Resource Type: Report

Performance Benchmark Report 2025

Banks need systems that are fast, secure, scalable and AI driven, as well as sustainable. Check out our latest report with Microsoft, where we put the Temenos Banking Platform to the test again.

Elastic scalability for core banking goes beyond maximizing performance. To help banks meet the growing importance of carbon-conscious computing in banking, the Temenos Performance Benchmark 2025 provides insight into how high transaction performance can be delivered with a reduced carbon footprint.

As banks increasingly adopt AI for financial crime mitigation, application development, and operational efficiency, we’ve also integrated AI workloads into the 2025 benchmark. This allows us to test scalability and performance, helping banks understand the infrastructure and capabilities needed to run these advanced applications reliably and efficiently in real-world environments.

Each year, Temenos conducts a production-grade simulation in collaboration with key partners to validate the latest release of the Temenos Banking Platform in a real-world, production-like environment. This rigorous test pushes the boundaries of elasticity, transaction throughput, response times, efficiency, and sustainability.

What you’ll discover

Delivering significant efficiency and decarbonization, we achieved a notable 17,000+ transactions per second (TPS).

As banks increasingly adopt AI for financial crime mitigation, we integrated AI workloads into the 2025 benchmark.

How we have enhanced performance through more efficient code and the use of Azure ARM Cobalt chipsets.

Essential insights into how banks can meet evolving sustainability standards and advance their ESG commitments.

Benchmark partner

Microsoft Azure

In 2011, Temenos and Microsoft were the first in the industry to bring core banking to the cloud. Today, the partnership supports financial institutions that leverage the cloud around the world. The combination of Temenos SaaS and the Azure Cloud Platform enables banks to leverage modern and trusted cloud technology that can live up to specific requirements across regions, including data regulation, security, and compliance.

Explore the results and take the next step toward the future of banking.

Discover how a faster, more secure, scalable, AI-driven, and sustainable banking platform can transform your financial institution.

Learn more about Temenos Technology

Learn how we empower our clients to benefit from continuous innovation, driven by our market-leading R&D investment in our single code base.

Temenos Sustainability Benchmark Report 2024

The 2024 benchmark is centered on delivering significant efficiency and decarbonization, achieving a notable 15,000 transactions per second (TPS).

IBSi SLT: Temenos #1 for Core Banking for 20 years

Temenos has been recognized as the #1 best-selling software provider in 13 categories in the IBSi Sales League Table 2025, being named #1 for Core Banking for the 20th consecutive year.

The IBS Intelligence Annual Sales League

An annual benchmarking exercise, which has been running for over 24 years and is based on the number of new customer contracts signed in a calendar year. The SLT is recognized as the barometer for financial technology providers’ sales performance across the banking industry.

In 2025, Temenos ranked #1 in the following categories:

- Universal Banking – Core

- Digital Banking and Channels

- Payments – Retail

- Private Banking and Wealth Management

- Risk Management

- Treasury and Risk Management

- Digital Only Banks

- Datawarehouse & BI

- Islamic Banking – Universal Banking – Core

- Islamic Banking – Risk Management

- Islamic Banking – Payments – Retail

- Islamic Banking – Wholesale Banking Treasury

- Islamic Banking – Digital Banking and Channels

Download report:

Temenos Sustainability Benchmark

As banks look to accelerate performance of their technology, the Temenos Banking Platform proves maximum scalability with a minimum footprint.

Temenos Sustainability Benchmark

As banks look to accelerate performance of their technology, the Temenos Banking Platform proves maximum scalability with a minimum footprint.

Temenos Sustainability Benchmark

As banks look to accelerate performance of their technology, the Temenos Banking Platform proves maximum scalability with a minimum footprint.

Sustainability Benchmark Report

Banks look for elastic scalability, but also need to deliver to sustainability goals. Learn from the report how the Temenos Banking Platform can help you decarbonize your banking operations, by adopting highly scalable banking capabilities using a minimum footprint.

Beyond transaction performance

In recent years, the Temenos Benchmark has shown that the Temenos Banking Platform was able to deliver up to 150.0000 transaction per second. In the 2024 scenario, the benchmark is centered on decarbonization through ongoing engineering and architecture improvements.

Benchmark Partners

Microsoft Azure

In 2011, Temenos and Microsoft were the first in the industry to bring core banking to the Cloud. Today, the partnership supports financial institutions that leverage the Cloud around the world. The combination of Temenos SaaS and the Azure Cloud Platform enables banks around the world to leverage modern and trusted Cloud technology that can live up to specific requirements in regions, including data regulation, security, and compliance.

More efficient, low carbon

In this explainer video narrated by Temenos Chief Technology & Innovation Officer, Tony Coleman, explains the basics of our ongoing pursuit of efficiency.

Learn more with the Temenos Sustainability Report 2024: Maximum Scalability, Minimum Footprint.

Explore the benchmarks

Benchmark 2024 press release

The 2024 sustainability benchmark shows the advances in Temenos’ leaner and more sustainable architecture to support banks to meet their sustainability goals.

Benchmark 2023 press release

Temenos processed 200 million embedded finance loans and 100 million retail accounts at a record breaking 150,000 transactions per second on Microsoft Azure with MongoDB database.

Benchmark 2022 press release

The benchmark of 100 million customers and 200 million deposit accounts with 100,000 transactions per second and up to 61 transactions per second per core on AWS underscores Temenos’ leaner and greener architecture.

Download Report

Temenos Sustainability Benchmark Report 2024

Annually Temenos performs a production-like simulation in cooperation with key partners to test the latest release of the Temenos Banking Platform,

deployed in a production-representative scenario and stack.

Here, we push the limits of what is possible in terms of elasticity, transaction performance, response times, efficiency, and sustainability.

This paper helps you understand:

- The 2024 benchmark is centered on delivering significant efficiency and decarbonization, achieving a notable 15,000 transactions per second (TPS).

- The Sustainability Benchmark of 2024 shows that by enhancing performance through more efficient code and a leaner architecture, it is possible to decrease the demand for infrastructure, reduce the necessary processing power, and consequently, lowered energy consumption and carbon emissions.

- This is critical to support new standards and requirements such as the rapidly advancing needs of banks to drive down carbon emissions and deliver to their ESG agenda.

Learn more about Temenos Technology

Learn more about Temenos Technology and how our clients reap the benefits from our innovation, as we invest market-leading R&D into our single code base.

Temenos Sustainability Benchmark

As banks look to accelerate performance of their technology, the Temenos Banking Platform proves maximum scalability with a minimum footprint.

As APAC banks continue to evolve, the balance between innovation and operational stability remains paramount. By aligning closely with strategic goals, continuously tracking progress, and fostering a culture that embraces change, banks can not only adapt to the digital era but lead the charge in redefining the future of banking in the Asia-Pacific region.

Download our report to learn how systematic innovation can help unlock new growth avenues, enrich customer experiences, and build a resilient, adaptive banking ecosystem for the years to come.

Key Contributors

Frankie Wai

Business Solutions Group Director,

Temenos

Arvind Swami

Financial Services Industry Vertical Leader, Red Hat Asia Pacific

Fill In the Form to Download the Report

Temenos Sustainability Benchmark

As banks look to accelerate performance of their technology, the Temenos Banking Platform proves maximum scalability with a minimum footprint.

Learn How Cloud Banking Enables Continuous Innovation in an Increasingly Competitive Environment

The banking industry is experiencing a rapid evolution in consumer preferences and technology, putting immense pressure on banks to innovate while providing highly personalized and seamless banking experiences, especially as digital native fintechs push the envelope even further.

Incumbent banks must consider how to meet the growing demand for enhanced customer experiences. The available options usually involve transforming legacy systems, adopting cloud-based solutions to bridge the gap, or building cloud-native solutions from scratch.

Read this report to gain insights into the strategic role of cloud banking in enabling continuous innovation amidst growing competition.

Key Contributors

Zannettos Zannettou

SaaS Principal Consultant

Temenos

Navin Dulani

Regional Head Banking Products, APAC

Tech Mahindra

Ansley Verzosa

Senior Partner Solutions Architect

Amazon Web Services

Fill In the Form to Download the Report

Temenos Sustainability Benchmark

As banks look to accelerate performance of their technology, the Temenos Banking Platform proves maximum scalability with a minimum footprint.

Scrappy fintech firms and neobanks took the lead in using new technologies to provide better customer experiences, reach underserved markets. Now Europe’s traditional banks are fighting back.

- New research from Economist Impact finds that European banks are more likely than other regions to expect neobanks to be their biggest competitors in the next five years – 35% in Europe compared to 25% globally.

- However, payment players (36%) and technology providers (36%) continue to be top of mind, with payments being the space where European banks predict that new entrants will gain the most market share.

- European banks are emulating the way that new entrants have used technology to reach new and existing customers and support them in managing their personal finances.

- Over one in five see moving to public cloud as a strategic priority to ensure that their operations are agile and secure.

To learn more about the latest banking trends in Europe download the Economist report today!

Temenos Sustainability Benchmark

As banks look to accelerate performance of their technology, the Temenos Banking Platform proves maximum scalability with a minimum footprint.

Temenos Highwater Benchmark Report

At Temenos, we see our customers building a successful business model around BaaS. Being able to provide financial services, like accounts or loans to brands in Retail and commercial businesses opens a far larger audience. But, with the rapidly rising popularity of embedded finance and BaaS, performance factors come into play: Massive scalability for any transaction volume.

Supporting the needs of future banking models

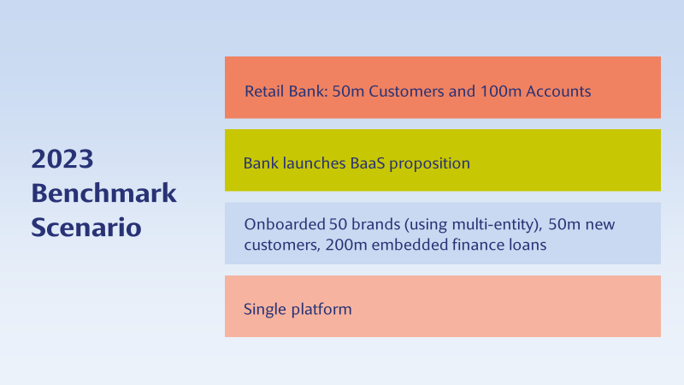

To test the needs of accelerating embedded finance models, we defined the benchmark test scenario for 2023. Th scenario simulates a larger Retail bank that launches a BaaS proposition to open the door to 50 brands. The hypothesis for this benchmark was to support all these banking models on an instance of software on a single platform, processing a representative transaction mix.

Benchmark Partners

Microsoft Azure

In 2011, Temenos and Microsoft were the first in the industry to bring core banking to the Cloud. Today, the partnership supports financial institutions that leverage the Cloud around the world. The combination of the Temenos Banking Cloud and the Azure Cloud Platform enables banks around the world to leverage modern and trusted Cloud technology that can live up to specific requirements in regions, including data regulation, security, and compliance.

MongoDB

Temenos and MongoDB joined forces in 2019 and are on the quest to service the widespread, specific, and strict data requirements that banks need. As Temenos provides its platform for banks around the globe, MongoDB is the trusted partner with a developer data platform that enables financial institutions to innovate faster and build modern applications.

HID

HID provides pre-integration solutions that facilitate integrations and customization with the Temenos Banking Platform. The solutions include identity verification, authentication and real-time risk management for true fraud prevention with a clear focus on offering the best security without compromising on user experience. HID has been a trusted Temenos partner for over 15 years and powers trusted identities of millions of people in more than 100 countries.

View the Highwater benchmark video

Tony Coleman, CTO at Temenos presents the Temenos Highwater Benchmark results.

Explore the benchmarks

Benchmark 2024 press release

The 2024 sustainability benchmark shows the advances in Temenos’ leaner and more sustainable architecture to support banks to meet their sustainability goals.

Benchmark 2023 press release

Temenos processed 200 million embedded finance loans and 100 million retail accounts at a record breaking 150,000 transactions per second on Microsoft Azure with MongoDB database.

Temenos Banking Cloud

The trusted SaaS for 700+ banks around the world. Through the Temenos Banking Cloud, our clients can deliver new services, new features, and changes in an exceptionally short time to market.

Download eBook

Contact us to learn more about the Temenos Banking Cloud and how scalability can help you reach new audiences, efficiencies and drive sustainability.

Learn more about the Temenos Banking Cloud

Temenos Sustainability Benchmark

As banks look to accelerate performance of their technology, the Temenos Banking Platform proves maximum scalability with a minimum footprint.

Looking for the latest IBS 2025 report?

Temenos Recognized by IBS Intelligence as #1 best-selling banking software in 13 categories

IBS Intelligence’s annual Sales League Table 2023 evaluated systems purchases made by over 1000+ banks across 134 countries and 57 suppliers, Temenos was ranked:

- #1 core banking system for the 18th year

- #1 digital banking and channels

- #1 Payments Systems (retail)

- #1 risk management system with Temenos Financial Crime Mitigation

- #1 Islamic Universal Core Banking

- #1 for Digital-only Banks

- #1 for Treasury & Risk Management

- 1 for Islamic Banking (Risk Management)

Download the report here:

Temenos Sustainability Benchmark

As banks look to accelerate performance of their technology, the Temenos Banking Platform proves maximum scalability with a minimum footprint.

Asia-Pacific retail banks continue to struggle in offering a hyper-personalized customer experience, at a speed and ease that makes being hyper-personal worth it. Composable banking ensures that truly customer-centric banking does not break the bank.

According to the Fintechthon Survey 2021 (Reinvestment Survey by IDC Financial Insights Asia-Pacific), the percentage of Asia-Pacific banks that cited customer centricity as the most important priority rose from 47% in 2021 to 64% in 2022.

Download this IDC Infobrief to find out:

- Key trends in APAC and why there is a need for business model reinvention

- The impact of composability in APAC retail banks and its attributes to enable hyper-personalized experiences

- What APAC retail banks are doing to make customer centricity real

Register to get access to the report.

Sponsored by

Temenos Sustainability Benchmark

As banks look to accelerate performance of their technology, the Temenos Banking Platform proves maximum scalability with a minimum footprint.

Looking for the latest IBS 2025 report?

Temenos Recognized by IBS Intelligence as #1 best-selling banking software in 13 categories

IBS Intelligence’s annual Sales League Table 2022 evaluated systems purchases made by over 1000+ banks across 134 countries and 60 suppliers, Temenos was ranked:

- #1 core banking system for the 17th year

- #1 digital banking and channels with Temenos Infinity for the fifth consecutive year

- #1 retail payments systems with Temenos Payments

- #1 risk management system with Temenos Financial Crime Mitigation

- #1 Islamic Core Banking

- #1 for Neo Banks & Challenger Banks