The Temenos Account Origination Module Provides PSECU With Dramatic Time Savings

Within four hours of going live, PSECU completed their first automatic member account origination process

MALVERN, PENNSYLVANIA – August 1, 2016 – Temenos (SIX: TEMN), the software specialist for banking and finance, and Pennsylvania State Employees Credit Union (PSECU) today announced the successful implementation of the Lifecycle Management Suite’s Account Origination module.

PSECU, a Symitar user with more than 400,000 members and assets exceeding $4 billion, was looking for a method to streamline the account opening process for both deposit and loan-based accounts when they agreed to partner with Temenos and move forward with the Account Origination module. Within four hours of going live on the system, PSECU not only completed their first automatic member origination process, but did so without manual involvement from a single staff member.

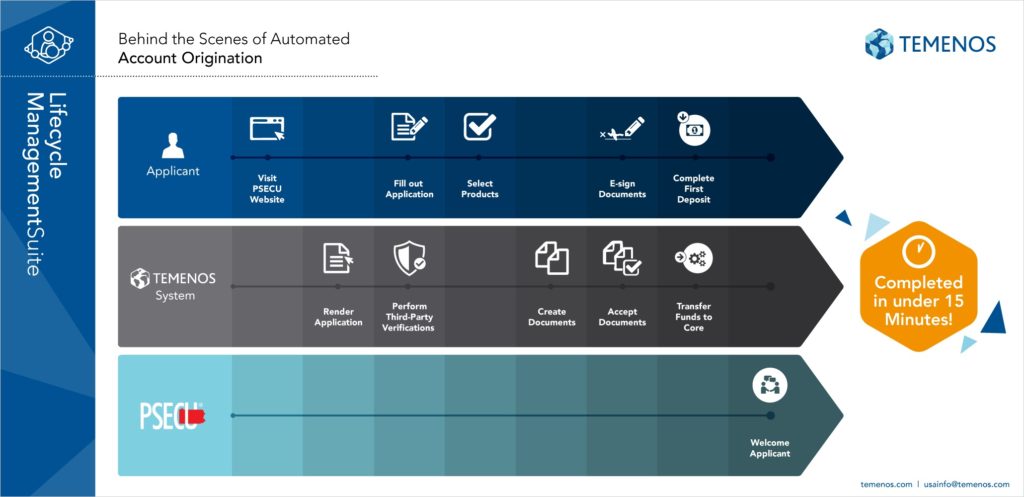

With the implementation of the Account Origination module, when an applicant goes online to apply for an account, they complete three easy steps. Step one, the applicant enters their basic personal information such as name, address and date of birth. Step two, the applicant chooses the products or services in which they are interested. Step three, the applicant receives an automatic decision and is able to make their first deposit if approved!

What the applicant does not see is the system working in the background to create the application, perform third-party verifications, render necessary documents and accept electronic signatures, and finally clear stipulations before powering the funding of the account. The account is funded using automation and configuration settings defined by the credit union and built into the system prior to the launch, ensuring that all approvals meet PSECU’s criteria. The entire streamlined and comprehensive process can be completed on average within five to ten minutes, truly making it easy for the new member.

Andrew Coy, AVP of Lending, PSECU, said:

“At PSECU, it really is as easy as 1, 2, 3! The account origination solution goes hand-in-hand with the other Temenos Lifecycle Management Suite products we’ve implemented over the years, but most importantly the Loan Origination module. Being able to not only auto-decision loan approvals, but now to also automatically create the accounts so that all the steps are consolidated into one streamlined application process has already dramatically reduced our processing time for indirect loans. In the future, we will begin to integrate this functionality into all other loan products to continue streamlining processes for new members. We’re thrilled with the results and we’re excited that our employees can begin spending less time on manual tasks and instead focus on our overall member service strategy.”

Larry Edgar-Smith, SVP of Product Evangelism, Temenos, commented:

“The Lifecycle Management Suite was designed to meet the needs of account holders at every phase of the account lifecycle. PSECU has followed Temenos (previously Akcelerant) through the journey as we’ve expanded our product offering from collection to loan origination to service to profitability, and now account origination. As our inaugural customer on the collection module, we have a long history of partnering with PSECU, and it’s terrific to see how our system, combined with their inspiring commitment to the member experience, can reap such huge efficiencies.”

Temenos Press Contacts

Scott Rowe

Temenos Global Public Relations

+44 20 7423 3857 [email protected]Gabriel Goonetillake

Edelman Smithfield for Temenos

Tel: +44 7813 407710 [email protected]