IBM

Partner Badges

Region

-

Asia and the Pacific

-

Europe

-

Latin America

-

Middle East and Africa

-

North America

With a partnership of over 20+ years, IBM and Temenos have collaborated to deliver successful solutions and drive value for clients across the globe resulting in hundreds of successfully installed banks that have relied on the Temenos-IBM Partnership. IBM and Temenos are taking their relationship to the next level by exploiting IBM Technology (RedHat OpenShift, IBM, LinuxOne and IBM Power) and by building a dedicated service practice with creation of Off-Shore and Near-Shore Centers of Excellence.

Temenos and IBM Collaboration

Luis Carrasco, Head of IBM’s Temenos Practice talks about the new Sales and Services Partnership, what it means for our clients and how LinuxOne fits within this strategy.

Why clients choose IBM

One-Stop Shop

IBM has the unique ability to align

technology and business needs.

With the launch of Temenos’ new

Impact Partner Program, IBM has

been selected as one of the global

strategic partners covering three

categories: Technology, Sales and

Services.

Risk Sharing

What makes IBM a unique partner

in your journey is that we operate at

scale and, in doing so, we can take

on the risk of delivery and project

financing to support our clients

when facing a large transformation

program.

Technology

IBM’s enterprise-level scalable,

secure and cost-efficient servers, in

combination with RedHat’s cutting edge OpenShift Container Platform

can offer a seamlessly integrated

hybrid infrastructure to give you the

flexibility you need.

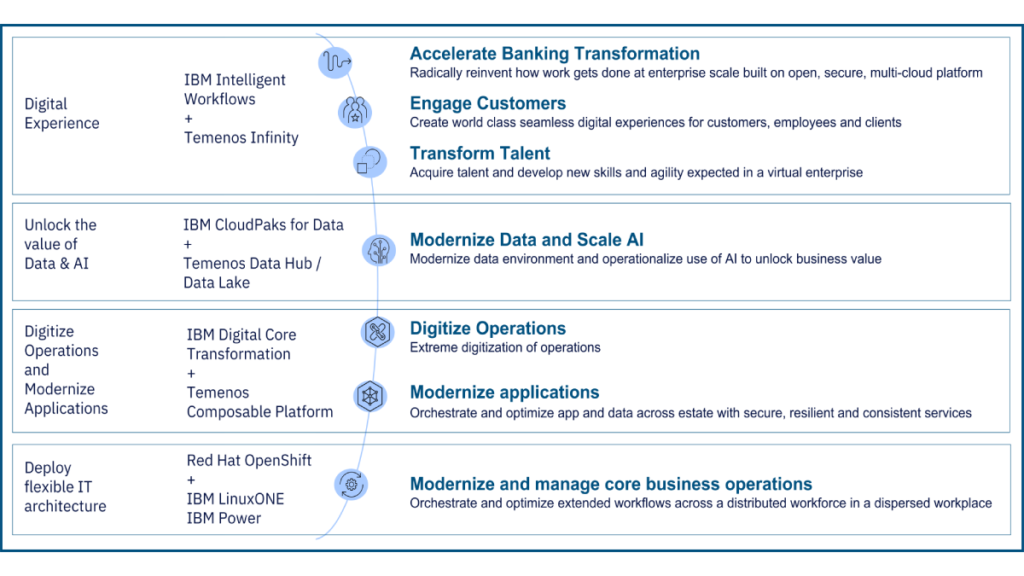

How IBM and Temenos can help you

What IBM offers for your Temenos Transformation Journey

IBM Consulting

IBM Consulting believes open ecosystems, open technologies, open innovation and open cultures are key to creating opportunities and the way forward for modern business and for out world. With over 100 participants in major banking transformation projects and more than 10,000 Banking industry professionals, IBM Consulting can help our clients create, grow and rethink what’s possible when transforming their business with Temenos Composable Banking Platform at the core.

- Program Management & Design Authority

- Product Configuration & Development

- QA & Testing

- Data Migration

- Integration

- Architecture

IBM Technology

IBM Power® helps more than 200 customers with mission critical Temenos workloads respond faster to business demands, protect data from core to cloud, and streamline insights and automation while maximizing reliability in a sustainable way. Power can modernize applications and infrastructure with a frictionless hybrid cloud experience to provide the agility companies need.

IBM LinuxONE is an enterprise-grade Linux® server with a unique architecture designed to meet the needs of mission-critical workloads. It brings together IBM’s experience in building sustainable, secure and scalable systems with the openness of the Linux operating system.