Ap-Tap – ApTap Limited

ApTap connects financial institutions to merchants to help consumers save.

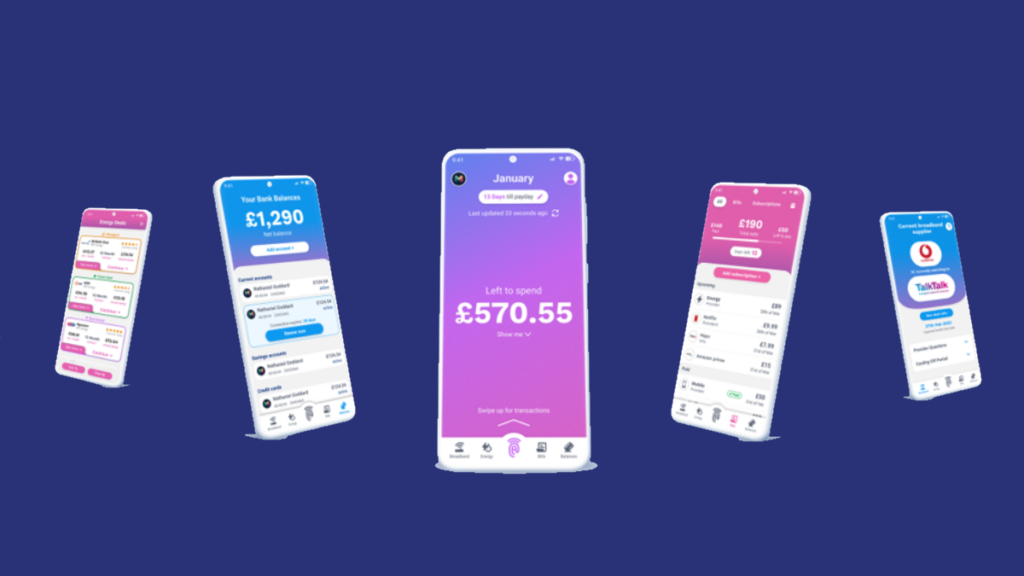

ApTap is on a mission to save consumers billions on their bills and subscriptions. We help financial institutions to embed e-commerce journeys and empower users to cancel, switch, renegotiate, sign up, and more within their banking app.

People struggle to cancel, switch, sign up, renew, renegotiate, access rewards/ discounts/cash back, navigate support, and generally manage their money. Banks need to provide an experience focused on consumer wellbeing and merchants/suppliers need to drive engagement and retention. ApTap aligns banks and merchants around engagement, retention and revenue putting the consumer in control.