and Max Chuard, CFO and COO, will host a conference call to present the results and offer an update on the business outlook. Listeners can access the conference call using the following dial in numbers:

0800 740 377 (Swiss Free Call)

1 866 966 1396 (USA Free Call)

0800 376 7922 (UK Free Call)

+44 (0) 207 192 8000 (UK and International)

Conference ID # 7964688

A transcript will be made available on the Company website 48 hours after the call. Presentation slides for the call can be accessed on the Temenos Investor Relations website.

Non-IFRS financial Information

Readers are cautioned that the supplemental non-IFRS information presented in this press release is subject to inherent limitations. It is not based on any comprehensive set of accounting rules or principles and should not be considered as a substitute for IFRS measurements. Also, the Company’s supplemental non-IFRS financial information may not be comparable to similarly titled non-IFRS measures used by other companies. In the reconciliation of IFRS to non-IFRS found in Appendix II, the Company sets forth the most comparable IFRS financial measure and reconciliations of this information with non-IFRS information. The Company’s non-IFRS figures exclude any deferred revenue write-down resulting from acquisitions, discontinued activities that do not qualify as such under IFRS, acquisition related charges such as advisory fees and integration costs, charges as a result of the amortisation of acquired intangibles, costs incurred in connection with a restructuring plan implemented and controlled by management, and adjustments made to reflect the associated tax charge relating to the above items.

Below are the accounting elements not included in the 2018 non-IFRS guidance:

FY 2018 estimated deferred revenue write down of USD 1m

FY 2018 estimated amortisation of acquired intangibles of USD 38m

FY 2018 estimated restructuring costs of USD 5m

FY 2018 estimated acquisition costs of USD 13m

Restructuring costs include realising R&D, operational and infrastructure efficiencies. Acquisition costs include the costs associated with the bid for Fidessa. These estimates do not include impact of any further acquisitions or restructuring programmes commenced after 17 October 2018. The above figures are estimates only and may deviate from expected amounts.