Transmit Security

End-to-end cyber-identity security. AI-driven Identity Security

Protect your customers and their accounts – at all times

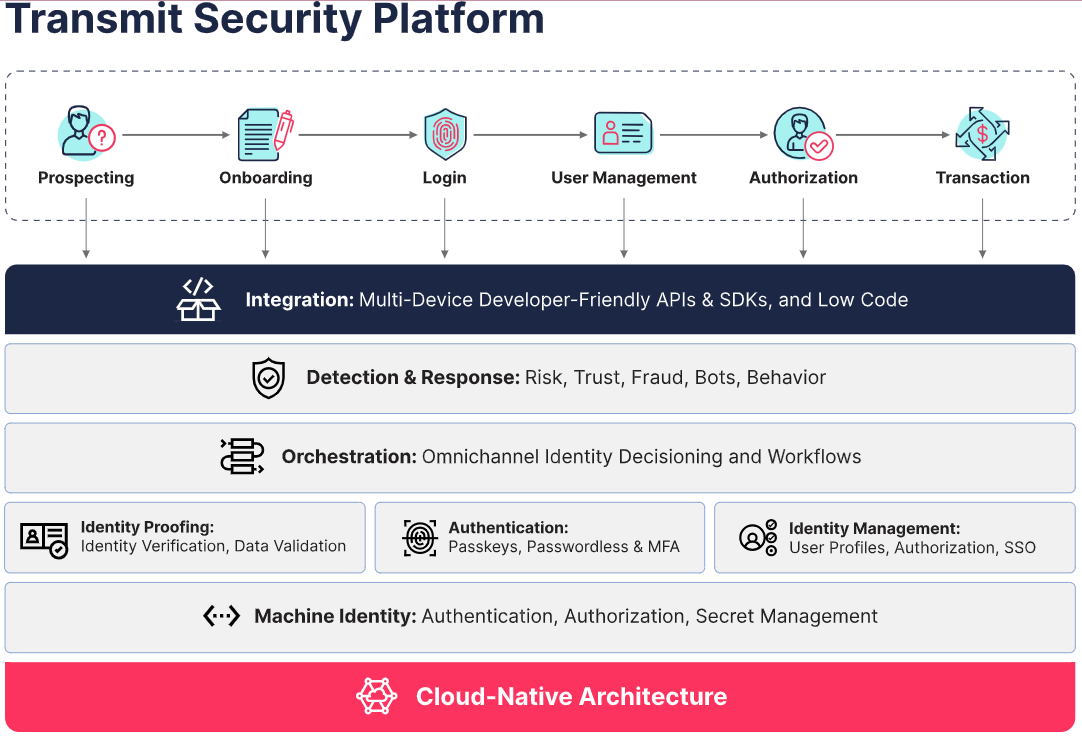

Transmit Security services deliver the broadest and strongest protection for customer-facing banking applications. Unified, orchestrated customer identity & access management (CIAM) services secure and simplify the full identity lifecycle while minimizing IT cost and effort.

Deliver a coordinated defense

Gain immediate, AI-powered protection against today’s most deceptive, evolving identity threats. Dynamic fraud prevention examines hundreds of signals in real time, across the full identity lifecycle. Smart, contextual analysis improves detection — so you can trigger the right response at the right time.

Developer-friendly APIs and SDKs with out-of-the-box user flows and decisioning rules expedite and simplify implementation. This modular platform is flexible by design, so you can roll out the services you need now and expand later as your requirements change.

Best-in-class security services include

Detection and Response Service

Monitor risk, trust, fraud, bots and behavior to stop threats & improve CX in real time.

- Continuously analyzes hundreds of signals

- Runs behavioral biometrics & device fingerprinting

- Leverages multi-method detection, ML and AI

- Identifies fraudulent accounts and prevent ATO

Orchestration Services

Build seamless customer identity experiences with no code and drag-and-drop visual flows.

- Resolve identity stack complexity & reduce cost

- Make access decisions based on risk & context

- Implement policies in configuration, not code

- React fast to emerging risks

Authentication Services

Strengthen authentication with passkeys, passwordless and PSD2-ready MFA.

- Authenticate with fingerprint or face ID, passkeys, email magic links or OTPs

- Phase out or eliminate passwords completely

- Support all channels, apps and devices

- Speed and simplify customer logins

Identity Verification Service

Secures onboarding with photo ID and selfie analysis for the highest level of assurance.

- Prevent account opening fraud

- Comply with KYC, AML, PEP & GDPR

- Minimize cost & effort with automated verification

- Passive authentication of IDs with NFC chips

- Simplify CX with an easy self-service

Data Validation Services

Instantly determine if the identity data that users provide is accurate and authentic.

- Comply with global regulations

- Prevent account opening fraud

- Secure onboarding for high-risk users

Identity Management

Works seamlessly with Temenos Core to improve visibility, analytics and control.

- Consolidate identity across brands and channels

- Do more with an extensible, dynamic user store

- Protect private data and prevent t attacks

- View events, tune rules to optimize security & CX

- Authorize user access based on roles or context

- Utilize industry standards: SAML 2.0, OIDC, OAuth 2.0