QRIS, E-Wallets, digital Rupiah and BNPL

How will Indonesia manage payments in the future?

By Zakaria Lim, Country Director, Temenos Indonesia

Introduction

Indonesia’s digital payments landscape is undergoing a rapid transformation, driven by innovative solutions like QRIS, e-wallets, and Buy Now, Pay Later (BNPL) services. As Southeast Asia’s largest digital economy, growing at an impressive rate of 414% from 2017 to 2021, the country is embracing cashless transactions at an unprecedented pace, fuelled by tech-savvy consumers, government support, and a thriving fintech ecosystem. QRIS has unified fragmented QR payment systems, e-wallets are becoming the go-to for everyday transactions, and BNPL is reshaping how Indonesians access credit. But what does this mean for the future of payments, and how could this innovative trend reshape the banking industry for Indonesia? To better appreciate the intricacies and interplay of the market forces with the financial services industry in Indonesia, Temenos, Aspire, and Thunes have co-hosted the Payments Executive Roundtable 2025 (Indonesia) to appreciate better how these trends are redefining financial inclusion, consumer behavior, and the broader economic landscape—ushering in a new era where Indonesia is quite literally paying tomorrow, today.

Beyond the Transaction: Global Payments Trends and Their Implications

Indonesia’s payments revolution is just beginning. With QRIS standardisation, e-wallet adoption, and BNPL growth laying the foundation, the next decade will see the country leapfrog into a cashless future, where seamless, inclusive, and borderless transactions redefine economic potential. As fintech and traditional banks converge, Indonesia could emerge as a regional hub for next-gen financial services, leveraging its tech-savvy population and agile regulatory environment. Speed and flexibility remain the key for Indonesian banks. Harnessing AI-driven personalisation, interoperable systems, and embedded finance could turn payments into a gateway for broader opportunities. As global banks look to integrate future payment capabilities into their technology stack, there is a realisation of the potential of a “level of abstraction” required in the enterprise payments technology stack, to accommodate and leverage the changing regulations and disruptions, such as, diverse fintech offering cross border payments, or the need to prepare for an global economy where digital currencies in various forms, such as regulated (CBDCs, regulated stablecoins) or unregulated (stablecoins, private crypto currencies). Will strengthen business models around tokenisation. A bank’s growth ambitions would also require its payments technology stack to allow for “builds” that they can control. Risk of disintermediation by fintech on the broader banking value chain, expansion into new segments and markets, and adapting to geopolitical shifts, all require the payments technology stack to have elements of abstraction built into it. As banking moves away from traditional banks, we believe that in the long term, they will evolve into platforms, becoming the holders of risk and liquidity, either directly or indirectly. The race is on: those who build scalable, customer-centric platforms today will shape Indonesia’s trillion-dollar digital economy tomorrow.

Combating fraud amidst Indonesia’s digital payments boom: the role of Central Bank leadership and AI

The rapid growth of digital and real-time payments in Indonesia, driven by post-pandemic adoption and the global implementation of ISO 20022 standards, has been accompanied by escalating fraud risks, with over $1 trillion lost globally—70% of which remains unreported—and money mulling complicating detection. With only 7% of Indonesians feeling immune to fraud and victims likely to switch banks after repeat incidents, a robust AI-powered fraud prevention is critical.

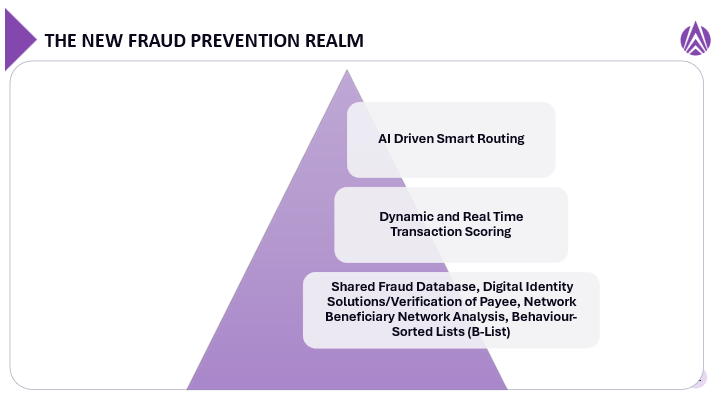

Aspire Systems opines that a three-layered approach—a) shared fraud intelligence, b) strong identity verification (biometrics/KYC), and c) AI-driven real-time transaction scoring—can mitigate risks, but it also requires central banking leadership to consolidate cross-bank collaboration to build a unified predictive fraud database. Technology today can potentially enable AI to dynamically block, reroute, or freeze suspicious transactions, while CBDCs and DLT-based networks could also offer solutions. The issue on the horizon lies with cross-border complexities, data privacy, data compliance, and data integrity standards. Given Indonesia’s high e-commerce fraud risk, there is an added priority for action on these fronts—AI adoption, centralised fraud intelligence, and tighter coordination among banks, regulators, and law enforcement—to secure trust amidst Indonesia’s digital payments boom.

The future of payments in Indonesia: modernization, cross-border expansion, and digital innovation

Indonesia advances its payment infrastructure through Bank Indonesia’s Payment System Blueprint, focusing on seamless integration and cross-border connectivity. Indonesia has already linked with Singapore and Malaysia via QRIS and plans to expand to other Asian countries, enabling faster, cheaper international transactions. To support such modernization, Indonesia needs regulatory updates and industry collaboration between banks, fintech, and policymakers. Bank Indonesia today is encouraging industry-led innovation, including multi-currency wallets and blockchain-based solutions, to enhance efficiency and reduce reliance on legacy systems. One example of its initiative includes a digital rupiah, exploring wholesale use cases, and focuses on interoperability, ensuring CBDCs work alongside existing payment rails without disrupting financial stability. Key hurdles, such as fraud prevention, dispute resolution, and cybersecurity, however, remain, and a structured approach like the 5C framework (Compliance, Cybersecurity, Consumer Protection, Cross-border Coordination, Collaboration) could help mitigate risks while fostering innovation. By embracing CBDCs and regulatory reforms, Indonesia is positioning itself as a leader in fast, secure, and globally integrated payments. Success depends on collaboration, robust security, and adaptive policies—paving the way for a digital payments revolution.

Conclusion

Indonesia’s digital payments revolution is reshaping the financial landscape, driven by innovations like QRIS, e-wallets, and BNPL—empowering consumers, fostering financial inclusion, and positioning the country as a regional fintech leader. However, as adoption accelerates, challenges such as fraud prevention, cross-border complexities, and cybersecurity require a collaborative approach among banks, fintech companies, regulators, and law enforcement. The future hinges on AI-driven security, interoperable systems, and forward-thinking policies that strike a balance between innovation and risk management. With initiatives such as those by the ASEAN, connecting payments systems of all countries in the region, BIS (Bank of International Settlement) Nexus which aims to integrate instant payments schemes around the world, CBDCs, and projects such as BIS mBridge, Indonesia is poised to leapfrog into a cashless, borderless economy—but success will depend on agility, trust, and sustained industry collaboration. As the nation embraces this transformation, one thing is clear: Indonesia isn’t just adapting to the future of payments—it’s leading it. Temenos is once again honored to host our network of senior banking executives in Indonesia, and we look forward with anticipation to how the financial sector here will accelerate in the coming days ahead!

Temenos Payments Solutions

Providers require faster, smarter and better customer engagement services to win new business and grow revenues. Temenos leverages advanced, scalable technologies to provide lower cost routings, quicker times to market, faster payment deliveries, and frictionless customer experiences.