SpeciCRED - SpeciTec

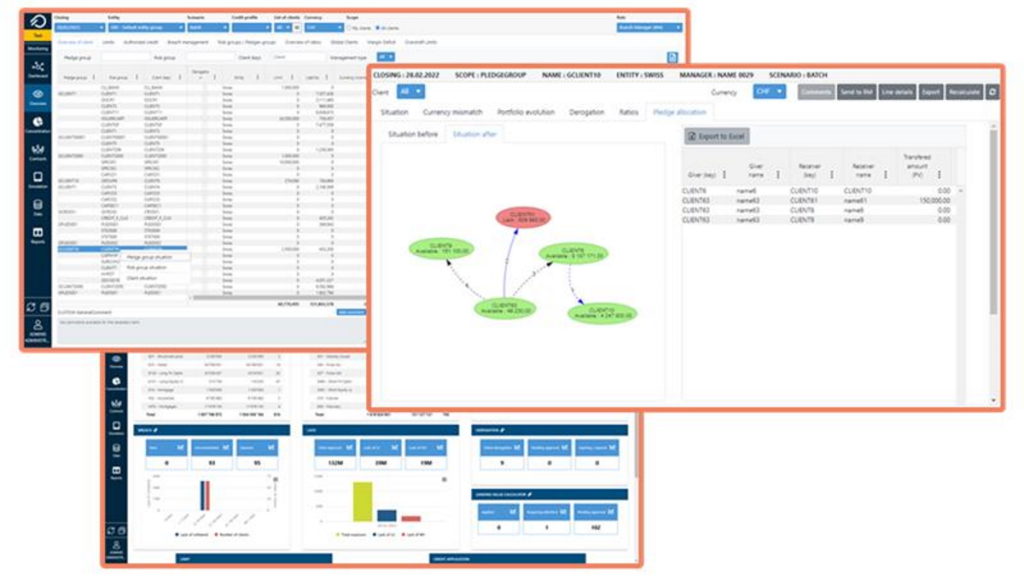

SpeciCRED – Lombard credit monitoring solution with overview at portfolio, client & group levels

Leverage the size of your Lombard Credits portfolio

To increase its Lombard Credits portfolio, all Private Banks need a sophisticated solution to accurately assess the Lombard Credits, automate the monitoring, and speed-up the credit requests approval processes.

Overview

SpeciCRED provides an effective environment to assess and control Lombard Credits

SpeciCred is a software to compute the client loanable value more accurately, manage the workflows and generate the documents for the credit request.

SpeciCRED automates the daily breach detection by using dynamic pledge allocation, concentration, netting, offsetting, exception to policy, stress test and simulation.