Automated Credit Applications – 6 Sigma

Automated Credit Applications

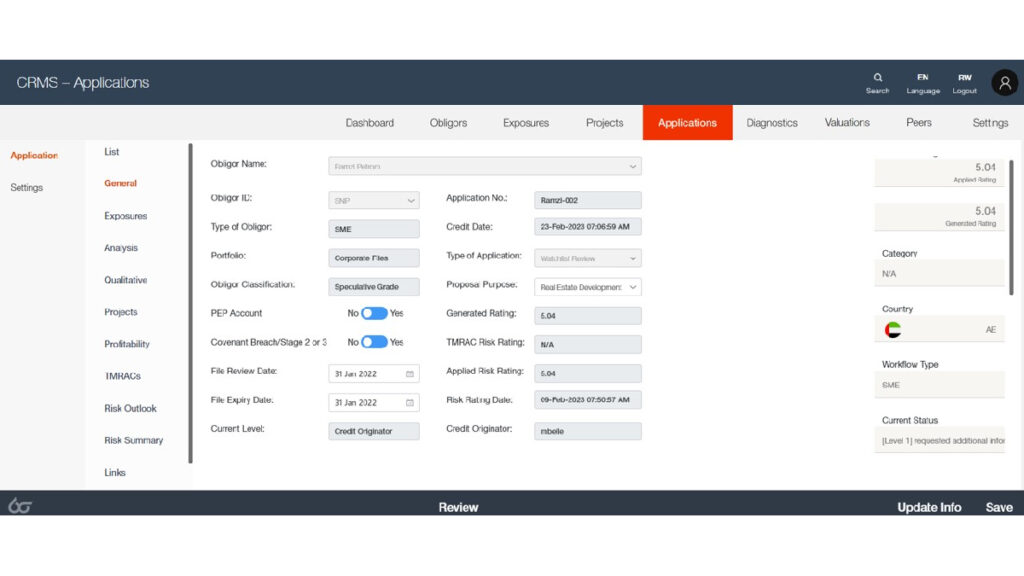

The Credit Application module is fully automated end-to-end credit automation segment of the system where Users can create and submit credit applications for risk rated Obligors.

The Credit Application Module is a fully automated credit application process

The bank can create multiple workflows relating to type of obligor, portfolio, country, type of application, and PEP or Default/Stage 2 and 3 categorization. Approval levels can be singular or multiple with origination having Makers, Checkers and Conditions Precedent flags. Approval levels carry multiple rules including majority, consensus, specific to individuals in case of multiple approving authorities. Reviewer notes provide full disclosure of decision making at all levels. Logs provides full time-line and bottle-neck issues.

Resources

ESG & Enterprise Readiness Assessment Scores for 6 Sigma conducted by The Disruption House

| Category | Award | Date |

| Business Resiliency Accreditation | Builder | October 2023 |

| Sustainability Accreditation | Builder | October 2023 |