Provider Category: PFM & Open Banking

Carry out financial transactions with a digital wallet & open banking platform that has 120 features fully integrated

EnWallet is a next-generation digital wallet and payment platform that unifies open banking, SoftPOS, and payment gateway capabilities within a single ecosystem. With over 120 ready-to-use wallet features, multi-currency support, and modular APIs, EnWallet enables financial institutions to launch secure, compliant, and fully customizable digital payment services, ready to scale into a super app.

Key benefits

Certified & Secure Architecture

Built with advanced omni-channel architecture, EnWallet meets the highest security and regulatory standards, ensuring continuous compliance and reliability.

End-to-End Payment Ecosystem

Combines wallet, payment gateway, and SoftPOS functions in one platform — offering institutions a complete, compliant, and secure foundation for digital finance.

Faster Time-to-Market & Flexibility

Provides modular and flexible infrastructure, reducing deployment time and cost by up to 50%, while supporting multiple integration options and third-party services.

Multi-Currency & Multi-Platform Support

Supports iOS, Android, React Native, and Flutter with multi-currency account management, enabling global transactions through a unified, seamless experience.

Key features

Open Banking Module

Offers regulatory-compliant API infrastructure enabling real-time account sharing, consent management, and payment initiation between banks, third parties, and fintechs.

Digital Wallet

Delivers 120+ ready-to-use wallet functions with customizable design, loyalty features, and Wallet-as-a-Service (WaaS) capabilities, ready to evolve into a super app.

Payment Gateway

Supports multiple payment methods with real-time processing, automated onboarding, and value-added services, empowering merchants and payment facilitators on one platform.

SoftPOS

Transforms any Android device into a contactless POS terminal, supporting multi-acquirer setup, smart switching, and analytics for cost-effective, sustainable payments.

Resources

Request a demo

The complete platform

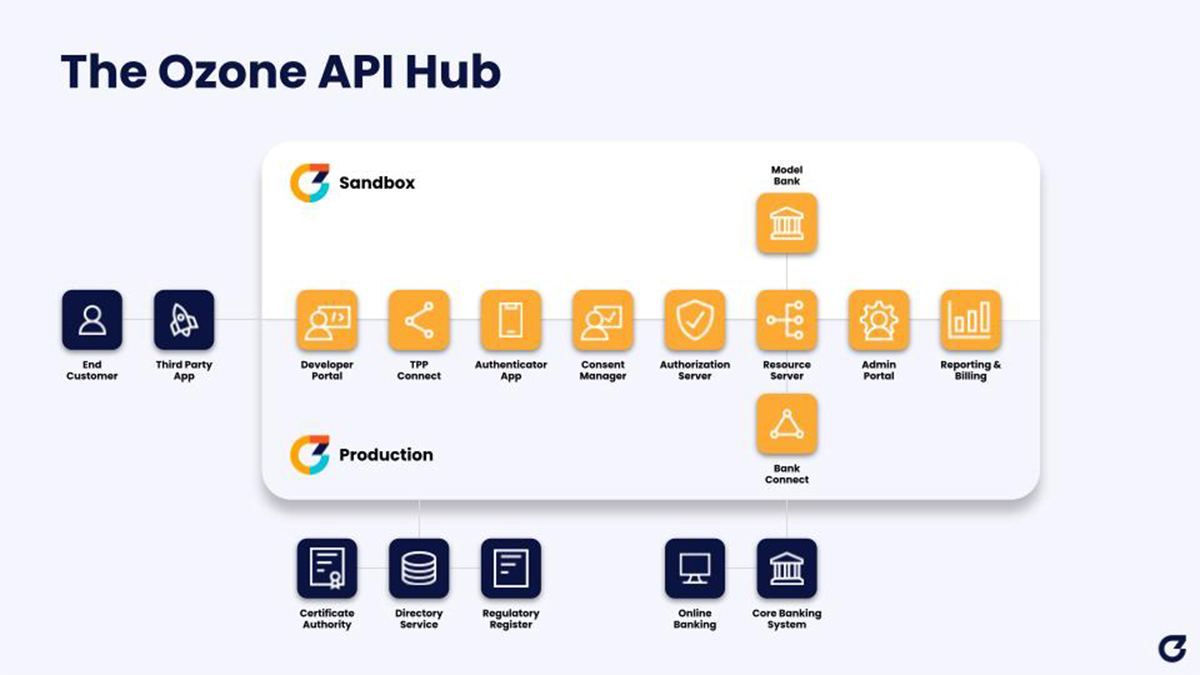

The Ozone API is the leading open API solution for banks and financial institutions, delivering ‘out of the box’ compliance with open banking standards and regulations around the world.

In fact, Ozone API is the only platform designed and proven to support all open finance standards globally; ensuring our customers are able to deploy a strategic solution that scales as they do.

Our software goes beyond compliance and makes it quick and easy for account providers to turn open APIs, including premium APIs, into a profitable commercial channel.

Ozone API empowers banks and financial institutions to adapt and thrive in the new world of open finance. We provide technology that delivers compliant open APIs and goes beyond, to monetize open banking globally.

Temenos core banking (T24) customers can achieve open banking and open finance compliance in weeks, not months. In addition to being open banking compliant by quickly deploying Ozone API’s solution on top of T24, banks can leverage the platform to easily venture into new commercial business models such as BaaS and embedded finance.

Overview

The Ozone API delivers out of the box compliance. We handle the complexity of open banking so you don’t have to, allowing you to focus scarce engineering resources elsewhere and ensuring low cost of ownership.

Our turnkey solution includes:

Pre-built Temenos connector to enable fast and simple integration

Full TPP management, including automated onboarding, TPP validation and ongoing TPP support

Strong customer authentication and consent management with an out of the box consent and authentication app or the tools to simply connect to your existing authentication solutions

A comprehensive administration portal and reporting suite for simple channel management and reporting

The Ozone API delivers out of the box compliance. We handle the complexity of open Open banking delivers a new way for banks and FIs to build partnerships, distribute products and drive new revenue streams, which means going beyond simple compliance.

The Ozone API unlocks this potential with:

Full support for a wide range of premium APIs to enable banks to commercialise richer functionality

A rich reporting and billing capability to support commercial API propositions

The tools to enable developers with simple onboarding, the right tools and ‘best in class’ API performance

Designed to scale, delivering premium APIs built in line with global standards

Resources

Case studies

Intro deck

Request a Demo

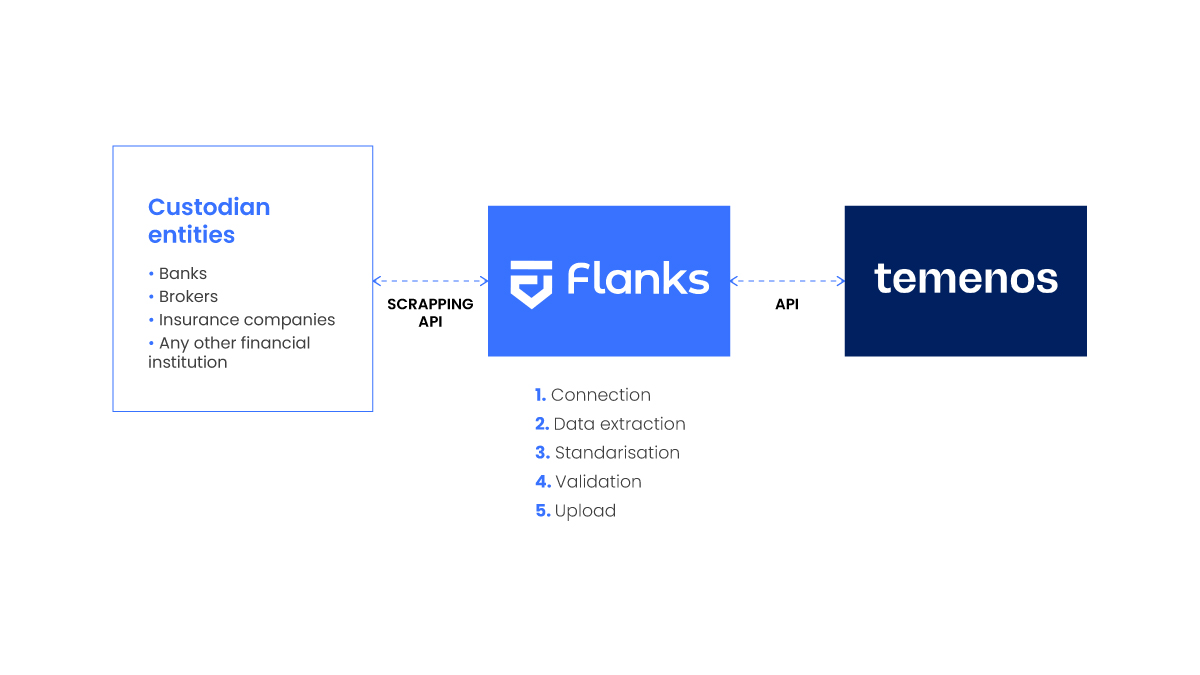

A Wealth Tech B2B service platform which digitally optimizes your operational efficiency by automating and scaling connections between Temenos and any custodian entity across the globe

Using Flanks as a wealth data orchestrator allows bankers to connect Temenos to any global entity automatically. And therefore, help them aggregate their clients’ wealth within Temenos. By using Flanks’ solution, they get a global position of their clients’ operations across all entities on a daily basis, enabling them to provide multi-custodian advisory services.

Overview

Global coverage

We can connect to any custodian entity across the globe. It takes Flanks 1-2 weeks to add a new custodian entity.

Product coverage

Our technology enables us to go beyond the normal PSD2 and any open banking regulation. We can easily retrieve all data (position and transactions) of any financial product that financial advisors require.

Designed for Wealth

Our platform is designed solely for wealth management, and allows you to have a global view of the position of your clients and monitor it on a daily basis.

Safe and secure

Your data is safe with us. We are fully regulated and comply with the AISP regulation in the EU. We have cybersecurity experts working 24/7 and top-grade-support from several big corporations.

Seamless integration with Temenos

We’re fully integrated with Temenos, and both positions and transactions are uploaded into the platform on a daily basis.

ISV Assessments/Awards

ESG & Enterprise Readiness Assessment Scores for Flanks conducted by The Disruption House

| Category | Award | Date |

| Business Resiliency Accreditation | Builder | December 2024 |

| Sustainability Accreditation | Starter | December 2024 |

Interested in the full Flanks report? Click here to buy it now.

Request a Demo

Unlock the full power of Open Banking with Salt Edge API

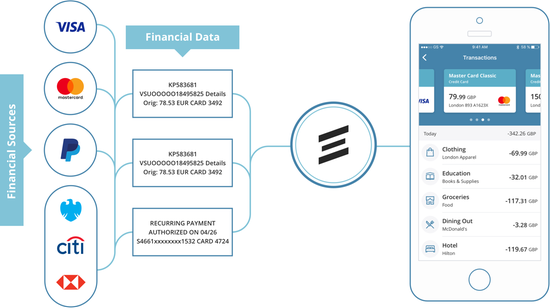

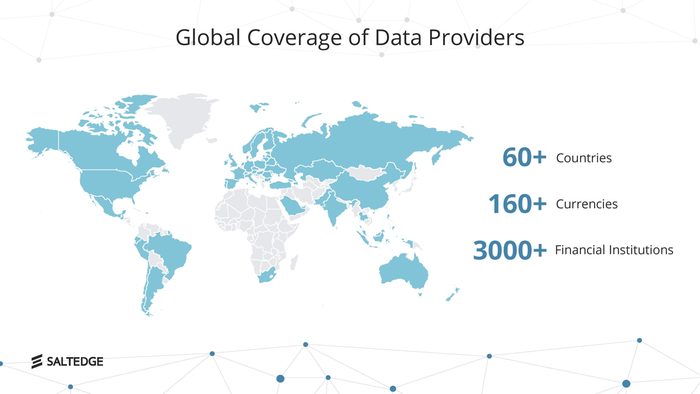

Salt Edge enables businesses to connect to end-customers’ bank accounts from across the globe, and supports them with instant payment initiation, data exchange and enrichment solutions.

Overview

The Global Data Aggregation API is the cornerstone of Salt Edge’s technology, with a coverage of over 3000 financial institutions in 60+ countries. It presents you with the end-customer’s transaction information in a clean and easy-to-understand format to offer a holistic overview of their financial wellness.

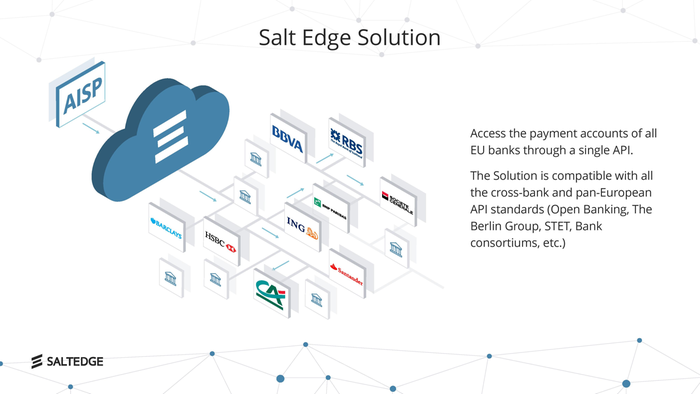

Aggregates end-customer account data from any EU bank via a single API gateway. By integrating just one API, you get access to thousands of bank connections. Salt Edge takes care of all the registration and technical connections to banks, helping you to focus on your core business.

Initiate payments on behalf of end-customers, with their consent, from any of their EU bank accounts, via Open Banking and PSD2 channels. Salt Edge API supports any payment types which are provided by each single bank: one-time, future dated, scheduled, bulk payments, etc.

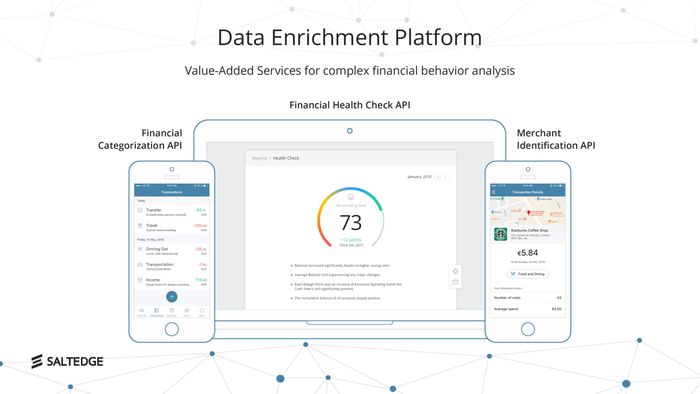

Financial Institutions receive a set of Value-Added Services for conducting complex financial behavior analysis. Salt Edge empowers you to provide personalized services and conduct better risk assessments based on detailed customer spending patterns.