Advancements in machine learning are assisting – rather than replacing – the human wealth manager in Asia

Those of us in the financial software industry have talked so much about trends in AI and machine learning in recent years that it’s often difficult to distinguish sensationalism and bluster from meaningful progress and real innovation.

With that in mind, let’s cut to the chase and identify what’s really in store in terms of machine learning for the rest of 2018, and in the immediate years ahead.

Robots will onboard you

From my vantage point here at Temenos’ Asia headquarters in Singapore, it’s clear that the two most meaningful developments in this region are significant evolutions in automated client onboarding via more sophisticated chatbots, and much more active aggregation of social information by wealth managers to build sales leads.

Let’s tackle developments in onboarding first.

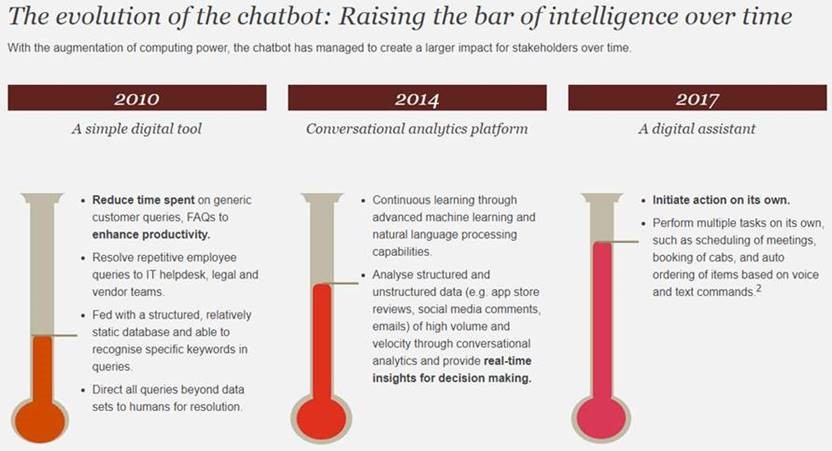

The rise of chatbots in the wealth management sector – and their increasing role in process automation – is in some ways an old story. That’s because chatbots have been around for years and by now are woven seamlessly into the fabric of Asia’s financial services industry.

How so? Well, in recent years chatbots have steadily taken over the more tedious administrative aspects of client service, especially in the middle and mass wealth management markets. These tasks include routine notifications about account status and assisting with automated transfers between accounts.

Banks like DBS in Singapore, for example, deploy chatbots on Facebook Messenger, creating a seamless interface between customers and the bank.

According to our 10th Annual survey findings (2017), the channel that will dominate 64% of customer interactions across all segments within 10 years is AI-driven chatbots.

The response is consistent across segments, with only wealth managers predicting a slightly lower figure (56% of interactions done via chatbots). Even so, that number is still massive. The wealth management market in Asia has reached $36.5 trillion — out of which 81% is investable assets — according to BCG’s Global 2018 report.While chatbots in and of themselves are impressive, by far the most important development is that some chatbots are now able to produce real outcomes, traveling the entire arc from process initiation all the way through process completion – including opening an account for a new client.

Generally speaking these newly evolved chatbots are servicing the middle market wealth management segment so banks can maximise efficiencies as they extend their services to a wider client base in Asia, where the middle market is historically underserved.

Chatbots are also becoming better tools for client dialogue as algorithms evolve beyond a simple command/order level of artificial intelligence. Due to advancements in machine learning, the algorithms are increasingly able to process diverse sets of information over a long time horizon and make deductions and inferences based on historical data and behaviour patterns.

To be sure, even as we near 2020 artificial intelligence isn’t quite human in the area of reading nuance and context – we haven’t entered the realm of science fiction just yet. But it’s safe to say significant strides in AI have been made.

Source: PwC

Sourcing clients via social platforms

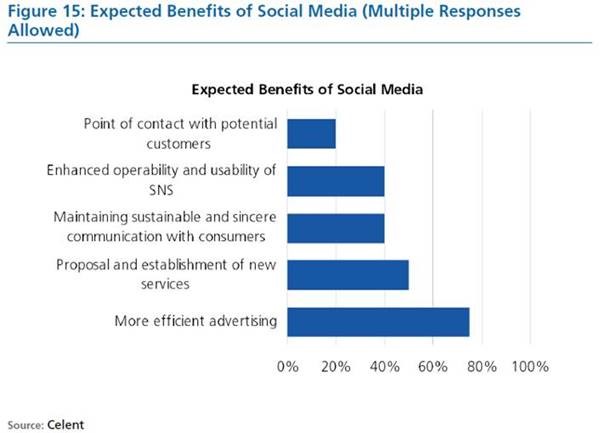

The other meaningful trend we see is that more Asian banks are building and deploying their own social networks, and using machines to analyse social data, to find new wealth management clients.

Some banks, for example, are much more actively using Facebook pages to identify potential wealth management clients – using new big data tools to track ‘likes’ and commentaries and other data points to see if there’s a potential fit for a new wealth management service for a particular user persona.

| Examples of Social Media Use Among Banks in Asia | Social Media Use |

| Dah Sing Bank | Uses Facebook and YouTube for publicity purposes |

| DBS Bank | Uses ‘DBS BusinessClass’ social platform in Singapore to strengthen services to SMEs |

| Citibank (China) | Almost 90% of new customers sign up and activate their cards through WeChat, and about 97% of active card base is digitally engaged via services such as WeChat |

| Mingsheng Bank | Launched ‘WeChat Bank’ 2.0 which integrates and connects debit cards, credit cards, and direct banking services under China Minsheng Bank’s WeChat terminal |

Source: Temenos; Dah Sing Bank; DBS Bank; Citibank; Mingsheng Bank

Social networks – and the AI tools that drive them – are effective means for a bank to identify peer groups and aggregate information about those peer groups, allowing them to back up their sales strategies with real data.

It’s worth remembering that in many ways, wealth management is one of the financial services most vulnerable to disruption. Clients will migrate toward new fintech platforms if portfolio management is more efficient and convenient. What is more, in this digital world clients also expect to be contacted about specific services that will benefit them, as long as the contact is not invasive or bothersome.

Humans are here to stay – for now

Despite these significant developments in AI , have no fear – robots aren’t taking over Asia’s wealth management industry just yet.

Clients, especially high net worth individuals, still expect actual human beings to explain the nuances of each service category or product group. They also expect wealth managers to tailor explanations and service offerings to their unique needs and investor profile – something chatbots are not yet able to do.

Put another way, Asia’s investors still want the human touch. No matter how addicted they are to their phones and screens, at some point they want to look their wealth manager in the eye and trust they are getting the best advice about the risks and rewards in their chosen portfolios. The need for a reassuring ‘gut feel’ hasn’t disappeared – no matter how good the data, or how efficient the algorithms.

That’s why Temenos is a strong evangelist for a future that embraces a hybrid model for wealth management in the decades to come. In short, that model is: humans make critical decisions and deliver tailor-made advisory work, while robots and software mine data, provide intelligence, and automate cumbersome administrative processes.

I’m just as excited as others about advancements in AI and machine learning, but it bears repeating: humans and machines will be working side-by-side in Asia’s wealth management sector for a long time to come.