Thank you for your interest!

IDC MarketScape 2025 North American Retail Digital Banking Solutions Report

Access the excerpt:

IDC MarketScape 2025 North American Retail Digital Banking Solutions Report

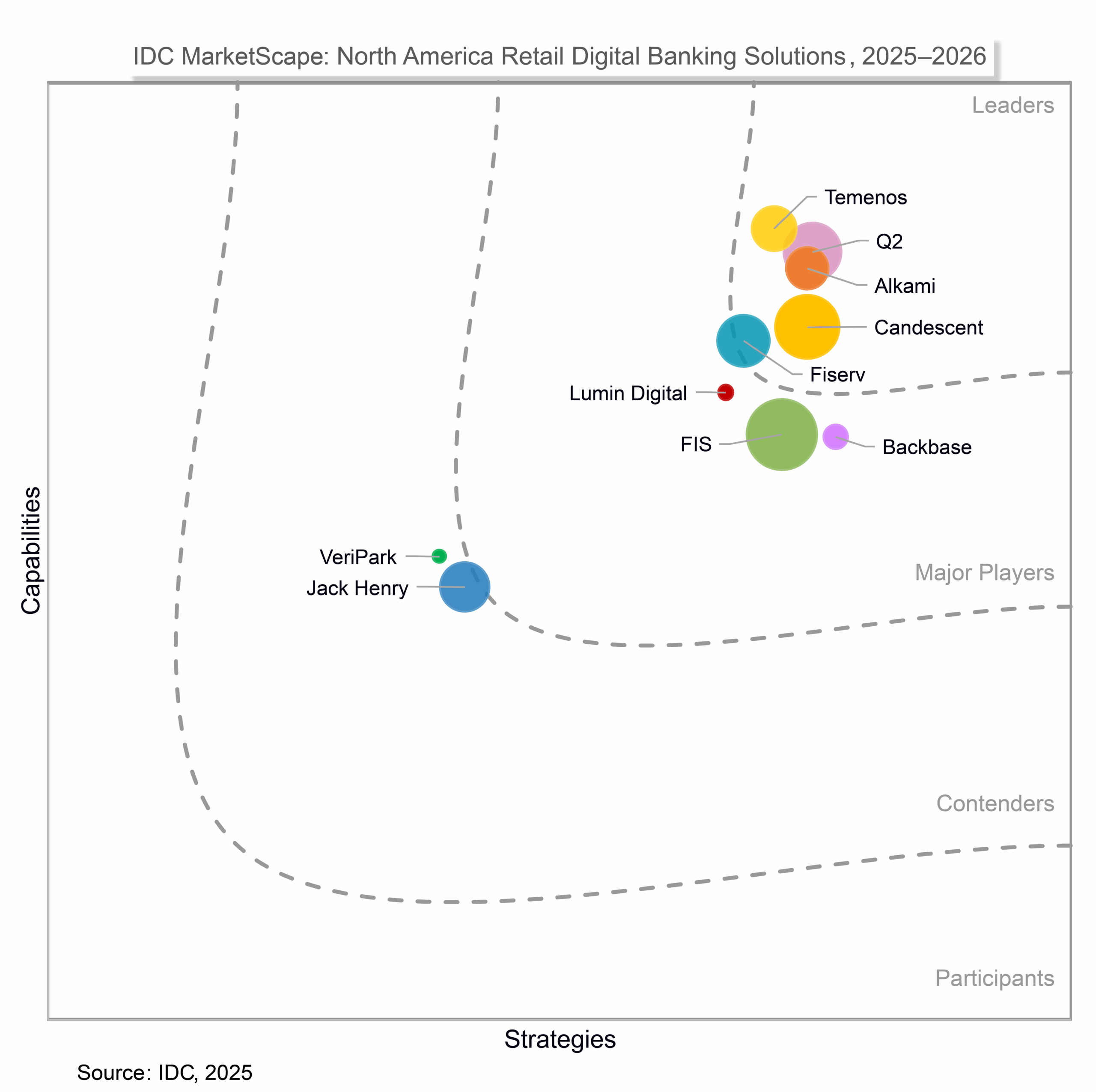

Temenos has been positioned as a Leader in the IDC MarketScape: North America Retail Digital Banking Solutions 2025–2026 Vendor Assessment.

According to the report, “Temenos Digital is well suited for midsize to large banks, credit unions, direct banks, and neobanks seeking a core-agnostic, modern digital banking platform deployable across multiple environments.”

The report noted the following strengths for Temenos:

- Scale and reliability: Long-standing public company with strong financial stability and market presence

- Flexible architecture: API-driven, microservices-based design enables omni-channel delivery, advanced security features, and deployment on cloud or on premises

- Ecosystem and integrations: Pre-integrated with Temenos Core while remaining core agnostic and extended through the Temenos Exchange marketplace for fintech add-ons

Download the Excerpt

Thank you for your interest!

Download White Paper

Amazon Web Services

Temenos is an AWS Partner. Amazon Web Services (AWS) is the world’s most comprehensive and broadly adopted cloud platform, offering over 200 fully featured services from data centers globally. Millions of customers—including the fastest-growing startups, largest enterprises, and leading government agencies—are using AWS to lower costs, become more agile, and innovate faster.

Cloud Banking

Leverage banking solutions in the cloud to help you lead.

Thank you for your interest!

Digital Onboarding and Origination – Get all the insights!

Thank you for your interest!

IDC MarketScape 2025 Wealth Management Report

Access the excerpt:

IDC MarketScape 2025 Wealth Management Report

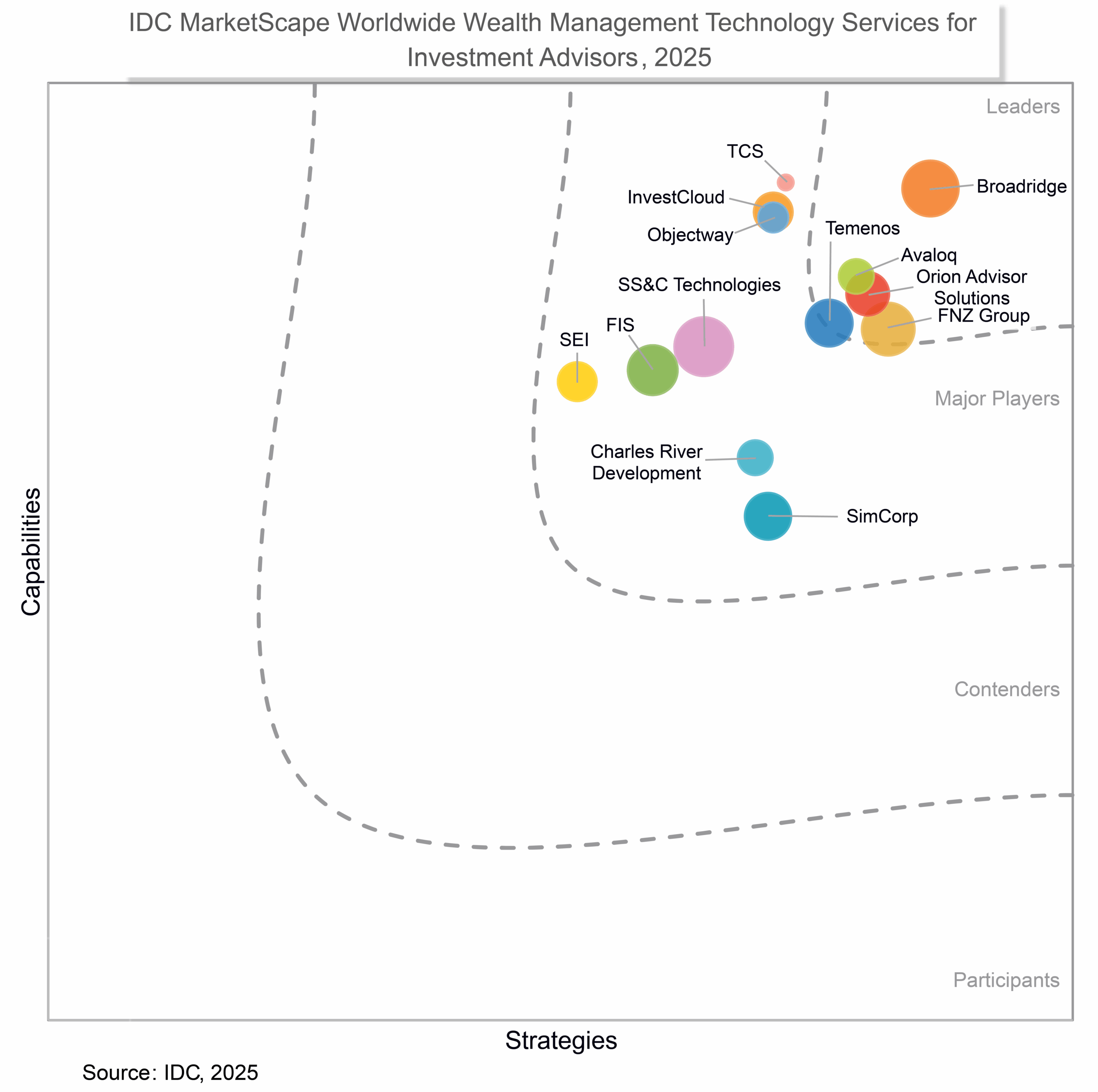

Temenos has been positioned as a Leader in the IDC MarketScape: Worldwide Wealth Management Technology Services for Investment Advisors 2025 Vendor Assessment.

The IDC MarketScape notes the following strengths for Temenos:

- Integrated front office to back office specific to wealth

- Functionally rich for portfolio management

- Global and local compliance expertise

Download the Excerpt

Thank you for your interest!

Get all the insights from the Temenos Performance Benchmark 2025.

Browse our latest reports

Temenos Named a Leader in IDC MarketScape 2025 North American Retail Digital Banking Solutions

Temenos Named a Leader in IDC MarketScape for Wealth Management Technology Services for Investment Advisors.

Banks need systems that are fast, secure, scalable and AI driven, as well as sustainable. Check out our latest report with Micro...

Performance Benchmark Report 2025

Banks need systems that are fast, secure, scalable and AI driven, as well as sustainable. Check out our latest report with Microsoft, where we put the Temenos Banking Platform to the test again.

Elastic scalability for core banking goes beyond maximizing performance. To help banks meet the growing importance of carbon-conscious computing in banking, the Temenos Performance Benchmark 2025 provides insight into how high transaction performance can be delivered with a reduced carbon footprint.

As banks increasingly adopt AI for financial crime mitigation, application development, and operational efficiency, we’ve also integrated AI workloads into the 2025 benchmark. This allows us to test scalability and performance, helping banks understand the infrastructure and capabilities needed to run these advanced applications reliably and efficiently in real-world environments.

Each year, Temenos conducts a production-grade simulation in collaboration with key partners to validate the latest release of the Temenos Banking Platform in a real-world, production-like environment. This rigorous test pushes the boundaries of elasticity, transaction throughput, response times, efficiency, and sustainability.

What you’ll discover

Delivering significant efficiency and decarbonization, we achieved a notable 17,000+ transactions per second (TPS).

As banks increasingly adopt AI for financial crime mitigation, we integrated AI workloads into the 2025 benchmark.

How we have enhanced performance through more efficient code and the use of Azure ARM Cobalt chipsets.

Essential insights into how banks can meet evolving sustainability standards and advance their ESG commitments.

Benchmark partner

Microsoft Azure

In 2011, Temenos and Microsoft were the first in the industry to bring core banking to the cloud. Today, the partnership supports financial institutions that leverage the cloud around the world. The combination of Temenos SaaS and the Azure Cloud Platform enables banks to leverage modern and trusted cloud technology that can live up to specific requirements across regions, including data regulation, security, and compliance.

Explore the results and take the next step toward the future of banking.

Discover how a faster, more secure, scalable, AI-driven, and sustainable banking platform can transform your financial institution.

Learn more about Temenos Technology

Learn how we empower our clients to benefit from continuous innovation, driven by our market-leading R&D investment in our single code base.

Temenos Sustainability Benchmark Report 2024

The 2024 benchmark is centered on delivering significant efficiency and decarbonization, achieving a notable 15,000 transactions per second (TPS).

Accelerating Digitization in Credit Unions for a Gen Z Future

Discover how banks and credit unions can accelerate digitization and deliver seamless, Gen Z-ready digital experiences that drive growth and loyalty.

Gen Z expects fast, intuitive, fully digital banking. For credit unions to stay competitive, accelerating digitization is essential. This whitepaper outlines challenges and opportunities in modernizing operations and shows how to create seamless, personalized member journeys that build loyalty and trust.

Inside, you’ll learn how to eliminate friction in account opening and onboarding, leverage data and automation to personalize experiences, and adopt practical strategies that scale. The paper highlights proven approaches used by leading credit unions and offers an actionable roadmap to future-proof your member experience.

Download whitepaper

A practical playbook for credit unions to reduce onboarding friction and deliver the digital–first experiences Gen Z expects.

Thanks for registering!

Elevating member experience | Accelerating digitization in credit unions for a Gen Z future

Explore more whitepapers

Temenos Named a Leader in IDC MarketScape 2025 North American Retail Digital Banking Solutions

Temenos Named a Leader in IDC MarketScape for Wealth Management Technology Services for Investment Advisors.

Banks need systems that are fast, secure, scalable and AI driven, as well as sustainable. Check out our latest report with Micro...