Provider Category: Document Management

Glasswall Halo

Scalable Zero Trust file protection for any environment, any interface.

Halo is a cloud-native Content Disarm and Reconstruction (CDR) solution that provides security teams with infinitely scalable, Zero Trust file protection by removing the reliance on detection.

Glasswall Halo is a zero trust Content Disarm & Reconstruction (CDR) solution, built on scalable Kubernetes architecture, deployable on-premises, in the cloud, or within air-gapped networks. It sanitizes files to a known-good state, outperforming antivirus, sandboxing and EDR, and integrates via Web UI, APIs or ICAP servers. It supports seamless, high-performance protection across diverse environments.

Key benefits

Glasswall CDR delivers zero-trust file protection by rebuilding files into a safe, clean standard, eliminating malware risks. Outperforming antivirus, sandboxing, and EDR, it’s essential for secure file transfers across trust boundaries, ensuring trusted content without relying on detection.

Glasswall Halo, built on Kubernetes, delivers a cloud-native CDR solution that is highly scalable and easily deployable across diverse security environments. Its powerful architecture ensures seamless integration, robust performance, and adaptability for protecting files in on-premises, cloud, and hybrid deployments.

Glasswall Halo integrates seamlessly via API endpoints and ICAP servers, delivering zero trust file protection within document workflows. It removes threats in real time from web traffic by connecting with firewalls, proxies, and gateways, ensuring security wherever files move or are stored.

Glasswall Halo integrates ReversingLabs for multiscanning and real-time threat intelligence, using instant hash lookups to assess malware status. Safe files are automatically approved for use, while suspicious or malicious ones are blocked, adding extra layers of proactive file security.

Key features

85+ supported file types and counting

Sync and Async API endpoints for ease of integration with existing services

ICAP integration for web proxy servers, enabling SSL sanitization in real-time

Manage high-risk content in files (such as macros) with tailored security policies

Analyze original file risk with real-time classification of files through a vast database of known goodware and malware.

Kubernetes architecture provides highly-scalable protection to meet demand

Resources

Glasswall Halo product information

Glasswall Halo data sheet

Glasswall Halo documentation

Request a demo

Kinective

Streamline the eSignature experience. Integrated to the Temenos LMS loan origination module.

The IMM eSign Remote Connector makes electronic signature (eSignature) easier with direct integration to Temenos LMS Origination.

Key Features

Certified eSignature Connector

Reduce costs per transaction by decreasing paper generation and operating costs. IMM eSign Remote helps to execute account and loan documents faster, enabling account holders to open new accounts and start loans within minutes.

Streamlined Verification Process

The eSign Remote connector offers authentication options which enable financial institutions to easily verify the signer and validate the document integrity each time it is accessed going forward. Each option provides a greater level of assurance so the financial institution can match the option most appropriate to the transaction. IMM eSign Remote offers authentication options including email verification, share secret password authentication, and knowledge-based authentication (KBA) questions.

Ensured Compliance

Using the eSign Remote connector can help financial institutions meet compliance requirements by controlling the signing process and ensuring all information remains secure IMM eSign Remote is fully compliant with UETA and ESIGN acts as well as fully legally enforceable.

Benefits

Reduce Cost Through Efficiency Gains

Lower transaction expenses by minimizing paper usage and reducing operational overhead. IMM eSign Remote streamlines the signing process for account and loan documents, allowing customers to open accounts and initiate loans in just minutes.

Increase Efficiency

Use a single system to manage all online documents and signatures, as well as present pre-populated PDF documents with eSignature capabilities to account holders.

Increase Staff Productivity

The eSign Remote connector eliminates the time-consuming tasks associated with paper documents. Staff can send documents for signature to account and loan applicants instantly and set up automated reminders to progress the process. There is also no need to re-key data because eSign Remote can automatically update information from the system.

Resources

Kinective eSign Remote Connector-

Request a Demo

DocuSign Connector

eSignatures Made Easy with DocuSign. Integrated to the Temenos LMS Loan Origination Module.

The DocuSign connector allows documents generated in Temenos LMS Origination to be seamlessly transmitted to DocuSign for distribution and e-signature.

Key Features

Seamless Integration

Documents are seamlessly transferred from Temenos to DocuSign for signature using their standard “envelope” concept. DocuSign tracks all signature captures, as well as automatically distributes any necessary reminders and expiration notifications. During the document lifecycle, as well as when all signatures are obtained, DocuSign sends the updated and completed status back to Temenos and the documents are stored in the system or your archiving system for future reference.

Identify Signers

The DocuSign connector allows a financial institution representative to easily identify all appropriate document signers and reviewers within the platform. Individuals not marked as a signer or reviewer by default can be manually selected and added to the distribution list.

Security & Signature Verification

The identity of a signer can be verified using the optional ID Check. This security feature presents a signer with six verification questions, of which four must be answered correctly in order to gain access to the document(s).

Benefits

Single Platform Approach

DocuSign’s e-signature and notification services are fully integrated with Temenos LMS Origination. No longer will financial institution employees need to leave the system to distribute documents or check the status of applicant signatures.

Added Convenience

Using the DocuSign connector provides additional convenience to both the financial institution and potential applicant. Financial institution employees are no longer dependent on an applicant’s ability to visit a branch in order to finalize an account or loan. Applicants receive an enhanced experience through the ability to quickly and easily sign documents anywhere, anytime!”

Resources

DocuSign Connector

Request a Demo

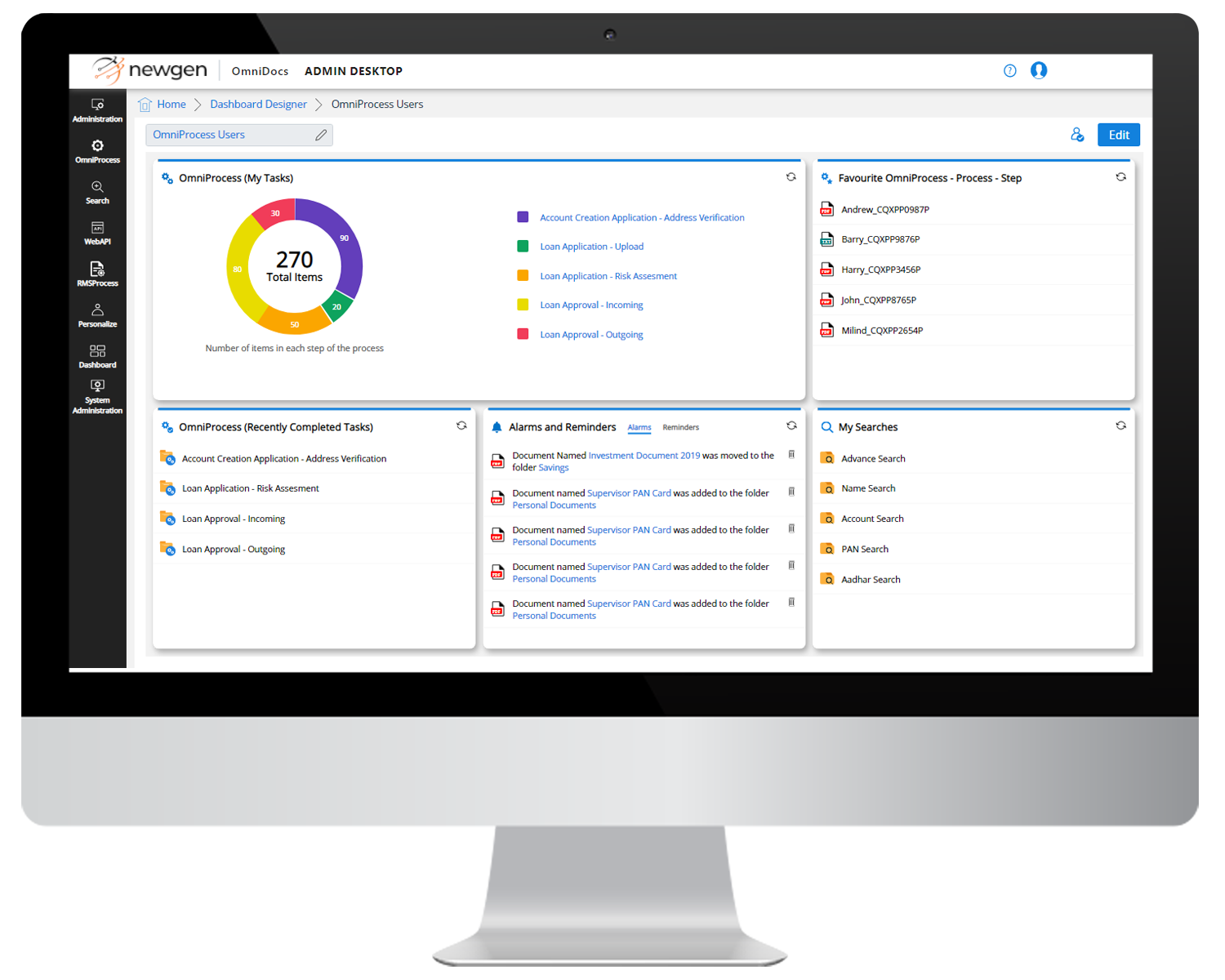

ONE OmniDocs – Newgen

Manage the entire content lifecycle while ensuring security and compliance for all your banking operations

NewgenONE OmniDocs platform helps organize content in a secure, centralized repository, and makes information available across your Temenos’ product suite. Using the OmniDocs, your employees to take quicker decisions by enabling anytime anywhere access and seamless collaboation with their peers. Furthermore, it helps enterprises mitigate business risks by ensuring compliance with various regulatory requirements and securing business-critical information.

Overview

Unified Access to Content

Easy access to document capabilities through an intuitive user interface to ensure a single source of truth.

Content Lifecycle Management

Streamline content management by capturing content from multiple sources, classifying it with metadata, surfacing it in frequently used applications, defining retention rules, and disposing of content when required.

Collaboration Among Users

Using a centralized repository, users can collaborate while avoiding content duplication and managing document versions. Annotations and notes can also be used to collaborate, and password-protected content can be shared.

Security and Monitoring

Assign user rights at file, folder, and cabinet levels and metadata-driven rights for enhanced security. Monitor users’ activities, capture audit trails, and generate system reports for detailed insights.

Compliance and Governance

Manage the document lifecycle while ensuring better compliance and governance. The platform is ISO, and DOD certified to meet various regulatory requirements.

Better SLA adherence

Better control over enterprise-wide content, resulting in enhanced compliance and SLA adherence

Request a Demo

bossDMS – Boss Info

bossDMS: Streamlined Document Management System for Banking Solutions

bossDMS streamlines document management for banks, consolidating all archiving needs into one secure system with central access control

Regardless of storage technology or application lifecycle, it efficiently archives automatically emails, ERP documents, contracts, and more. From data to file servers and SharePoint, bossDMS simplifies compliance and boosts productivity, allowing your team to focus on core banking operations.

Overview

Gain Time

Quickly find documents with a simple keyword search, reducing search time to just seconds and improving operational efficiency.

Reduce Costs & Avoid Duplicates

Centralized archiving eliminates duplicate storage across departments, reducing storage needs and cutting costs, replacing inefficient silos.

Flexible Access

Access important documents anytime, anywhere via laptop, smartphone, or tablet, enabling mobile banking operations.

Prevent Data Loss

Secure cloud storage ensures all documents are safely stored, protecting against data loss and ensuring continuous access.

Ensure Legal Compliance

Meet legal standards like Finma, GDPR, and GeBüV with automated compliance, ensuring full adherence to retention requirements.

Leverage Version Control

Versioning provides full transparency on document changes. Check-in/Check-out features ensure secure, exclusive editing rights.

Resources

Boss Info One Pager

ISV Assessments/Awards

| Category | Award | Date |

| Business Resiliency Accreditation | Builder | August 2023 |

| Sustainability Accreditation | Starter | August 2023 |

Interested in the full BossInfo report? Click here to buy it now.

Request a Demo

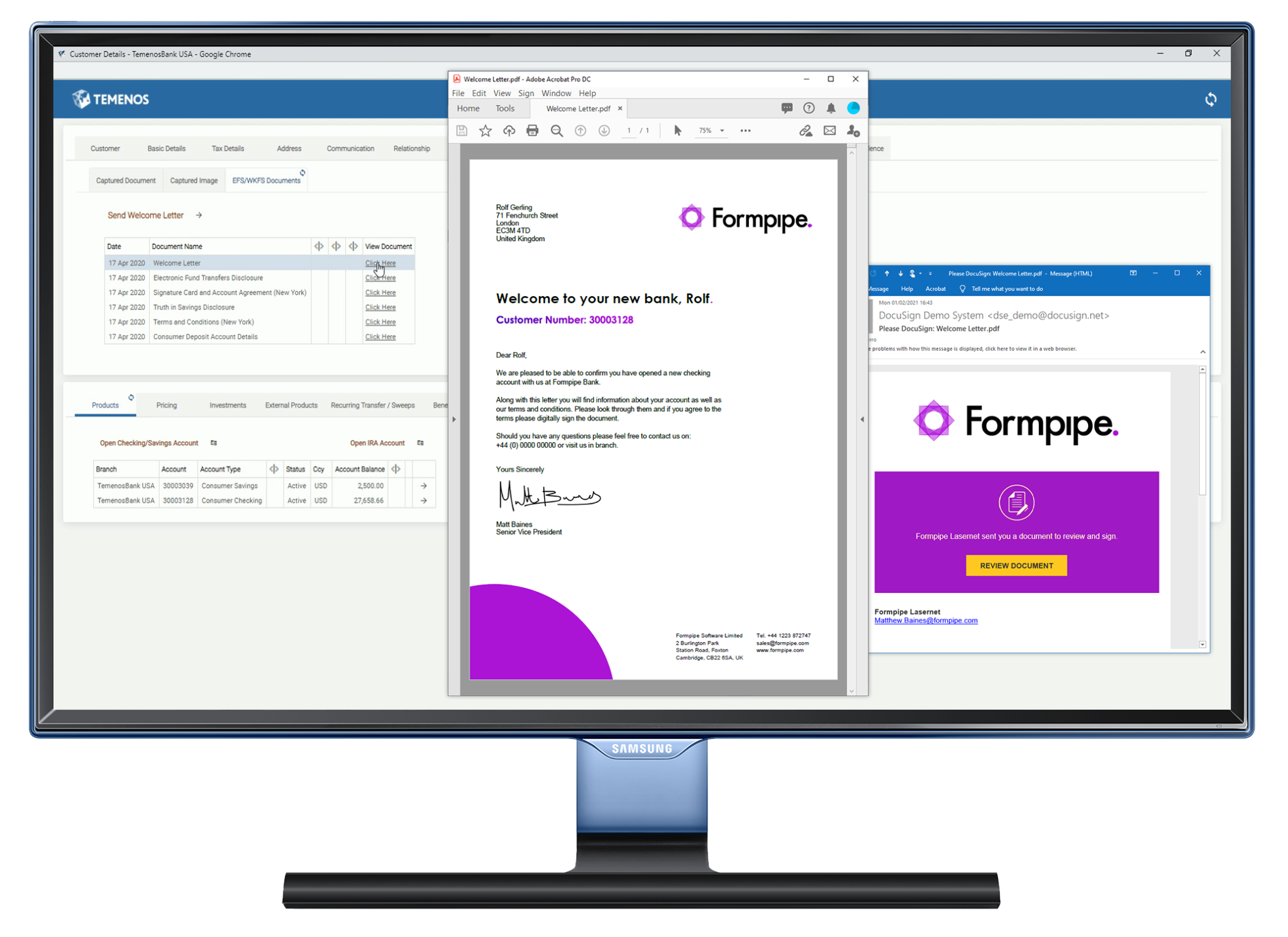

Formpipe Banking Solutions

Formpipe Banking Solutions – Industry Leading Output and Document Management for Temenos Customers.

The Complete Document Generation, Distribution, Archiving and Retrieval Solution for Your Bank.

Formpipe’s software uses the standard data in Temenos’ product suite to create perfectly designed and branded digital and hard copy documentation, across your entire banking network. With real-time distribution to customers & automatic digital archiving, documents and data can be accessed quickly and securely through the Temenos UI using Formpipe’s easy integrations or via mobile app / internet banking.

Overview

Generate

Lasernet takes care of your data, leaving you free to focus on your document design. Just create a digital template, then drag & drop the Temenos Transact output where you want it. No programming, no consultants and no delay.

Distribute

Formpipe’s software can automatically sort, batch, schedule and send your customer documents based on their preferences. Instantly broadcast to multiple channels, including: archive (& internet banking), email, API endpoints, local printers, external print houses, mobile messaging and network fax.

Archive

User friendly and quick to deploy, Autoform DM provides a centrally available, customer-focused digital repository, accessible from within all Temenos banking solutions. Staff and customers can access stored documents at the click of a button from a single interface.

Retrieve

24/7 secure access to documents 365 days a year is essential for modern banking and Autoform DM gives your staff and customers the ability to rapidly retrieve photos, signatures, forms, IDs and banking documents through Temenos Transact and Temenos Infinity.

Proven

Formpipe’s software is currently generating, archiving and distributing millions of documents around the clock for banks across the world. You can rely on Formpipe to give your customers and clients the information they want, exactly when they want it.

Quick to deploy

Whether on-premise, in the cloud or as SaaS, Formpipe’s easily integrated solutions and services, combined with their extensive project management experience, allow them to support the tight timelines, expectations and challenges of any core banking project.