Resource Type: White Paper

Accelerating Digitization in Credit Unions for a Gen Z Future

Discover how banks and credit unions can accelerate digitization and deliver seamless, Gen Z-ready digital experiences that drive growth and loyalty.

Gen Z expects fast, intuitive, fully digital banking. For credit unions to stay competitive, accelerating digitization is essential. This whitepaper outlines challenges and opportunities in modernizing operations and shows how to create seamless, personalized member journeys that build loyalty and trust.

Inside, you’ll learn how to eliminate friction in account opening and onboarding, leverage data and automation to personalize experiences, and adopt practical strategies that scale. The paper highlights proven approaches used by leading credit unions and offers an actionable roadmap to future-proof your member experience.

Download whitepaper

A practical playbook for credit unions to reduce onboarding friction and deliver the digital–first experiences Gen Z expects.

As the wealth management industry evolves, 2025 is poised to be a transformative year, driven by technological innovation, shifting client expectations, and global economic dynamics. Eric Mellor, Wealth Management Specialist at Temenos explores the six key trends impacting the wealth management sector in 2025, and how an ability to blend cutting-edge technology with a human touch to meet the evolving needs of a diverse client base continues to be the key to unlocking the potential for this sector.

Download the White Paper

Author

Ajay Singh Pundir

Business Development Director – Payments, MEA & APAC

Get Insights on the Approach Financial Institutions Should Take in Preparation for the Growth of the Vietnam Payments Landscape

Vietnam with its population close to 100 million has seen substantial changes over the last 5 years through National Digital Transformation Programme. What’s next then for the country’s Payments industry and broader digital economy?

In this whitepaper, Ajay Singh Pundir, Business Development Director – Payments, Middle East, Africa and Asia Pacific of Temenos, goes into great detail on:

– Regulations impacting the International Payments Business

– Preparation for the Domestic Payments Regulations in Vietnam

– Rebuilding the technology architecture and operations for Growth

– Growth Approach with the wider Vietnam FinTech ecosystem and across ASEAN

Download the whitepaper to explore the challenges that Banks and FinTechs face, and the approach they should be taking to prepare for the growth that the payments industry is expected to experience over the next half-decade.

Fill In the Form to Download the Full Whitepaper

Learn About the Strategic Role of Personas in

Modern Wealth Management

In partnership with LTIMindtree, we collaborated with Kapronasia to produce this whitepaper that makes the case for hyper-personalization in wealth management powered by emerging capabilities like AI, ML, and Cloud platforms, and how integrating these technologies can enable tailored portfolio construction, advanced customer insights, and on-demand flexibility.

The whitepaper explains how hyper-personalized wealth management moves away from traditional models that rely on static and generalized segments, to a model that develops tailored investor personas based on psychographics, behaviors, and fluid financial goals that enables financial institutions to create rich and tailored customer experiences that resonate with next-generation priorities.

Download the whitepaper to read on case studies and examples of how global wealth managers leverage data and technology to enable bespoke sustainability offerings, psychographic profiling, and digitized advisory.

Key Contributors

Eric Mellor

Wealth Management Specialist

APAC, Middle East & Africa

Temenos

Minh Duc Le

Client Engagement Director

Global Wealth Lead

LTIMindtree

Fill In the Form to Download the Whitepaper

The challengers are all customer-centric, leveraging disruptive technologies such as AI to develop compelling customer experiences. But how do they navigate through…

- Profitability barriers?

- The uncertain path for growth?

- Rising interest rate and recessionary environment?

450

challenger banks globally

$300B

worth in 2022 compared to $161B in 2017

up to

75%

lower operational cost from fully operating digitally

Byte-sized banking: Can banks create a true ecosystem with embedded finance?

As payments, technology and e-commerce disruptors compete against banks with embedded finance solutions, banks must harness emerging technologies to create their own digital ecosystems and remain at the center of the banking universe.

Can disruptive technologies bolster the competitiveness of North American Banks?

North American banks are turning to new technologies, to modernize and secure their core infrastructure and processes, while competing with non-traditional players. Download the new report from the Economist, commissioned by Temenos.

Temenos Highwater Benchmark

As banks are expected to seamlessly perform huge transaction volumes around the clock, the Temenos Banking Platform it’s massive scalability once again.

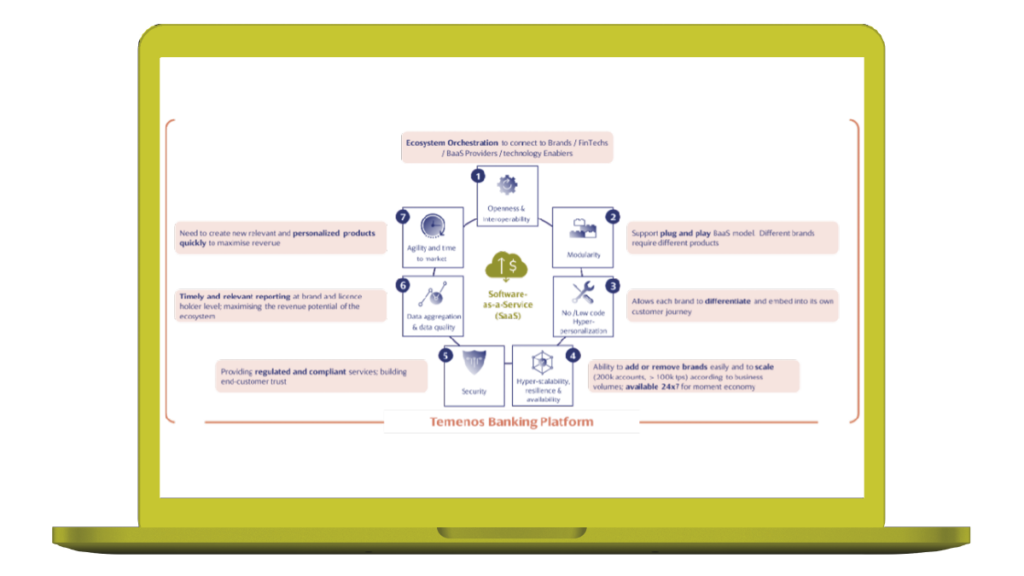

The banking world is undergoing a paradigm shift in today’s rapidly evolving financial landscape. Traditional institutions are at a crossroads, faced with the daunting task of adapting to a digital-first era. As technology companies increasingly shape and distribute financial services, the need for innovation, agility, and sustainability has never been more urgent. Adopting Cloud and Software-as-a-Service (SaaS) models is the key to addressing these challenges.

This new white paper explores the trends driving the SaaS model. We highlight how the approach taken by SaaS vendors like Temenos is helping boost productivity while reducing costs and creating new opportunities through composable banking. We evidence it with examples of financial organisations that employ SaaS and have achieved significant performance and customer experience gains.

Download Whitepaper

Click on the button to download our Whitepaper

Embrace the Power of SaaS for Banking Evolution

Cloud technology has already proven its transformative capabilities by providing financial institutions with a more flexible, scalable, and secure approach to managing their IT systems. The migration to a cloud-based SaaS model has become a competitive necessity. It offers an end-to-end digital infrastructure that enhances performance, ensures always-on availability, and elevates service delivery. In an era where customers expect one-click convenience, functionality, and engaging experiences, SaaS is the next generation of IT outsourcing that enables banks to stay competitive.

No more worrying about maintaining complex software

With SaaS, banks no longer bear the financial burdens and constraints of maintaining and upgrading hardware and software through on-prem hosting. Scalability and security are greatly enhanced, bolstering regulatory compliance and ESG commitments. Core services, such as payment processing, become streamlined and refined. Furthermore, SaaS facilitates the integration of advanced technologies like AI and machine learning, allowing banks to introduce embedded finance and new services to the market swiftly.

Market Overview: Adapting to New Market Forces

To thrive in the digital-first era, banks must emulate the strategies of tech giants, who leverage digital channels to deeply understand their customers, aligning their needs with tailor-made services. Banks need to harness vast amounts of data and convert it into descriptive, predictive, and prescriptive analytics, akin to the practices of GAFAs (Google, Apple, Facebook, and Amazon). SaaS excels at onboarding and supporting advanced analytics, AI, and machine learning to process this data.

Legacy technology, managed in-house, constrains banks from delivering timely innovation and addressing environmental concerns. The slow pace of incremental tech upgrades cannot keep up with the demands of the modern market, leaving banks exposed to fintech competition and regulatory pressures.

Capturing the ‘Netflix Effect’ with SaaS

Most banks have already embraced the cloud, with 72% of IT executives favouring a cloud strategy for products and services. By implementing SaaS end-to-end, banks can manufacture and distribute highly personalized products and services on demand, 24/7/365. In other words, working with a SaaS provider can achieve the ‘Netflix effect’ for banks, providing an exceptional customer experience.

Four Key Drivers for SaaS Adoption

SaaS in Action: Real-world Success Stories

Our white paper details the experiences of Alex Bank, Flowe and Barko Financial Services who all use Temenos SaaS.

Collaborate with Temenos for SaaS Transformation

The adoption of SaaS is becoming pivotal in the financial industry’s evolution. Incumbents and emerging players alike must make SaaS a fundamental part of their operations and collaborate with digital transformation experts like Temenos. Temenos Banking Cloud supports over 700 SaaS customers worldwide, providing continuous updates, scalability, governance, security, and depth of service.

Download The Whitepaper Today To Find Out More:

Temenos is a global leader in composable banking, empowering over 1.2 billion people around the world with state-of-the-art customer experiences and top-performing solutions. Its open platform enables clients to achieve remarkable returns on equity and cost-to-income ratios. To learn more about how Temenos can help you unlock the future of banking, click the button:

Unlock The Future Of Banking

As payments, technology and e-commerce disruptors compete against banks with embedded finance solutions, banks must harness emerging technologies to create their own digital ecosystems and remain at the center of the banking universe.

- New technologies will have the biggest impact on banks in the next five years—more than customer demands and evolving regulation.

- More than 71% of survey respondents see unlocking value from AI as a key differentiator between winners and losers. While 75% expect generative AI to impact banking.

- Banks see their business model evolving in the next 12-24 months, offering banking-as-a-service to brands and fintechs (20%).

- However, twice as many (38%) banks foresee acting as a true digital ecosystem themselves.

- Customer centricity is driving banks to offer more embedded ESG propositions to their customers (73%).

- With the focus on lowering their carbon footprint, as well as the increasing use of data-intensive AI, banks are inevitably moving to the public cloud—51% of respondents agree that banks will no longer own any private datacenters after moving to the public cloud.

Download the Economist report today to find out more:

70%

see unlocking value from AI as a key differentiator between winners and losers

20%

see their business model evolving to offering BaaS

38%

banks foresee acting as a true digital ecosystem themselves

As payments, technology and e-commerce disruptors compete against banks with embedded finance solutions, banks must harness emerging technologies to create their own digital ecosystems and remain at the center of the banking universe. Across the globe, banks are saying that new technologies will have the biggest impact on banks in the next five years—more than customer demands and evolving regulation.

In 2023, the Economist conducted a study, commissioned by Temenos, including a survey of 300 banking executives. These reports, based off of that survey, dig into the latest trends around technology, strategy, competition and customer demands.

Download one of the Economist reports to learn more:

Can investments in disruptive technologies bolster the competitiveness of North American banks?

Download the NAM Economist Impact report today

Can banks create a true ecosystem with embedded finance?

Download the Global Economist Impact report today

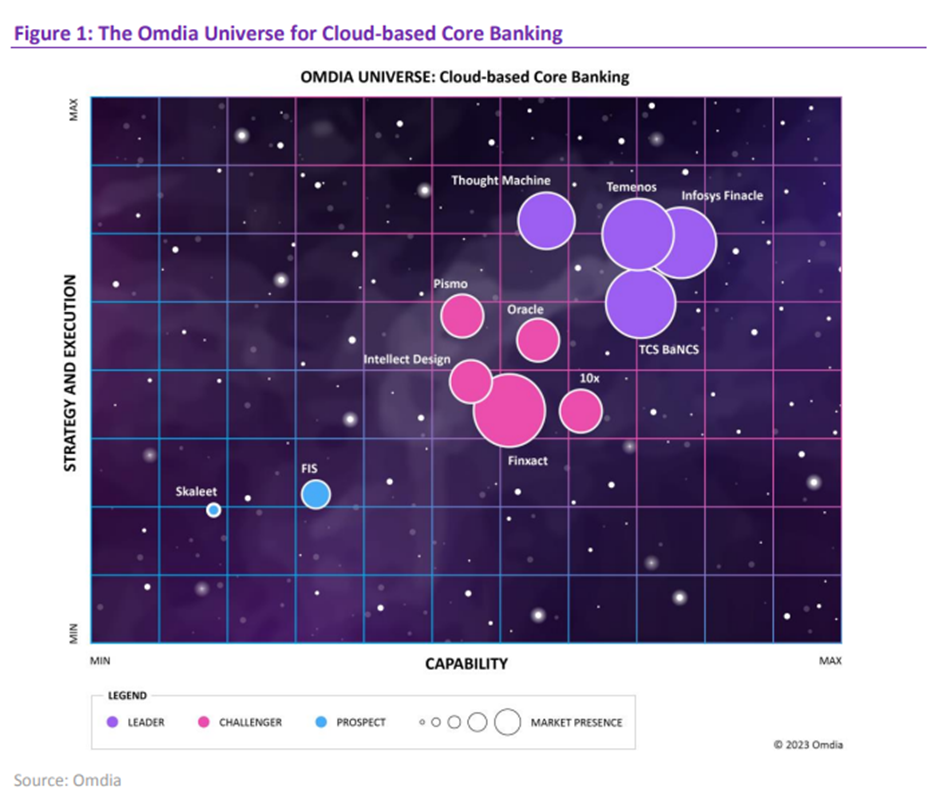

- Omdia recognized that Temenos was a high performer across the board and achieved the highest scores overall for market alignment and innovation, in addition to performing strongly for Temenos Banking Cloud’s broader platform capabilities.

- Omdia highlights the strength of the Temenos solution which offers innovation in the areas of open products for the creation of highly configurable financial products (i.e., smart products), AI and ESG.

- Other strengths referenced by Omdia include Temenos’ (X)AI-enabled analytics which are embedded throughout the platform.

According to Philip Benton, Senior Analyst, Omdia:

“Temenos should appear on your shortlist, particularly if you are seeking a platform that enables rapid new product launches and innovation.”

Download the report to learn more about why Omdia recognizes Temenos as a leader among Cloud-based Core Banking providers.

The complexity of products, processes and transactions in corporate banking has so far resulted in relatively lower levels of digitization compared to retail. Yet business owners increasingly expect simple, holistic processes and a seamless customer experience.

Open banking provides a unique opportunity for banks to meet this need, by enabling increased automation and personalization of services for business customers. At the same time, it enables banks to move beyond traditional banking activities and open up new revenue streams through Banking-as-a-Service (BaaS).

Find out more about the opportunities in open banking for corporates and SMEs in this whitepaper.

Temenos advances platform capabilities to accelerate Banking-as-a-Service

Temenos is the banking platform of choice for embedded finance, enabling licensed banks and BaaS providers to offer BaaS to brands and fintechs

Want to harness the power of BaaS?

From retailers and airlines, to ride-sharing apps and coffee chains, brands are embedding financial services into their online and mobile offerings to increase revenues, build customer loyalty and gain deeper insights about them.

How Temenos challenges the banking industry’s conventions

The way people bank is evolving. Banking services are increasingly embedded in people’s everyday

lives – banking itself is becoming a journey and an experience.

Download the whitepaper today to find out more: