Corporate and commercial banking is undergoing a seismic shift driven by margin pressure, evolving client expectations, and the need to modernize. At the heart of this transformation is lending, the primary engine of growth for MEA banks. Yet many are still held back by fragmented systems, manual processes, and operational silos.

Join Temenos and a panel of pioneering MEA banks to discover how a unified lending platform can break down those barriers, automating the full loan lifecycle, enabling real-time insights, and delivering a seamless experience for both customers and bank employees. Learn how to reduce cost-to-income ratios, redeploy human capital for strategic growth, and scale into new lending areas to unlock untapped portfolio value – moving at the speed of your clients.

What You’ll Learn:

- How to consolidate fragmented systems and modernize credit operations to accelerate time to market

- Why real-time data and automation are key to efficiency, better credit decisions, and future growth

- How MEA banks are challenging the status quo to reduce cost, unlock new value, and lead the way in lending transformation

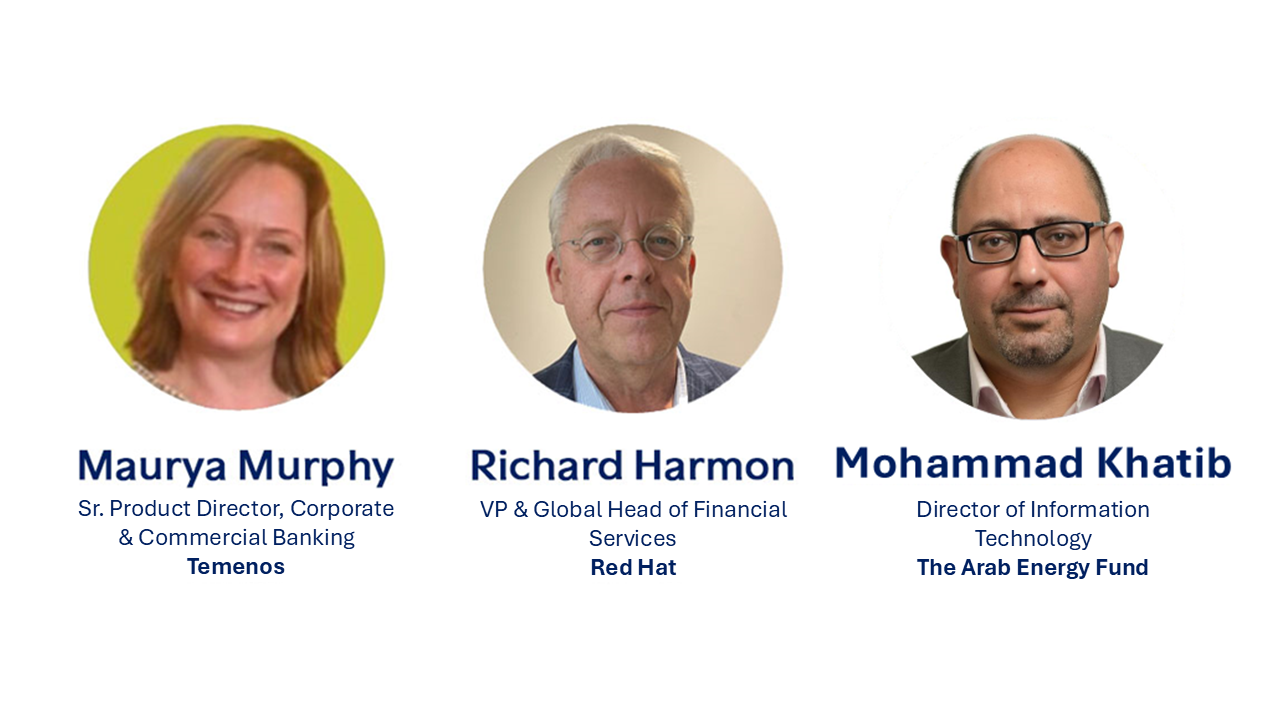

Meet the Speakers:

Watch on-demand webinar

Don’t miss this opportunity to hear about the “Corporate & Commercial Banking.”

The MEA Corporate and Commercial Lending webinar is co-hosted by Temenos in partnership with Red Hat. As a result, you acknowledge and agree that both Temenos and Red Hat are collecting your personal data submitted as part of the registration process. The personal data you provide will be used for commercial purposes and will be treated and processed in accordance with Temenos’ privacy policy and Red Hat’s privacy statement [redhat.com].