Temenos Raises Full Year Guidance on Back of Strong Q3 Results; Announces Share Buyback

Temenos today reports outstanding third quarter 2016 results and announces intention to launch share buyback of up to USD 100m in Q4.

GENEVA, Switzerland, 19 October 2016 – Temenos (SIX: TEMN), the software specialist for banking and finance, today reports its third quarter 2016 results.

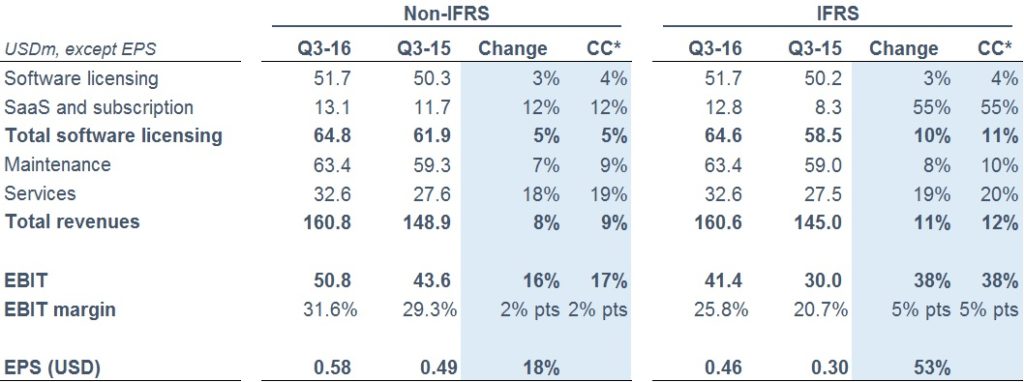

The definition of non-IFRS adjustments is below and a full reconciliation of IFRS to non-IFRS results can be found in Appendix II

* Constant currency (c.c.) adjusts prior year for movements in currencies

Q3 2016 Highlights

- Outstanding performance across all KPIs, FY 2016 guidance raised

- Total software licensing grew 5.5% in constant currencies against tough comparative, which was up 95.5% and included Nordea, our largest deal ever

- On an LTM basis, total software licensing grew 32% in constant currencies and 20% LFL

- Digitalization and cost focus continue to drive strategic decision making and market growth

- Technology partner of choice for system modernization as demonstrated by Bank of Ireland (BOI), Standard Chartered Bank and Nordea

- Strong start to Q4 due to BOI, record level of revenue visibility

- Pipeline into 2017 is very strong, significant breadth and depth of deals

- Intention to launch share buyback of up to USD 100m in Q4 subject to regulatory approvals (see Q3 2016 results presentation for more details)

Q3 2016 Financial Summary

- Non-IFRS total software licensing up 5.5% (c.c.) and IFRS total software licensing up 11% (c.c.) Y-o-Y

- Non-IFRS maintenance growth of 9% (c.c.) and IFRS maintenance growth of 10% (c.c.) Y-o-Y

- Non-IFRS EBIT up 17% (c.c.) and IFRS EBIT up 38% (c.c.) Y-o-Y

- Non-IFRS EPS increase of 18% and IFRS EPS increase of 53% Y-o-Y

- Q3 2016 LTM cash conversion of 125%

- DSOs down 40 days Y-o-Y

Commenting on the results, Temenos CEO David Arnott said:

“The business has performed very well in Q3, sustaining our strong momentum. We were able to grow against a tough comparative which included Nordea, and total software licensing is now up 32% in the last twelve months. Our performance has been driven by broad based client activity across geographies, tiers and verticals, and we are confident in building on this as we look towards 2017.

He added:

“It is clear that banks are focused on moving to scalable, customer-centric models with digital at the heart of their transformation, and our solution is able to meet these demands as demonstrated by the multiple deals we have announced with Tier 1 and 2 banks in the last 2 years. I am particularly pleased with the deal we announced with Bank of Ireland for UniversalSuite, which shows the benefit of leveraging a vertically integrated solution across multiple business lines to prepare for a digital future.”

Commenting on the results, Temenos CFO and COO Max Chuard said:

“Q3 has been an excellent quarter, in which we grew total revenues by 9% and profit by 17%. Our operating cash grew 8% and we ended the quarter with DSOs at 129 days, a decrease of 40 days in the last twelve months. With the announcement of the Bank of Ireland deal, we had a strong start to Q4 and have raised our guidance for the full year to reflect the revenue growth and visibility in the business. We are now guiding for total software licensing to grow 15% to 20%, and for total revenues to grow between 12.5% and 14.5%.”

Revenue

IFRS revenue for the quarter was USD 160.6m, up from USD 145.0m in Q3 2015. Non-IFRS revenue was USD 160.8m for the quarter, up from USD 148.9m in Q3 2015, representing an increase of 9% in constant currencies. IFRS total software licensing revenue for the quarter was USD 64.6m, and non-IFRS total software licensing revenue for the quarter was USD 64.8m, an increase of 5.5% from Q3 2015 in constant currencies. The year-on-year growth was driven by the Standard Chartered Bank deal and strong delivery in Europe, enabling the business to lap a tough comparative which included Nordea, our largest deal ever.

EBIT

IFRS EBIT was USD 41.4m this quarter, up from USD 30.0 in Q3 2015. Non-IFRS EBIT was USD 50.8m in Q3 2016, an increase of 17% from Q3 2015 in constant currencies. Q3 2016 non-IFRS EBIT margin was 31.6%, up 2% points on Q3 2015.

Earnings per Share (EPS)

IFRS EPS for the quarter was USD 0.46 vs. USD 0.30 in Q3 2015. Non-IFRS EPS was 0.58 for the quarter vs. USD 0.49 in Q3 2015, an increase of 18%.

Pre-Tax Operating Cash

IFRS operating cash was an inflow of USD 39.7m in Q3 2016 compared to USD 36.6m in Q3 2015. For LTM to September 2016, operating cash was USD 262.5m representing a conversion of 125% of IFRS EBITDA into operating cash.

Revised 2016 Guidance

The company raises its outlook for the year as follows*:

- Non-IFRS total software licensing growth at constant currencies of 15% to 20% (implying non-IFRS total software licensing revenue of USD 245m to USD 256m), up from 10% to 15%

- Non-IFRS revenue growth at constant currencies of 12.5% to 14.5% (implying non-IFRS revenue of USD 621m to USD 632m), up from 7.5% to 11.0%

- Non-IFRS EBIT at constant currencies of USD 184m to 186m (implying non-IFRS EBIT margin of c.30%), up from USD 180m to USD 185m

- 100%+ conversion of EBITDA into operating cash flow

- Normalized tax rate of 17% to 18%

*Assumes FX rates as disclosed in Q3 2016 results presentation – https://www.temenos.com/en/about-temenos/investor-relations)

Conference Call

At 18.30 CET / 17.30 GMT / 12.30 EST, today, 19 October 2016, David Arnott, CEO, and Max Chuard, CFO and COO, will host a conference call to present the results and offer an update on the business outlook. Listeners can access the conference call using the following dial in numbers:

0800 828 006 (Swiss Free Call)

1 866 966 9439 (USA Free Call)

0800 694 0257 (UK Free Call)

+44 (0) 1452 555 566 (UK and International)

Conference ID # 96581163

A transcript will be made available on the Company website 48 hours after the call. Presentation slides for the call can be accessed using the following link: https://www.temenos.com/en/about-temenos/investor-relations/results-and-presentations/.

Non-IFRS Financial Information

Readers are cautioned that the supplemental non-IFRS information presented in this press release is subject to inherent limitations. It is not based on any comprehensive set of accounting rules or principles and should not be considered as a substitute for IFRS measurements. Also, the Company’s supplemental non-IFRS financial information may not be comparable to similarly titled non-IFRS measures used by other companies. In the reconciliation of IFRS to non-IFRS found in Appendix II, the Company sets forth the most comparable IFRS financial measure and reconciliations of this information with non-IFRS information. The Company’s non-IFRS figures exclude any deferred revenue write-down resulting from acquisitions, discontinued activities that do not qualify as such under IFRS, acquisition related charges such as advisory fees and integration costs, charges as a result of the amortisation of acquired intangibles, costs incurred in connection with a restructuring plan implemented and controlled by management, and adjustments made to reflect the associated tax charge relating to the above items.

Below are the accounting elements not included in the 2016 non-IFRS guidance:

- FY 2016 estimated amortisation of acquired intangibles of USD 35m

- FY 2016 estimated restructuring costs of USD 4m

Restructuring costs include completion of Multifonds integration and realising R&D efficiencies in acquired products. These estimates do not include impact of any further acquisitions or restructuring programmes commenced after 19 October 2016.

The above figures are estimates only and may deviate from expected amounts.

Investor & Media Contacts

Adam Snyder

Head of Investor Relations, Temenos

+44 207 423 3945 [email protected]Press and media enquiries

Conor McClafferty | Martin Meier-Pfister

+44 7920 087 914 | +41 43 244 81 40 [email protected] | [email protected]