Three Takeaways from Temenos Regional Forum Philippines

As we emerge from the pandemic, the global banking landscape has evolved. Digitization continues to shape the financial services landscape in Philippines, and as Bangko Sental ng Pilipinas continues on the journey to accelerate this move with its Digital Payments Transformation Roadmap and the National Strategy for Financial Inclusion, Temenos held a thought leadership industry forum on the theme of “Everyone’s Banking Platform”. The event explored how market forces, global economic dynamics, as well as intelligent technology practice adoptions such as Cloud, AI, Open & Composable Banking can benefit in building and implementing robust, innovative and future-ready digital finance infrastructure for the Nation, as well as strategies to serve the unbanked population.

Our regional forum engaged the global and regional banks, fintechs, and hyperscalers in a discussion on how the banking industry should not only respond, but also reposition themselves to ride on the waves of change to gain a competitive advantage, as Philippines continues to rise to become a critical economic force in Asia. Here are some key takeaways from the Temenos Regional Forum 2022 in Philippines.

Composable Banking and Open Banking, a Platform for Everyone

Banking doesn’t just have to happen in a bank anymore, it can happen anywhere. Open and collaborative business models like Banking-As-A-Service are transforming banking. Banking and Finance is getting embedded in the day of a life of the everyday Filipino. The future of banking has no borders or boundaries, and to facilitate that, Filipino banks need an open to eco-system, highly secure, cloud-native platform, that can create endless opportunities for Filipinos, where people can interchangeably play the role of a provider and consumer of new and innovative services.

What does this mean from a technological perspective? We, at Temenos, pioneer the cause to make banking services more composable. Composable Banking helps bankers compose, or build, products and services based on what their specific customer’s needs, and allows banks to progressively renovate its IT landscape to deploy new services faster, more cost-effectively, at scale. Composable banking capabilities would lead to hyper-personalization of products and services that in turn would ensure loyal customers.

Customers’ expectations are increasing – they want the ‘Amazon experience in banking’. And now we have the disruptive technology like AI, Cloud, APIs to make this possible. The combination of these customer expectations and disruptive technology is leading to the banking value chain being split between the manufacturing and the distribution of financial products. This is arranging banking into smaller clusters, with fierce competition across multiple areas between traditional banks and new players, with the emergence of new banking business models. While this increases competition, it is also opening the doors of opportunity for the future-ready Filipino banker.

For Filipino bankers, what this means is a need for unprecedented business agility. Filipino bankers need to be able to compose new banking solutions. They need to be able to deconstruct the traditional legacy banking offerings, distil the crucial components that value add to customers, and then recompose them into cutting edge, agile value propositions for tomorrow’s banking leaders. This makes it even more critical for the Filipino banker to consider some critical factors while evaluating a technology platform for the bank. The platform must allow the bankers to build granular banking capabilities from scratch or from its basic building blocks, like a personalized sandbox. Such a platform needs to be able to be integrated with third party solutions in today’s rapidly evolving fintech ecosystems or allow Filipino bankers to consume information and technology products or services however they want, on-premise, or on any private or public cloud.

It is a platform where services can be built and consumed by everyone, both existing and new to bank customers, for any banking business segment, whether as a licensed bank or a licensed digital lender. Such a platform empowers the Filipino bankers to dream, to build, and then to scale. And such a platform is now available in the Philippines. That’s why all of us at Temenos are always talking about Everyone’s Banking Platform.

Next-Generation Digital Banking in the Philippines

The APAC region, including the Philippines, is poised to be the next battleground for digital banks, with existing players stepping up their expansion plans in addition to the entrance of new players. Trends like the hybrid banking model, the gig economy, and financial inclusion is opening the pathway for new financial services needs in the Philippines. To address the changing expectations of today’s Filipinos, digital banks have emerged providing financial services to address these market trends and segments who have not been adequately served before.

One of the hot trends in the digital space is the rise of embedded finance. Specifically, digital banks are looking to partner with other FinTech’s to deliver superior user experiences while also in parallel improving on the cost-to-income ratios. The key to a successful partnership lies in the partners’ ability to scale rapidly, and to provide that seamless user experience that Filipinos today and tomorrow and looking for. In our forum with heavyweights like Paolo Eugenio J Baltao, Senior Vice President Philippine National Bank (PNB), Maria Lourdes “Long” (Solis) Pineda, Country President – Philippines, Tonik and Lester Cruz, Head of Liabilities – Products & Partnerships at UNO Digital Bank, Temenos explored how COVID-19 has accelerated digital banking in the Philippines, and how digital banking have emerged to constitute a critical segment in the banking sector in the Philippines. Consequently, digital banking have also emerged to become a new means through which today’s Filipino bank can capture new market share in digital channels which include Filipinos who previously may not have access to the physical branches around the nation. Indeed, the panel concluded that the need for digital banking to be integrated to the SMEs, the financially underserved, and the financially unserved is of utmost importance to unlock the potential to propel Philippines ahead into a digital economy.

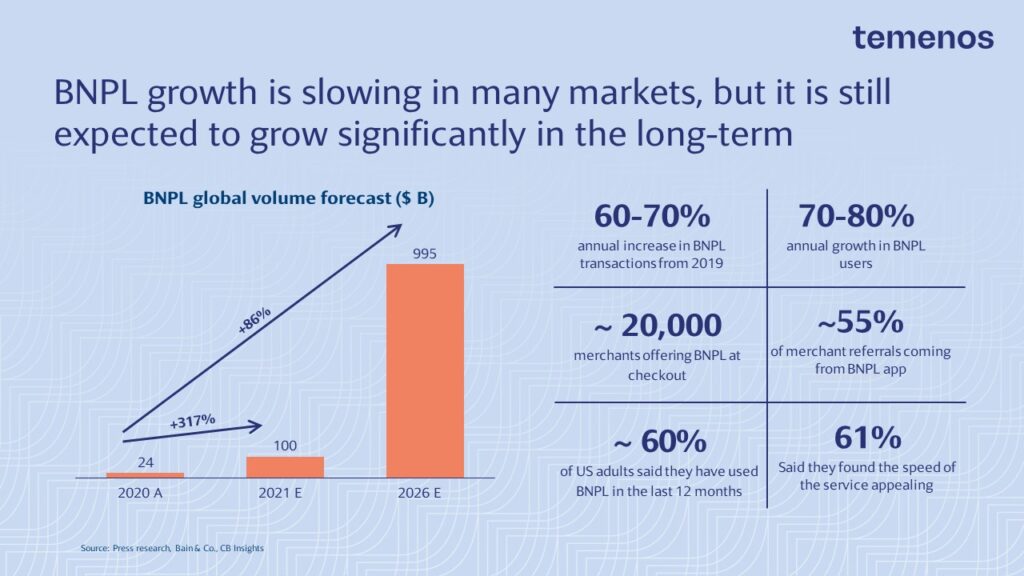

Buy-Now-Pay-Later as a hinge towards Digital Lending

Top of the mind for Filipino bankers is also how the Philippines could rapidly digitize its economy and equip the unbanked or underbanked into the digital age. One key innovation that paves the way forward by both providing needed leverage as well as enabling rapid digital financing is the trend of “Buy-Now-Pay-Later.” Key to this trend would be how Filipino banks can tap on the existing capabilities that modern technology can provide, potentially even offering a digital element for traditional financial services like SME loans or Mortgages at scale. As the Philippines continues to be one of the emerging markets with a high concentration of young people, the key to successful BNPL and digital lending in product innovation.

The core challenge on BNPL is around an effective business model, as well as finding the right platform through which BNPL can be served to Filipinos. Temenos for BNPL is a comprehensive, SaaS-first solution that empowers banks and Fintechs to create amazing BNPL experiences for both customers AND merchants. Temenos feature three unique differentiations:

- Firstly, to allow banks and fintechs to go to market fast, thanks to our packaged banking capabilities. Temenos BNPL comes out of the box with pre-configured BNPL products and APIs that cover the entire customer journey, from seeing available instalment options, to placing an order, to even cancelling the order or asking for a refund. Essentially, this is a plug & play solution that fits nicely into your existing ecosystem.

- Secondly, Temenos has a unique embedded explainable AI engine that helps BNPL providers lend more responsibly, helping to address a huge challenge in this market that we highlighted earlier. We enable lenders to effectively guide their customers towards the best instalment plan for their own financial circumstances, reducing financial burden and also allowing the bank to reduce credit risk.

- Thirdly, Temenos help banks and fintechs grow this line of business in a cost-efficient and scalable way with our platform. We’ve seen our customer scaling our BNPL solution to a remarkable extent, and we’re very proud of the scalability of our platform

But the key consideration, however, is that Temenos offers a composable service. Essentially Temenos BNPL platform combines capabilities from across product lines and use them to create a solution that is fit for purpose. Embracing such capabilities will enable the Filipino banker to not just digitally include the unbanked and underbanked, it also provides that necessary step in securing the Philippines’ aspiration to leapfrog ahead into a digital economy of the future in Asia.

Conclusively, considering the key insights of a) Composable Banking, b) Next-Generation Digital Banking, and c) Buy-Now-Pay-Later, the Temenos Regional Forum Philippines indeed reshaped the perspectives of the Filipino banking community on what’s possible, as the Philippines emerges out of the pandemic and continues to establish itself as an economic powerhouse in the region.

With the right perspectives and framework today’s technologies can carve out a way for Filipino banks. Temenos Regional Forum endeavors to be that industry forum where the latest ideas, business models, and capabilities are exchanged and discussed, so that the financial services of tomorrow can be enabled, today. Our Temenos ecosystem of solutions enable engaging banking customers, growing market share, or scaling banking operations. We’re empowering everyone to build tomorrow’s banks, today. That’s why we’re Everyone’s Banking Platform.

See you at Temenos Regional Forum 2023!