Indigita SA

The new RegTech standard for automated cross-border compliance and suitability solutions.

A leading Swiss regulatory technology company, enabling financial institutions to safely and efficiently conduct business worldwide in an increasingly complex regulatory environment.

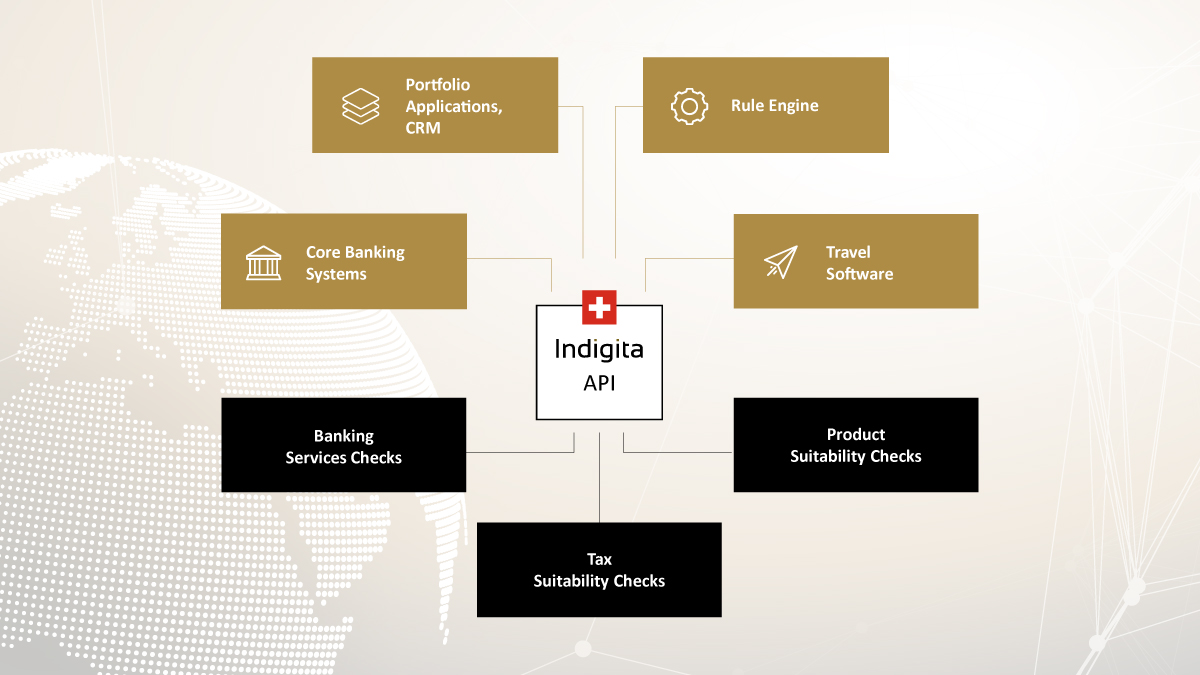

Indigita’s suite of digital solutions includes web-based modular applications, APIs and interactive online trainings backed by the knowledge and expertise of the BRP Group’s Country Manuals accross 190+ jurisdictions. Indigita’s solutions help financial institutions obtain clear answers on complex regulatory questions, including multi-jurisdictional scenarios. The integration of Indigita’s API into the Temenos Wealth Management software adds automated cross-border compliance and tax suitability checks to the existing solution.

Overview

Integrated solution

The Indigita API is integrated into the Temenos Wealth Management Software, making it accessible and functional without the need for additional installation processes and costs.

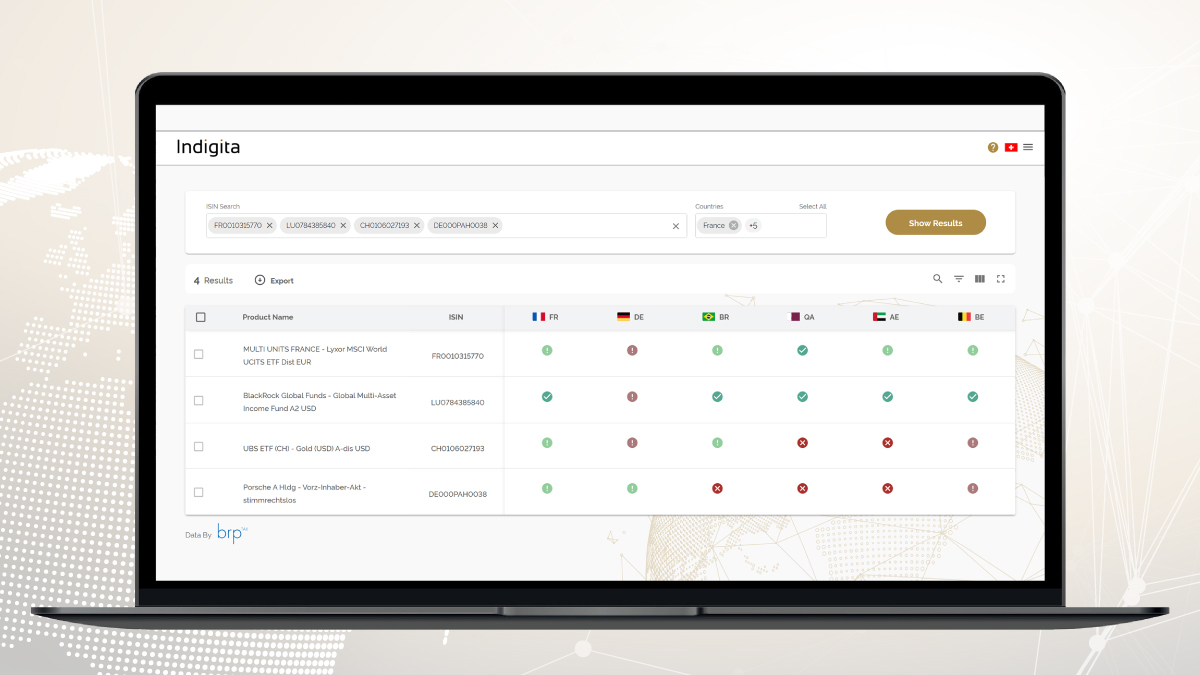

Filter suitable products

The API returns a list of products based on the client model and cross-border situation and provides the possibility to filter only the ones that are suitable.

Get the answer to your specific situation

The solution provides straight answers for simple or complex situations (e.g. multiple account members domiciled in different countries).

Always up to date

The API’s data and rules are continuously updated, ensuring a compliant answers as per the content in Country Manuals of BRP Bizzozero and Partners and BRP Tax.

Customisable rules

The solution offers the possibility to customise the rules based on the financial institution’s needs.

Swiss cloud-based solution

Indigita’s API is a cloud-based solution hosted in Switzerland, accessible 24/7.

Features

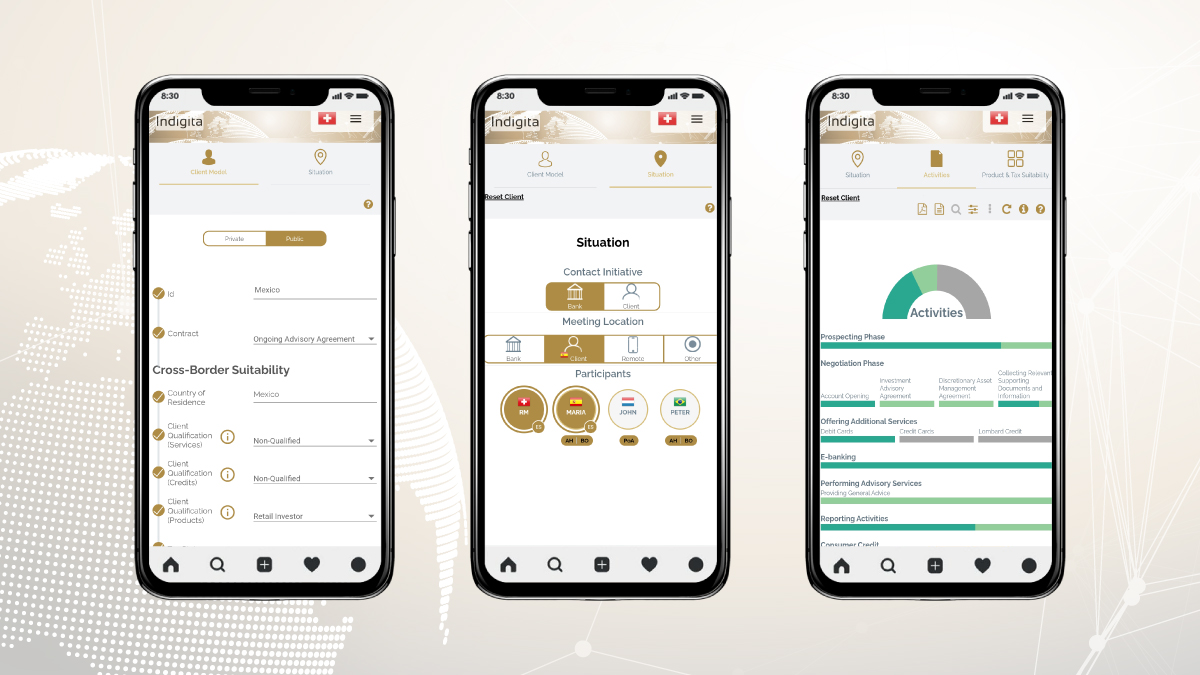

inApp – a modular, web-based application, which offers instant, context-dependent answers on regulatory compliance questions straight to the user’s mobile device or computer.

inApp Tax – a web-based application to enable financial planners, investment advisors and portfolio managers to assess the tax impact of an entire portfolio, considering different geographical markets and special tax regimes.

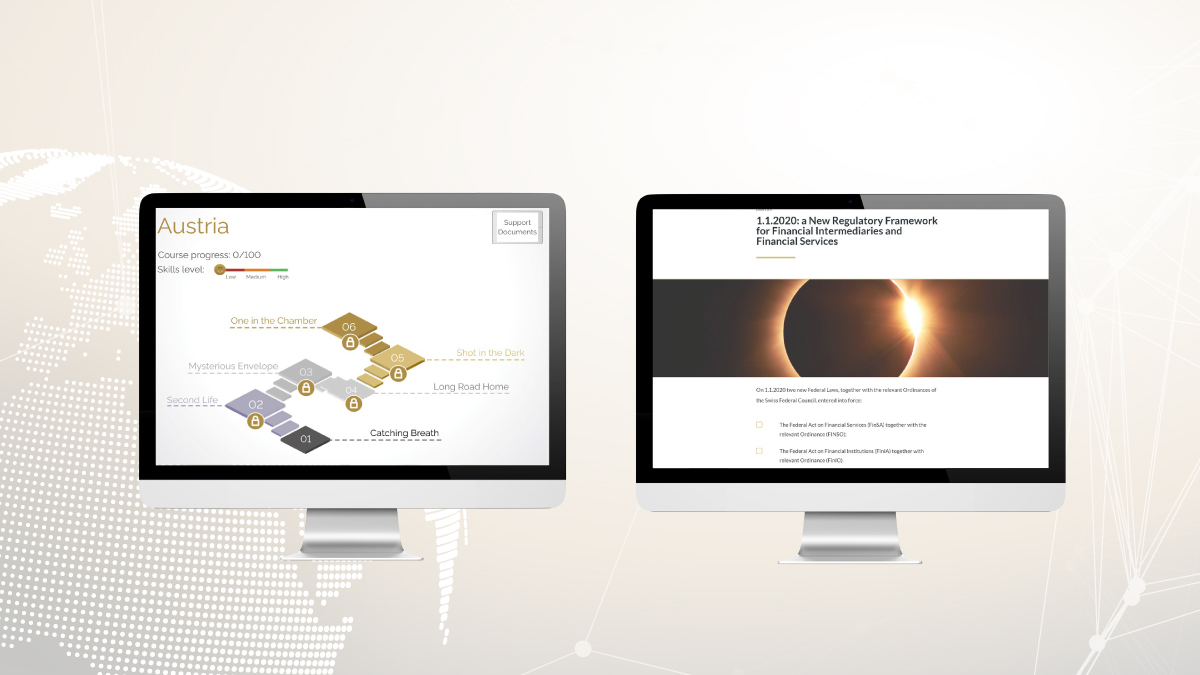

e-Learning – audit-proof cross-border and compliance trainings to mitigate business risks, as per art. 398 of the Swiss Code of Obligations.

Travel API – a solution that simplifies and enhances the cross-border travel authorisation process by establishing a direct link between the Indigita learning management system (LMS) and the corporate travel platform to automatically flag or block travel authorisation requests that do not comply with regulatory training requirements.