Driving Digital Engagement with Impact Finance by Doconomy

Superpowering the digital channels of retail and private banking Financial Institutions

Impact Finance

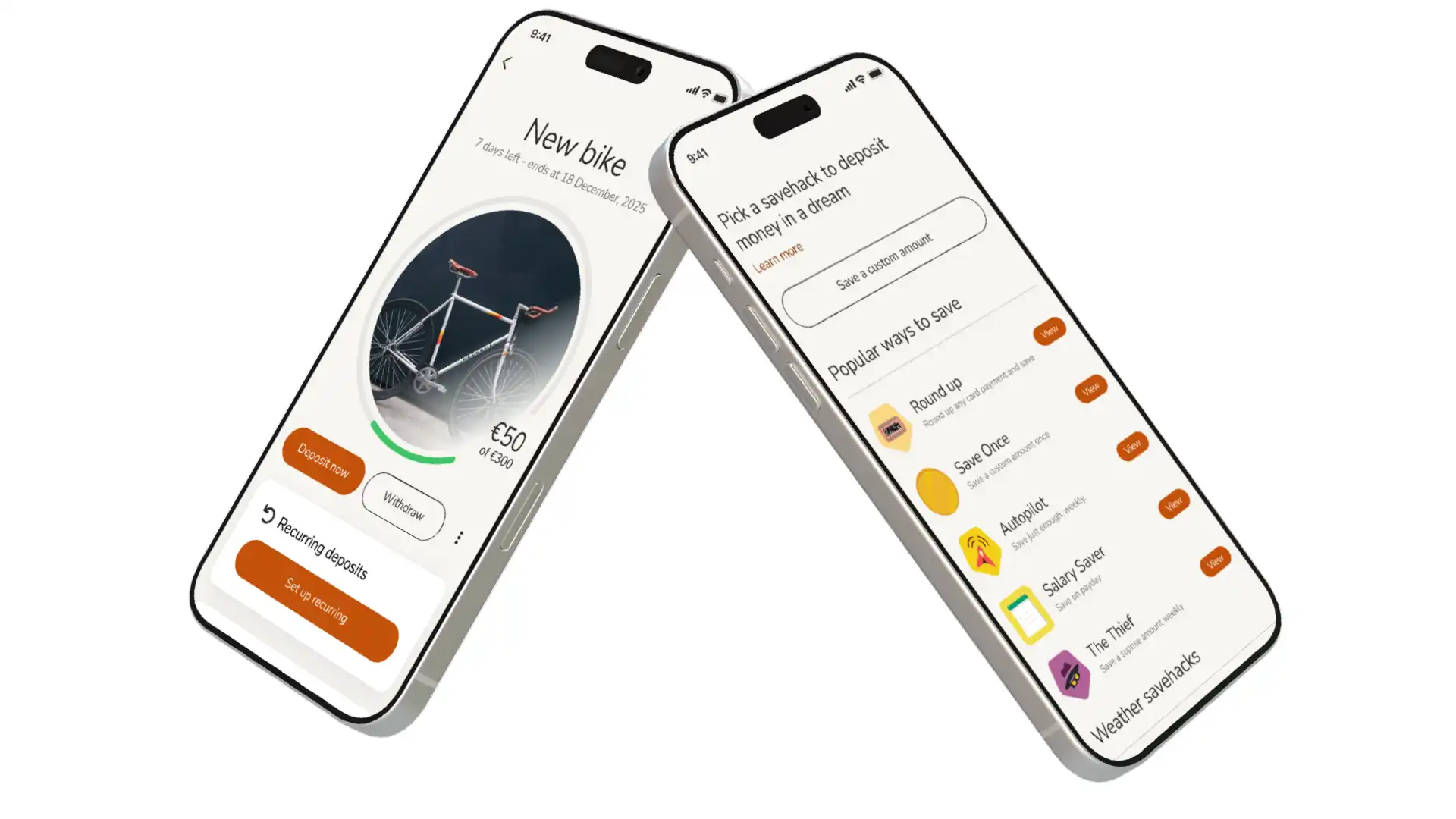

Delivering increased digital customer engagement while helping them enhance their financial well-being

Global financial instability and rising inflation are pressuring household finances, forcing many to reevaluate their spending habits. This cost-of-living crisis is likely to increase motivation for saving and financial care. However, motivation alone isn’t enough for lasting behavioral change.

As customers navigate the cost-of-living crisis, a parallel concern is increasingly shaping their financial decisions: environmental impact. These twin challenges—managing expenses and reducing environmental footprint—are becoming inseparable aspects of modern banking.

Research shows that financial stress and climate concerns represent two leading sources of customer anxiety. The cost-of-living crisis has heightened awareness of consumption patterns, creating a unique moment where customers are more receptive to changing both their financial and environmental behaviors.

This convergence creates an opportunity. When customers are already reconsidering their spending habits due to economic pressures, they’re more open to making changes that benefit both their finances and the environment. Simple shifts in daily habits—like reducing energy consumption or choosing sustainable transport options—can simultaneously lower expenses and environmental impact.

Key features

Enhanced Loyalty and Retention

Impact Finance allows to build stronger digital banking relationships across key customer groups (young, adults, and any desired segment) by fostering deeper digital relationships and engagement, thanks to its advanced segmentation capabilities. The tool allows to provide different experiences as per the bank’s strategy. This translates into more loyal and more long-term customers.

Business Revenue and Engagement

By supporting the customers’ financial wellbeing, the solution is designed to deliver core business results, specifically resulting in increased savings/deposits, higher adoption of relevant banking products, as well as increased investors into suitable products.

Promoting Sustainable Consumption

A central feature is the ability to enable and encourage customers, boosting their increased ability to adopt more sustainable consumption habits and boosting customer’s perception towards sustainability.

Resources

About Doconomy

Founded in Sweden in 2018, Doconomy recognizes this crucial intersection. Through partnerships with leading organizations like UNFCCC, Mastercard, and WWF, we’ve developed solutions that address both financial wellbeing and environmental responsibility.

Our approach helps banks:

- Transform financial constraints into opportunities for sustainable behavior change

- Make environmental impact tangible through everyday financial decisions

- Create engaging experiences that motivate lasting behavioral changes

By integrating sustainability into core banking features, we help customers discover how mindful consumption can benefit both their financial health and the planet. This creates a powerful motivation that drives continued engagement and positive change.

Understanding how to boost customers’ financial ability is the first step in this transformation. Let’s explore the key factors that influence financial ability and how banks can leverage these insights to create meaningful change