Provider Category: Technology

OCR Engine – Tungsten Automation

Australian Driver’s License scan for information prefill in Temenos Journey Manager

Unlocking Potential: Navigating OCR Solutions for Australian Driver’s Licenses

This package offers integration with the Top Image Systems OCR engine, specifically designed for scanning Australian Driver’s Licenses and extracting data. While Top Image Systems has developed this service anticipating market demand, it has not yet been utilized in a production setting and is not currently available as a commercially managed or supported product.

Before deploying in a production environment, it is essential to conduct thorough testing and establish the service.

Please note that the accuracy of OCR for Australian Driver’s Licenses may be lower than expected due to the intricate background imagery on the licenses, raising questions about the value of this service in a customer flow. For more details, visit our website.

Overview

Secure documents, data and more

Get production-level scanning and indexing from structured and unstructured documents that contain information in many forms, including machine-printed text, barcodes and checkboxes.

Content capture anywhere, any time

Extend capture capabilities with an integrated link between intelligent devices like MFDs, network scanners and mobile.

Realize a swift return on investment

Automate content capture and distribution by placing content at your workers’ fingertips, creating efficiencies that result in a higher and faster ROI.

Request a Demo

Google Places – Google

Global address lookup and autocomplete using the Google Places API.

Get location data for over 200 million places

The Google Places API Web Service for Temenos Journey Manager empowers developers to access comprehensive information on more than 150 million locations globally. This API facilitates a range of applications, enabling users to discover restaurants, bars, coffee shops, and other points of interest tailored to their geographical location.

Two key features of this service include:

Place Search

The Place Search feature allows users to locate places by proximity or keyword and retrieve details about a place, such as its name, address, and coordinates.

Place Details

The Place Details feature provides more in-depth information, including user reviews, ratings, and photographic content, enhancing the ability to create interactive and engaging applications.

Request a Demo

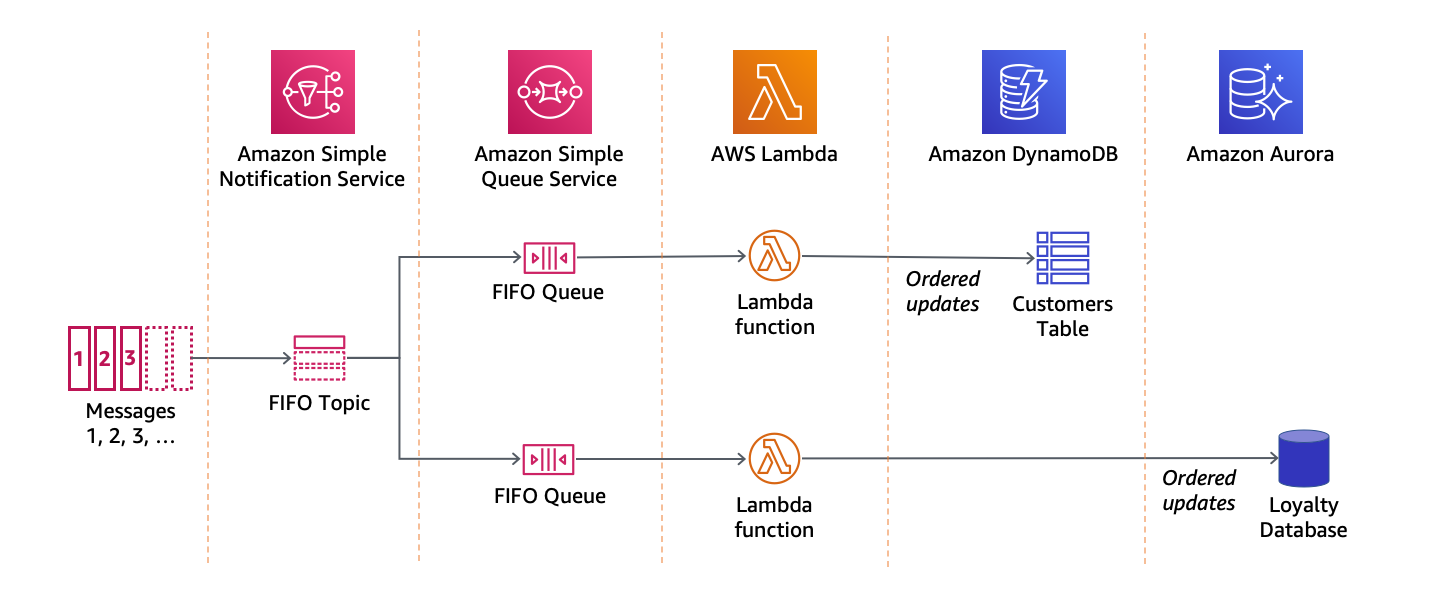

Amazon SNS – AWS

This package enhances your Temenos Journey Manager experience by integrating Amazon Simple Notification Service (SNS) for improved communication and security.

Boost Your Temenos Journey Manager with Amazon SNS

Amazon Simple Notification Service (SNS) is a flexible, fully managed pub/sub messaging and mobile notifications service for coordinating the delivery of messages to subscribing endpoints and clients. With SNS you can fan-out messages to a large number of subscribers, including distributed systems and services, and mobile devices. It is easy to set up, operate, and reliably send notifications to all your endpoints – at any scale. You can get started using SNS in a matter of minutes using the AWS Management Console, AWS Command Line Interface, or using the AWS SDK with just three simple APIs. SNS eliminates the complexity and overhead associated with managing and operating dedicated messaging software and infrastructure.

Temenos Journey Manager Package: Key Benefits

Enhanced Security

With Second Factor Authentication, ensure that only authorized users gain access to applications through SMS verification.

Flexible Messaging

The Open SMS Message feature allows form builders to send customizable text messages, improving user engagement and communication.

Efficient Setup

Quickly integrate and operate SNS within Temenos Journey Manager, streamlining the notification process without the complexity of managing dedicated messaging systems.

Request a Demo

Everything begins with trusted identity. authID’s IDaaS platform delivers mobile biometric solutions that provide strong identity verification to enable businesses to grow without the fear of fraud.

authID stands at the axis of trusted identity and digital transformation, offering AI-powered, mobile identity proofing and multi-factor authentication solutions that serve as weapons in the ever-evolving battle against fraud. On-board more customers remotely and authenticate transactions anywhere in the world with speed, reliability and biometric certainty.

Overview

Identity Assurance. Business Growth

Onboard new customers with high-speed, accurate biometric matching. Reduce fraud and account takeover by extending the value of a “Proofed” identity to any transaction across all customer channels.

Global IDaaS Platform – Anywhere, Anytime

Multi-national client support across systems, languages and regulations. End-to-end identity solutions balance cost, IT drain and usability. Flexibility for customization via low-risk API integration.

Trusted Digital Identities. Trusted Transactions

Fast, remote identity proofing and multi-factor authentication. Auditable consent to everyday questions: “Who is applying online for a loan; logging into my systems; transferring funds; calling support.

Automated Document Verification. Trusted Data Sources

Biometric data and ID documents validated with trusted sources. Includes government registries, global validation of chip-based passports, and algorithms for North American driver’s licenses.

Secure, Seamless, “Live” User Experience

Balance usability and security with low-friction mobile identity solutions. Confirm the person holding the ID is present with Liveness detection and AI-powered anti-spoofing techniques.

Enhanced Security and Performance

Secure encryption, retention and segregation of biometric and PII data. High-speed biometric matching; automated document verification. Compliant with applicable data privacy and security laws.

Resources

Read Case Study

Watch Demo

ISV Assessments/Awards

ESG & Enterprise Readiness Assessment Scores for authID conducted by The Disruption House

| Category | Award | Date |

| Business Resiliency Accreditation | Leader | October 2024 |

| Sustainability Accreditation | Starter | October 2024 |

Interested in the full authID report? Click here to access now.

Request a Demo

Recurring Payment Transfer – ClickSWITCH

The Temenos Journey Manager ClickSWITCH package provides an automated account switching solution that allows account holders to effortlessly, securely, and efficiently transfer their recurring payments from old accounts to new ones.

ClickSWITCH quickly, safely and efficiently switches account holders recurring payments from their old accounts to new ones.

With the integration of real-time checking or savings account creation, this service can be easily incorporated into any onboarding application.

This not only simplifies the process for customers, but also saves them time and effort in manually transferring their recurring payments from old accounts to new ones. It eliminates the need for customers to contact each individual merchant to update their payment information, making it a hassle-free experience.

Overview

Automated Account Switching

Streamlines the transfer of recurring payments from old accounts to new ones, saving users time and hassle.

Seamless Integration

Easily integrates real-time checking or savings account creation into onboarding applications, enhancing the user experience.

Efficient Payment Transfers

Simplifies the process of transferring payments, ensuring a smooth transition for users once their new account details are confirmed.

Request a Demo

End-to-end Collection & Recovery Technology

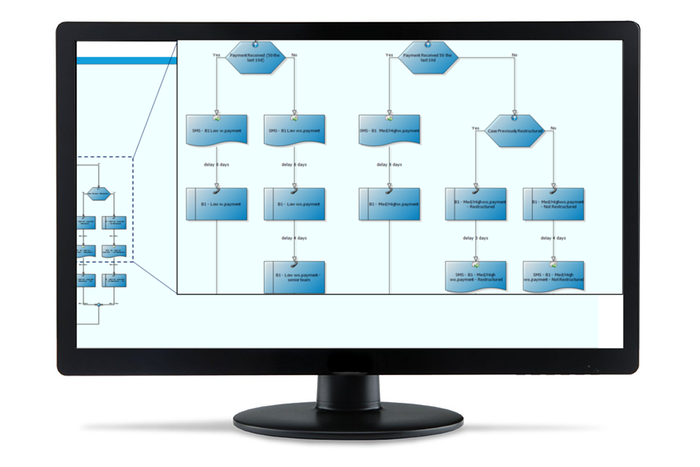

QUALCO Collections & Recoveries helps banks manage high volumes of non-performing assets effectively and compliantly. The technology uses data-driven analytics to predict customer behaviour and optimise treatment strategies. It manages debt portfolios through the entire lifecycle, from performing accounts to early delinquency and recoveries. The solution supports all banking products, from unsecured debt to mortgages and SME loans and is used by creditors to manage accounts on both an in-house and outsourced basis.

Overview

The Perfect Fit for Temenos Tier 1 & 2 Banks

Our solution ideally fits to Temenos Tier 1 & 2 Banks size and business needs. Secures smooth T24 & Insight integration and evolution of the system.

A Highly Sophisticated Decisions Engine

A highly sophisticated Decisions Engine enables the originator to determine the resolution strategy to apply, and manage the flow of the portfolio throughout the various stages of the debt lifecycle.

Compliant with ECB Guidance for Npl Management

Set up workout units and allocate management. Reach a sustainable solution by considering disposable income and Net Present Value. Implement Going and Gone Concern approaches through user configurable workflows and configure restructuring products that offer a wide variety of options such as interest rate reduction, tenor extension, debt forgiveness, and split balance balloon payments.

Clarity on Performance

Clarity on performance, measurement and reporting. Monitor & improve productivity/financial performance through real-time reporting & analysis tools and built-in Data Warehouse.

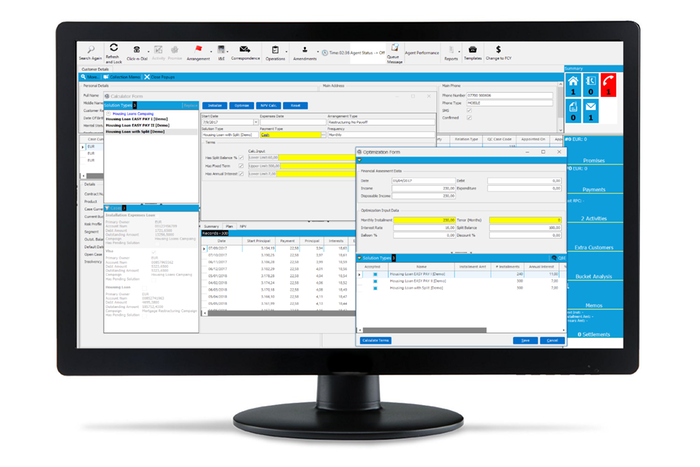

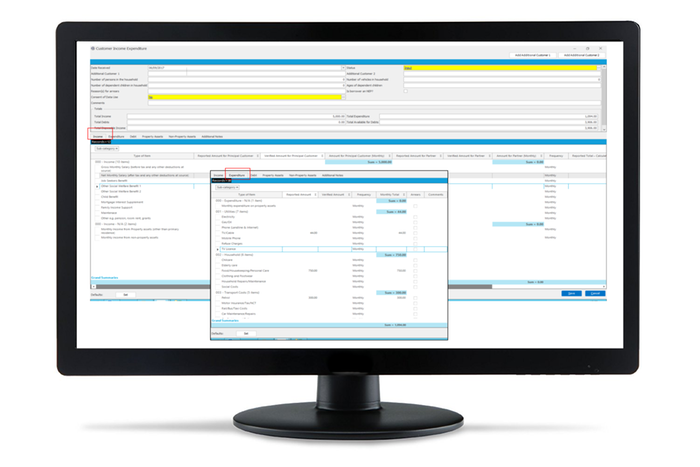

Features

Advanced Segmentation, Customer Classification and Strategy Definition through the most sophisticated Decision Engine in the market incorporating scoring and decision that enables business decisions & automates treatment processes.

Customer Solutions functionality to configure, negotiate and offer affordable solutions to the customer with flexible repayment plans. Calculation of the NPV of affordable Solutions allows for ranked proposals to bank’s customers.

Financial Assessment functionality that identifies the disposable income of the client in order to choose the most appropriate solution and proper strategy re-shaping.

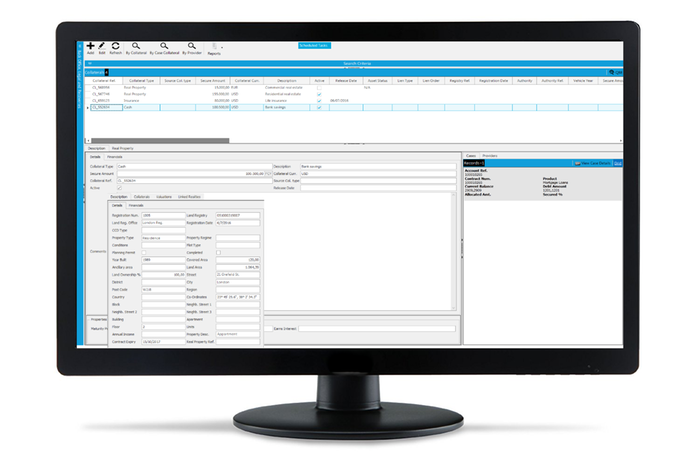

Collateral Management & Asset registry functionality for the management and maintenance of a detailed list of collaterals pledged by customers against their loan, with detailed information on their characteristics.

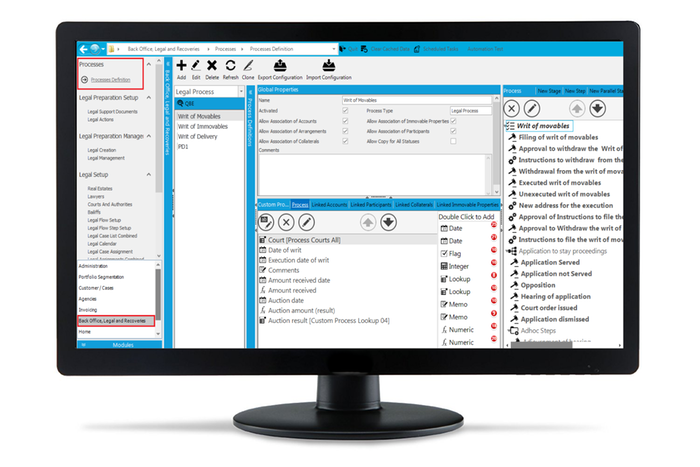

Legal Management and Process Set Up, through a fully configurable environment that supports end-to-end legal processes along with any related action taken to customers and accounts going under litigation.

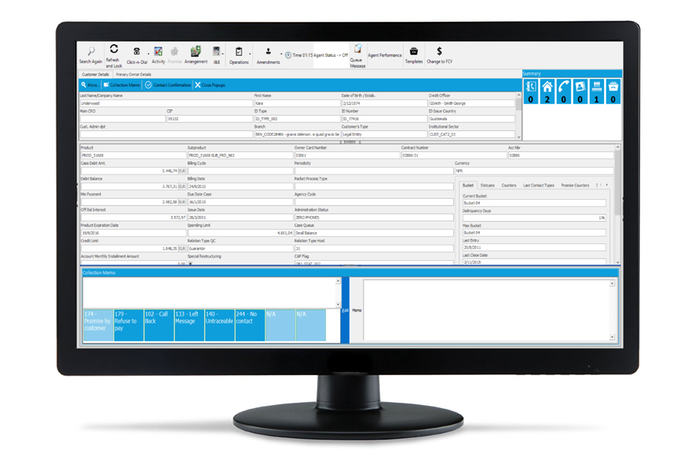

“One Call to Customer approach”. Due to the Customer centric approach of Qualco Collections & Recoveries and the presentation of all Customer information in one screen, the system allows the agent to conduct “one call” managing the complete Debt relation with the Customer.

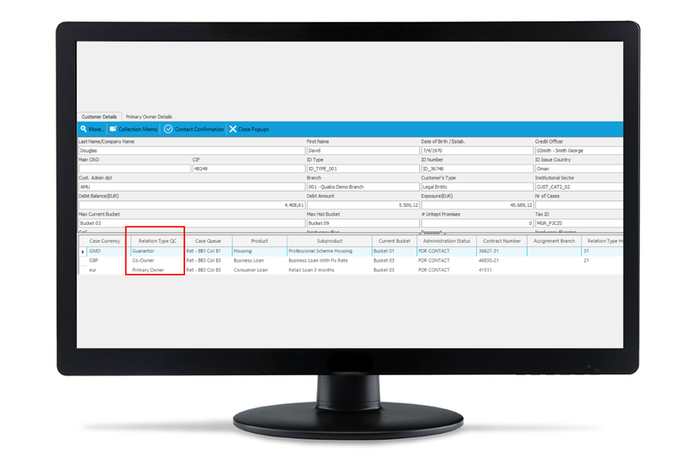

Customer relationships (e.g. main debtor, guarantors, joint cardholders, and other co-signers) between the account and customers of the Bank can be displayed and handled through the Collection Screen and various actions that allow different treatment for main owner and co –signers is supported.

Reporting at any management level through comprehensive and user-friendly out-of-the-box data warehouse, analytics environment & dashboard presentations.

Resources

United Bulgarian Bank case study

Vojvodjanska Banka case study

kbc case study

Stopanska Banka case study

ISV Assessments/Awards

ESG & Enterprise Readiness Assessment Scores for QUALCO conducted by The Disruption House

| Category | Award | Date |

| Business Resiliency Accreditation | Builder | February 2024 |

| Sustainability Accreditation | Builder | February 2024 |

Interested in the full QUALCO report? Click here to buy it now.

Request a Demo

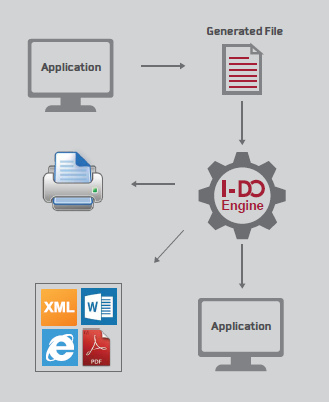

Integrated Data Output

Design, customize, and generate your own report, from multiple data sources. Are you looking for an easy solution to design and generate customized reports? We have the right solution for you. Our Output Management solution is a powerful free-form report designing business tool, to create custom template layouts at will. The solution provides customers with the capability of designing, formatting, editing, and generating reports and templates quickly and easily, interfacing with Microsoft Office. This is possible through our partnership with Windward, a provider of template design tools.

Overview

Business Oriented

Any business user, such as marketers, can easily create and design custom report templates.

Techies are out!

Your developers need not waste their time on designing reports for business units.

Integration is Key

Integrate your systems into one application in a reduced time, without the monotonous manual intervention.

It’s Alive

Transform your Multiple data sources into lively graphs and charts.

Embrace Management

I-DO does not only integrate with T24, but also with current and potential software solutions such as ERP, CRM, etc.

It’s all about Security

Manage your print output securely according to the data, conditions, and confidentiality.

Time is of the Essence

Reduce delays by applying automatic schedules and email distribution rules.

Features

Our state-of-the-art solution allows you to create report templates in Microsoft Office. The interface permits you to:

- Select only the data you wish to view on your report with simple drag and drop actions, using the XML file generated as data source.

- Add calculations and text fields

- Repeat parts and include conditional parts of the document

- Sort the data in any desired manner

- I-DO design tool comes as an Office plugin, it adds a ribbon to Word, Excel, PowerPoint…

- I-DO design tool is user friendly: no need for experienced developers to design an output

IMS IDO Rules Engine will provide:

- The ability to set parametric conditions on each report

- The ability to print locally in each branch

- The ability to set rule-based printing actions by report, including but not limited to:

- Method of printing

- Ability to invoke more than one report based on the data provided by T24

- Ability to group more than one output file from T24 into one document to be printed

- The ability to hold or suspend the printing of a document based on details available within the data provided

- Maintaining document security and regulatory compliance by implementing rules that can prevent confidential documents from being printed or inform the user when they are printed

I-DO integrates with T24 or any other software application installed using common integration interfaces.

- I-DO works using multiple data source formats utilizing several integration types: Directory based, Web services, Database Listeners, etc.

- I-DO acts as a listener for one or several applications at the same time.

After the report is generated in the desired format, it can be delivered by various means:

- I-DO generates reports in many formats such as PDF, DOCX, XLSX, PPTX

- I-DO can then store and print reports

I-DO is a fully-automated tool

- I-DO will be triggered automatically and will deliver the output at runtime in a glance

I-DO helps you transform your complex reports into charts and graphs.

- With I-DO, users and clients can easily analyze significant patterns, trends, and correlations that might go undetected in text-based or tabular formats

- Users can easily use the generated graphs to compare data and to track changes over time

The below features classify I-DO as your right solution:

- E-Statement

- Customer Independence: Client does not need to revert back to vendor while developing reports

I-DO is in constant growth! Below are our upcoming features:

- Interactive E-Statement

- Additional Plug and Play templates

- API to retrieve statistical data on the executes jobs by I-DO

Request a Demo

ChexSystems

Integrates the FIS ChexSystems to support QualiFile (for individual risk scoring for deposit account opening in the US), OFAC, Identity Verification (IDV) and Identity Authorization (IDA – out-of-wallet questions).

Unlock Seamless Onboarding: Enhance Identity Verification with FIS ChexSystem Services!

This package equips Temenos Journey Manager customers with the following FIS ChexSystem services:

Perform real-time identity verification and OFAC checks for US individuals using the FIS ChexSystems Identity Verification and OFAC check service.

Conduct real-time identity verification for US individuals through the FIS ChexSystems ID Authentication service (also known as Knowledge-Based Authentication / KBA).

Execute real-time fraud checks during onboarding processes for US Checking Accounts using FIS QualiFile.

Benefits

Define various risk assessment and decision-making strategies tailored for different applications across your organization

Limit the number of attempts to minimize unnecessary calls and costs

Automatically clear sensitive personal information when it’s no longer needed.

Generate reports on the sources of FIS calls (online, in-branch) for auditing and reconciliation

Request a Demo

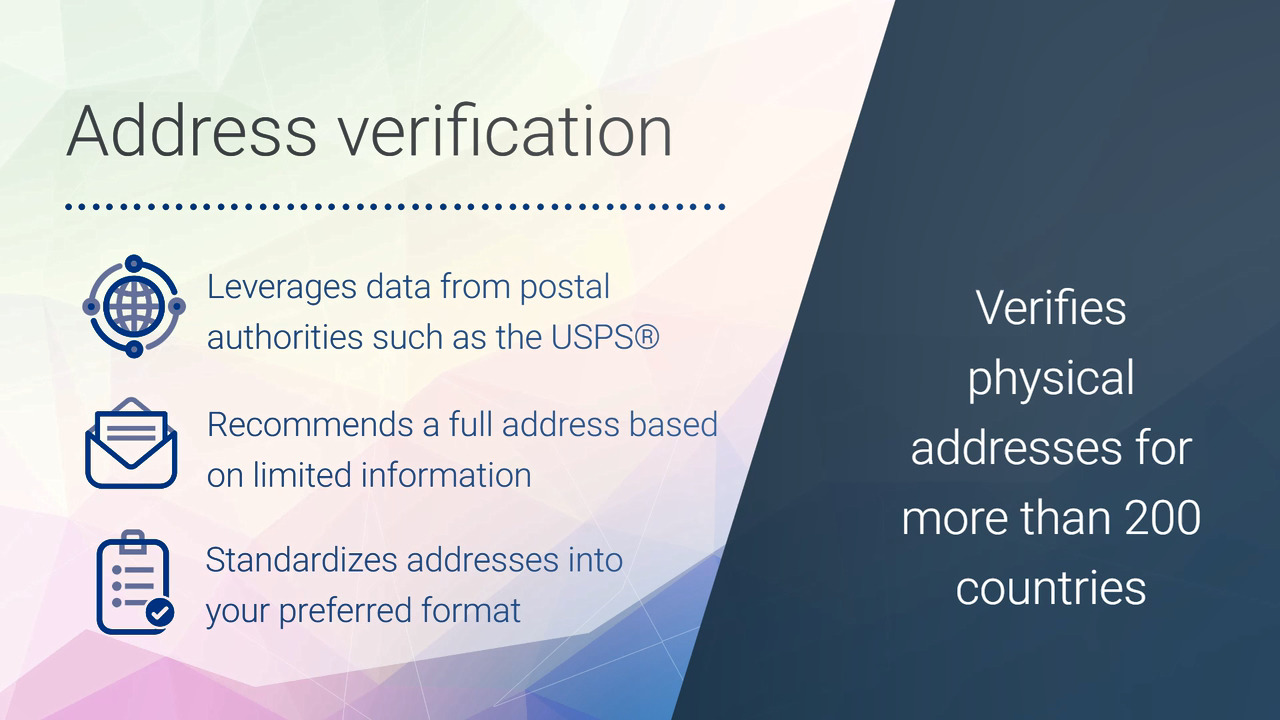

Data Quality – Experian

Global address lookup and autocomplete using the Experian Data Quality APIs (formerly QAS) for Temenos Journey Manager.

Global address lookup and autocomplete

The Experian Data Quality APIs provide complete and accurate address validation based on international address data files.

This package provides components that are pre-integrated into the Experian real-time address capture service for hastle free inclusion into Avoka applications.

Note this service was formerly called QAS.

Benefits of Experian Data Quality APIs

Real-Time Processing

The real-time address capture service ensures that customers can validate and capture addresses instantly, enhancing customer experience and streamlining operations during critical touchpoints.

Global Reach

Utilizing international address data files, customers can validate addresses from around the world, enabling businesses to expand their reach and serve diverse markets more effectively.

Seamless Integration

The APIs are designed for effortless integration into Journey Manager applications, allowing customers to enhance their address capture processes without disruption to their existing workflows.

Enhanced Accuracy

With Experian’s comprehensive address validation, Journey Manager customers can ensure that their databases are populated with precise and up-to-date address information, reducing errors and improving overall data quality.

Request a Demo

IDMatrix – Equifax

Real-time identity verification of Australian individuals using the Equifax IDMatrix service for Temenos Journey Manager Customers.

IDMatrix is Australia’s most comprehensive verification solution.

Whether you have an obligation under the Anti-Money Laundering and Counter-Terrorism Financing Act to Know Your Customer, need to meet ARNECC’s Verification of Identity Rules or just want to establish further trust with your customers, IDMatrix has a verification solution to assist you.

Identity Verification sits at the core of the IDMatrix service and can be configured to meet your business and compliance requirements. Allowing a risk-based approach, you specifying which verification data sources are to be searched, the rules to determine a successful outcome and the user experience workflow, your business is in complete control of the verification processes.

Features and Benefits

Search, Match and Screen against More Than 30 Data Sources

Includes the Australian Government’s Document Verification Service (DVS) or integrate your own data or screening lists into a solution.

Seamless Integration

IDMatrix is integrated seamlessly in to your account opening or loan origination experience for immediate verification and decisioning.

Easy Customization

Customise your business rules, data sources, workflows and many other metrics to match your organisations compliance requirements and risk profile.

Reporting Portal

Your IDMatrix access offers a comprehensive reporting portal to allow you to keep an audit trail of previous transactions, view score card performance and view data source performance, amongst other things.