The most progressive and forward looking financial institutions will use this period as a time to refine their strategy.

To identify key trends and invest. To increase operational efficiency and to minimize unnecessary costs. To enhance their product and service offering and, by doing so, to emerge in a strong position as normality resumes.

These are just some of the key trends that we anticipate will be top of mind for key decision makers in wealth management throughout 2023.

The Generational Wealth Transfer

With an estimated 40 to 60 trillion dollars set to change hands from the original baby boomers to their Gen X and Millennial children, this trend will remain of critical importance to wealth managers focused on higher net worth clients.

Environmental, Social & Governance (ESG) compliant frameworks

Multiple studies have shown that a younger generation of investors are seeking investments that reflect their underlying values and those that are not willing or unable to address client demands for ESG compliant portfolios risk losing those clients to other service providers.

Individual and Team Mobility

Hybrid working models and digital collaboration tools have granted the flexibility to make new engagement models possible and in some cases, these may become a preference for both advisers and their clients.

Fintech Adoption

With rising costs and clients demanding

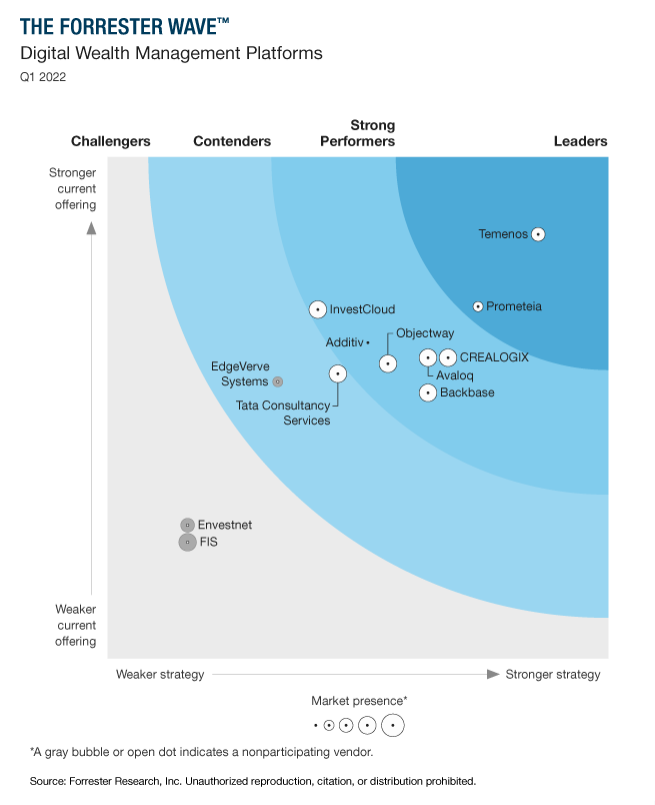

more than ever, wealth managers, especially those in larger and less specialized customer segments, will recognize that the rapid ability to enhance a product or service offering may best be achieved by outsourcing to a specialist service provider or vendor.

API-ification

The increase in the use of APIs will allow wealth managers to offer more targeted and relevant solutions and services to multiple client segments, and for global or multi-region providers, across multiple geographies.

Hyper-personalization

The ability to leverage existing customer data in a structured manner will enable the creation of insights that may lead bespoke or semi-bespoke proposals. These will, at the very least, create a perception of a unique, tailored offering that if formulated correctly, is more likely to appeal to the selected sub-set of customers.

Personalized or custom indexing

Reflecting rising trends focused on hyper-personalization and ESG, we see a rapid growth in personalized or custom indexing. Advances in technology have helped to ease the associated administration burden making this financially viable for a new range of potential investors.

About the author

Eric Mellor is a wealth specialist at Temenos, responsible for bridging the gap between customers and vendors, working with banks to define their wealth management goals and ambitions and translating these to practical, effective technology-driven solutions.