Portfolio Risk Rating (PRR) and Stress Testing – 6 Sigma

Portfolio Risk Rating (PRR) and Stress Testing

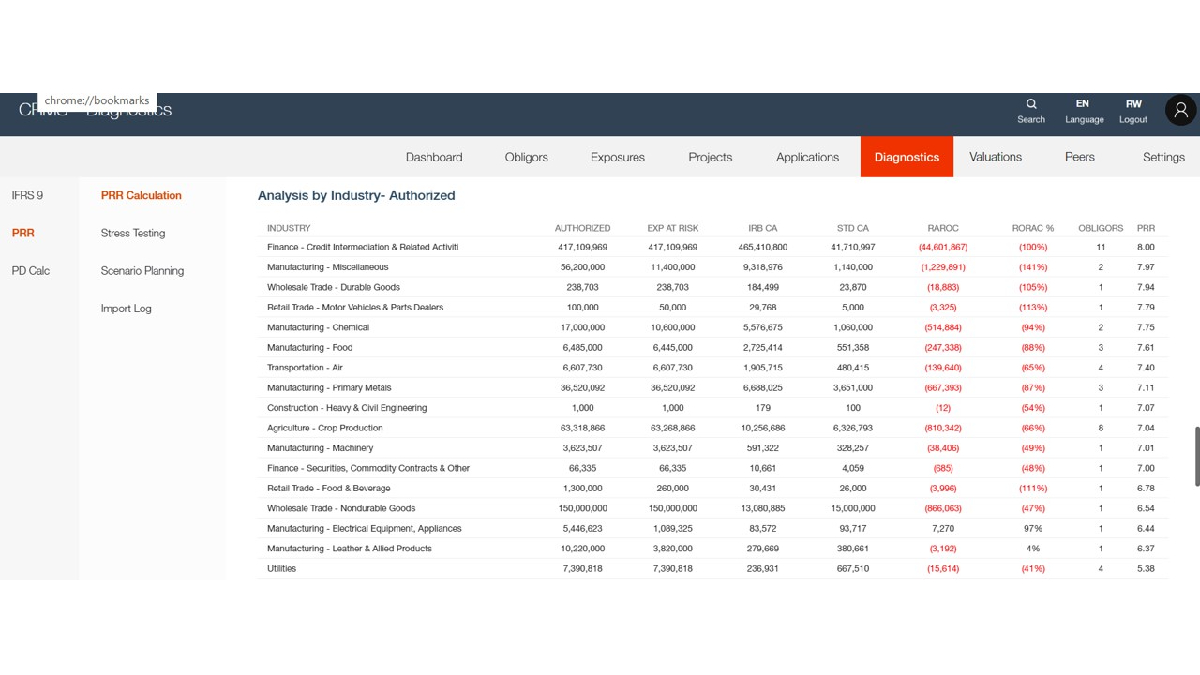

The PRR Module provides facility risk rated listing of exposures by industries, countries, portfolios, product and collateral types

It is used in stress testing the portfolio and provides the means to direct stratgy within the bank by product, industry and target market (hence adherance to Basel’s Principle 3 of Managing Credit Risk).

Portfolio Management is an integral part of the credit process that enables the Bank to manage concentrations, volatility, liquidity and achieve optimum earnings. It does so through portfolio strategies and planning, performance assessment and reporting functions into one comprehensive management process.

The module is fully configurable and user friendly. PIT ratings can be generated using 6 Sigma’s CRMS or imported from third parties. Outputs are on screen with summarized IRB and Standardized Capital Adequacy, RAROC, PRR by both Authorized and Outstanding. In addition to concentration listing, and breakdown of exposures by industries, countries, portfolios, product and collateral types. Export of data is availbale for good measure.

Overview

The module is fully configurable and user friendly. PIT ratings can be generated using 6 Sigma’s CRMS or imported from third parties. Outputs are on screen with summarized IRB and Standardized Capital Adequacy, RAROC, PRR by both Authorized and Outstanding. In addition to concentration listing, and breakdown of exposures by industries, countries, portfolios, product and collateral types. Export of data is availbale for good measure.

- ORR and FRR

- RAROC and RORAC both Authorized and Outstanding

- Concentration Authorized and Outstanding

- Capital Adequacy (IRB and STD) and PRR measurement

- Breakdown by Industry, Facility, Collateral, Country etc.

- Stress Test the results.

In a user-friendly, efficient, and accurate manner. Essentially the steering wheel of a bank.

Resources

Brief PRR Presentation 2023

ISV Assessments/Awards

ESG & Enterprise Readiness Assessment Scores for 6 Sigma conducted by The Disruption House

| Category | Award | Date |

| Business Resiliency Accreditation | Builder | October 2023 |

| Sustainability Accreditation | Builder | October 2023 |

| Business Resiliency Accreditation | Builder | December 2024 |

| Sustainability Accreditation | Builder | December 2024 |

Interested in the full 6 Sigma report? Click here to buy it now.