Temenos Announces Outstanding FY 2017 with Total Software Licensing Growth of 22%

GENEVA, Switzerland, 13 February 2018 – Temenos Group AG (SIX: TEMN), banking software company, today reports its fourth quarter and full year 2017 results.

Constant currency (c.c.) adjusts prior year for movements in currencies

Q4 and FY 2017 highlights

- Continued outstanding performance in 2017 on back of very strong 2016

- Strong double-digit growth across all geographies

- Digital and regulatory pressure and move to open banking are driving market growth

- Tier 1 and 2 banks contributed 71% of total software licensing in Q4 and 59% in FY 2017

- 19 new customer wins in Q4, total of 65 in FY 2017

- Competitive deals contributed 56% of software licensing in Q4 and 41% of software licensing in FY 2017

- Market leader, raising barriers to entry and pulling ahead of the competition

- Strong start to Q1 2018, highest ever revenue visibility driven by pipeline growth and committed spend

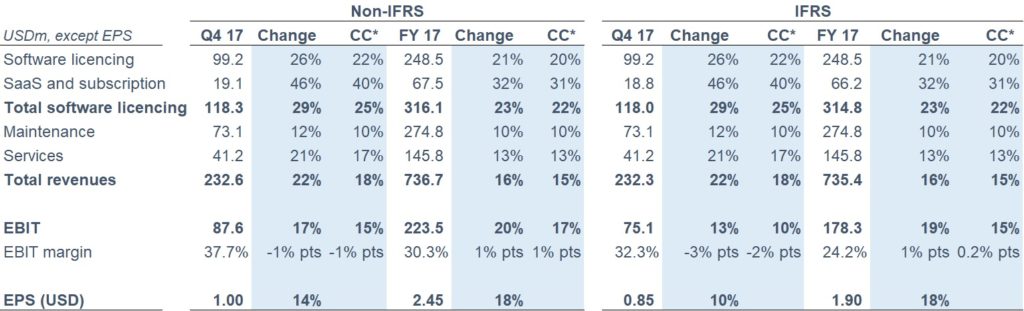

Q4 and FY 2017 financial summary

- Non-IFRS total software licensing revenues up 25% in Q4 17 and up 22% in FY 17 (c.c.)

- Non-IFRS maintenance growth of 10% in Q4 17 and 10% in FY 17 (c.c.)

- Non-IFRS EBIT up 17% in Q4 17, FY 17 non-IFRS EBIT margin of 30.3%

- FY 17 non-IFRS EPS increase of 18% to USD 2.45

- FY 17 non-IFRS services margin improvement of 0.6% pts to 9.7%

- FY 17 cash conversion of 114%

- DSOs down 8 days Y-o-Y to 119 days

- Profit and cash flow strength support proposed dividend of CHF 0.65, an 18% annual increase

- 2018 guidance of non-IFRS total software licensing growth of 13.5% to 18.5%, non-IFRS total revenue growth of 10% to 13% (c.c.) and non-IFRS EBIT of USD 255m to 260m (guidance under IAS 18, pre-adoption of IFRS 15)

Commenting on the results, Temenos CEO David Arnott said:

“I am delighted with our performance in Q4, in which the business has continued to accelerate and capitalise on the significant momentum in our end market. We have ended the year in a very strong position, with double digit growth across all our geographies, which is a testament to the dedication and talent of all our colleagues and our ability to consistently execute at a very high standard year after year.

2017 has been a year in which our traction and leadership with tier 1 and 2 banks has been clearly demonstrated. We won deals with Openbank, Itau, KBC and a US tier 1 bank among others, which speaks to our global relevance and the strength of our value proposition. Our clients are looking for a software partner that will help them understand and address the pressures of digitization, regulation and the new world of open banking. With the leading packaged, upgradeable and open banking software in the market, we are the vendor of choice for the world’s largest banks.

Looking forward to 2018, I am hugely excited by the opportunities we have. We continue to grow our addressable market and our end market is expanding rapidly. I am confident we will continue to take market share and pull ahead of the competition in 2018.”

Commenting on the results, Temenos CFO and COO Max Chuard said:

“We have had a very strong performance in 2017, with total software licensing growth of 22% and total revenue growth of 15%. We also grew profit by 17% and delivered margin expansion of 98bps year-on-year. Our cash conversion of 114% for 2017 is significantly above our target of 100% of EBITDA and means we are recommending a 2017 dividend of CHF 0.65, an increase of 18% on 2016.

We have announced our guidance for 2018 which reflects our expectation of continued strong growth in the year. We are guiding for non-IFRS total software licensing growth of 13.5% to 18.5% and non-IFRS total revenue growth of between 10% and 13%. We are guiding for 2018 non-IFRS EBIT of USD 255m to 260m, which implies a margin of over 31%. Given the acceleration we saw during 2017 and the strong start to 2018 we expect our sales momentum to continue accelerating. We have excellent revenue visibility driven by committed spend and our pipeline growth, and I am confident in achieving our 2018 guidance.”

Revenue

IFRS revenue for the quarter was USD 232.3m, up from USD 190.8m in Q4 2016. Non-IFRS revenue was USD 232.6m for the quarter, up from USD 191.1m in Q4 2016, representing an increase of 18% in constant currencies. IFRS total software licensing revenue for the quarter was USD 118.0m, and non-IFRS total software licensing revenue for the quarter was USD 118.3m, an increase of 25% from Q4 2016 in constant currencies.

EBIT

IFRS EBIT was USD 75.1m for the quarter, up from USD 66.5m in Q4 2016. Non-IFRS EBIT was USD 87.6m in Q4 2017, an increase of 15% in constant currencies. FY 2017 non-IFRS EBIT margin was 30.3%, up 98bps on FY 2016.

Earnings per share (EPS)

IFRS EPS for the quarter was USD 0.85, an increase of 10% vs. Q4 2016. Non-IFRS EPS was 1.00 for the quarter vs. USD 0.88 in Q4 2016. For FY 2017, non-IFRS EPS was USD 2.45, and increase of 18%.

Operating cash flow

For FY 2017 IFRS operating cash was an inflow of USD 299.7m compared to USD 257.6m in FY 2017, representing a conversion of 114% of IFRS EBITDA into operating cash.

Dividend

Taking into account the strength of profit growth and cash generation, as well as the expected strength of future cash flows, subject to shareholder approval at the AGM on 15 May 2018, Temenos intends to pay a dividend of CHF 0.65 per share for 2017. The timing for the dividend payment will be as follows:

- 15 May AGM approval

- 18 May Shares trade ex-dividend

- 22 May Record date

- 23 May Payment date

As with previous years, the 2017 dividend will be paid as a distribution of capital contribution reserves and therefore be exempted of withholding tax. Temenos’ policy is to distribute a sustainable to growing dividend.

IFRS 15

Temenos has implemented IFRS 15 for reporting period 1st January 2018 onwards using the modified retrospective method. Under the modified retrospective method the 2017 and prior results will not be restated under IFRS 15. The reporting of the results for 2018 will be provided on both the previous reporting standards basis and under IFRS 15, which will allow for comparability against 2017 and prior year results. From 2019, the reporting of results will be provided only under IFRS15. For more information on the impact of IFRS15, please visit the Temenos Investor Relations Website.

2018 guidance

Our guidance for 2018 in constant currency is based on the previous reporting standards i.e. before the adoption of IFRS 15. The guidance is as follows:

- Non-IFRS total software licensing growth at constant currency of 13.5% to 18.5% (implying total software licensing revenue of USD 363m to USD 379m)

- Non-IFRS revenue growth at constant currency of 10% to 13% (implying revenue of USD 819m to USD 840m)

- Non-IFRS EBIT at constant currency of USD 255m to 260m (implying non-IFRS EBIT margin of 31.1% – 31.0%)

- 100%+ conversion of EBITDA into operating cashflow

- Tax rate of 15% to 16%

Medium term targets

Our medium term targets are as follows:

- Non-IFRS total software licensing growth of at least 15% CAGR

- Non-IFRS revenue growth of 10% – 15% CAGR

- Non-IFRS EBIT margin improvement of 100 to 150bps on average p.a.

- Non-IFRS EPS growth of at least 15% CAGR

- Cash conversion over 100% of EBITDA p.a.

- DSOs reducing by 5-10 days p.a.

- Tax rate of 17% to 18%

Currency assumptions for 2018 guidance

In preparing the 2018 guidance, the Company has assumed the following:

- USD to Euro exchange rate of 0.846;

- USD to GBP exchange rate of 0.719; and

- USD to CHF exchange rate of 0.946.

Conference call

At 18.30 CET / 17.30 GMT / 12.30 EST, today, 13 February 2018, David Arnott, CEO, and Max Chuard, CFO and COO, will host a conference call to present the results and offer an update on the business outlook. Listeners can access the conference call using the following dial in numbers:

0800 920 016 (Swiss Free Call)

1 866 966 1396 (USA Free Call)

0800 376 7922 (UK Free Call)

+44 (0) 207 192 8000 (UK and International)

Conference ID # 5093439

A transcript will be made available on the Company website 48 hours after the call. Presentation slides for the call can be found on the Temenos Investor Relations Website.

Non-IFRS financial Information

Readers are cautioned that the supplemental non-IFRS information presented in this press release is subject to inherent limitations. It is not based on any comprehensive set of accounting rules or principles and should not be considered as a substitute for IFRS measurements. Also, the Company’s supplemental non-IFRS financial information may not be comparable to similarly titled non-IFRS measures used by other companies. In the reconciliation of IFRS to non-IFRS found in Appendix II, the Company sets forth the most comparable IFRS financial measure and reconciliations of this information with non-IFRS information. The Company’s non-IFRS figures exclude any deferred revenue write-down resulting from acquisitions, discontinued activities that do not qualify as such under IFRS, acquisition related charges such as advisory fees and integration costs, charges as a result of the amortisation of acquired intangibles, costs incurred in connection with a restructuring plan implemented and controlled by management, and adjustments made to reflect the associated tax charge relating to the above items.

Below are the accounting elements not included in the 2018 non-IFRS guidance:

- FY 2018 estimated deferred revenue write down of USD 1m

- FY 2018 estimated amortisation of acquired intangibles of USD 38m

- FY 2018 estimated restructuring costs of USD 5m

Restructuring costs include realising R&D, operational and infrastructure efficiencies. These estimates do not include impact of any further acquisitions or restructuring programmes commenced after 13 February 2018.

The above figures are estimates only and may deviate from expected amounts.

Investor & Media Contacts

Adam Snyder

Head of Investor Relations, Temenos

+44 207 423 3945 [email protected]Press and media enquiries

Conor McClafferty | Martin Meier-Pfister

+44 7920 087 914 | +41 43 244 81 40 [email protected] | [email protected]