Temenos Earnings up 23% in 2015 on the Back of 52% Growth in Total Software Licensing

GENEVA, Switzerland, 11 February 2016 – Temenos AG (SIX: TEMN), the market leading provider of mission-critical software to financial institutions globally, today reports its fourth quarter and full year 2015 results.

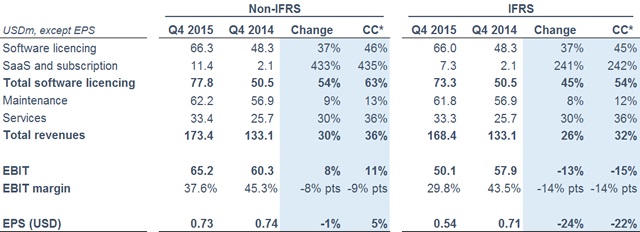

The definition of non-IFRS adjustments is below and a full reconciliation of IFRS to non-IFRS results can be found in Appendix II

* Constant currency (CC) adjusts prior year for movements in currencies

Q4 & FY 2015 Financial Summary

- Non-IFRS total software licensing revenues up 63% (cc) and 31% (LFL) in Q4 2015, and up 52% (cc) and 20% (LFL) in FY 2015

- Non-IFRS maintenance growth of 13% in Q4 2015 and 11% in FY 2015 (cc)

- Non-IFRS services margin improvement of 340bps in FY 2015

- Non-IFRS EBIT up 11% in Q4 2015 (cc), FY 2015 non-IFRS EBIT margin of 28.1%

- FY 2015 non-IFRS EPS increase of 20%

- FY 2015 cash conversion of 133%

- DSOs down 27 days Y-o-Y (30 days proforma)

- Profit and cashflow strength support proposed dividend of CHF 0.45, a 12.5% annual increase

- 2016 guidance of non-IFRS total software licensing growth of 10% to 15% (cc), and non-IFRS revenue growth of 7.5% to 11.0% (cc)

Q4 & FY 2015 Operational Highlights & Outlook

- Outstanding year driven by high levels of client activity, particularly in developed markets

- Significant growth across all products in Q4, in particular Private Banking and Channels

- Strong progress on larger deals and the U.S., major growth drivers for the future

- Progressive renovation opening up significant opportunities

- Strong pipeline generation in Q4 gives confidence for 2016

- Highest total revenue visibility ever, driven by high recurring revenues and progressive renovation

Commenting on the results, Temenos CEO David Arnott said:

“2015 has been a landmark year for Temenos. We have had exceptional performance across all lines of business. We have won all key new large deals, as well as seeing significant momentum in the installed base. Our value proposition is driving our growth, with progressive renovation and our multi-product offering opening up substantial opportunities with Tier 1 banks. Our industry-leading levels of product investment and culture of innovation are creating clear water between us and the competition, which we are capitalising on. Geographically our growth this year was driven largely by developed markets, with emerging markets only contributing 22% of total software licensing revenues.

We have made excellent progress on our strategic initiatives in 2015, extending our leadership in retail and wealth, gaining key references in the US and taking our partnership model to the next level. With the digitization of the financial services industry, banks have no choice but to invest in modern technology to stay relevant and capitalise on the opportunities this creates. With these structural drivers in place, we are well positioned for 2016 and are confident we will continue gaining market share.”

Commenting on the results, Temenos CFO and COO Max Chuard said:

“Our top line growth in both Q4 and the full year has been exceptional. Our results in 2015 reflect the strength of our business model, delivering substantial growth in revenues whilst improving our margins and profitability year-on-year. Our value proposition is enabling us to compete for and win large Tier 1 progressive renovations which, combined with our strong pipeline generation in the fourth quarter, have greatly improved our revenue visibility in 2016 and the medium term. With a 20% increase EPS, and cash flow generation well above our target of 100% of EBITDA, I am pleased to recommend a dividend of CHF 0.45 for 2015, an increase of 12.5% on last year.

We expect our strong financial performance to continue in 2016 with non-IFRS total software licensing growth of 10% to 15% and total revenue growth of between 7.5% and 11.0%. We are guiding for 2016 non-IFRS EBIT of USD 180m to 185m, which implies a margin of 30%.”

Revenue

IFRS revenue for the quarter was USD 168.4m, up from USD 133.1m in Q4 2014. Non-IFRS revenue was USD 173.4m for Q4 2015 up from USD 133.1m in Q4 2014, representing an absolute increase of 30% and a 36% increase in constant currency. IFRS total software licensing revenue for the quarter was USD 73.3m, and non-IFRS total software licensing revenue for the quarter was USD 77.8m, up 54% from Q4 2014 on a reported basis and 63% in constant currencies.

EBIT

IFRS EBIT was USD 50.1m this quarter. Non-IFRS EBIT was USD 65.2m in Q4 2015, 11% higher than in Q4 2014 (cc), with a FY 2015 non-IFRS EBIT margin of 28.1%, an increase of 80bps on FY 2014.

Earnings per Share (EPS)

IFRS EPS was USD 0.54 and non-IFRS EPS was 0.73 in Q4 2015. Non-IFRS EPS for FY 2015 was USD 1.73, up 20% vs FY 2014.

Pre-Tax Operating Cash

IFRS operating cash was an inflow of USD 161.3m in Q4 2015 compared to USD 118.5m in Q4 2014. For FY 2015, operating cash was USD 227m representing a conversion of 133% of IFRS EBITDA into operating cash.

Dividend

Taking into account the strength of profit growth and cash generation, as well as the expected strength of future cashflows, subject to shareholder approval at the AGM on 10 May 2016, Temenos intends to pay an annual dividend of CHF 0.45 per share. The shares will trade ex-dividend on 13 May 2016, and the dividend record date will be set on 17 May 2016. The dividend will be paid on 18 May 2016. As with previous years, the 2015 dividend will be paid as a distribution of capital contribution reserves and therefore be exempted of withholding tax. Temenos’ policy is to distribute a sustainable to growing dividend.

2016 Guidance

Our guidance for 2016 is as follows:

- Non-IFRS total software licensing growth at constant currency of 10% to 15% (implying total software licensing revenue of USD 234m to USD 245m)

- Non-IFRS revenue growth at constant currency of 7.5% to 11.0% (implying revenue of USD 594m to USD 614m)

- Non-IFRS EBIT at constant currency of USD 180m to 185m (implying non-IFRS EBIT margin of c.30%)

- 100%+ conversion of EBITDA into operating cashflow

- Tax rate of 17% to 18%

Medium Term Targets

Our medium term targets are as follows:

- Non-IFRS total software licensing growth of 15% CAGR

- Non-IFRS revenue growth of 10% CAGR

- Non-IFRS EBIT margin improvement of 100 to 150bps on average p.a.

- Non-IFRS EPS growth of 15% CAGR

- Cash conversion over 100% p.a.

- DSOs reducing by 10 to 15 days p.a.

- Tax rate of 17% to 18%

Currency Assumptions for 2016 Guidance

In preparing the 2016 guidance, the Company has assumed the following:

- USD to Euro exchange rate of 0.901;

- USD to GBP exchange rate of 0.691; and

- USD to CHF exchange rate of 0.992.

Conference Call

At 18.30 CET / 17.30 GMT / 12.30 EST, today, 11 February 2016, David Arnott, CEO, and Max Chuard, CFO and COO, will host a conference call to present the results and offer an update on the business outlook. Listeners can access the conference call using the following dial in numbers:

0800 920 016 (Swiss Free Call)

1 866 966 1396 (USA Free Call)

0800 376 7922 (UK Free Call)

+44 (0) 207 192 8000 (UK and International)

Conference ID # 40979283

A transcript will be made available on the this website 48 hours after the call using this link. https://www.temenos.com/en/about-temenos/investor-relations/results-and-presentations/

Presentation slides for the call can also be accessed using the link above

Non-IFRS Financial Information

Readers are cautioned that the supplemental non-IFRS information presented in this press release is subject to inherent limitations. It is not based on any comprehensive set of accounting rules or principles and should not be considered as a substitute for IFRS measurements. Also, the Company’s supplemental non-IFRS financial information may not be comparable to similarly titled non-IFRS measures used by other companies. In the reconciliation of IFRS to non-IFRS found in Appendix II, the Company sets forth the most comparable IFRS financial measure and reconciliations of this information with non-IFRS information. The Company’s non-IFRS figures exclude any deferred revenue write-down resulting from acquisitions, discontinued activities that do not qualify as such under IFRS, acquisition related charges such as advisory fees and integration costs, charges as a result of the amortisation of acquired intangibles, costs incurred in connection with a restructuring plan implemented and controlled by management, and adjustments made to reflect the associated tax charge relating to the above items.

Below are the accounting elements not included in the 2016 non-IFRS guidance:

- FY 2016 estimated amortisation of acquired intangibles of USD 35m

- FY 2016 estimated restructuring costs of USD 4m

Restructuring costs include completion of Multifonds integration and realising R&D efficiencies in acquired products. These estimates do not include impact of any further acquisitions or restructuring programmes commenced after 11 February 2016.

The above figures are estimates only and may deviate from expected amounts.

Investor & Media Contacts

Adam Snyder

Head of Investor Relations, Temenos

+44 207 423 3945 [email protected]Press and media enquiries

Conor McClafferty | Martin Meier-Pfister

+44 7920 087 914 | +41 43 244 81 40 [email protected] | [email protected]