Provider Category: Integrated Product

Taurus

Taurus is the market-leading platform to manage any digital asset: crypto-assets, tokenised securities and digital currencies.

Taurus provides everything you need to manage any digital asset with one platform. Multi-use cases, multi-blockchains.

Depending on your business model and strategy, you are able to seamlessly manage crypto assets (including staking), to digitise and tokenise any type of asset on any standard, and to process digital currencies of your choice. Taurus’ digital infrastructure is flexible to deploy (on-premise, SaaS or hybrid), fast to integrate and ready-to-scale. Used by all types of banks: online, retail, corporate, private, crypto, and systemic global banks.

Overview

Richest features and breadth of use cases

The Taurus platform provides the largest choice of applications in the market covering crypto-business, private assets, digital currencies as well as public and private blockchains.

Industry-leading Technology

Taurus’ engineers belong to a handful (4-5 in the world) mastering the full technology stack from software, hardware, security, cryptography, distributed systems and DevOps. This means for clients a fast execution and remaining at the forefront of technology progress.

Market-leading and Battle-tested Platform

Taurus solutions are entrusted by the full spectrum of banks in production: systemic banks, investment banks, private banks, retail/digital banks, crypto-banks and trading venues.

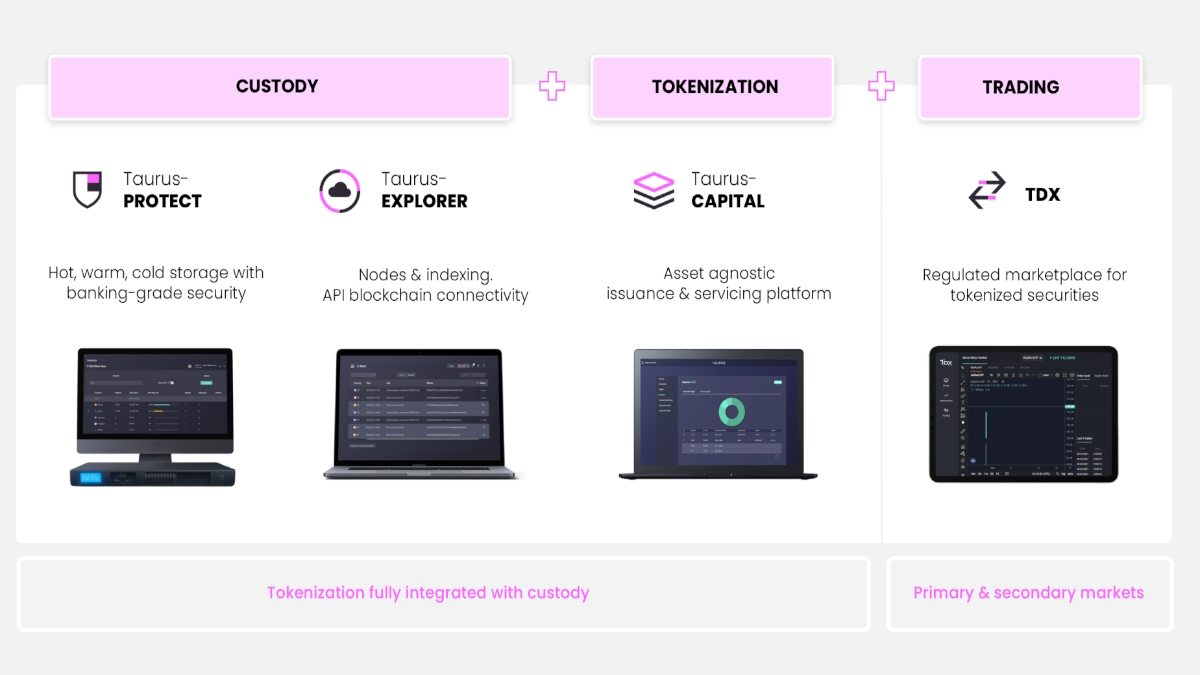

Taurus PROTECT – Custody Platform

Custody and process ANY digital asset such as crypto-assets, tokenised securities, private assets and digital currencies. All with the highest security, richest features and flexibility: deployed on-premise, SaaS or hybrid. Temperature-agnostic (hot, warm and cold). FIPS 140-2 Level 3 hardware security modules and MPC.

Taurus CAPITAL – Digital Issuance and Tokenisation Platform

Digitally issue & create your own financial products, digitise & tokenise any private asset. Upload and interact with any external smart contract from your clients or partners. Fully integrated with Taurus PROTECT for end-to-end asset servicing.

Taurus EXPLORER – SaaS Blockchain Connectivity & Indexing

Unified APIs to interact with 10+ blockchain protocols. Transfer assets, monitor wallets and manage counterparty risk, all in real-time. Taurus’ nodes and indexing SaaS service include reliable broadcasting, replay attack protection algorithms and strict SLAs. Allows you to reduce costs up to 80% and scale faster.

Resources

Request a Demo

Wise

Wise for Banks – Modernising your International Payments Experience.

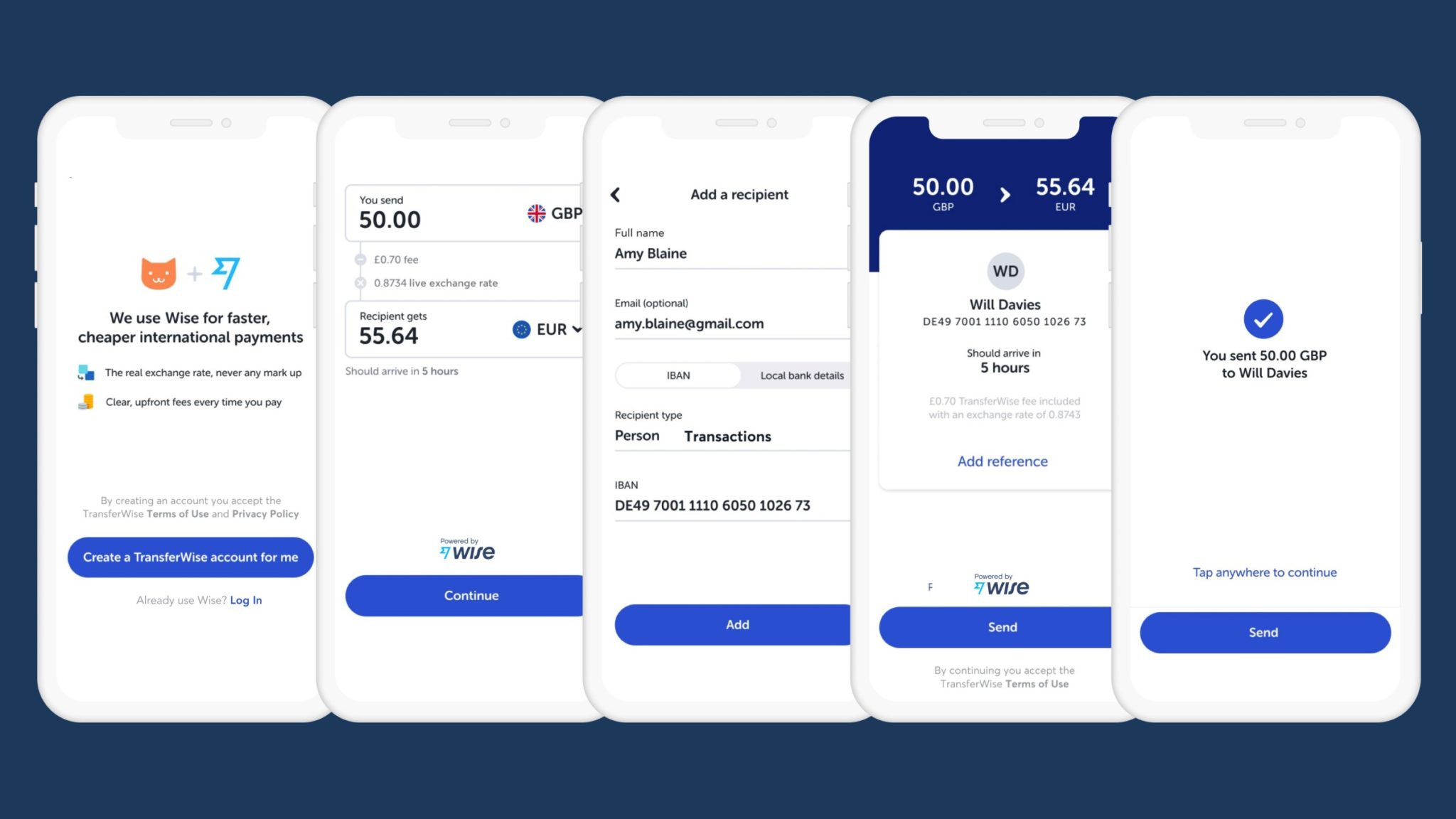

A Customer-Centric International Payments Solution

Wise is a global technology company, building the best way for people, businesses and financial institutions to move money around the world. More than 10 million customers use Wise – whether sending money to another country or making and receiving international business payments, Wise is on a mission to save customers money.

Financial institutions can seamlessly tap into Wise’s infrastructure to power a remarkably fast, convenient and transparent cross-border payments service for their customers – natively within your banking app. Globally, financial institutions have partnered with Wise, leveraging its complete infrastructure to scale their own reach, improve customer experience and reduce their costs.

Overview

With Wise international payments are:

Global

Leverage Wise’s local connectivity across 80+ countries. Wise invests heavily in its local banking network, including direct integrations to payment schemes – building an alternative to traditional correspondent banking rails.

Cheaper

Wise’s investment in experience not only delivers a high NPS, but also has verifiable cost savings. Wise will continue to invest in its product to bring its costs down, passing this straight through to you and your customers.

Faster

Investing in the power of instant. Over 30 percent of all global transfers are delivered instantly, with over 50% delivered within the hour.

Easier

Best in class APIs and design documentation – a trusted, out-of-the-box and completely online solution available with minimal integration and ongoing maintenance effort.

More Transparent

Transparency is becoming the norm – regulators globally are assessing how foreign exchange pricing has been implemented. Wise’s service uses the real, mid-market exchange rate as seen on Google or Reuters.

Request a Demo

Formpipe Banking Solutions

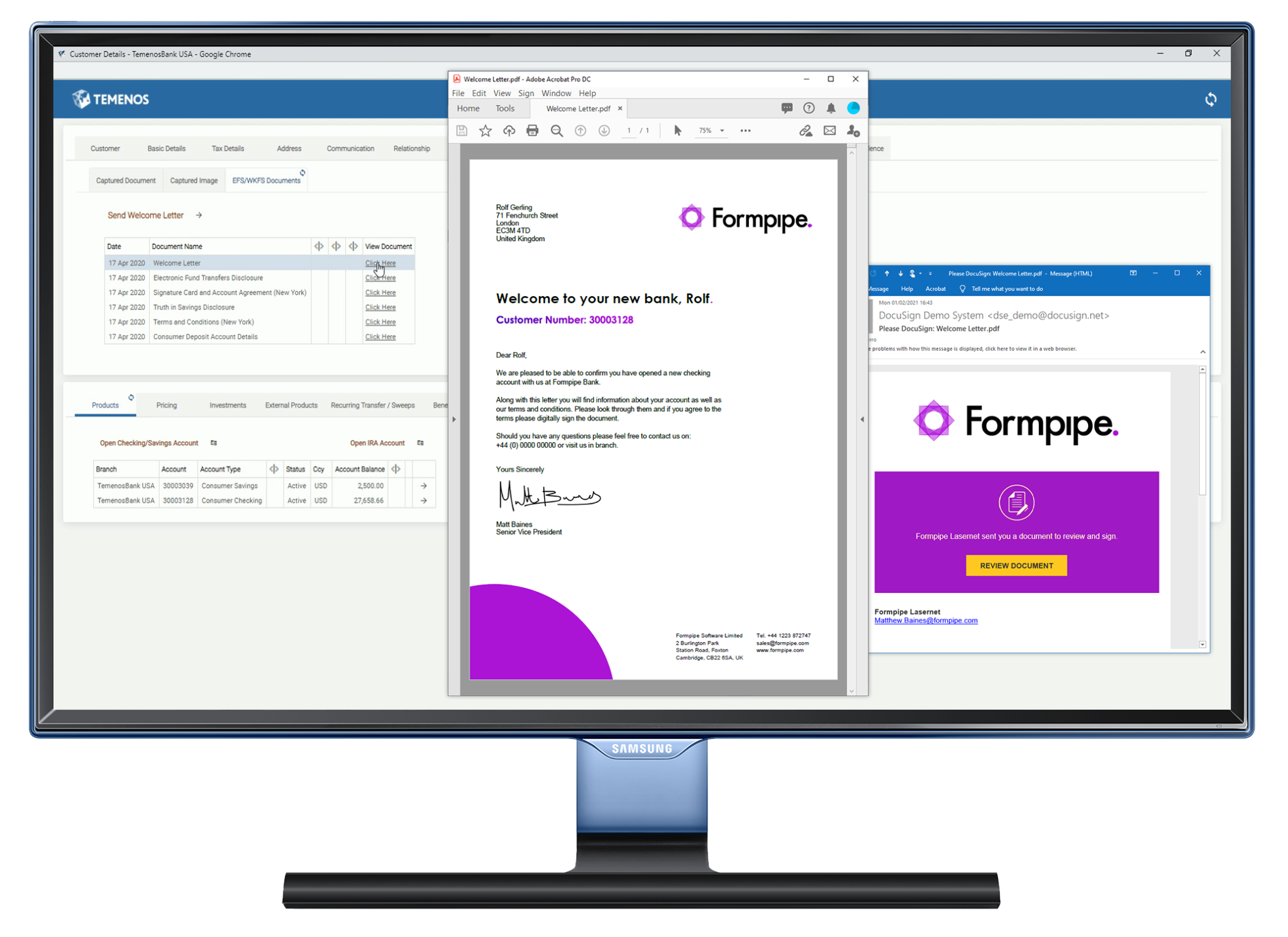

Formpipe Banking Solutions – Industry Leading Output and Document Management for Temenos Customers.

The Complete Document Generation, Distribution, Archiving and Retrieval Solution for Your Bank.

Formpipe’s software uses the standard data in Temenos’ product suite to create perfectly designed and branded digital and hard copy documentation, across your entire banking network. With real-time distribution to customers & automatic digital archiving, documents and data can be accessed quickly and securely through the Temenos UI using Formpipe’s easy integrations or via mobile app / internet banking.

Overview

Generate

Lasernet takes care of your data, leaving you free to focus on your document design. Just create a digital template, then drag & drop the Temenos Transact output where you want it. No programming, no consultants and no delay.

Distribute

Formpipe’s software can automatically sort, batch, schedule and send your customer documents based on their preferences. Instantly broadcast to multiple channels, including: archive (& internet banking), email, API endpoints, local printers, external print houses, mobile messaging and network fax.

Archive

User friendly and quick to deploy, Autoform DM provides a centrally available, customer-focused digital repository, accessible from within all Temenos banking solutions. Staff and customers can access stored documents at the click of a button from a single interface.

Retrieve

24/7 secure access to documents 365 days a year is essential for modern banking and Autoform DM gives your staff and customers the ability to rapidly retrieve photos, signatures, forms, IDs and banking documents through Temenos Transact and Temenos Infinity.

Proven

Formpipe’s software is currently generating, archiving and distributing millions of documents around the clock for banks across the world. You can rely on Formpipe to give your customers and clients the information they want, exactly when they want it.

Quick to deploy

Whether on-premise, in the cloud or as SaaS, Formpipe’s easily integrated solutions and services, combined with their extensive project management experience, allow them to support the tight timelines, expectations and challenges of any core banking project.

Request a Demo

HID Global – Risk Management Solution

One cohesive solution powered by AI-based behavioral intelligence for real-time threat detection and bank fraud prevention.

HID Risk Management Solution for real-time threat detection and fraud prevention

Introducing the HID Risk Management Solution (RMS) — a comprehensive approach to safeguarding all online banking channels and empowering organizations to effectively identify, assess, mitigate and monitor risks. This powerful solution offers a holistic defense against fraud thanks to its AI powered behavioral intelligence, the solution ensuring a secure and trustworthy digital experience for banks and other financial services providers. With HID RMS in place, organizations gain the tools and capabilities to build a seamless and reliable digital experience for their users. By implementing this cutting-edge solution, they can stay one step ahead of potential threats and create a safe environment, protecting both their users and their valuable assets.

What sets HID apart?

Pre-Integrated Features and Capabilities

Get a faster and more efficient implementation through HID’s 15 years of experience with the Temenos banking platform. HID’s consumer authentication solutions provide secure multi-factor authentication for login and transaction signing as well as risk-based authentication capabilities for banks using the Temenos banking platform ecosystem. HID is pre-integrated with the Temenos banking ecosystem and offers predefined workflows based on the very best banking practices to offer a superior user experience without compromising on security. The components can also be used to build a fully customized workflow should you choose to do so.

Partner Services

HID’s Identity and Access Management (IAM) Partner Services’ team are true Temenos banking platform experts. Their focus is on shortening the customer time to value realisation within the Temenos banking ecosystem. Following an agile delivery methodology, the team enables implementation partners by onboarding, training and supporting them on their Temenos integration journey. Partnering with HID for your Temenos integration will not only ensure that you have experts on your side to offer the best user experience, but also significantly shorten your time to market.

Enable the right security for the right user with massive scalability

Tailor your unique user journey through flexible and customizable authentication solutions that can be seamlessly integrated in your Temenos banking environment. Our approach is to secure today’s modern banking journeys through flexible workflows that have been rigorously tested to fit your end-to-end user needs.

Beyond traditional authentication that meets evolving banking needs

HID offers full authentication coverage to provide an end-to-end customer journey with some of the market’s broadest range of authentication solutions and form factors. Our authentication platform is backed with AI-based identity verification and real-time threat detection for true fraud prevention. By leveraging diverse modern authentication capabilities, including passwordless, phishing-resistant, risk-based, and adaptive authentication, HID’s authentication solutions are easy to deploy and flexible to grow with your business needs. The authentication services offered by HID are deployable in the public or private cloud and on premise and are highly interoperable with open standards and frameworks.

Delivered by a trusted industry leader

HID is your global security and identity expert. Benefit from the deep expertise of a proven leader in identity technology, trusted by financial institutions and other highly regulated industries around the world, to enable compliance with stringent data privacy, industry mandates and strong consumer authentication (SCA) relating to Open Banking.

Resources

HID Risk Management Solution (RMS) Executive Brief

HID Fraud Advisory and Mitigation Services Executive Brief

Request a Demo

REL-ID: Omnichannel Authentication – Uniken

Authentication, transaction signing, and MTD for Community & Inclusive Banking and Temenos Digital.

Seamless, Secure Authentication Across All Channels

REL-ID delivers seamless, omnichannel security for every client interaction, eliminating the need for passwords, tokens, and fragmented processes. Our platform ensures strong, passwordless authentication across all channels, from mobile to in-person, while protecting against evolving threats. REL-ID enables secure, frictionless experiences that scale effortlessly, ensuring both customer satisfaction and fraud prevention in one comprehensive solution.

Overview

Device Trustworthiness

Blocks connections from compromised devices at consumer speed using military-grade root/jailbreak/malware detection, ensuring only secure devices can access your services.

Secure Data-In-Transit

Ensures safe data transfer with an MITM-proof, beyond TLS secure communication tunnel, without adding operational complexity or cost.

True Omnichannel Support

Provides consistent, seamless customer experiences across all channels – online, mobile, call center, chat, digital assistant, and in-person—with unphishable, out-of-band authentication.

Customizable Policy Controls

Offers comprehensive, customizable set of policy controls based on device, user, and other context variables that align to unique business needs and risk parameters.

Strong Authentication Made Simple

Delivers mutual, simultaneous, and continuous multi-factor authentication built on 1:1 cryptographic keys directly from an app with the authenticator of choice.

Secure Data-at-Rest

Ensures a higher level of security than trusted execution environments (TEE) through locally stored, encrypted data utilizing a previously nonexistent key prior to a fully verified and trusted context is established.

APIS and Services Go Dark

Cloaks all public-facing APIs, services, and applications, allowing only strongly authenticated, authorized requests to access secured services.

Simple Integration

Easily integrates with your apps and services through REL-ID SDKs, ensuring the right level of security tailored to your specific needs and risk profiles.”

Resources

Omnichannel Authentication

REL-ID Datasheet

Solution Overview Video

Request a Demo

Put a financial advisor in your customer’s pocket

We designed Unblu’s Conversational Platform to solve the problem of connecting people with banks in a world where branches are disappearing and competition is increasing. We make those connections secure, meaningful, profitable and efficient both for the customer and the financial institution. With Unblu every engagement becomes an opportunity.

Overview

Full conversational banking platform

The Unblu Platform allows organizations to engage and interact with the visitors/customers on their websites and mobile applications, guiding them through their digital journey to a successful completion of a business transaction. Our platform is specially architected to allow advisors and relationship managers to engage with customers in secure environments such online banking applications or customer portals, leveraging the support and advisory experience to the next level.

Better engagement

Increase touchpoints with customers (text, video, voice and collaboration) by leveraging on digital tools to render a branch-like experience that your customers expect and love. Design customer journeys with total flexibility, offering advice and support where you know customers need it. It’s not just another chat icon on a website, hoping for the best, or an isolated video-meeting solution.

More revenue

Unblu allows banks to leverage the moment of truth. Providing financial advice when your customers need it. Unblu allows your agents and advisors to use technology to increase conversion rates by spending more quality time with customers.

Lower customer support costs

Adding visual context to support use cases is allows our customers to reduce the time you dedicate per call/chat, and increasing the first-call resolution ratio. Unblu allows you to engage with customers online in a natural, convenient and intuitive way, what translate in a higher efficiency when onboarding new customers.

Resources

Request a Demo

Multi-Factor Authentication for a fast and secure windows login

HID DigitalPersona is an advanced multi-factor authentication solution, facilitating swift and secure login to Windows workstations. The solution supports a wide range of authentication factors, including Keys, Cards, Bluetooth devices, OTP tokens, App-based methods, and much more.

This provides businesses with unprecedented freedom of choice of authentication methods by enabling them to combine up to 3 authentication factors of choice. It effectively and seamlessly helps secure enterprise, web, cloud, and legacy applications, as well as Virtual Private Networks. What sets DigitalPersona apart from competitors is its ability to leverage existing IT infrastructure for quick deployment, allowing it to be operational within hours, not weeks or months.

What sets HID apart?

Pre-Integrated Features and Capabilities

Get a faster and more efficient implementation through HID’s 15 years of experience with the Temenos banking platform. HID’s consumer authentication solutions provide secure multi-factor authentication for login and transaction signing as well as risk-based authentication capabilities for banks using the Temenos banking platform ecosystem. HID is pre-integrated with the Temenos banking ecosystem and offers predefined workflows based on the very best banking practices to offer a superior user experience without compromising on security. The components can also be used to build a fully customized workflow should you choose to do so.

Partner Services

HID’s Identity and Access Management (IAM) Partner Services’ team are true Temenos banking platform experts. Their focus is on shortening the customer time to value realisation within the Temenos banking ecosystem. Following an agile delivery methodology, the team enables implementation partners by onboarding, training and supporting them on their Temenos integration journey. Partnering with HID for your Temenos integration will not only ensure that you have experts on your side to offer the best user experience, but also significantly shorten your time to market.

Enable the right security for the right user with massive scalability

Tailor your unique user journey through flexible and customizable authentication solutions that can be seamlessly integrated in your Temenos banking environment. Our approach is to secure today’s modern banking journeys through flexible workflows that have been rigorously tested to fit your end-to-end user needs.

Beyond traditional authentication that meets evolving banking needs

HID offers full authentication coverage to provide an end-to-end customer journey with some of the market’s broadest range of authentication solutions and form factors. Our authentication platform is backed with AI-based identity verification and real-time threat detection for true fraud prevention. By leveraging diverse modern authentication capabilities, including passwordless, phishing-resistant, risk-based, and adaptive authentication, HID’s authentication solutions are easy to deploy and flexible to grow with your business needs. The authentication services offered by HID are deployable in the public or private cloud and on premise and are highly interoperable with open standards and frameworks.

Delivered by a trusted industry leader

HID is your global security and identity expert. Benefit from the deep expertise of a proven leader in identity technology, trusted by financial institutions and other highly regulated industries around the world, to enable compliance with stringent data privacy, industry mandates and strong consumer authentication (SCA) relating to Open Banking.