Twixor

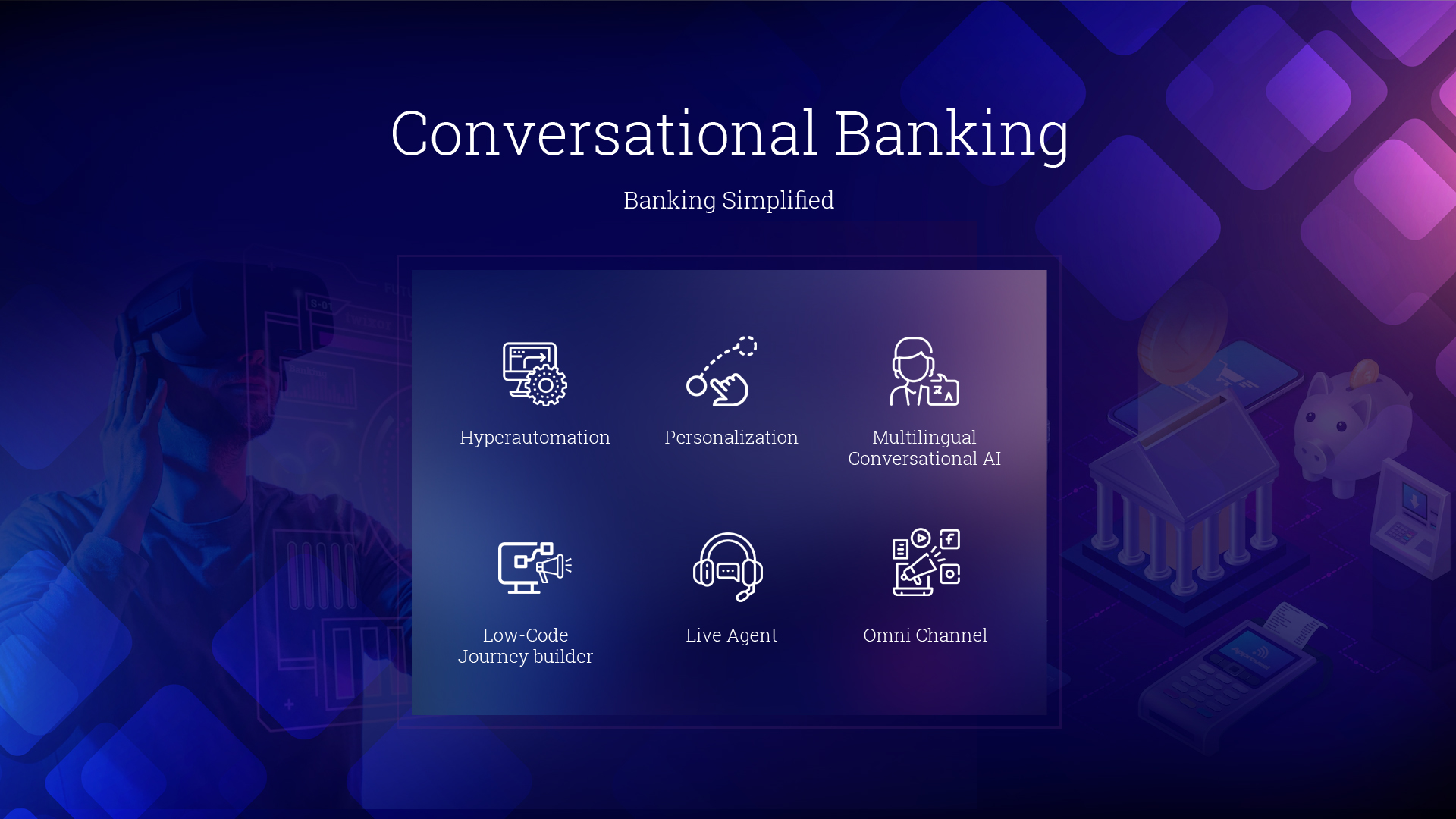

Conversational Banking powered by a low-code CX automation platform.

Twixor delivers end-to-end banking transactions on all customer-preferred channels.

Consumer behavior is changing, with an increasing preference for messaging channels and conversational banking, across all regions and customer categories. Twixor redefines customer experience in this messaging era, with revolutionary Conversational Banking Solutions across all traditional digital channels, and new instant messaging channels, and across banking functionalities (Retail, Corporate and Wealth Banking).

Overview

Twixor drives seamless low-friction multi-lingual app-less banking transactions – in contrast to a banking branch, web-site, mobile-app or call-center – all of which have varying degrees of friction.

This leads to significant impact on customer satisfaction, customer loyalty and cost of acquisition, service and retention including time to open an account (reduced by 80+%), time to access required information or complete banking transactions (reduced by 65+%) or estimated cost optimization at call center (reduced by 70+%).

Key Features

No-Code Omnichannel

No-code actionable conversations across digital (web-bots) and instant messaging channels like WhatsApp, FB Messenger, others. Deliver end-to-end fulfilment via transactional bots powered by conversational AI/NLP.

Low-Code Intelligent Process Automation

Supports in-built virtualization, contemporary actionable messaging, a sophisticated and secure API management framework and doubles up as an ESB (Enterprise Service Bus) & Document Management Engine.

Multi-lingual Transactional Bot

Our bots allow for the customers to transact within the context of a conversation. Also, capture customer feedback, automate support queries, and cut back on support costs.

Rich Cards in Messaging

Real-time intuitive data backed by rich templates. Display credit card statements, EMI Conversion calculators & more across all channels.

Drag and drop designer

Low-code workflow builder that has a proven, scalable architecture.

Live Agent Support

A bot with humans in the loop, or in hybrid modes to assist as and when required.