Twixor

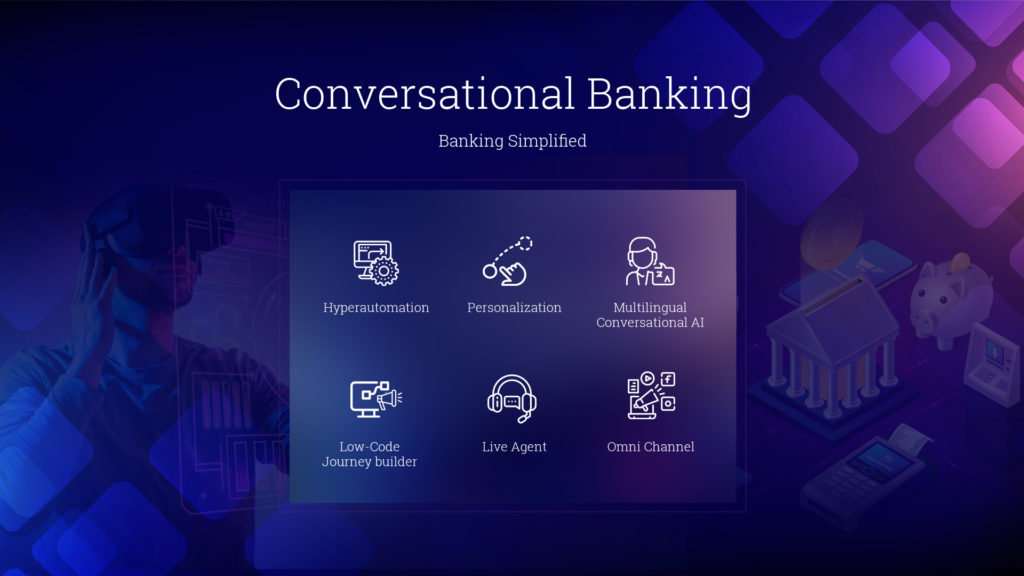

Conversational Banking powered by a low-code CX automation platform

Twixor delivers end-to-end banking transactions on all customer-preferred channels.

Consumer behavior is changing, with an increasing preference for messaging channels and conversational banking, across all regions and customer categories. Twixor redefines customer experience in this messaging era, with revolutionary Conversational Banking Solutions across all traditional digital channels, and new instant messaging channels, and across banking functionalities (Retail, Corporate and Wealth Banking).

Overview

Twixor drives seamless low-friction multi-lingual app-less banking transactions – in contrast to a banking branch, web-site, mobile-app or call-center – all of which have varying degrees of friction. This leads to significant impact on customer satisfaction, customer loyalty and cost of acquisition, service and retention including time to open an account (reduced by 80+%), time to access required information or complete banking transactions (reduced by 65+%) or estimated cost optimization at call center (reduced by 70+%)