Temenos Blogs

Discover the latest insights, trends and innovations in banking technology with expert analysis, case studies and industry updates from Temenos.

Blog

Time for a Reset in Money Movement and Management

Discover how simplifying money movement in the attention economy accelerates time-to-value for both established institutions.

Blog

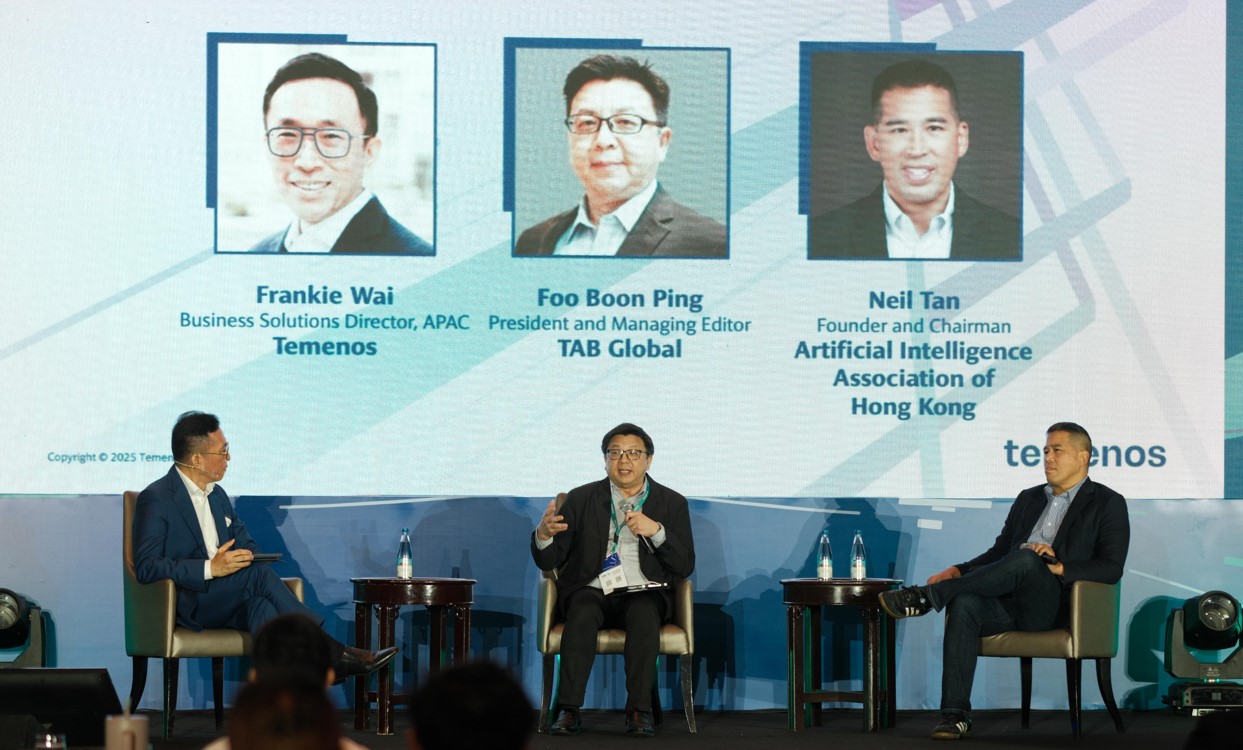

The Future of Banking in Asia Pacific: AI-Driven Transformation

90% of banks in Asia Pacific are exploring AI to enhance human capabilities.

Blog

EastWest Bank's Journey to Cloud-Native Banking

EastWest Bank’s Temenos cloud-native SaaS move shows how PH banks can scale and modernize for sustainable growth.

Blog

Scaling for the Future: Temenos Benchmark Insights

The 2025 Temenos Performance Benchmark, incorporating AI workloads for the first time, demonstrates that smarter engineering and...

Blog

Top Tips to Make Your Bank More Efficient

Discover how modernizing core banking unlocks secure, mobile-first experiences, AI-driven efficiency.

Blog

Streamlining Digital Onboarding in Financial Institutions

Explore the benefits, challenges, and best practices of digital onboarding in financial services to drive growth and improve cus...

Blog

Resiliency in Hybrid Banking for The Philippines

Temenos empowers Filipino thrift banks to innovate, collaborate, and grow in a fast-evolving digital landscape.