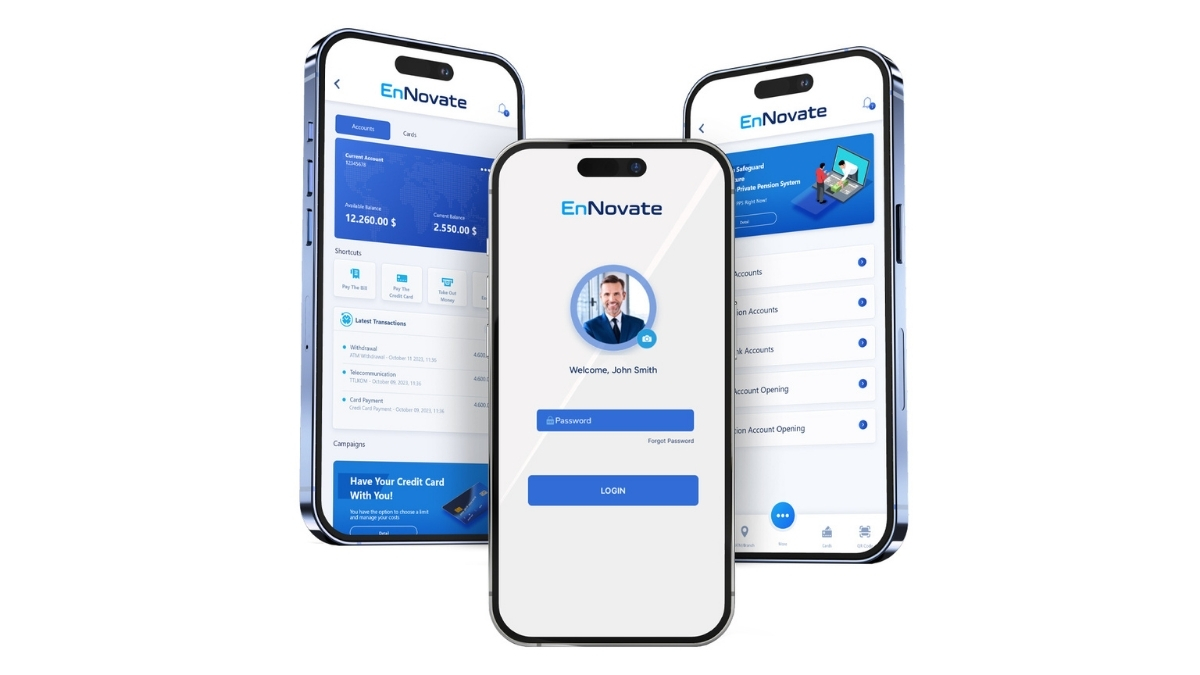

Provider Category: Digital Engagement

Accelerate digital transformation with seamless, responsive mobile & web applications for financial services

EnNovate is an AI-powered omni-channel management platform that accelerates digital transformation for banks, fintechs, and insurers. Supporting mobile and web applications across all channels, it delivers seamless, responsive, and secure experiences. With flexible architecture and modular APIs, EnNovate reduces time-to-market by up to 50%, empowering institutions to innovate, scale, and personalize every financial interaction.

Key benefits

Accelerated Digital Transformation

Reduces time-to-market by up to 50%, enabling institutions to launch and scale digital channels faster. Delivers ready-to-launch mobile and online banking experiences without long development cycles.

Seamless Omni-Channel Experience

Provides consistent and synchronized user journeys across mobile, web, and internet banking channels, ensuring real-time continuity, reduced friction, and improved customer satisfaction.

Enhanced Customer Engagement

Empowers financial institutions to personalize digital experiences with dynamic interfaces, multilingual support, and adaptive content, increasing user retention and engagement.

Secure, Scalable, and Future-ready

Combines top-notch security, speed, and scalability to support growing user bases and evolving financial ecosystems, ensuring compliance and uninterrupted service delivery.

Key features

Mobile & Online Banking

Enables end-to-end digital banking with real-time transactions, intuitive UX, and built-in integration capabilities for rapid deployment.

Mobile & Web Fintech Apps

Enables fintechs to launch innovative, AI-optimized digital platforms quickly through flexible APIs, ensuring secure transactions, smooth onboarding, and high user satisfaction.

Mobile & Web Insurance Apps

Empowers insurers to offer seamless digital policy management, claims processing, and personalized dashboards through web and mobile applications designed for agility and scalability.

Omni-Channel Management Middleware

Acts as a centralized management layer for all digital touchpoints, synchronizing user interactions and data across channels to ensure a unified experience.

Resources

Request a demo

Transform real-time customer communication with a virtual AI assistant, chatbot, live chat and video calling

EnConnect empowers organizations with a secure, AI-driven communication platform that unifies digital assistants, chatbots, live chat, and video call capabilities. With real-time messaging, NLP-powered automation, and end-to-end encryption, EnConnect enhances collaboration, customer engagement, and service efficiency all through flexible APIs, modular SDKs, and white-label customization across web and mobile platforms.

Key benefits

AI-powered Customer Engagement

Delivers intelligent, human-like interactions via virtual assistants and NLP chatbots, providing personalized, 24/7 customer support with zero human intervention.

Secure & Compliant Communication

Ensures full data privacy with end-to-end encryption, regulatory compliance, and group-based authorization for corporate and customer messaging.

Seamless Integration & Scalability

Easily integrates into existing banking, fintech, or insurance workflows through modular SDKs and APIs for web and mobile applications.

Enhanced Collaboration & Experience

Combines instant messaging, HD video calls, and file sharing in one platform to improve teamwork, service quality, and response time.

Key features

Virtual AI Assistant

AI-based digital assistant that provides real-time, personalized support without human involvement — enhancing efficiency and customer satisfaction.

AI Chatbot

NLP powered delivers natural, context-aware conversations, enabling automated workflows and document, image, or video sharing through secure and adaptive chat experiences.

Live Chat

Supports instant messaging for both customer service and internal collaboration, allowing group-based communication and white-label customization for enterprises.

Video Call

Offers secure, AI-assisted video call guidance with voice and subtitle support enabling remote customer onboarding, advisory sessions, and seamless engagement.

Resources

Request a demo

A fully customisable banking platform

Pannovate is an orchestration layer and Banking-as-a-Service enabler, with 150 APIs and a network of 47 truly agnostic vendors from processors to KYC providers and BIN sponsors.

Our platform and orchestration layer are used by many for wallet management, payment processing, and card issuing. You can gain access to Pannovate’s modular solutions to create your value proposition cost-effectively and launch to market in record time.

Overview

Syllo

You design the ecosystem. Add and switch suppliers as your product evolves. Plug in different third-party suppliers or use your existing suppliers.

Launchpad

LaunchPad offers an out-of-the-box mobile and web app and integrates all third-party suppliers required for a programme to launch, from ppliers to processors.

Launchpad Lite

Launchpad Lite offers the full range of expected features with a customisable user interface enabling you to create a unique omni-channel value proposition, in just 6 weeks.

Platform Benefits

Build your product on a modern platform.

Test on 150 APIs

Launch within 12-16 weeks

A network of 47 agnostic partners across geographies

Scale seamlessly into multiple regions

Add any functionality quickly and cost-effectively to create a value proposition via a range of value add solutions and pre-approved providers

Bankvault

Bankvault is Pannovate’s analytics suite and provides a detailed insight into your product performance and customer activity and behaviour in real-time.

Resources

Overview

Request A Demo

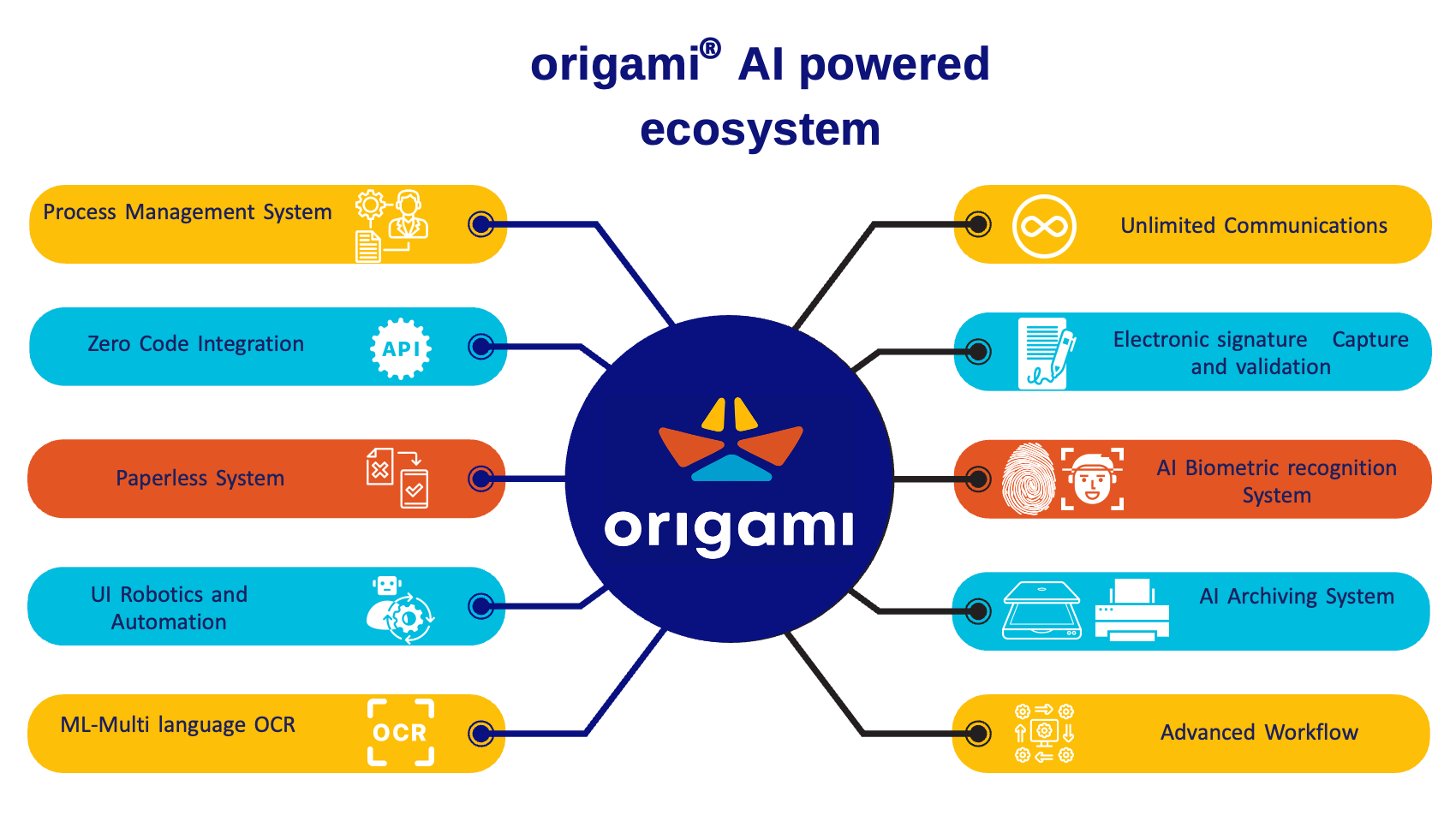

Origami – Maxbit

Digital transformation is not an option, it is a necessity. With Origami it is closer than ever.

Origami™️ is a digital transformation solution enabling organizations to convert all kinds of paper – based procedures into an optimized digital paperless alternative with ZERO integrations or modifications to their existing software or IT environment components regardless of its age or technology.

Origami™ automatically detects documents sent to printers or from Origami Webform, or Scanners; Origami stop printing task, reads the documents/form, and smartly decide its proper digital process based on the defined setup.

Origami™ Converts your legacy slow paper-based processes into very fast digital based in no time with no need to modifications to the existing solutions even for legacy old, branded software saving hundred thousand to millions of dollars –depending on the firm size- of the printing costs.

In addition, it saves employees time cost while boasting productivity and shorten process timing dramatically reflecting a very modern and prestigious image of the organization infront of their clients and the market. Origami™ is equipped with an innovative Robotics engine for UI automation and a dynamic webform builder to cover all paperless conversion aims and reach the maximum operational excellence.

Overview

Smart Documents recognition

- Recognize Documents by Title

- Recognize Documents By Contents

- Recognize Documents by a Barcode/QRcode

- Recognize documents by file name

- Recognize documents through text images using OCR capabilities

Web forms

- Build dynamic webforms to facilitate business and data entry as well as paperless automation

- Build complete process on the developed webforms to manage their cycles and processes efficiently with no need to changes in current systems or solution

Process Workflow

- Ability to forward the process to another user to do additional tasks (Users lists and groups can be defined on each type of documents)

- Ability to return the process to the sender in case there is any mistake or missing action need to be completed first.

- Ability to return the process to initiator to complete it or modify it and send it back.

- Email Approval or rejection.

Capture Signatures

- Capture Signatures through Customers & Users Mobile phones using OTP.

- Capture signature through Graphical signature capture devices.

- Capture signature through Android & IOS Tablets.

- Abilioty to define any number of needed signatures and locate the required location to place the signature within the document.

- Ability to integrate with any digital signature and authentication authorities i.e PACI in Kuwait for example.

- Remote signature Capture.

- Parallel Signatures Capture.

- Email Signatures.

Robotics UI Automation

- Origami Can automatically fill any system screen with data coming from documents or from Origami webfroms (UI Automation).

- Origami start process automatically by listening to certin folders. when any document is placed, Origmai reads and initiate its workflow automatically with no manual intervention.

Documents Sharing

- Share document with the customer using Emails.

- Document can be protected by Password which will be delivered to the customer in another message

- Share document by Whatsapp

- Share document by iMessage

- Share document by SMS, by publish the document and share the URL and OTP to the customer to access it.

- Option to share the document hard copy with the customer by redirect the document to physical printer

- Integrate with any DMS to archive the documents

Unlimited Integration

- Ability to integrate to REST API or SOAP services using the element read from the document or from the database.

- Additional features available for authentication and prepare the request http header

- Ability to read Json data from the response and keep it as element to be used during the process

- Ability to read xml data from the response and keep it as element to be used during the process

- Ability to read text search/regular expression match from the response to identify elements which can be used during the process.

- Smart Chip reading. i.e CIVIL ID chips …etc.

Comprehensive Documents Handling

- Automatically Capture Document and Read all the contents.

- Ability to read text/barcode contents of any page of the document, and the store within the process and saved to database or pushed to REST API/Soap Service.

- Or it can be used as a meta data for the document with integration to any DMS system for better search and audit requirements.

- The system provide the ability to read the text elements by element location on the page.

Rich Image Capture Capabilities

- Integrating with scanners to capture images and add it to the document Bborder detection is available in order to reduce image size

Database Activities (Read & Write)

- Ability to read data from database, all elements read from the document can be used inside the database query

- Ability to push the document read elements to database.

Brand and polish documents

- Add Text Stamp to any page of the document or to all pages.

- Add Image Stamp to any page of the document or to all pages.

- Add Client Username Stamp to any page of the document or to all pages.

- Add Client Machine Name Stamp to any page of the document or to all pages.

Request a Demo

OneDigitalTrust

Deliver Exceptional Value with Comprehensive Estate & Inheritance Planning

A Will or Trust for Every Adult American!

Revolutionize client relationships with our white-label estate planning software. Provide an all-digital service for creating and maintaining valid inheritance plans, sparing loved ones from bureaucracy. Seamlessly integrates into major digital banking systems, catering to banks, credit unions, and insurance companies. Simplify end-of-life documentation, enhance value, and streamline the process for clients.

Overview

White Labeling

Establish a consistent, distinctive brand in the market while maintaining your business identity.

Single Sign On

Seamlessly allow access to estate planning tools using a single set of login credentials, enhancing efficiency, convenience, and security through centralized authentication.

Realtime Reporting and Analytics

Gain valuable insights, guiding strategic decisions by comprehending the impact and engagement of estate planning services provided to clients.

Configuration Portal

Customize the platform to align with your brand and client needs, reinforcing commitment and crafting a unique estate planning experience to enhance client relationships.

Essential Documents

Provide a DIY platform for essential estate planning docs—Wills, Trusts, Advance Directives, Guardianship, Powers of Attorney, and cherished items provisions. Elevate services, ensuring clients secure their legacy confidently.

Secure Document Vault

Provide seamless storage, receive ‘Smart’ update notifications for essential document revisions. Keep clients proactive, ensuring their estate plans stay aligned with intentions.

Asset Probate Tracking

After adding Assets & Liabilities, offer clients estimated probate time and cost. Provide state-specific steps to bypass probate for each Asset, easing family stress during times of grief.

Memory Library

Empower your clients to curate a digital treasury of cherished letters, photos, audio, and video, preserving life’s essence. They can privately share this with loved ones, fostering meaningful connections.

ISV Assessments/Awards

ESG & Enterprise Readiness Assessment Scores for OneDigitalTrust API conducted by The Disruption House

| Category | Award | Date |

| Business Resiliency Accreditation | Leader | September 2024 |

| Sustainability Accreditation | Builder | September 2024 |

Interested in the full OneDigitalTrust report? Click here to buy it now.

Request a Demo

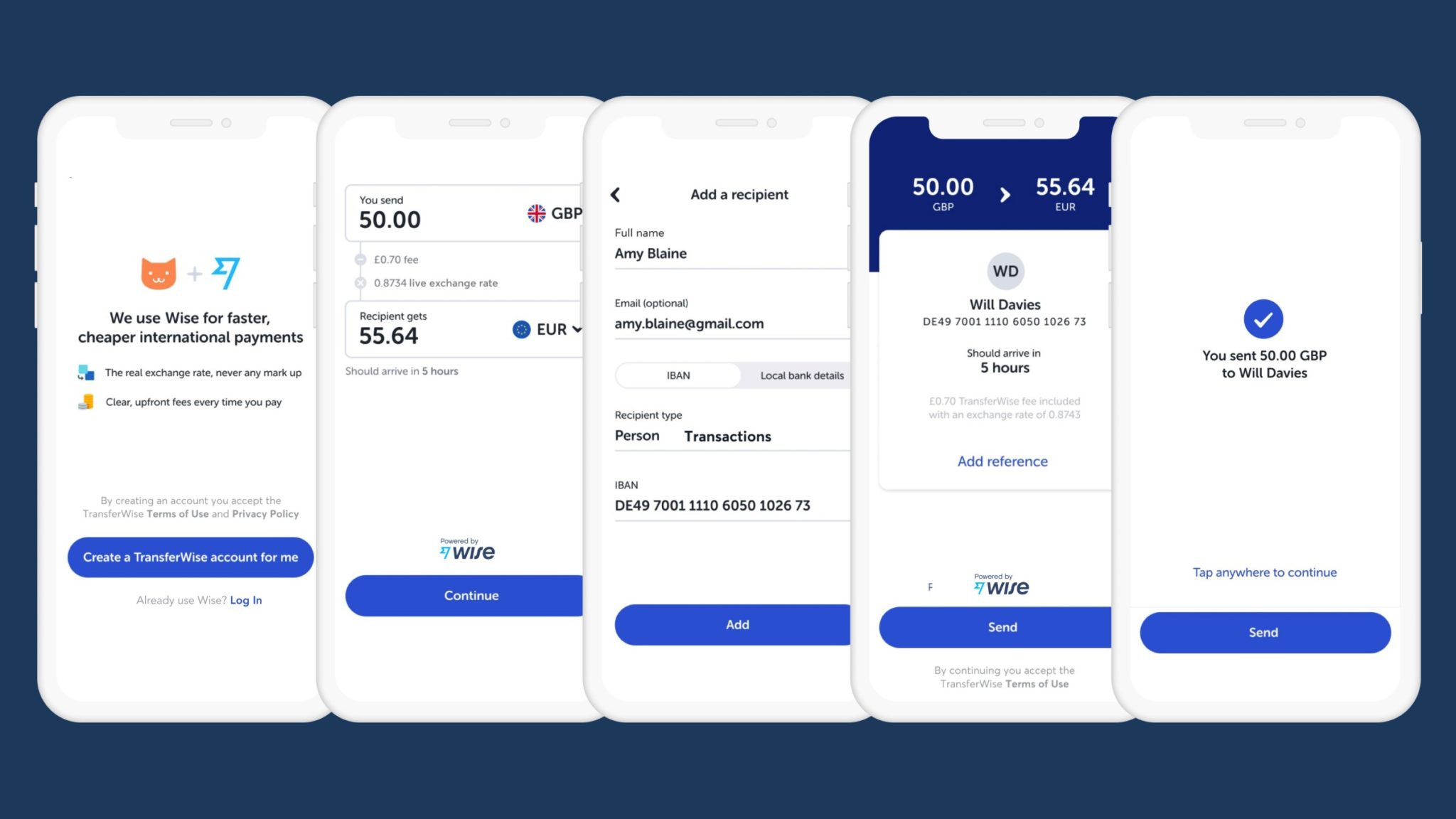

Wise

Wise for Banks – Modernising your International Payments Experience.

A Customer-Centric International Payments Solution

Wise is a global technology company, building the best way for people, businesses and financial institutions to move money around the world. More than 10 million customers use Wise – whether sending money to another country or making and receiving international business payments, Wise is on a mission to save customers money.

Financial institutions can seamlessly tap into Wise’s infrastructure to power a remarkably fast, convenient and transparent cross-border payments service for their customers – natively within your banking app. Globally, financial institutions have partnered with Wise, leveraging its complete infrastructure to scale their own reach, improve customer experience and reduce their costs.

Overview

With Wise international payments are:

Global

Leverage Wise’s local connectivity across 80+ countries. Wise invests heavily in its local banking network, including direct integrations to payment schemes – building an alternative to traditional correspondent banking rails.

Cheaper

Wise’s investment in experience not only delivers a high NPS, but also has verifiable cost savings. Wise will continue to invest in its product to bring its costs down, passing this straight through to you and your customers.

Faster

Investing in the power of instant. Over 30 percent of all global transfers are delivered instantly, with over 50% delivered within the hour.

Easier

Best in class APIs and design documentation – a trusted, out-of-the-box and completely online solution available with minimal integration and ongoing maintenance effort.

More Transparent

Transparency is becoming the norm – regulators globally are assessing how foreign exchange pricing has been implemented. Wise’s service uses the real, mid-market exchange rate as seen on Google or Reuters.

Request a Demo

Put a financial advisor in your customer’s pocket

We designed Unblu’s Conversational Platform to solve the problem of connecting people with banks in a world where branches are disappearing and competition is increasing. We make those connections secure, meaningful, profitable and efficient both for the customer and the financial institution. With Unblu every engagement becomes an opportunity.

Overview

Full conversational banking platform

The Unblu Platform allows organizations to engage and interact with the visitors/customers on their websites and mobile applications, guiding them through their digital journey to a successful completion of a business transaction. Our platform is specially architected to allow advisors and relationship managers to engage with customers in secure environments such online banking applications or customer portals, leveraging the support and advisory experience to the next level.

Better engagement

Increase touchpoints with customers (text, video, voice and collaboration) by leveraging on digital tools to render a branch-like experience that your customers expect and love. Design customer journeys with total flexibility, offering advice and support where you know customers need it. It’s not just another chat icon on a website, hoping for the best, or an isolated video-meeting solution.

More revenue

Unblu allows banks to leverage the moment of truth. Providing financial advice when your customers need it. Unblu allows your agents and advisors to use technology to increase conversion rates by spending more quality time with customers.

Lower customer support costs

Adding visual context to support use cases is allows our customers to reduce the time you dedicate per call/chat, and increasing the first-call resolution ratio. Unblu allows you to engage with customers online in a natural, convenient and intuitive way, what translate in a higher efficiency when onboarding new customers.

Resources

Request a Demo

Acquire your next generation of customers

Chore Scout is an app for banks to acquire children and their parents as customers. It lets parents set chores around the home. As the children complete the chores they receive their allowances, transferred from mum and dad’s bank account into theirs, which can then be used to save for goals such as skateboards and Lego or converted into cash. Chore Scout teaches fundamental financial literacy skills such as saving and the value of money and acts as a customer acquisition tool for banks.

Overview

Acquire Youth Customers

Customers who have banked with a provider throughout their early years are far more likely to extend this relationship into their student days and beyond when profit contribution increases significantly. Research indicates that only 10% would consider changing banks once their relationship is established, reinforcing the view that the youth segment is the optimum point of market entry. This existing relationship delivers a clear advantage when financial institutions are attempting to access friends and family of their existing account holder, with “92% of consumers saying they trust word of mouth and recommendations from friends and family above all other forms of advertising. Having a savings accounts in childhood is associated with being two times more likely to own savings accounts, two times more likely to own credit cards, and four times more likely to own stocks in young adulthood, compared to not having savings accounts in childhood. A wide variety of studies suggest a positive relationship between the ownership of a savings account and higher levels of economic and financial wellbeing such as savings, income, and assets, as well as academic achievement and educational attainment. By examining the journey below, a bank can begin to choose when to begin working with customers to help them win and build a bank of great customers.

Corporate and Social Responsibility

Financial institutions have a key role to play in laying the groundwork for youth to realize their potential. By offering child and youth friendly financial services, banks offer children and youths a chance to believe in themselves, save for a better future, build a savings record, make payments and access other essential financial services. By learning how to manage their own resources, children can develop the necessary life skills, and skills needed for employment or entrepreneurship. Changing a young person’s life can be that simple. There are 2.2 billion children (aged 0-18) and approximately 1.2 billion youth (aged 15-25) in the world. As leaders in finance and economies, financial institutions have an opportunity to create the next generation of entrepreneurs, business leaders, and responsible economic citizens. Financial inclusion for these groups is key to unlocking intergenerational cycles of poverty, indebtedness, school dropout and unemployment. Financial institutions who decide to address these issues broaden their playing field while addressing their social responsibility. According to the World Savings and Retail Banking Institute people need the ability to act financially through education, knowledge, skills, confidence and motivation, and access to adequate banking services and responsible institutions. Without access to these types of banking products they will not build the skills necessary to learn how to use complex financial services in a productive and responsible manner later in life.

Improve your Brand

The global financial landscape is becoming increasingly sophisticated with accelerating adoption of innovative financial technology. Serving highly technologically literate children and youth can help financial institutions rethink and perhaps diversify the services and distribution channels they offer. This in turn can have a positive impact on brand perception – the financial institution can meet/exceed/lead market needs – therefore attracting more customers.

Untapped savings market

On average 37.9% of youngsters aged 15 – 25 have accounts at a formal financial institution. OECD countries and East Asia and the Pacific are above this average, whilst penetration in the Middle East is as low as 12.9%. In Eastern Europe and central Asia, these rates are as low as 3.98% With low cost, mobile solutions that are fun and relevant this market can be captured. A 2013 global CYFI study of 135 banks, representing over 1 billion retail customers and over €39 trillion in assets found that child and youth financial inclusion was a sustainability priority for less than 5% of banks. This compares with CBA who attest that 20% of their savings volume is “youth related”.

Resources

ChoreScout Brochure

Request a Demo

Multi-Factor Authentication for a fast and secure windows login

HID DigitalPersona is an advanced multi-factor authentication solution, facilitating swift and secure login to Windows workstations. The solution supports a wide range of authentication factors, including Keys, Cards, Bluetooth devices, OTP tokens, App-based methods, and much more.

This provides businesses with unprecedented freedom of choice of authentication methods by enabling them to combine up to 3 authentication factors of choice. It effectively and seamlessly helps secure enterprise, web, cloud, and legacy applications, as well as Virtual Private Networks. What sets DigitalPersona apart from competitors is its ability to leverage existing IT infrastructure for quick deployment, allowing it to be operational within hours, not weeks or months.

What sets HID apart?

Pre-Integrated Features and Capabilities

Get a faster and more efficient implementation through HID’s 15 years of experience with the Temenos banking platform. HID’s consumer authentication solutions provide secure multi-factor authentication for login and transaction signing as well as risk-based authentication capabilities for banks using the Temenos banking platform ecosystem. HID is pre-integrated with the Temenos banking ecosystem and offers predefined workflows based on the very best banking practices to offer a superior user experience without compromising on security. The components can also be used to build a fully customized workflow should you choose to do so.

Partner Services

HID’s Identity and Access Management (IAM) Partner Services’ team are true Temenos banking platform experts. Their focus is on shortening the customer time to value realisation within the Temenos banking ecosystem. Following an agile delivery methodology, the team enables implementation partners by onboarding, training and supporting them on their Temenos integration journey. Partnering with HID for your Temenos integration will not only ensure that you have experts on your side to offer the best user experience, but also significantly shorten your time to market.

Enable the right security for the right user with massive scalability

Tailor your unique user journey through flexible and customizable authentication solutions that can be seamlessly integrated in your Temenos banking environment. Our approach is to secure today’s modern banking journeys through flexible workflows that have been rigorously tested to fit your end-to-end user needs.

Beyond traditional authentication that meets evolving banking needs

HID offers full authentication coverage to provide an end-to-end customer journey with some of the market’s broadest range of authentication solutions and form factors. Our authentication platform is backed with AI-based identity verification and real-time threat detection for true fraud prevention. By leveraging diverse modern authentication capabilities, including passwordless, phishing-resistant, risk-based, and adaptive authentication, HID’s authentication solutions are easy to deploy and flexible to grow with your business needs. The authentication services offered by HID are deployable in the public or private cloud and on premise and are highly interoperable with open standards and frameworks.

Delivered by a trusted industry leader

HID is your global security and identity expert. Benefit from the deep expertise of a proven leader in identity technology, trusted by financial institutions and other highly regulated industries around the world, to enable compliance with stringent data privacy, industry mandates and strong consumer authentication (SCA) relating to Open Banking.