Watchlist – Cybera

CYBERA empowers financial institutions to build customer loyalty by fighting scams and helping victims recover assets.

CYBERA Watchlist™

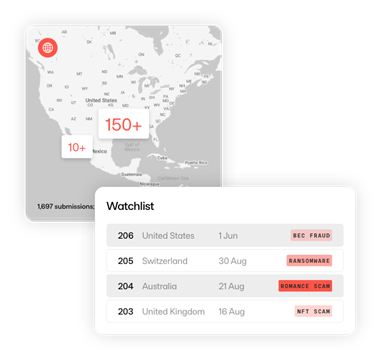

Introducing the world’s first dedicated Cybercrime Watchlist – a unique and powerful global dataset to detect and prevent cyber related financial crime, scams, and money laundering.

CYBREA closes the gaps that allow cyber criminals to thrive by sharing actionable intelligence in real-time.

Stop fraud, scams & money Laundering in a world of instant payments

CYBERA enables next-level real time data sharing of financial cybercrime data to minimize costs, loss & regulatory risk by preventing transacting with mule accounts.

Integrating our data means higher automatic approval rates and a decrease in fraudulent accounts, false positives, manual reviews and unnecessary document requests. Improve cybercrime related risk decisions throughout the customer lifecycle.

Overview

Reduce victim losses, costs & regulatory risk

Introducing the world’s first dedicated Cybercrime Watchlist – a unique and powerful global dataset to detect and prevent cyber related financial crime, scams, and money laundering.

Efficiently improving fraud detection

Protect customers by improving rules and ML-models with additional insights, reducing false positives, while still preventing fraud.

Support your growth strategy

Launch new fiat or crypto products and services with the risk intelligence you need to meet regulations, while keeping costs down.

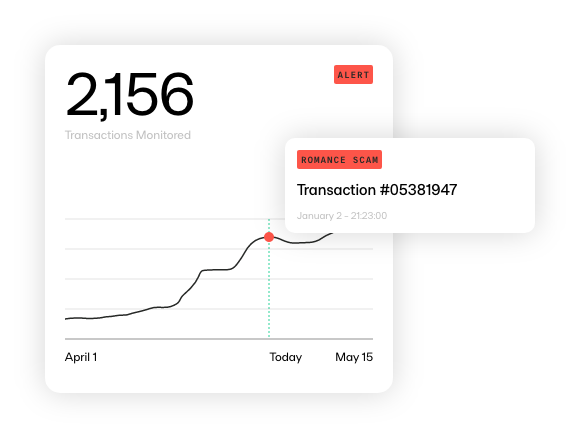

Stop Fraud

Reduce losses & protect your customers from fraud & scams.

- Stop payments to known mules in real time

- Reduce false positives

- Stop onboarding known mules

Stop Money Laundering

Money laundering is still increasing, along with regulation and the associated costs – improve your tool set and compliance.

- Multiple data points providing tangible, actionable intelligence in real time.

- Protect yourself from the impact of mules, frauds and scams from onboarding to inbound payments.

- Global coverage as CYBERA is not constrained by national silos.

Real-time data centric platform

- Centralized knowledge of cybercriminals

- Unique data source to provide tangible and actionable intelligence

- Multiple data points on a real-time REST API

Features

CYBERA Watchlist™

Unique data correlated to financial cybercrime.

Our Platform

Integrating our data means higher automatic approval rates and a decrease in fraudulent accounts, false positives, manual reviews and unnecessary document requests. Improve cybercrime related risk decisions from onboarding and beyond.

DATA POINTS

- Bank Accounts (AML)

- Crypto Addresses (AML)

- High-Risk VASPs

- Suspect Beneficiary Names

- Scam URLs (Websites)

- Scam Phone & Email

- Scam Social Media Profiles

- Crime Trends

- Cross-matches

- Patterns / Typologies

Regulating bodies such as FATF and leading industry groups such as P20 confirm the value of information sharing. Our concept breaks today’s silos and centralizes tangible cybercrime data points to add an extra layer of actionable intelligence to your fraud and money laundering defense.

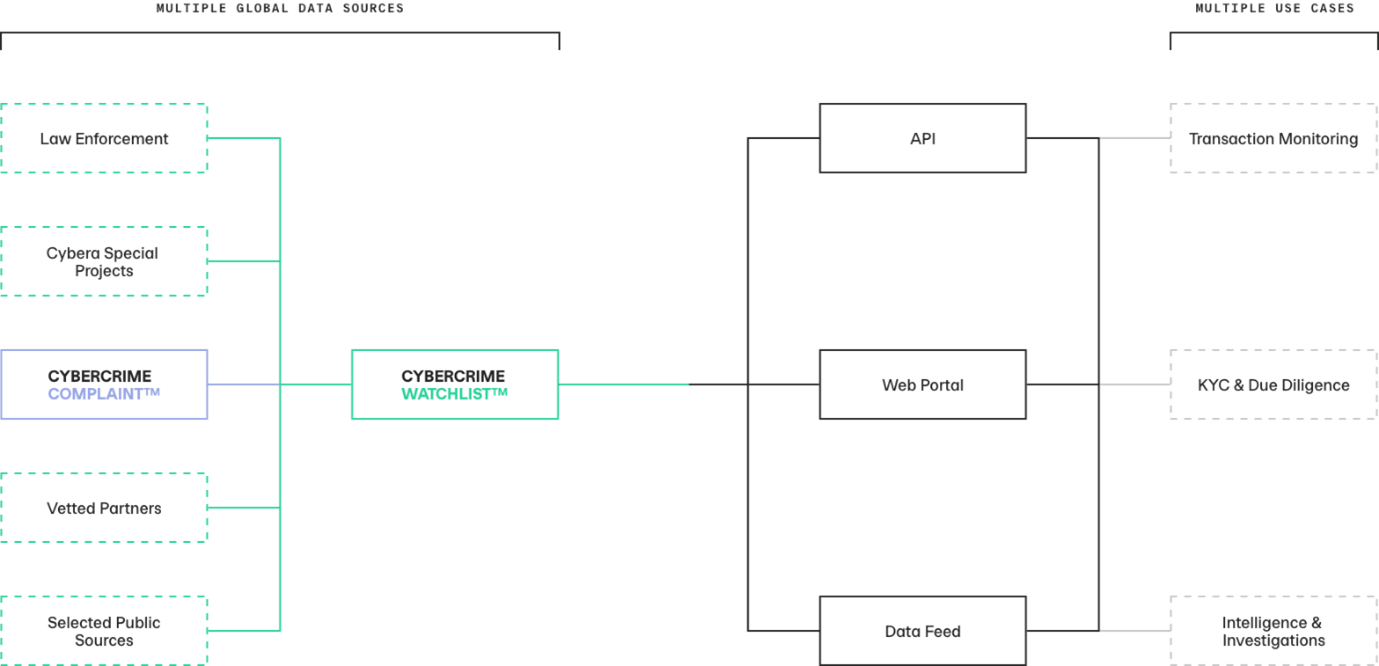

Integration Options

API

REST API for simple integration to your existing systems to deliver matches and intelligence in Real-time.

Web Portal

Allow your teams to Investigate suspicious entities within our secure web portal to reduce risk.

Data Feed

Regularly updated dataset to check against within your infrastructure* *(subset of use cases).