Provider Category: Digital Identity & Security

Revolutionize onboarding with AI-Driven, secure, accurate and fast digital ID Verification

EnQualify is a state-of-the-art, AI-integrated digital ID verification platform built on Mobile Edge technology. Running four AI models simultaneously on mobile devices, it performs real-time deepfake and fraud detection with unparalleled speed and accuracy. By combining cutting-edge technology with seamless user experience, EnQualify empowers financial institutions to stay ahead of fraud, regulations, and rising customer expectations.

Key benefits

Mobile Edge AI Verification

With AI on Mobile Edge technology, EnQualify runs four AI models simultaneously on mobile devices—performing deepfake and fraud detection in real time. Enables secure digital ID verification in under five seconds, even offline.

Fully Automated Experience

Delivers an unprecedented user experience with a fully automated verification process—no manual intervention required. Seamlessly guides users through every step for a fast, smooth, and frustration-free onboarding.

Proven Accuracy & Efficiency

Achieves 99% accuracy and up to 90% successful onboarding completion rates, with 94.5% end-user satisfaction after onboarding—setting the market standard for reliability and customer trust.

Industry Recognition & Compliance

Recognized with the ICA Compliance Award for innovation in financial crime prevention and trusted by top-tier banks and fintechs, EnQualify ensures global compliance and superior security standards.

Key features

OCR & NFC Verification

Reads and verifications ID card data by checking all visual and chip-level security elements, ensuring accurate document validation and compliance with ICAO standards.

Face Recognition & Liveness Detection

Performs NIST-certified AI-based face recognition and liveness detection to prevent spoofing attacks, verifying user identity in real time.

Secure Video Identification

Supports WebRTC-based peer-to-peer video calls with integrated AI verification and agent dashboard capabilities, ensuring seamless and compliant remote onboarding.

Verification Platform

Provides a comprehensive back-office dashboard for decision-making, monitoring, and audit management—enabling real-time oversight of digital onboarding operations.

Resources

Request a demo

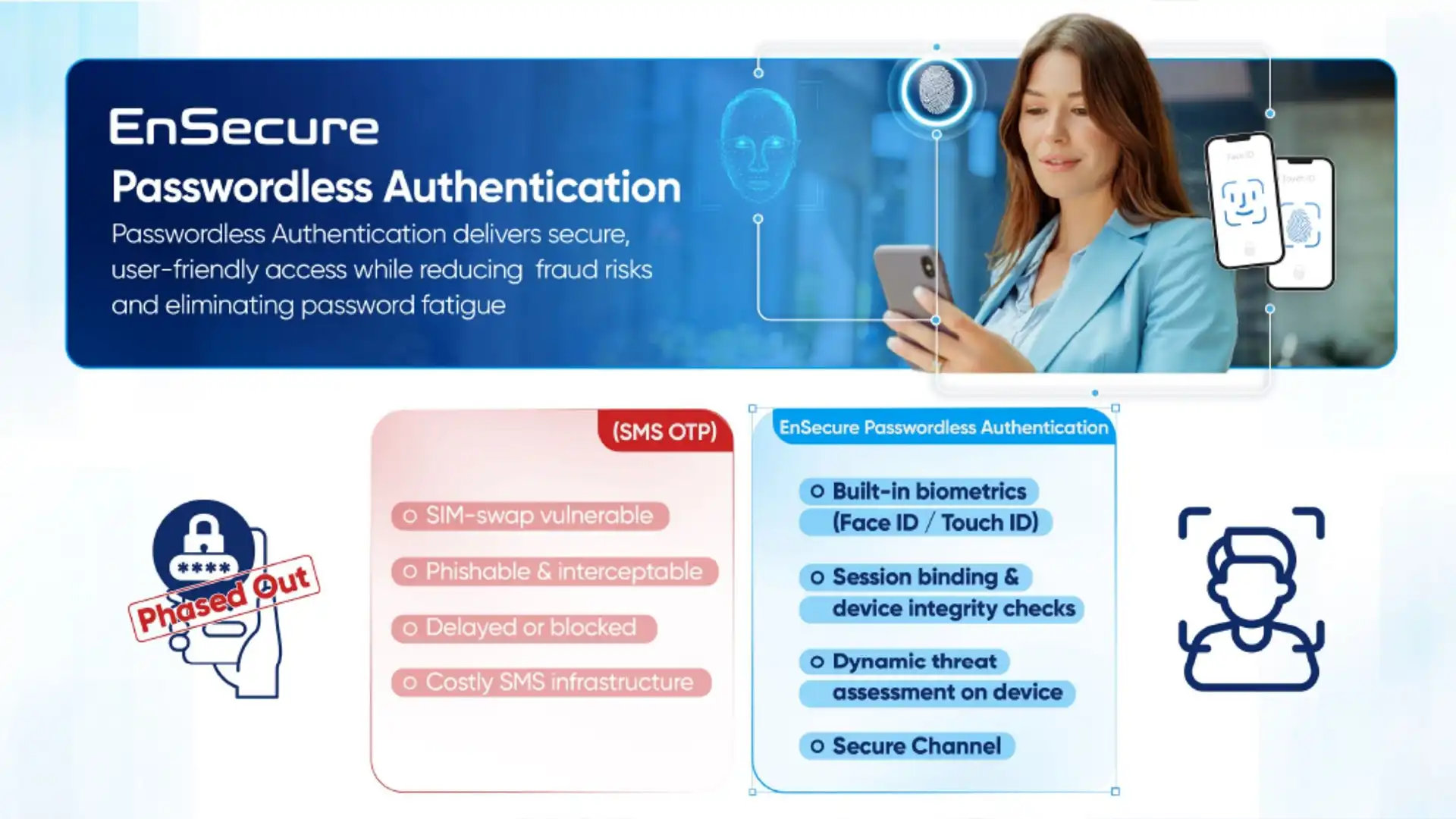

Enhance security with strong authentication for secure logins, transaction authorization and document signing

EnSecure provides robust multi-factor and passwordless authentication, enabling secure access, transaction signing, and document verification across digital channels. With advanced biometric verification, asymmetric signing for high-risk transactions, and seamless SDK integration, EnSecure ensures frictionless user experience, regulatory compliance, and unmatched protection for financial applications, all operational within a week.

Key benefits

Frictionless Yet Secure Experience

Built-in biometrics and QR-based verification simplify authentication into a single scan, eliminating password fatigue while maintaining enterprise-grade security.

Regulatory Compliance & Fraud Prevention

Meets global security and regulatory standards, protecting digital banking and financial applications against fraud, tampering, and unauthorized access.

Asymmetric Signing for High-Risk Transactions

Enhances transaction and document signing with asymmetric cryptography, ensuring integrity, non-repudiation, and maximum protection against advanced threats.

Rapid Integration with SD

EnSecure SDK integrates seamlessly with iOS and Android apps, enabling institutions to deploy strong authentication and digital signing solutions within a week.

Key features

Multi-Factor & Passwordless Authentication

Combines built-in biometrics, session binding, and adaptive authentication to deliver secure, user-friendly logins without passwords.

Document & Transaction Signing

Offers PKI-based digital signing with PAdES-compliant certificates, real-time validation, and Adobe Reader compatibility for legally binding digital transactions.

Mobile Application Shielding

Protects financial apps with anti-tampering, real-time fraud detection, cryptographic signing, and automatic blocking for compromised devices.

Multi-App / Channel Authentication

Enables users to authenticate once and confirm actions across web and mobile channels with push notifications and strong device binding.

Resources

Request a demo

Candour Face ID – Candour Identity

Candour Face ID – 1-second true identity verification in every interaction.

Candour Face ID: AI-Driven Instant Identity Verification for Seamless Security

Candour Face ID revolutionizes digital identity verification with AI-powered, instant biometric true verification for every login and transaction. It works like mobile phone facial recognition solutions for end-users but goes further, offering fraud-proof security in one second. Seamlessly integrating into any digital service, it ensures compliance, elevates trust, and provides unmatched user experiences through globally scalable, proprietary technology.

Benefits

Only instant true verification

Candour Face ID offers instant, fraud-proof biometric identity verification for every login and transaction, setting a new standard for security, compliance, and user trust.

Mobile phone facial recognition solution-like simplicity

Provides seamless biometric recognition that works effortlessly like mobile phone facial recognition solutions, while ensuring true identity verification and protecting sensitive transactions with unmatched ease for end-users.

Cost-effective solution

Candour Face ID is the most affordable biometric verification solution on the market, combining security, speed, and reliability at a fraction of competitors’ costs.

Global reach and compliance

Operating currently across 150 nationalities and adhering to stringent regulatory standards, Candour Face ID ensures worldwide usability and compliance for diverse user bases.

Overview

AI-powered true verification

Leverages cutting-edge AI for instant biometric verification with advanced liveness checks and anti-spoofing measures, ensuring unmatched security and accuracy.

One-second verification

Delivers true identity verification in just one second, transforming the identity check process into a seamless and efficient experience.

Proprietary technology

Developed 100% in-house, Candour Face ID eliminates reliance on third-party components, ensuring total control, cost efficiency, and continuous innovation.

Effortless system integration

Easily integrates via APIs or SDKs into existing digital services, enhancing security with minimal disruption to customer operations.

Resources

Candour Face ID One Pager

Candour Takeaway

Request a Demo

Everything begins with trusted identity. authID’s IDaaS platform delivers mobile biometric solutions that provide strong identity verification to enable businesses to grow without the fear of fraud.

authID stands at the axis of trusted identity and digital transformation, offering AI-powered, mobile identity proofing and multi-factor authentication solutions that serve as weapons in the ever-evolving battle against fraud. On-board more customers remotely and authenticate transactions anywhere in the world with speed, reliability and biometric certainty.

Overview

Identity Assurance. Business Growth

Onboard new customers with high-speed, accurate biometric matching. Reduce fraud and account takeover by extending the value of a “Proofed” identity to any transaction across all customer channels.

Global IDaaS Platform – Anywhere, Anytime

Multi-national client support across systems, languages and regulations. End-to-end identity solutions balance cost, IT drain and usability. Flexibility for customization via low-risk API integration.

Trusted Digital Identities. Trusted Transactions

Fast, remote identity proofing and multi-factor authentication. Auditable consent to everyday questions: “Who is applying online for a loan; logging into my systems; transferring funds; calling support.

Automated Document Verification. Trusted Data Sources

Biometric data and ID documents validated with trusted sources. Includes government registries, global validation of chip-based passports, and algorithms for North American driver’s licenses.

Secure, Seamless, “Live” User Experience

Balance usability and security with low-friction mobile identity solutions. Confirm the person holding the ID is present with Liveness detection and AI-powered anti-spoofing techniques.

Enhanced Security and Performance

Secure encryption, retention and segregation of biometric and PII data. High-speed biometric matching; automated document verification. Compliant with applicable data privacy and security laws.

Resources

Read Case Study

Watch Demo

ISV Assessments/Awards

ESG & Enterprise Readiness Assessment Scores for authID conducted by The Disruption House

| Category | Award | Date |

| Business Resiliency Accreditation | Leader | October 2024 |

| Sustainability Accreditation | Starter | October 2024 |

Interested in the full authID report? Click here to access now.

Request a Demo

HID Global – Identity Verification Service

An AI powered Identity Verification Solution for Digital Onboarding and Beyond.

HID Identity Verification Solution – An AI powered solution for seamless digital onboarding and beyond

HID’s Identity Verification Service (IDV) is an AI-powered solution for smooth digital onboarding and beyond. It is ideal for highly regulated industries such as banking.

The HID IDV is an industry-leading, all-in-one solution to fight against ID theft, fraud, and money laundering. This solution can be used to support compliance with various regulations such as KYC. Built on AI-powered decision-making technology with a 3-step automated process, IDV offers the smoothest and most secure identity verification journey available in the market today.

Our IDV solution goes beyond an onboarding solution, addressing multiple use-case scenarios for new and returning customers such as account reactivation, expired document renewal, updating primary account details, registering a new device and much more. It comes with a multitude of options ranging from a simple out-of-the-box option to highly customizable and rebranding alternatives.

What sets HID apart?

Pre-Integrated Features and Capabilities

Get a faster and more efficient implementation through HID’s 15 years of experience with the Temenos banking platform. HID’s consumer authentication solutions provide secure multi-factor authentication for login and transaction signing as well as risk-based authentication capabilities for banks using the Temenos banking platform ecosystem. HID is pre-integrated with the Temenos banking ecosystem and offers predefined workflows based on the very best banking practices to offer a superior user experience without compromising on security. The components can also be used to build a fully customized workflow should you choose to do so.

Partner Services

HID’s Identity and Access Management (IAM) Partner Services’ team are true Temenos banking platform experts. Their focus is on shortening the customer time to value realisation within the Temenos banking ecosystem. Following an agile delivery methodology, the team enables implementation partners by onboarding, training and supporting them on their Temenos integration journey. Partnering with HID for your Temenos integration will not only ensure that you have experts on your side to offer the best user experience, but also significantly shorten your time to market.

Enable the right security for the right user with massive scalability

Tailor your unique user journey through flexible and customizable authentication solutions that can be seamlessly integrated in your Temenos banking environment. Our approach is to secure today’s modern banking journeys through flexible workflows that have been rigorously tested to fit your end-to-end user needs.

Beyond traditional authentication that meets evolving banking needs

HID offers full authentication coverage to provide an end-to-end customer journey with some of the market’s broadest range of authentication solutions and form factors. Our authentication platform is backed with AI-based identity verification and real-time threat detection for true fraud prevention. By leveraging diverse modern authentication capabilities, including passwordless, phishing-resistant, risk-based, and adaptive authentication, HID’s authentication solutions are easy to deploy and flexible to grow with your business needs. The authentication services offered by HID are deployable in the public or private cloud and on premise and are highly interoperable with open standards and frameworks.

Delivered by a trusted industry leader

HID is your global security and identity expert. Benefit from the deep expertise of a proven leader in identity technology, trusted by financial institutions and other highly regulated industries around the world, to enable compliance with stringent data privacy, industry mandates and strong consumer authentication (SCA) relating to Open Banking.

Overview

Seamless User Experience

- An intuitive and convenient workflow for end-customers and businesses to securely submit their identity information anytime, anywhere in less than 1 minute.

- A Business Portal provides streamlined workflow for business to review and approve submissions

Ease of implementation

- Integrated into the existing workflows within a day

- Instantly customisable to the needs of the customer

- Fully branded with the business colours and logo in a few clicks

Robust Compliance

- Meet AML & KYC requirements without the complexity, cost, timelines and risk

- Industry-leading biometric, document and database checks verify that documents have not been forged or tampered with

Reduced Customer Dropoff

The seamless and convenient customer experience significantly reduces the number of customers that don’t complete the onboarding process

Reduced integration time

- Pre-integrated into Temenos Infinity and Temenos Transact, creating the user profile in T24 after the identity verification process

- Can be delivered with HID Authentication and HID Risk Management Solutions for a secure and consistent, end-to-end digital identity lifecycle

Reduced Risk of Identity Fraud

Each customer submission is thoroughly verified and authenticated using a suite of industry-leading technologies, thus reducing the risk of identity fraud for the business.

Resources

Executive Brief: HID Identity Verification Service

Request a Demo

HID Global – Risk Management Solution

One cohesive solution powered by AI-based behavioral intelligence for real-time threat detection and bank fraud prevention.

HID Risk Management Solution for real-time threat detection and fraud prevention

Introducing the HID Risk Management Solution (RMS) — a comprehensive approach to safeguarding all online banking channels and empowering organizations to effectively identify, assess, mitigate and monitor risks. This powerful solution offers a holistic defense against fraud thanks to its AI powered behavioral intelligence, the solution ensuring a secure and trustworthy digital experience for banks and other financial services providers. With HID RMS in place, organizations gain the tools and capabilities to build a seamless and reliable digital experience for their users. By implementing this cutting-edge solution, they can stay one step ahead of potential threats and create a safe environment, protecting both their users and their valuable assets.

What sets HID apart?

Pre-Integrated Features and Capabilities

Get a faster and more efficient implementation through HID’s 15 years of experience with the Temenos banking platform. HID’s consumer authentication solutions provide secure multi-factor authentication for login and transaction signing as well as risk-based authentication capabilities for banks using the Temenos banking platform ecosystem. HID is pre-integrated with the Temenos banking ecosystem and offers predefined workflows based on the very best banking practices to offer a superior user experience without compromising on security. The components can also be used to build a fully customized workflow should you choose to do so.

Partner Services

HID’s Identity and Access Management (IAM) Partner Services’ team are true Temenos banking platform experts. Their focus is on shortening the customer time to value realisation within the Temenos banking ecosystem. Following an agile delivery methodology, the team enables implementation partners by onboarding, training and supporting them on their Temenos integration journey. Partnering with HID for your Temenos integration will not only ensure that you have experts on your side to offer the best user experience, but also significantly shorten your time to market.

Enable the right security for the right user with massive scalability

Tailor your unique user journey through flexible and customizable authentication solutions that can be seamlessly integrated in your Temenos banking environment. Our approach is to secure today’s modern banking journeys through flexible workflows that have been rigorously tested to fit your end-to-end user needs.

Beyond traditional authentication that meets evolving banking needs

HID offers full authentication coverage to provide an end-to-end customer journey with some of the market’s broadest range of authentication solutions and form factors. Our authentication platform is backed with AI-based identity verification and real-time threat detection for true fraud prevention. By leveraging diverse modern authentication capabilities, including passwordless, phishing-resistant, risk-based, and adaptive authentication, HID’s authentication solutions are easy to deploy and flexible to grow with your business needs. The authentication services offered by HID are deployable in the public or private cloud and on premise and are highly interoperable with open standards and frameworks.

Delivered by a trusted industry leader

HID is your global security and identity expert. Benefit from the deep expertise of a proven leader in identity technology, trusted by financial institutions and other highly regulated industries around the world, to enable compliance with stringent data privacy, industry mandates and strong consumer authentication (SCA) relating to Open Banking.

Resources

HID Risk Management Solution (RMS) Executive Brief

HID Fraud Advisory and Mitigation Services Executive Brief

Request a Demo

REL-ID: Omnichannel Authentication – Uniken

Authentication, transaction signing, and MTD for Community & Inclusive Banking and Temenos Digital.

Seamless, Secure Authentication Across All Channels

REL-ID delivers seamless, omnichannel security for every client interaction, eliminating the need for passwords, tokens, and fragmented processes. Our platform ensures strong, passwordless authentication across all channels, from mobile to in-person, while protecting against evolving threats. REL-ID enables secure, frictionless experiences that scale effortlessly, ensuring both customer satisfaction and fraud prevention in one comprehensive solution.

Overview

Device Trustworthiness

Blocks connections from compromised devices at consumer speed using military-grade root/jailbreak/malware detection, ensuring only secure devices can access your services.

Secure Data-In-Transit

Ensures safe data transfer with an MITM-proof, beyond TLS secure communication tunnel, without adding operational complexity or cost.

True Omnichannel Support

Provides consistent, seamless customer experiences across all channels – online, mobile, call center, chat, digital assistant, and in-person—with unphishable, out-of-band authentication.

Customizable Policy Controls

Offers comprehensive, customizable set of policy controls based on device, user, and other context variables that align to unique business needs and risk parameters.

Strong Authentication Made Simple

Delivers mutual, simultaneous, and continuous multi-factor authentication built on 1:1 cryptographic keys directly from an app with the authenticator of choice.

Secure Data-at-Rest

Ensures a higher level of security than trusted execution environments (TEE) through locally stored, encrypted data utilizing a previously nonexistent key prior to a fully verified and trusted context is established.

APIS and Services Go Dark

Cloaks all public-facing APIs, services, and applications, allowing only strongly authenticated, authorized requests to access secured services.

Simple Integration

Easily integrates with your apps and services through REL-ID SDKs, ensuring the right level of security tailored to your specific needs and risk profiles.”

Resources

Omnichannel Authentication

REL-ID Datasheet

Solution Overview Video

Request a Demo

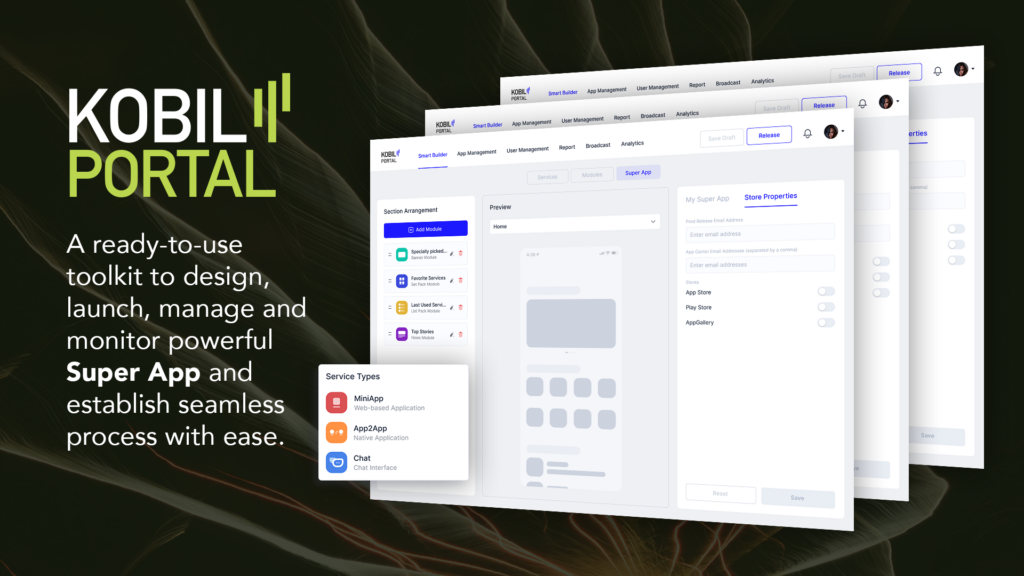

KOBIL Systems

Patented secure Identity, Chat, Signature and Payment solutions tailored to your needs from 200+ features, seamlessly integrated with Temenos Banking Solutions.

Supercharge your Bank with KOBIL & Temenos

Temenos client’s choice for secure and compliant ID solutions.

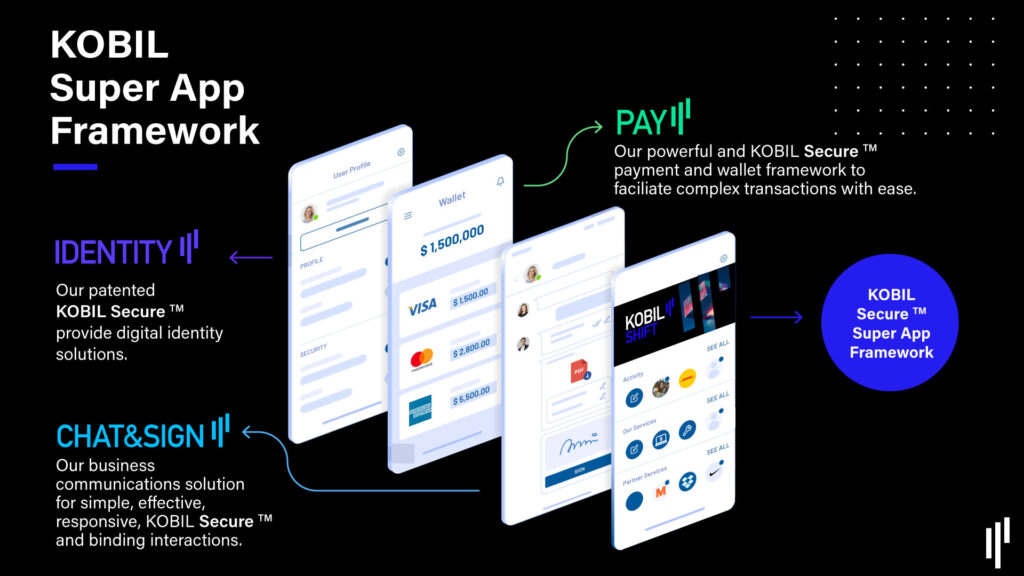

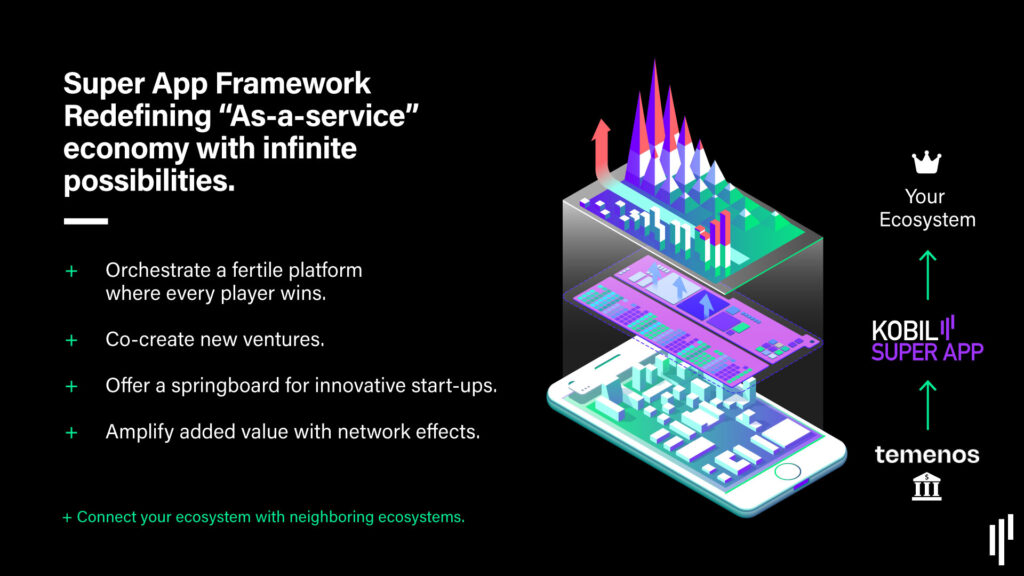

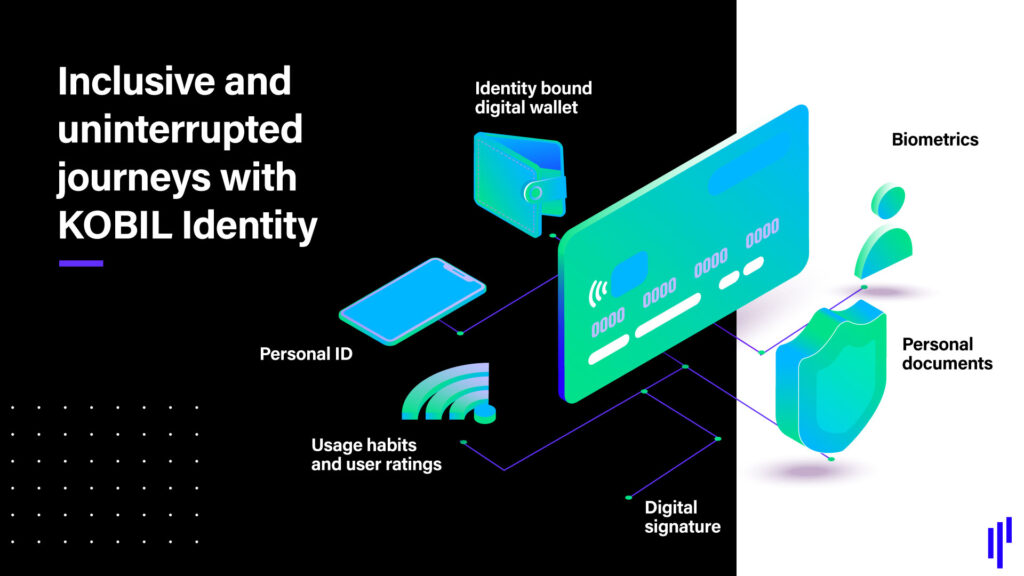

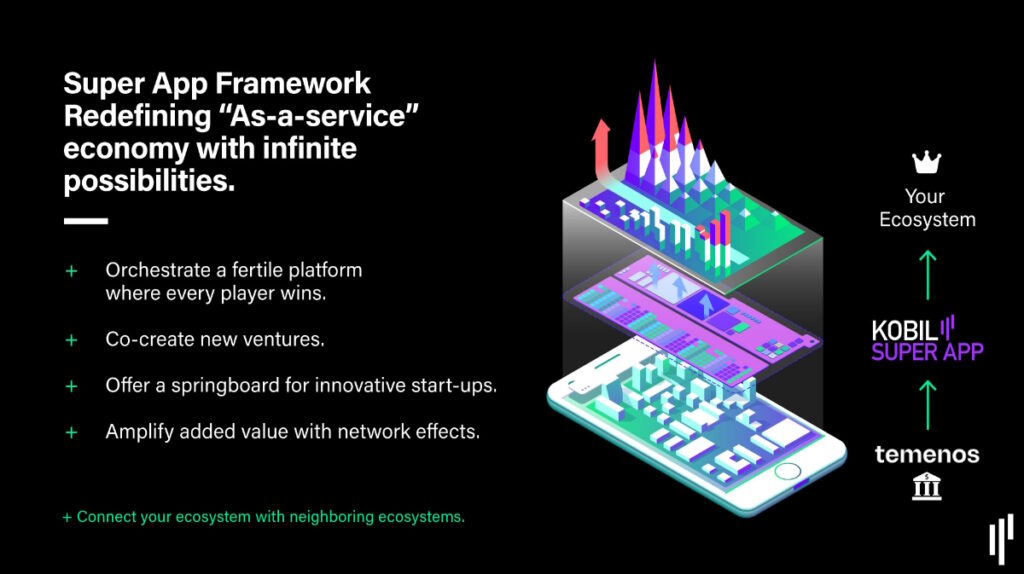

KOBIL is an all-in-one suite of high-secure digital identity technology provider, empowering businesses for sustainable growth via platform business models. With a low-code, modular development framework called KOBIL Super App Framework, build platforms with mini-apps to supercharge the customer experience. Compatible with Temenos platforms and more, prioritize seamless user experience on authentication and security with KOBIL.

KOBIL SUPER APP FRAMEWORK

One App, One Login, One User Experience – with all Banking Services. Super App for Every Bank!

KOBIL IDENTITY

Patented high-security digital Identity solutions

KOBIL CHAT&SIGN

Communication solutions for identity-bound and real-time interactions

KOBIL PAY

Secure Payment Gateway Solution

Overview

Secure Digital Banking

KOBIL’s multi-layered security approach ensures secure digital banking with Temenos platform.

Regulatory Compliance

KOBIL’s solutions comply with strict regulations, ensuring adherence to local and global banking standards.

User-Friendly Experience

KOBIL’s solutions provide a seamless and user-friendly experience for customers using Temenos banking platform.

Seamless Integration

KOBIL’s solutions integrate seamlessly with Temenos platform, providing a complete end-to-end solution.

Real-Time Authentication

KOBIL’s real-time authentication technology offers an added layer of security, ensuring customers’ data is secure.

Fraud Prevention

KOBIL’s solutions offer advanced fraud prevention techniques to help banks protect their customers’ data and assets.

Multi-Factor Authentication

KOBIL’s solutions offer multi-factor authentication to ensure only authorized personnel access sensitive banking data.

Identity Management

KOBIL’s solutions offer a complete identity management solution for Temenos banking platform.

Flexibility

KOBIL’s solutions are highly flexible, allowing banks to customize and adapt to their unique requirements.

Cost-Effective

KOBIL’s solutions offer a cost-effective solution for banks looking to enhance their digital banking experience with Temenos platform.

Features & Benefits

Request a Demo

HID Consumer Authentication for Modern Digital Banking Solutions

The HID consumer authentication solutions offer banks seamless, intelligent, and intuitive authentication for login and transaction signing. Available as a service (SaaS) or on premise, HID’s offering provides highly scalable authentication and enables for compliances with major central banking regulations as well as data privacy laws. It is also highly compatible with a wide range of authenticators including OTP tokens, FIDO authenticators and the award-winning HID Approve for push-based authentication. HID authentication significantly shortens the deployment time thanks to its pre-integration with the Temenos Banking Platform and helps banks bring innovative products and services confidently and quickly to market, while meeting evolving business needs.

What sets HID apart

Pre-Integrated Features and Capabilities

Get a faster and more efficient implementation through HID’s 15 years of experience with the Temenos banking platform. HID’s consumer authentication solutions provide secure multi-factor authentication for login and transaction signing as well as risk-based authentication capabilities for banks using the Temenos banking platform ecosystem. HID is pre-integrated with the Temenos banking ecosystem and offers predefined workflows based on the very best banking practices to offer a superior user experience without compromising on security. The components can also be used to build a fully customized workflow should you choose to do so.

Partner Services

HID’s Identity and Access Management (IAM) Partner Services’ team are true Temenos banking platform experts. Their focus is on shortening the customer time to value realisation within the Temenos banking ecosystem. Following an agile delivery methodology, the team enables implementation partners by onboarding, training and supporting them on their Temenos integration journey. Partnering with HID for your Temenos integration will not only ensure that you have experts on your side to offer the best user experience, but also significantly shorten your time to market.

Enable the right security for the right user with massive scalability

Tailor your unique user journey through flexible and customizable authentication solutions that can be seamlessly integrated in your Temenos banking environment. Our approach is to secure today’s modern banking journeys through flexible workflows that have been rigorously tested to fit your end-to-end user needs.

Beyond traditional authentication that meets evolving banking needs

HID offers full authentication coverage to provide an end-to-end customer journey with some of the market’s broadest range of authentication solutions and form factors. Our authentication platform is backed with AI-based identity verification and real-time threat detection for true fraud prevention. By leveraging diverse modern authentication capabilities, including passwordless, phishing-resistant, risk-based, and adaptive authentication, HID’s authentication solutions are easy to deploy and flexible to grow with your business needs. The authentication services offered by HID are deployable in the public or private cloud and on premise and are highly interoperable with open standards and frameworks.

Delivered by a trusted industry leader

HID is your global security and identity expert. Benefit from the deep expertise of a proven leader in identity technology, trusted by financial institutions and other highly regulated industries around the world, to enable compliance with stringent data privacy, industry mandates and strong consumer authentication (SCA) relating to Open Banking.