Wise

Wise for Banks – Modernising your International Payments Experience

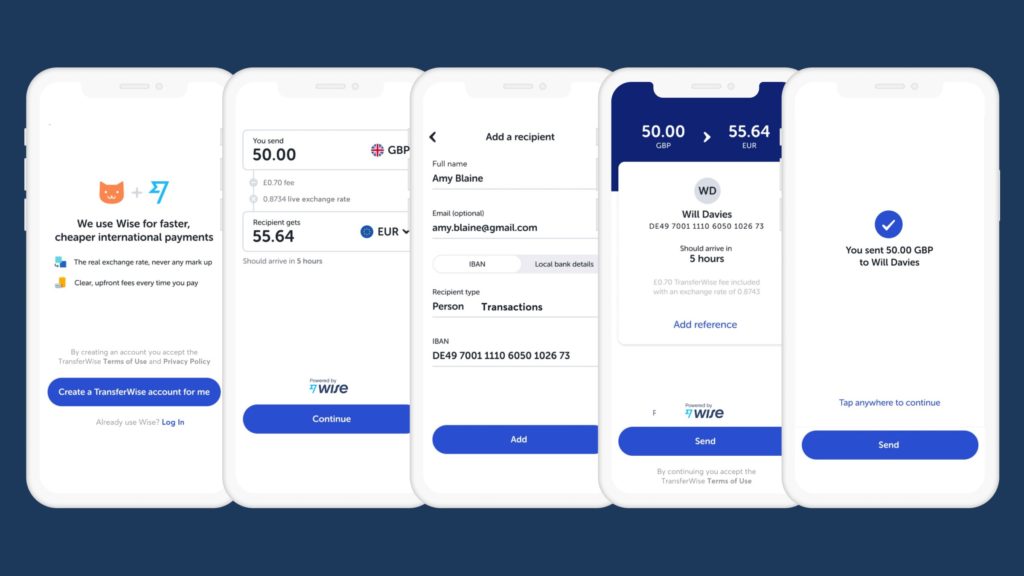

A Customer-Centric International Payments Solution

Wise is a global technology company, building the best way for people, businesses and financial institutions to move money around the world. More than 10 million customers use Wise – whether sending money to another country or making and receiving international business payments, Wise is on a mission to save customers money.

Financial institutions can seamlessly tap into Wise’s infrastructure to power a remarkably fast, convenient and transparent cross-border payments service for their customers – natively within your banking app. Globally, financial institutions have partnered with Wise, leveraging its complete infrastructure to scale their own reach, improve customer experience and reduce their costs.