StockRepublic is a B2B fintech company that helps banks activate, engage, and grow their users.

With our Portfolio Pulse and Social Investing products (available via white label and API), bank and brokerage clients can keep a competitive edge by offering an interactive, educational investing experience so that average investors can beat the market.

Overview

Boost profitability & AUM in self-directed investing

Increase trading volumes

Activate & engage dormant customers

Grow new customers organically

Attract younger, tech-savvy investors

Stay competitive

Key Features

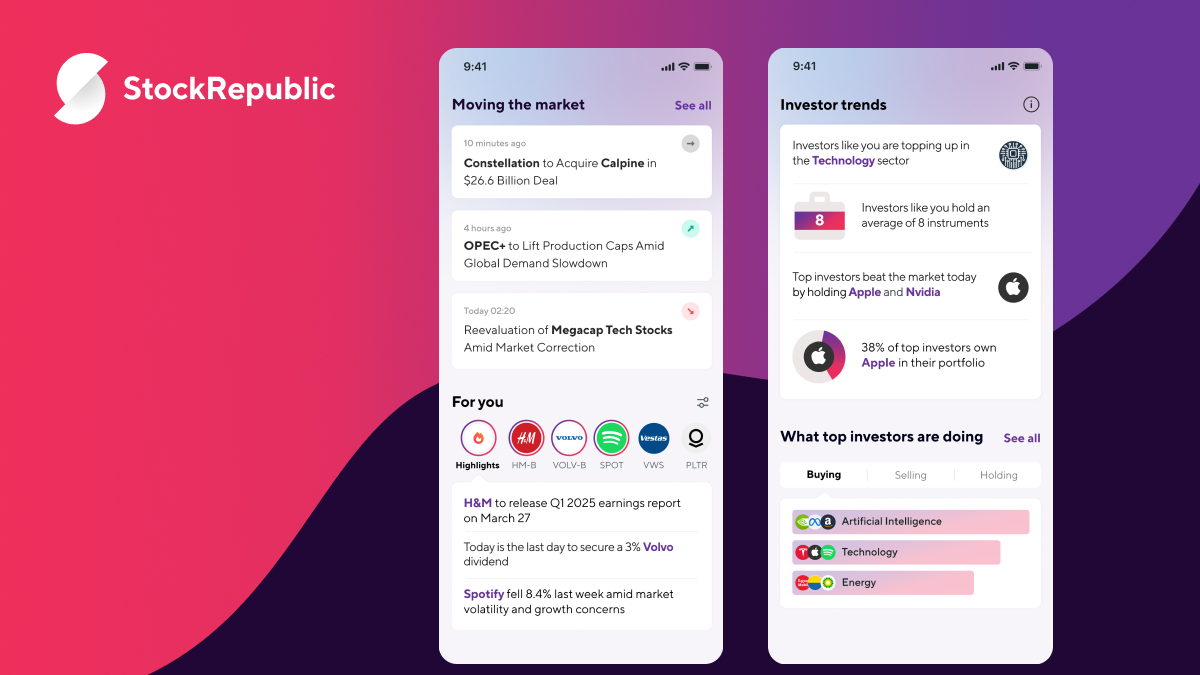

Investor Trends

What top-performing and like-minded investors are buying, selling, and holding, along with detailed tracking of buy/sell activities, complete with visual markers and profit/loss analysis.

Performance Analytics

Benchmark returns against peers and market indices, track diversification across sectors, assess risk-adjusted performance with anonymous portfolio ratings, and evaluate CO2 risk levels with sustainability data.

Community Engagement

Connect through public or private forums, share insights, and discuss market movements within an engaged investing community.

Personalized Insights

Real-time updates on news, trends, and events that impact a user’s portfolio, delivered in a way that aligns with their investment preferences.

Resources

ISV Assessments/Awards

ESG & Enterprise Readiness Assessment Scores for StockRepublic API conducted by The Disruption House

| Category | Award | Date |

| Business Resiliency Accreditation | Builder | October 2024 |

| Sustainability Accreditation | Starter | October 2024 |

Interested in the full StockRepublic report? Click here to buy it now.