Temenos Announces Q4 2013 Software Licensing Growth of 14% With Full Year Growth of 10%

FY 2013 non-IFRS EBIT margin above top end of guidance drives non-IFRS EPS growth of 36%

GENEVA, Switzerland, 18 February 2014 – Temenos Group AG (SIX: TEMN), the market leading provider of mission-critical software to financial institutions globally, today reports its fourth quarter and full year 2013 results.

The definition of non-IFRS adjustments is below with a full reconciliation of IFRS to non-IFRS results can be found in Appendix II

* Like-for-like (LFL) excludes contributions from acquisitions and adjusts for movements in currencies

** Earnings before interest, tax, depreciation and amortisation (EBITDA) into cash generated from operations

Q4 & FY Financial Highlights

- Q4 like-for-like software licencing growth of 15% drives FY 2013 growth at the top end of guidance

- Services strategy ahead of expectations with lower contribution to group revenues and 7.8% points improvement in FY 2013 non-IFRS services margin

- Better revenue mix and lower costs delivers FY 2013 non-IFRS EBIT up 30%

- FY non-IFRS EBIT margin up 4.9% points to 24.1%, above the top end of guidance

- FY non-IFRS EPS up 36% to USD 1.22

- FY operating cash inflow of USD 169.3m with cash conversion** of 119% in 2013; DSOs reduced by 28 days

- Strength of operational performance and cashflows supports 25% increase in annual dividend

- 2014 guidance includes software licensing growth of 10% to 15% and non-IFRS EBIT margin of 25.1%

Q4 Sales & Operational highlights

- Continued strong sales into the installed base

- 14 new customer wins (Q4 2012:10)

- Strong growth in Europe and APAC

- Strong delivery with 10 implementation go-lives in (Q4 2012:9)

- Update on strategy to be presented tomorrow at Analyst & Investor Event

Commenting on the results, Temenos CEO David Arnott said:

“In February last year we set out our guidance for 2013 and our strategy for the medium term. Our results demonstrate that we have delivered on our strategy, with full year software licensing growth of 10% at the top of our guidance and non-IFRS EBIT margin above our expectations.

Tomorrow we will host an event for analyst and investors at which we will provide further details on how we are delivering on our commitments. Our market opportunity is massive and has increased following the launch of the Temenos Payment Suite. The industry is undergoing a structural shift and to meet the challenges banks must have IT which is efficient, agile and omnichannel and which delivers actionable analytics. We have the solutions to meet the industry’s needs and are consolidating our leadership position.

Taking all of these things together, we have great confidence in meeting our medium term targets, driving strong earnings and cash generation, and delivering significant returns to our shareholders.”

Commenting on the results, Temenos CFO Max Chuard said:

“2013 has demonstrated that we are focused on turning strong operational delivery into strong financial performance. A better revenue mix combined with good cost control has delivered non-IFRS EBIT margin above the top end of our guidance, and this will provide the new base from which the 2014 non-IFRS EBIT margin will increase. Efficient tax and financing structures have allowed Temenos to deliver EPS growth of 36%, above the 30% growth in EBIT.

We have once again delivered cash conversion comfortably over 100%, with DSOs reducing by 28 days in the year. The strength of Temenos’ cash generation in 2013, as well as the expected strength of future cashflows, provides financial flexibility to pursue our strategic ambitions as well as providing confidence to declare an increase of 25% over last year’s dividend.”

Revenue

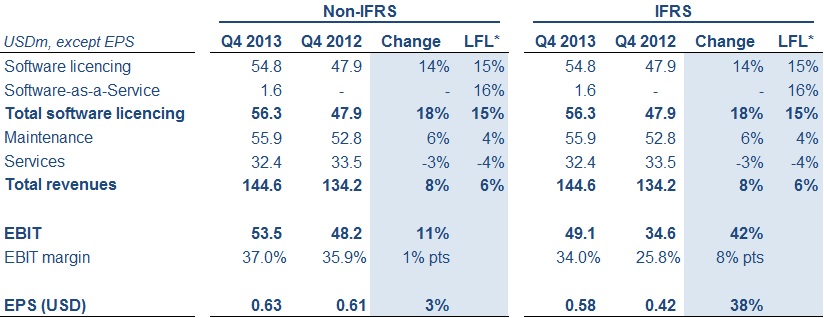

Both IFRS and non-IFRS total revenue for the quarter was USD 144.6m, which was up 8% on Q4 2012, driven by 14% growth in software licensing revenue. Total revenue for the full year was USD 467.8m, an increase of 4% over the prior year despite services revenue being down 9%.

EBIT

Non-IFRS EBIT was USD 53.5m in Q4, 11% higher than in Q4 2012, with a non-IFRS EBIT margin in Q4 of 37.0%, up 1.1% points on Q42012. IFRS EBIT was up 42% from USD 34.6m in Q4 2012 to USD 49.1m in Q4 2013. Non-IFRS EBIT for the full year was USD 112.8m, a 30% increase over 2012, with a non-IFRS EBIT margin of 24.1%, above the top end of guidance.

Earnings per Share (EPS)

Non-IFRS EPS was USD 0.63 in the quarter, compared to USD 0.61 in the prior year. For FY 2013, non-IFRS EPS was USD 1.22, up over a third from USD 0.90 in 2012. IFRS EPS for the quarter moved from USD 0.42 to USD 0.58.

Pre-Tax Operating Cash

Operating cash was USD 126.3m in Q4 2013 compared USD 114.3m in Q4 2012. For full year, operating cash was USD 169.3m, representing a 119% conversion of EBITDA into operating cash.

Dividend

Temenos is highly cash generative with a strong balance sheet which enables investment in the business, including industry leading R&D spend, and funding for targeted acquisitions whilst also providing for returning value to shareholders.

Taking into account the strength of operational performance and cash generation, as well as the expected strength of future cashflows, subject to shareholder approval at the AGM on 28 May 2014, Temenos intends to pay an annual dividend of CHF 0.35 on 5 June 2014, representing an increase of 25% over last year’s CHF dividend. The dividend record date will be set on 4 June 2014 with the shares trading ex-dividend on 2 June 2014. Temenos policy is to distribute a sustainable to growing dividend.

2014 Guidance

Our guidance for 2014 on a non-IFRS basis is:

- Total non-IFRS revenue growth of 5% to 10% (implying non-IFRS revenue of USD 491m to USD 515m)*

- Software licensing growth of 10% to 15% (implying software licensing revenue of USD 152m to USD 158m)*

- Non-IFRS EBIT margin of 25.1% (implying non-IFRS EBIT of USD 123m to USD 129m)*

- 100%+ conversion of EBITDA into operating cashflow

- Tax rate of 17% to 18%

* Based on the currency assumptions set out below

Medium Term Targets

Our medium term targets, which we announced in February 2013, on a non-IFRS basis are:

- Non-IFRS revenue growth of 5%+ on average per annum with

- Software licensing growth of 10%+ on average per annum

- Services contributing 20% to 25% of group revenue and be profitable

- Non-IFRS EBIT margin improvement of 100 to 150bps on average per annum

- 100%+ conversion of EBITDA into operating cashflow

- DSOs reducing by 10 to 15 days per annum

- Tax rate of 17% to 18%

Conference Call

At 17.30 BST / 18.30 CET / 12.30 EST, today, 18 February 2014, David Arnott, CEO, and Max Chuard, CFO, will host a conference call to present the results and offer an update on the business outlook. Listeners can access the conference call using the following dial in numbers:

+44 (0)1452 569 335 (UK and International)

0808 238 0673 (UK Free Call)

0445 804 038 (Swiss Local Call)

0800 650 052 (Swiss Free Call)

+1 866 655 1591 (USA Free Call)

Conference ID # 40700555

A transcript will be made available on the Company website 48 hours after the call. Presentation slides for the call can be accessed using the following link: https://www.temenos.com/en/about-temenos/investor-relations/results-and-presentations/.

Analyst & Investor Event

Temenos will tomorrow host an event for analysts and investors at Deutsche Bank, 1 Great Winchester Street, London EC2N 2DB from 10am to 2pm (UK time). Should you wish to attend the event, please register your attendance at https://www.temenos.com/en/about-temenos/investor-relations/investor-day-2014/.

Currency Assumptions for 2014 Guidance

In preparing the 2014 guidance, the Company has assumed the following:

- USD to Euro exchange rate of 0.734;

- USD to GBP exchange rate of 0.607; and

- USD to CHF exchange rate of 0.903.

Non-IFRS Financial Information

Readers are cautioned that the supplemental non-IFRS information presented in this press release is subject to inherent limitations. It is not based on any comprehensive set of accounting rules or principles and should not be considered as a substitute for IFRS measurements. Also, the Company’s supplemental non-IFRS financial information may not be comparable to similarly titled non-IFRS measures used by other companies. In the reconciliation of IFRS to non-IFRS found in Appendix II, the Company sets forth the most comparable IFRS financial measure and reconciliations of this information with non-IFRS information.

The Company’s non-IFRS figures exclude any deferred revenue write-down resulting from acquisitions, discontinued activities that do not qualify as such under IFRS, acquisition related charges such as advisory fees and integration costs, charges as a result of the amortisation of acquired intangibles, costs incurred in connection with a restructuring plan implemented and controlled by management, and adjustments made to reflect the associated tax charge relating to the above items.

Investor & Media Contacts

Adam Snyder

Head of Investor Relations, Temenos

+44 207 423 3945 [email protected]Press and media enquiries

Conor McClafferty | Martin Meier-Pfister

+44 7920 087 914 | +41 43 244 81 40 [email protected] | [email protected]