Formpipe Banking Solutions

Formpipe Banking Solutions – Industry Leading Output and Document Management for Temenos Customers

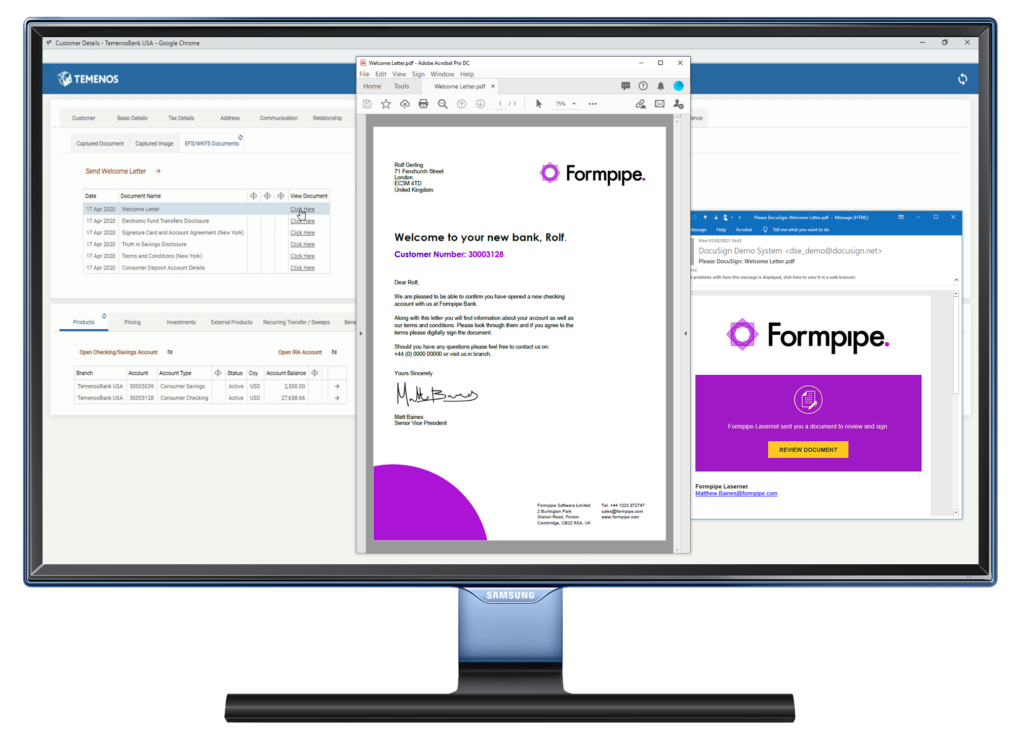

The Complete Document Generation, Distribution, Archiving and Retrieval Solution for Your Bank.

Formpipe’s software uses the standard data in Temenos’ product suite to create perfectly designed and branded digital and hard copy documentation, across your entire banking network. With real-time distribution to customers & automatic digital archiving, documents and data can be accessed quickly and securely through the Temenos UI using Formpipe’s easy integrations or via mobile app / internet banking.