Regulatory Reporting Platform - deltaconX

Full-stack reporting solution simplifying multi-regime compliance across global regulations.

Smarter Reporting for a Complex Regulatory World

deltaconX: Full-stack regulatory reporting made simple. Our platform empowers banks and financial institutions with seamless integration, enhanced control, and complete transparency to strengthen risk management and deliver consistent compliance across global regulations. With advanced data lineage and a single point of access, deltaconX reduces complexity, streamlines reporting processes, and provides the confidence needed to navigate today’s demanding regulatory landscape.

Key benefits

Full-Stack Solution

deltaconX delivers a full-stack solution with straight-through processing, detailed pre-submission validation, real-time reporting visibility, and remediation management. Supported by expert services, it ensures transparency, data lineage, and operational alignment—simplifying compliance, strengthening oversight, and building confidence in every regulatory submission

Multi-Regime Coverage

One platform supports global regulations including EMIR, MiFID II/MiFIR, SFTR, Dodd-Frank, FinfraG, MAS, ASIC, and REMIT. This breadth eliminates fragmented systems, reduces complexity, and ensures consistent, streamlined compliance across multiple jurisdictions.

Strengthened Risk Management

By embedding robust controls and automation, deltaconX minimizes errors, reduces operational risks, and safeguards against regulatory breaches. Reliable reporting supports proactive compliance and protects institutions from reputational and financial risk

Seamless Integration & Efficiency

With straightforward integration into existing core banking and trading systems, deltaconX ensures rapid adoption without disruption. Institutions gain cost efficiency, streamlined processes, and scalable compliance capabilities that evolve with regulatory demands

Key features

Pre-Submission Validation & Controls

Advanced validation checks and straight-through processing ensure data accuracy before submission. Institutions gain confidence in reporting quality, reduce errors, and meet regulatory obligations more efficiently.

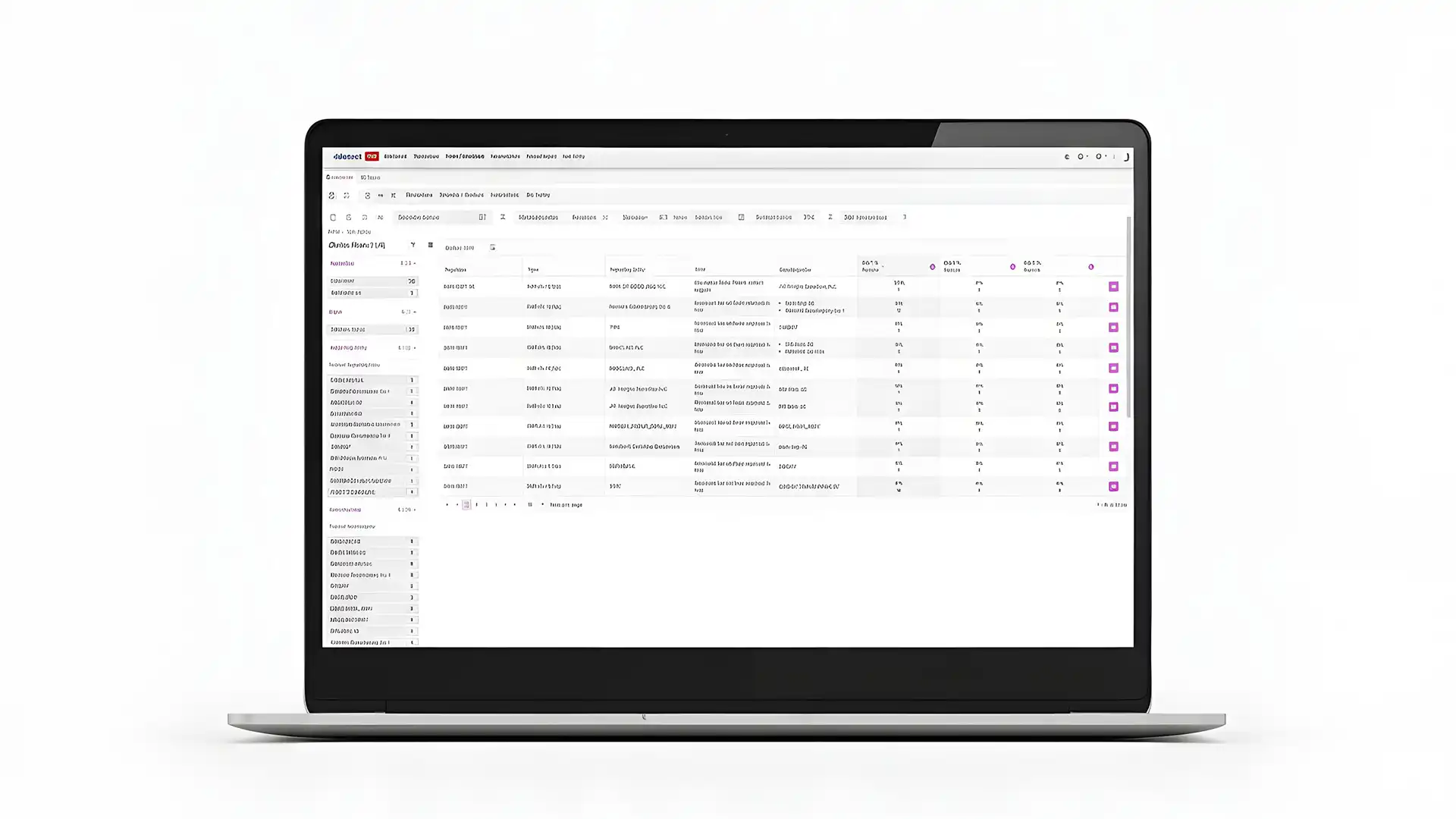

Real-Time Transparency & Data Lineage

Interactive dashboards deliver real-time status tracking, complete data lineage, and full change history for every submission. Institutions benefit from accountability, audit readiness, and unmatched transparency across reporting processes

End-to-End Reconciliation & Remediation

Automated reconciliation with TRs, ARMs, and counterparties highlights discrepancies early. Integrated remediation management tools allow swift resolution, reducing compliance risk and operational burden.

Expert Services & Seamless Integration

Professional services and consultancy support operational, IT, and project teams. Combined with seamless system integration, this enables smooth onboarding, efficient workflows, and long-term compliance confidence.