Provider Category: Technology

AdobeSign – Adobe

The Temenos Journey Manager package offers a seamless integration with AdobeSign, supporting various signature capture scenarios, including in-form, post-submit, and a combination of both.

Get documents signed in minutes, not days.

Utilize Adobe to finalize approvals and agreements in minutes, not days, from any location and on any device. This package offers seamless integration with Adobe Sign, supporting in-form, post-submit, and a combination of both signature capture scenarios specifically for Temenos Journey Manager packages.

Adobe Sign is a powerful tool that allows you to streamline your approval and agreement processes. With its seamless integration with Adobe, you can now finalize approvals and agreements in minutes, rather than days.

One of the main benefits of using Adobe Sign is its flexibility. You can access it from any location and on any device, making it perfect for remote work or when you’re on-the-go.

AdobeSign Temenos Journey Manager Benefits:

Streamlined Onboarding Process

By integrating AdobeSign with Temenos Journey Manager, banks and credit unions can offer an exceptionally smooth and efficient onboarding process. This combination allows for the automation of document handling and signature collection, reducing the need for manual intervention. As a result, customers can enjoy a fast-tracked experience that minimizes wait times and potential errors, leading to enhanced satisfaction and quicker access to banking services.

Enhanced Security and Compliance

Security is paramount in the financial industry, and the AdobeSign Temenos Journey Manager package offers robust compliance features that ensure all transactions meet regulatory standards. With advanced encryption and secure authentication methods, banks can protect sensitive customer data while maintaining full compliance with legal and industry mandates, thereby minimizing risks related to data breaches and non-compliance.

Increased Customer Engagement and Satisfaction

The seamless digital journey facilitated by this package enables banks and credit unions to keep their customers engaged throughout the onboarding process. The flexibility of signing documents remotely without the need for in-person visits enhances convenience, which is particularly appealing in the digital age. Consequently, this leads to higher customer satisfaction levels and stronger customer relationships, as customers appreciate the efficiency and ease of interaction with their financial institution.

Request a Demo

Back Office Service – AU10TIX

au10tix BOS is available for Temenos Journey Manager customers, authenticating and validating ID documents in real time, ensuring accuracy and efficiency.

AU10TIX Back Office Service (BOS)

AU10TIX is designed for Temenos Journey Manager customers, offering real-time authentication and validation of ID documents to ensure accuracy and efficiency. The platform automates the authentication, validation, and conversion of ID documents into usable digital records for customer onboarding. It seamlessly integrates with automated e-form population, signature pads, biometric devices, and other essential customer processing tools, creating a comprehensive, paperless Secure Customer Onboarding platform.

Key Benefits of AU10TIX:

Enhanced Security

AU10TIX employs advanced technology to verify identities, reducing the risk of fraud and ensuring a secure onboarding process for customers.

Increased Efficiency

By automating the ID validation process, AU10TIX speeds up customer onboarding, allowing businesses to serve clients faster and improve overall operational efficiency.

Seamless Integration

The platform easily connects with existing tools and systems, allowing companies to enhance their workflows without overhauling their current processes.

Request a Demo

Mobile Identity – Danal

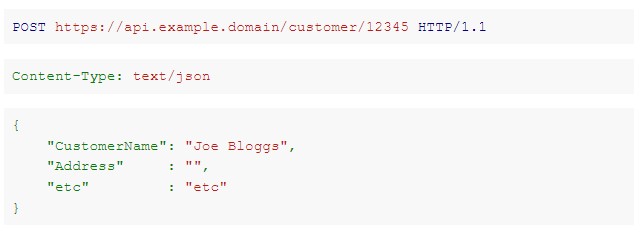

Danal Mobile Identity allows US applicants completing forms while connected to the cellular network to prefill their personal data held by the mobile carrier into the form.

Danal Mobile Identity

The Temenos Journey Manager package, featuring Danal Mobile Identity, recognizes that completing forms is crucial for consumers’ interactions with a company and, ultimately, its success. However, manually entering data into forms—particularly on mobile devices—can create friction, resulting in higher abandonment rates for registrations, leads, and sales.

Danal’s Autofill service addresses this issue by seamlessly and automatically populating tedious form fields with essential information, such as First Name, Last Name, Address, City, State, Zip Code, Phone Number, and Email. This enhancement significantly boosts the conversion rate of visitors into clients or members on both desktop and mobile platforms.

Danal’s Autofill service Benefits:

Seamless Autofill Integration

With Danal’s Autofill service, users can say goodbye to tedious data entry! Automatically populate essential form fields like name, address, and contact details, making the registration process smooth and hassle-free, whether on desktop or mobile.

Direct Data Retrieval

Thanks to partnerships with mobile carriers, Temenos Journey Manager retrieves accurate data directly from secure databases. This ensures that the registration process is not only efficient but also reliable, enhancing user trust and satisfaction.

Secure Mobile Authentication

Danal generates legitimate mobile IDs from live mobile operator networks, providing robust authentication for mobile subscribers. This feature empowers merchants to offer financial services confidently, ensuring a secure and convenient experience for consumers.

Request a Demo

Enrich – Credit Sense

Credit Sense

The Temenos Journey Manager package integrates the Credit Sense service by embedding its user interface within an iFrame. This integration uses back-channel APIs to efficiently retrieve transaction data from users’ bank accounts. Credit Sense enhances the Yodlee APIs with better categorization and analysis of transactions, resulting in a comprehensive profile report.

As a decision support service, Credit Sense specializes in bank statement analysis, automatically retrieving and analyzing customers’ transactions for a complete view of their financial activity. Each transaction is carefully examined using patented heuristics and pattern matching techniques. With Credit Sense, you can approve more customers and effectively boost completion rates.

Overview

Enhanced Financial Insights

Credit Sense provides deep analysis and categorization of transaction data, allowing Journey Manager customers to gain a clearer understanding of their clients’ financial activities and behaviors.

Increased Approval Rates

By automatically analyzing bank statements and transactions, Credit Sense helps Journey Manager customers approve more applicants with confidence, leading to higher completion rates and improved business outcomes.

Streamlined Decision-Making

With its advanced heuristics and pattern-matching techniques, Credit Sense simplifies the decision support process for Journey Manager users, enabling faster and more informed lending decisions.

Request a Demo

Companies House API – Companies House

Temenos Journey Manager provides access to the Companies House API, a complimentary REST-based service offered by the UK government that delivers information about UK companies.

Companies House REST API

The Companies House API offers a wide range of data that can be leveraged by businesses for various purposes. One potential use case is conducting market research to gather insights about competitors or potential partners. By accessing company profiles and financial data through the API, businesses can gain a better understanding of their industry landscape and make more informed decisions.

In addition to market research, the Companies House API can also be used for due diligence purposes. Before entering into a partnership or business deal with another company, it’s crucial to have a thorough understanding of their financial health and history. The API allows businesses to access up-to-date information on company finances, including annual reports and accounts.

Companies House API Benefits

Comprehensive Company Insights

The Companies House API provides access to detailed information on over 4 million UK companies, including current and historical data on company filings, directors, and financial health. This wealth of information is invaluable for US-based businesses looking to understand their competitors or identify potential partners in the UK market.

Streamlined Due Diligence

With real-time access to up-to-date financial data and annual reports, the API simplifies the due diligence process for US businesses. This ensures that companies can make informed decisions before entering partnerships or deals, reducing risks associated with financial instability or hidden liabilities.

Automated Compliance Management

By integrating with the Companies House API, US businesses can effortlessly maintain accurate and compliant records of their UK operations. This automation not only saves time but also helps ensure adherence to government regulations, thereby minimizing the risk of penalties and enhancing operational efficiency.