Temenos Delivers Solid Q3 Results and Increases Full Year Non-Ifrs EBIT Margin Guidance

GENEVA, Switzerland, 21 October 2014 – Temenos Group AG (SIX: TEMN), the market leading provider of mission-critical software to financial institutions globally, today reports its third quarter 2014 results.

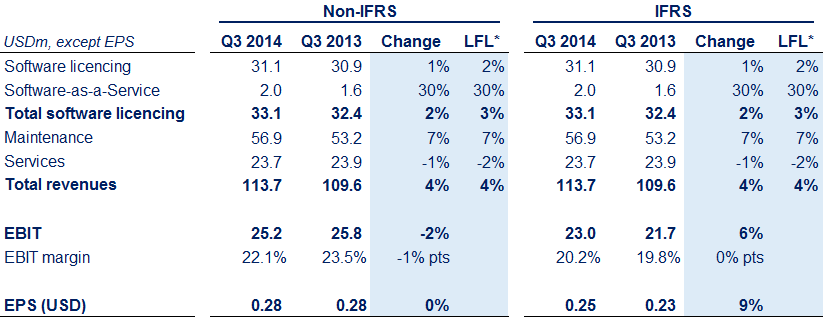

The definition of non-IFRS adjustments is below with a full reconciliation of IFRS to non-IFRS results can be found in Appendix II

* Like-for-like (LFL) excludes contributions from acquisitions and adjusts for movements in currencies

** Earnings before interest, tax, depreciation and amortisation (EBITDA) into cash generated from operations

Q3 2014 financial highlights

- LFL software licensing growth in Q3 of 2% taking growth to 11% on a 12 month basis (LTM)

- Continued strong execution on services strategy with a positive non-IFRS services margin in the quarter

- Non-IFRS EBIT down 2% in Q3 2014 vs Q3 2013 due to timing of investment; up 13% on an LTM basis

- Cash conversion** of 123% in the twelve months to September 2014; DSOs down 25 days vs Q3 2013

- USD 87.2m returned in 2014 YTD through share buybacks; repurchasing c.3.5% of the issued share capital

- Full year software licensing guidance reaffirmed with non-IFRS EBIT margin guidance increased to 25.5%

Q3 2014 operational highlights and outlook

- 7 new customer wins (Q3 2013: 5) and strong execution with 14 implementation go-lives (Q3 2013: 13)

- Positioned as a ‘leader’ in the latest Forrester Wave on Global Banking Platforms with highest strategy score

- Further US progress with Model Bank delivered to US team and launch of multi-product SaaS solutions

- Continued encouraging levels of customer activity across all geographies

- Larger deals moving towards closure

- Year-to-date performance and pipeline underpins confidence in achieving FY guidance

Commenting on the results, Temenos CEO David Arnott said:

“Q3 saw a solid performance. Our pipeline remains strong, with a broad geographic spread, and we are making progress on larger deals which are moving towards closure. The strength of our pipeline and the progress we are making underpins our confidence for a strong fourth quarter which, together with our year-to-date performance, leaves us on track to meet our full year guidance.

It has been 18 months since we acquired TriNovus in the US and I am delighted to have made significant progress on our strategy. Our US Model Bank has now been delivered to the team and we are moving towards our first go-lives. We have also launched our business intelligence and anti-money laundering compliance solutions, both enabled for software-as-a-service (SaaS) deployment, whilst expanding our datacenter footprint into Texas and Georgia. Temenos has a unique proposition for US banks which leaves us well placed to realise the vast market opportunity that exists in the world’s largest financial services market.”

Commenting on the results, Temenos CFO Max Chuard said:

“The quarter delivered growth in software licensing as well as strong execution on our services strategy. “Premium” services now account for almost 30% of total services revenues, driving a positive non-IFRS services margin both in the quarter and over the past twelve months, with our services margin now expected to be positive for the full year. Our cash performance was particularly strong in the quarter with an operating cash inflow of USD29.9m contributing to cash conversion of 123% on a twelve month basis.

I am pleased to be able to once again reaffirm our full year software licensing guidance with a better revenue mix expected to drive an increased full year non-IFRS EBIT margin of c.25.5%.”

Revenue

Both IFRS and non-IFRS revenue for the quarter was USD 113.7m, up from USD 109.6m in Q3 last year, representing an increase of 4% on both a reported like-for-like basis. Licence revenue for the quarter was USD 31.1m, 1% higher than in the same period in 2013 on a reported basis and 2% on a like-for-like basis.

EBIT

Non-IFRS EBIT was USD 25.2m in Q3, 2% lower than in Q3 2013 due to the timing of investments, with a non-IFRS EBIT margin in Q3 of 22.1%, down 1.4% points on Q3 2013. IFRS EBIT increased from USD 21.7 in Q3 2013 to USD 23.0m in Q3 2014 with a margin of 20.2%, up 0.4% points.

Earnings per share (EPS)

Non-IFRS EPS was USD 0.28, unchanged compared to the prior year. LTM 2014 non-IFRS EPS was USD 1.34, up 11% on the previous 12 months. IFRS EPS for the quarter increased from USD 0.23 per share to USD 0.25 per share.

Pre-tax operating cash

Operating cash was an inflow of USD 29.9m in Q3 2014 compared to USD 16.1m in Q3 2013. For LTM to September 2014, operating cash was USD 198.1m representing a 123% conversion of EBITDA into operating cash.

2014 guidance

Full year guidance for software licensing revenue and total revenue guidance is reaffirmed. Due to the acceleration of our strategy to reduce the contribution from our services business which will deliver a better revenue mix, the full year non-IFRS EBIT margin guidance has been increased to c.25.5%.

Full year guidance for software licensing revenue and total revenue guidance is reaffirmed. Due to the acceleration of our strategy to reduce the contribution from our services business which will deliver a better revenue mix, the full year non-IFRS EBIT margin guidance has been increased to c.25.5%.

Our guidance for 2014 on a non-IFRS basis is:

- Total non-IFRS revenue growth of 5% to 10% (implying non-IFRS revenue of USD 489m to USD 512m, versus the previous implied guidance range of USD 491m to USD 515m due to the impact of revised currency assumptions)*

- Software licensing growth of 10% to 15% (implying software licensing revenue of USD 151m to USD 158m, versus the previous implied guidance range of USD 152m to USD 158m, also due to the impact of revised currency assumptions)*

- Non-IFRS EBIT margin of 25.5%, increased from 25.1% (implying non-IFRS EBIT of USD 124m to USD 130m, versus the previous implied guidance range of USD 123m to USD 129m)*

- 100%+ conversion of EBITDA into operating cashflow

- Tax rate of 17% to 18%

* Based on the revised currency assumptions set out below

Conference call

At 18.30 CET / 12.30 EST / 17.30 BST, today, 21 October 2014, David Arnott, CEO, and Max Chuard, CFO, will host a conference call to present the results and offer an update on the business outlook. Listeners can access the conference call using the following dial in numbers:

0445 804 282 (Swiss Local Call)

0800 650 024 (Swiss Free Call)

+1 866 254 0808 (USA Free Call)

+44 (0)1452 541 003 (UK and International)

0800 694 5707 (UK Free Call)

Conference ID # 10056580

Currency assumptions for 2014 guidance

In preparing the 2014 guidance, the Company has taken the actual Q1, Q2 and Q3 2014 results and for Q4 2014 assumed the following:

- USD to Euro exchange rate of 0.786

- USD to GBP exchange rate of 0.614; and

- USD to CHF exchange rate of 0.948

Non-IFRS financial Information

Readers are cautioned that the supplemental non-IFRS information presented in this press release is subject to inherent limitations. It is not based on any comprehensive set of accounting rules or principles and should not be considered as a substitute for IFRS measurements. Also, the Company’s supplemental non-IFRS financial information may not be comparable to similarly titled non-IFRS measures used by other companies. In the reconciliation of IFRS to non-IFRS found in Appendix II, the Company sets forth the most comparable IFRS financial measure and reconciliations of this information with non-IFRS information. The Company’s non-IFRS figures exclude any deferred revenue write-down resulting from acquisitions, discontinued activities that do not qualify as such under IFRS, acquisition related charges such as advisory fees and integration costs, charges as a result of the amortisation of acquired intangibles, costs incurred in connection with a restructuring plan implemented and controlled by management, and adjustments made to reflect the associated tax charge relating to the above items.