Temenos Announces Strong Start to 2017 With Q1 Total Software Licensing Revenue Growth of 19%

Temenos, the software specialist for banking and finance, today reports its first quarter 2017 results

GENEVA, Switzerland, 20 April 2017 – Temenos Group AG (SIX: TEMN), the software specialist for banking and finance, today reports its first quarter 2017 results.

Q1 2017 Highlights

- Strong start to 2017 across all KPIs

- Digitization and cost focus continue to drive strategic decision making and market growth

- Strong sales momentum across geographies, both signings and pipeline generation

- Integrated, front-to-back digital offering is critical to client wins

- Ranked #1 best selling core banking system by IBS

- Ranked top of Forrester pyramids for new-name clients and for new and existing clients

- Strong pipeline supports outlook for 2017

- Bond issuance in Q1 2017 strengthens balance sheet and extends maturity profile

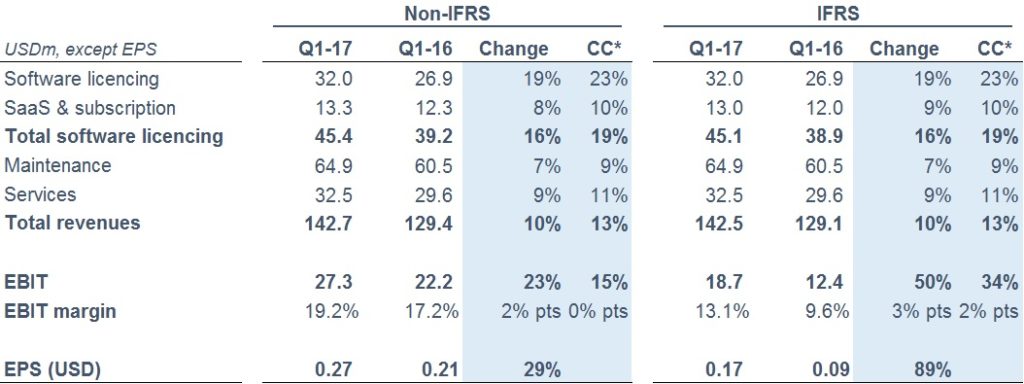

Q1 2017 Financial Summary

- Non-IFRS total software licensing revenues up 19% in Q1 17 (c.c.)

- Non-IFRS maintenance growth of 9% in Q1 17 (c.c.)

- Non-IFRS EBIT up 15% in Q1 17 (c.c.), LTM non-IFRS EBIT margin of 29.5%

- Non-IFRS EPS increase of 29%

- Q1 2017 LTM cash conversion of 117%

- DSOs at 127 days, down 24 days Y-o-Y

Commenting on the results, Temenos CEO David Arnott said:

“We have built on the momentum from last year with a strong start to 2017. Our performance and execution has been excellent across all our KPIs. Banks continue to focus on their digital future and are putting IT at the heart of their strategies to achieve this. More and more we are seeing banks moving from legacy in-house software, to complete front-to-back digital solutions that are seamlessly integrated, rather than focusing only on changing the front end.

We have once again been recognised as the leader in our market, with IBS ranking Temenos as the #1 best selling core banking solution as well as the best selling digital solution. We were also ranked at the top of both of the Forrester pyramids for sales to new and existing clients. These achievements are only possible with the dedication and hard work of all our employees and the continued trust and support of our clients around the globe.

With the continued growth in our market and our leading position within it, I am confident in the outlook for 2017 and the medium term.”

Commenting on the results, Temenos CFO and COO Max Chuard said:

“We had strong growth in both revenue and profitability in the first quarter, with total software licensing up 19% and our EPS up 29%, reflecting the momentum we have in the market. Our pipeline has continued to grow since the start of the year and, with multiple clients undergoing progressive renovation, our revenue visibility remains very high.

We took advantage of favourable market conditions in Q1 to issue CHF150m of new bonds on very attractive terms, enabling us to extend our maturity profile and further strengthen our balance sheet. We are in a strong position to deliver our strategic objectives and to capitalise on the market growth. Given the strong start to 2017 I am confident in reconfirming our guidance for year.”

Revenue

IFRS total revenue for the quarter was USD 142.5m, up from USD 129.1m in Q1 2016. Non-IFRS total revenue was USD 142.7m for the quarter, up from USD 129.4m in Q1 2016, representing an increase of 13% in constant currencies. IFRS total software licensing revenue for the quarter was USD 45.1m, and non-IFRS total software licensing revenue for the quarter was USD 45.4m, an increase of 19% from Q1 2016 in constant currencies.

EBIT

IFRS EBIT was USD 18.7m this quarter, up from USD 12.4 in Q1 2016. Non-IFRS EBIT was USD 27.3m in this quarter, an increase of 15% in constant currencies. Q1 2017 non-IFRS EBIT margin was 19.2%, up 2% points on Q1 2016.

Earnings per Share (EPS)

IFRS EPS for the quarter was USD 0.17, an increase of 89% vs. Q1 2016. Non-IFRS EPS was 0.27 for the quarter vs. USD 0.21 in Q1 2016.

Operating Cash Flow

IFRS operating cash was an inflow of USD 36.6m in Q1 2017 compared to USD 23.9m in Q1 2016. For LTM to March 2017, operating cash was USD 270.4m representing a conversion of 117% of IFRS EBITDA into operating cash.

Annual General Meeting

Temenos will hold its 16th AGM on 10 May 2017 at its offices in Geneva, Switzerland. Further information can be found on the company website – https://www.temenos.com/en/about-temenos/investor-relations/annual-general-meeting/

2017 Guidance

Our guidance for 2017, which excludes the impact of the proposed acquisition of Rubik, is as follows*:

- Non-IFRS total software licensing growth at constant currency of 10% to 15% (implying total software licensing revenue of USD 276m to USD 288m)

- Non-IFRS revenue growth at constant currency of 7.5% to 11.0% (implying revenue of USD 667m to USD 689m)

- Non-IFRS EBIT at constant currency of USD 210m to 215m (implying non-IFRS EBIT margin of c.31%)

- 100%+ conversion of EBITDA into operating cashflow

- Tax rate of 14% to 15%

*Assumes FX rates as disclosed in the Q1 2017 results presentation – https://www.temenos.com/en/about-temenos/investor-relations)

Conference call

At 18.30 CET / 17.30 GMT / 12.30 EST, today, 20 April 2017, David Arnott, CEO, and Max Chuard, CFO and COO, will host a conference call to present the results and offer an update on the business outlook. Listeners can access the conference call using the following dial in numbers:

0800 920 016 (Swiss Free Call)

1 866 966 1396 (USA Free Call)

0844 571 8892 (UK Free Call)

+44 (0) 207 192 8000 (UK and International)

Conference ID # 6677279

A transcript will be made available on the Company website 48 hours after the call. Presentation slides for the call can be accessed using the following link: https://www.temenos.com/en/about-temenos/investor-relations/results-and-presentations/.

Investor & Media Contacts

Adam Snyder

Head of Investor Relations, Temenos

+44 207 423 3945 [email protected]Press and media enquiries

Conor McClafferty | Martin Meier-Pfister

+44 7920 087 914 | +41 43 244 81 40 [email protected] | [email protected]