Temenos Announces Strong Q2-25 Results; FY-25 Guidance Raised on Back of Strong H1-25

Q2-25 and H1-25 summary (proforma, excluding Multifonds)

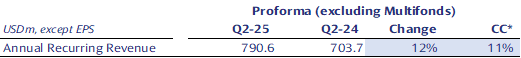

• Q2-25 ARR of USD 791m, up 11% y-o-y c.c.

• Non-IFRS Q2-25 subscription and SaaS up 24% c.c.; H1-25 subscription and SaaS up 12% c.c.

• Non-IFRS Q2-25 maintenance up 10% c.c.; H1-25 maintenance up 10% c.c.

• Non-IFRS Q2-25 EBIT up 28% c.c. with 4 points of margin expansion; H1-25 EBIT up 19% c.c.

• Non-IFRS Q2-25 EPS up 36% reported; H1-25 EPS up 27% reported

• Q2-25 free cash flow (FCF) of USD 65m, up 8% reported; H1-25 FCF up 10% reported

• FY-25 guidance raised; Subscription and SaaS growth of at least 6% c.c. (up from 5-7%), EBIT growth of at least 9% c.c. (increased from at least 5%), EPS growth of 10-12% reported (increased from 7-9%); ARR guidance of at least 12% c.c. and FCF guidance of at least 12% reported reconfirmed

• FY-28 targets reconfirmed (non-IFRS, constant currency, excluding Multifonds) with ARR to reach more than USD 1.2bn, EBIT to reach c.USD 450m and FCF to reach c.USD 400m.

Ad hoc announcement pursuant to Art. 53 LR

GRAND-LANCY, Switzerland, July 22, 2025 – Temenos AG (SIX: TEMN), a global leader in banking technology, today announces its second quarter 2025 results.

Annual Recurring Revenue (ARR, proforma)

Income statement and free cash flow (proforma)

Business update

- Strong Q2-25 and H1-25 performance across key metrics

- Sales environment remained stable

- Strong performance in Europe and the Americas in particular

- Good traction with existing customers, also winning significant number of new logos

- Continued executing targeted investments across the business including new senior hires in sales and product and technology

- Strong growth in profitability driven by good cost control and ongoing savings from cost efficiency programs

- New AI-integrated products launched at Temenos Community Forum

- Sale of Multifonds completed as planned on 31st May 2025

- FY-25 guidance raised; FY-28 targets reconfirmed

Commenting on the results, Temenos CEO Jean-Pierre Brulard said:

“I was pleased with our performance in the second quarter, which more than compensated for the slower start to the year. We benefited from a stable sales environment and strong execution, particularly in Europe and the Americas. We successfully closed a couple of large deals, in addition to catching up all the delayed deals from the first quarter. We saw strong demand from existing clients as well as signing a significant number of new logos.

From an operational perspective, the simplification of our product and technology organization is now largely complete and our teams are implementing our new SAFe operational framework. We continued to make selective senior hires to strengthen our talent pool and have been actively hiring in sales across all regions globally, with more than 25 new salespeople hired in Q2. We had over 50 new product and technology developers join our US innovation hub to support our US and AI strategies and will look to make further hires over the coming quarters. I am confident we are making the right investments at speed, building capacity to deliver on our full year 2025 and FY-28 targets.”

Commenting on the proforma results (excluding Multifonds), Temenos CFO Takis Spiliopoulos said:

“The second quarter performance was significantly stronger, with good execution across most regions. ARR grew 11% in constant currency in the quarter, again driven by a combination of strong subscription license signings as well as another strong quarter for maintenance, largely linked to good performance of our premium maintenance. Subscription and SaaS grew 24% in constant currency in the quarter and 12% for H1-25, which is very strong growth given we are still compensating for the headwind on SaaS from our BNPL customer as communicated with the Q1-25 results.

The investments we are making across the business continue to be largely self-funded through our cost saving program and we maintained our strong cost discipline in the quarter. Non-IFRS EBIT grew 28% in constant currency in the quarter and 19% for H1-25, reflecting both the strong revenue growth, our good cost control and ongoing savings from cost efficiency programs.

We generated USD 65m of free cash flow in the quarter, up 8% year-on-year and 10% in H1-25, and we ended the quarter with leverage at 1.2x net debt to non-IFRS EBITDA, well within our target operating leverage of 1.0x to 1.5x. I was pleased to announce the closure of the Multifonds sale at the end of May, as well as successfully closing a new RCF for USD 500m with a strong syndicate of US, European and Swiss banks. We now have no refinancing requirements until 2028 at the earliest. Our refinancing of the RCF was helped by the investment grade credit rating we received from S&P Global in the quarter.

Based on our H1-25 performance and our view of the sales environment, we are raising our guidance for FY-25. Furthermore, we have reconfirmed our FY-28 targets.”

Revenue

Reported IFRS and non-IFRS revenue was USD 285.5m for the quarter, an increase of 15% vs. Q2-24

Proforma non-IFRS revenue (excluding Multifonds) was USD 277.6m for the quarter, an increase of 17% vs. Q2-24

Reported IFRS and non-IFRS subscription and SaaS revenue for the quarter was USD 127.0m, an increase of 25% vs. Q2-24.

Proforma non-IFRS subscription and SaaS revenue (excluding Multifonds) for the quarter was USD 124.9m, an increase of 25% vs. Q2-24.

EBIT

Reported IFRS EBIT was USD 78.3m for the quarter, an increase of 49% vs. Q2-24.

Reported non-IFRS EBIT was USD 115.7m for the quarter, an increase of 28% vs. Q2-24.

Proforma non-IFRS EBIT (excluding Multifonds) was USD 111.6m for the quarter, an increase of 30% vs. Q2-24.

Earnings per share (EPS)

Reported IFRS EPS was USD 2.32 for the quarter, an increase of 364% vs. Q2-24.

Reported non-IFRS EPS was USD 1.27 for the quarter, an increase of 35%.

Proforma non-IFRS EPS (excluding Multifonds) was USD 1.22 for the quarter, an increase of 36% vs. Q2-24.

Cash flow

USD 65.3m of free cash flow (excluding Multifonds) was generated in the quarter, an increase of 8% vs. Q2-24.

Revenue line items and new cloud ARR disclosure

Temenos introduced new annual disclosure of cloud ARR at the time of its Q4-24 results announcement in February 2025, to provide transparency on the growth in cloud adoption. Its revenue disclosure was also updated to reflect changes in customer demand and industry best practice, with increasing use of hybrid and public cloud. ‘Total software licensing’ was renamed as ‘subscription and SaaS’ to bring disclosure in line with leading global software players. ‘Subscription and SaaS’ comprises subscription, term license and SaaS revenue. Term license is expected to continue declining to around USD 20-30m p.a. steady state.

FY-25 non-IFRS guidance raised

The guidance for FY-25 is non-IFRS and in constant currencies, except for EPS and FCF which are reported. The guidance excludes any contribution from Multifonds. FCF includes IFRS 16 leases and interest costs.

- ARR growth of at least 12% c.c. (no change)

- Subscription and SaaS growth of at least 6% c.c. (previously 5-7%)

- EBIT growth of at least 9% c.c. (previously at least 5%)

- EPS growth of 10-12% reported (previously 7-9%)

- FCF growth of at least 12% reported (no change)

Currency assumptions for FY-25 guidance

In preparing the FY-25 guidance, the Company has assumed the following:

- EUR to USD exchange rate of 1.16;

- GBP to USD exchange rate of 1.34; and

- USD to CHF exchange rate of 0.80

The Company has also assumed the following for FY-25 guidance:

- FY-25 tax rate expected to be between 15-17%, benefiting from one off tax impact of c.USD 15m from prior years; normalized tax rate of 19-21%

FY-28 targets

FY-28 targets exclude contribution from Multifonds. FCF includes IFRS 16 leases and interest costs.

- ARR of at least USD 1.2bn

- EBIT of c. USD 450m

- FCF of c. USD 400m

The guidance provided above and other statements about Temenos’ expectations, plans and prospects in this press release constitute forward-looking financial information and represent the Company’s current view and estimates as of July 22, 2025. We anticipate that subsequent events and developments may cause the Company’s guidance and estimates to change. Future events are inherently difficult to predict. Accordingly, actual results may differ materially from those indicated by these forward-looking statements as a result of a variety of factors. More information about factors that potentially could affect the Company’s financial results is included in its annual report available on the Company’s website.

Conference call and webcast

At 18.30 CET / 17.30 GMT / 12.30 EST today, July 22, 2025, Jean-Pierre Brulard, CEO, and Takis Spiliopoulos, CFO, will host a webcast to present the results and offer an update on the business outlook. The webcast can be accessed through the following link:

Please use the webcast in the first instance to avoid delays in joining the call. For those who cannot access the webcast, the following dial-in details can be used as an alternative. Please dial in 15 minutes before the call commences.

Switzerland / Europe: + 41 (0) 58 310 50 00

United Kingdom: + 44 (0) 207 107 06 13

United States: + 1 (1) 631 570 56 13

Non-IFRS financial information

Readers are cautioned that the supplemental non-IFRS information presented in this press release is subject to inherent limitations. It is not based on any comprehensive set of accounting rules or principles and should not be considered as a substitute for IFRS measurements. Also, the Company’s supplemental non-IFRS financial information may not be comparable to similarly titled non-IFRS measures used by other companies. The Company’s non-IFRS figures exclude share-based payments and related social charges costs, any deferred revenue write-down resulting from acquisitions, discontinued activities that do not qualify as such under IFRS, gain/loss from business disposals, acquisition/investment/carve out related charges such as financing costs, advisory fees and integration costs and fair value changes on investments, charges as a result of the amortization of acquired intangibles, costs incurred in connection with a restructuring program or other organizational transformation activities planned and controlled by management, and adjustments made to reflect the associated tax charge relating to the above items.

Below are the accounting elements not included in the FY-25 non-IFRS guidance, which remain unchanged

- FY-25 estimated share-based payments and related social charges of c.5% of revenue

- FY-25 estimated amortisation of acquired intangibles of USD 45m

- FY-25 estimated restructuring/M&A related costs of USD 35m

Investor and media contacts

Investors

Adam Snyder

Head of Investor Relations, Temenos

Email: [email protected]

Tel: +44 207 423 3945

International media

Conor McClafferty

FGS Global on behalf of Temenos

Email: [email protected]

Tel: +44 7920 087 914

Swiss media

Martin Meier-Pfister

IRF on behalf of Temenos

Email: [email protected]

Tel: +41 43 244 81 40