Provider Category: Core Banking & Infrastructure

Raise Partner - Smart Risk Decisions

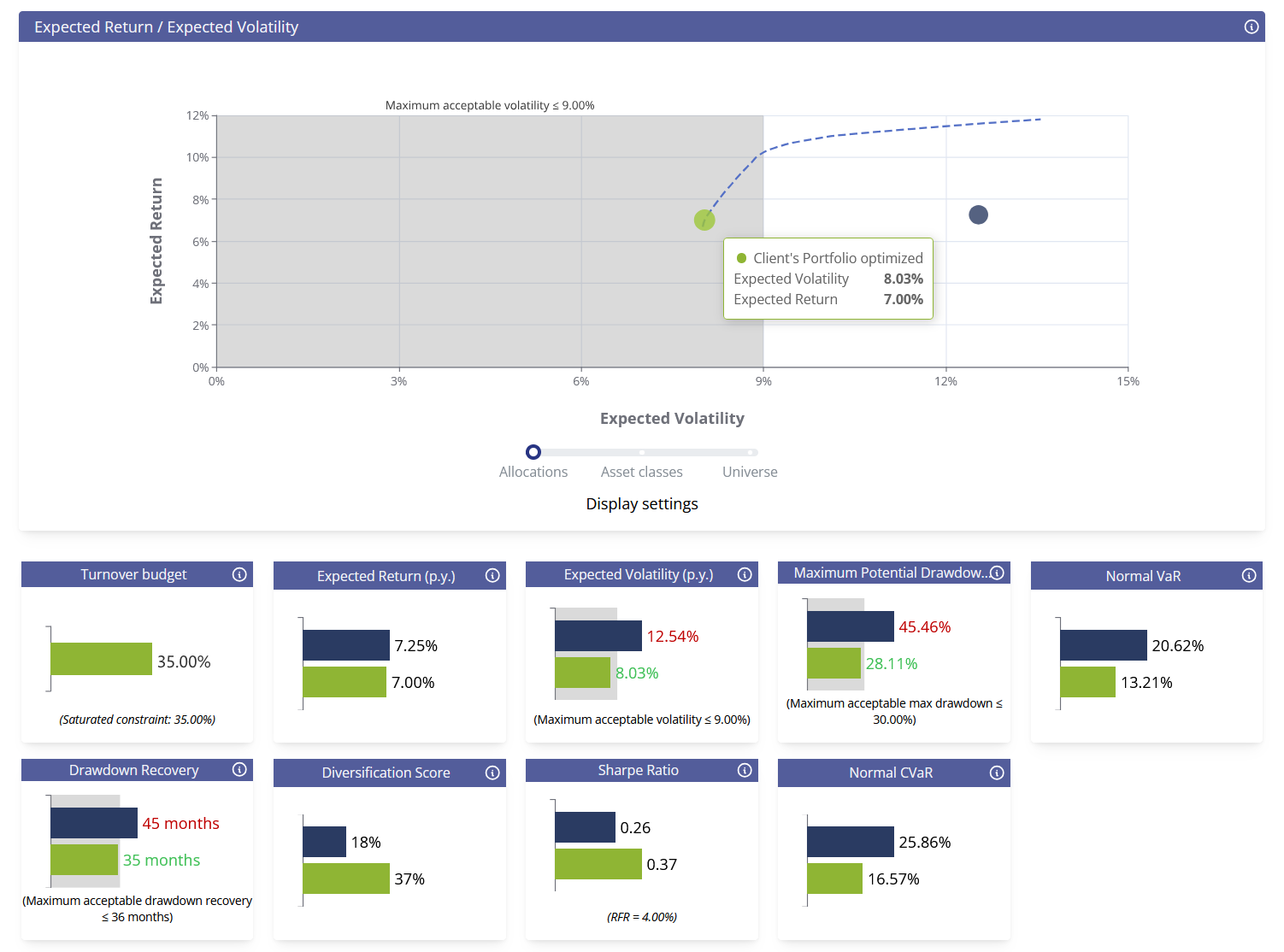

A turnkey web application that helps analyze and optimize multi-asset portfolios.

Tailored specifically for firms managing diversified investments, Smart Risk Decisions addresses growing client expectations for a global wealth approach and a personalised, transparent advice. With built-in market data and out-of-the-box analytics, advisers can simulate scenarios, assess risks, and deliver customised recommendations – instantly and seamlessly.

Key benefits

Total Portfolio View

Unified view across all asset classes — listed and private (equities, bonds, real estate, private equity, alternatives).”

Tailored investment proposals:

Client-centric approach to build tailored investment proposals based on client’s profile, objectives and preferences.

Advanced Risk Analytics:

Regulatory-compliant risk measures (volatility, VaR, drawdown, stress tests) to ensure robust decision-making.

Stronger Client Relationship:

Clear and visual insights to structure conversations, build transparency, and strengthen client trust.

Key features

Cross asset class portfolio risk and return analytics (absolute or relative to a benchmark)

Suitability analysis vs client profile

Scenario simulation and impact analysis

Portfolio optimization based on the client’s profile and preferences

Resources

Use case

Video

Request a demo

SAYA Platform - 3Cortex Technologies India PVT LTD

AI-powered automation for enterprise reconciliation & financial operations

Making business efficient through enterprise reconciliation, financial operations automation, and real-time insights

SAYA Platform streamlines financial operations by automating enterprise reconciliation, exception handling and reporting. Leveraging AI and Agentic workflows, it integrates disparate data sources, reduces manual effort by 70%, ensures compliance and delivers real-time insights — enabling banks and enterprises to operate with speed, accuracy and confidence.

Key benefits

DataX: unified & trusted data integration

Seamlessly connects ERP, CBS, SWIFT, files, and APIs—transforming fragmented data into clean, standardized inputs. Ensures reconciliation starts with accuracy, not cleanup.

ReconX: AI-powered reconciliation at scale

Automates complex matching with auto-rule creation, pattern recognition, and ATC. Achieves 99.9% accuracy across use cases like Nostro, G,L and inter-system reconciliations—with zero manual tuning.

ResolveX: autonomous exception resolution

Closes reconciliation gaps automatically by routing, suggesting, or posting corrections to core/ ERP systems. Reduces resolution time from days to minutes—no spreadsheets or IT tickets.

AnalytiX: real-time insight for smarter decisions

Turns operational data into actionable dashboards and predictive insights. Empowers CFOs with real-time KPIs on cash flow, compliance, and reconciliation health—role-based and audit-ready.

Key features

DataX: multi-source, multi-format data integration

Connects ERP, CBS, SWIFT, APIs, and files in 10+ formats (CSV, JSON, XML, Parquet, PDF, Excel). Automates transformation, anonymization, and mapping for trusted data ingestion.

ReconX: AI-driven reconciliation engine

Leverages Auto Rule Creation, Pattern Matching, AIM (Agent for Intelligent Matching) and Autonomous Tolerance Calibration (ATC) to match complex transactions with 99.9% accuracy

ResolveX: low-code exception workflow automation

Enables operations teams to design resolution workflows without IT. Integrates with external systems to auto-post corrections, reducing dependency and accelerating closures.

AnalytiX: real-time dashboards & predictive analytics

Provides role-based dashboards with live KPIs on reconciliation status, SLAs and exceptions. Includes predictive insights and audit-ready reporting for compliance teams.

Resources

SAYA platform overview

AI-driven finance analysis guide

SAYA knowledge base

Awards

ESG & Enterprise Readiness Assessment Scores for 3Cortex conducted by The Disruption House

| Category | Award | Date |

| Business Resiliency Accreditation | Builder | October 2025 |

| Sustainability Accreditation | Builder | October 2025 |

Interested in the full 3Cortex report? Click here to buy it now.

Request a demo

AI-driven real estate insights built to supercharge the customer experience for banks as well as the mortgage and credit risk processes for wealth manager’s and banks.

PriceHubble APIs and Platforms enable banks and financial institutions to build innovative digital experiences around the property their customers own, buy or sell, and to strengthen their mortgage credit risk process. PriceHubble products help customers open up new revenue streams and gain complete visibility of risks related to residential real estate.

Overview

Unique 360° view of all assets including real estate

Enable your clients to track the evolution of their home value within the online banking environment along with other asset classes.

Data-powered customer engagement

Leverage the depth and breadth of insights PriceHubble APIs provide to build relevant interactions for your customers’ plans for real estate selling, financing, buying or renting.

Property insights as ESG strategy enabler

ESG is increasingly relevant for your clients – PriceHubble can support them on the real estate part of their portfolio by providing the energy label data or potential renovation impact on value.

Instant collateral quality assessment

Evaluate, instantly and in detail, the collateral quality of your mortgage loans at origination and during their lifecycle using our industry leading data and dashboard.

Enhance the customer experience and increase retention

Leverage the unique emotional and financial value of real estate to boost the frequency and depth of your interactions with customers and enhance customer satisfaction.

Upgrade internal expertise and relevance

Become THE trusted partner in offering a new level of transparency on property. Detect intentions first, provide better recommendations, and stay relevant all along the real estate life cycle.

Unlock new revenue opportunities

Utilize the newly created transparency from the real estate asset class to create new advisory opportunities; making educated portfolio decisions, refinancing, rebalancing, improvement loans.

Accelerate property risk analysis

Identify possible issues early on by monitoring constantly and consistently across geographies, the evolution of the collateral value in your mortgage loan portfolio.

ISV Assessments/Awards

ESG & Enterprise Readiness Assessment Scores for Price Hubble conducted by The Disruption House

| Category | Award | Date |

| Business Resiliency Accreditation | Builder | October 2023 |

| Sustainability Accreditation | Builder | October 2023 |

Interested in the full Price Hubble report? Click here to buy it now.

Request a Demo

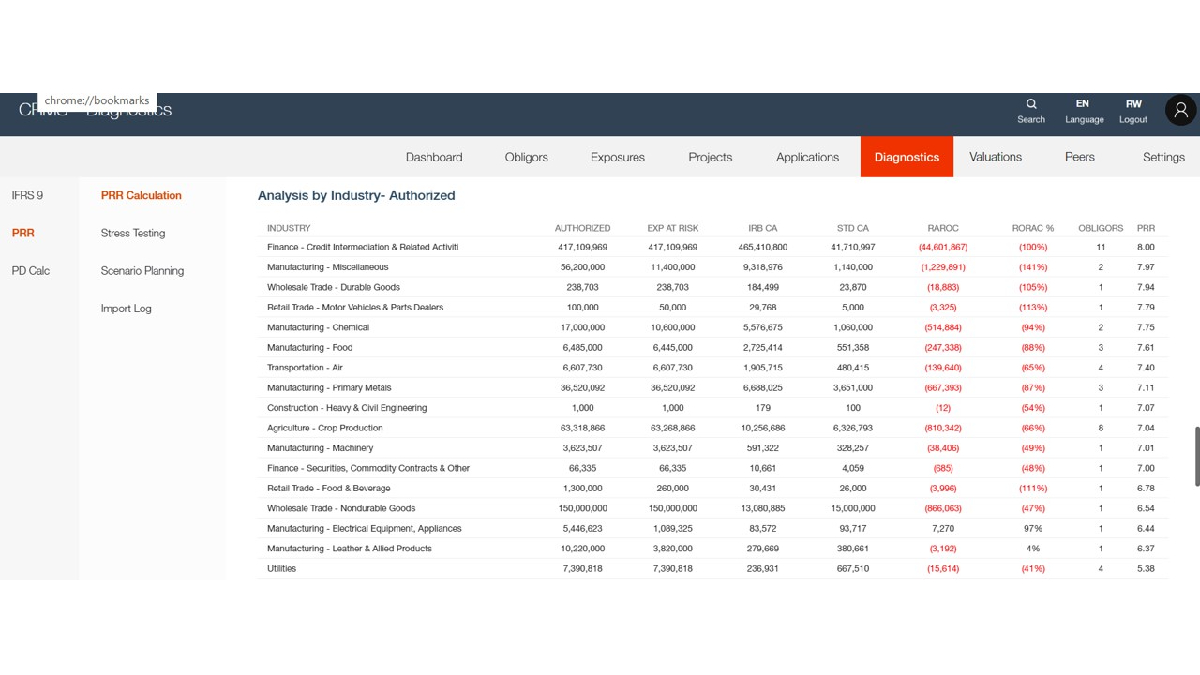

Portfolio Risk Rating (PRR) and Stress Testing – 6 Sigma

Portfolio Risk Rating (PRR) and Stress Testing

The PRR Module provides facility risk rated listing of exposures by industries, countries, portfolios, product and collateral types

It is used in stress testing the portfolio and provides the means to direct stratgy within the bank by product, industry and target market (hence adherance to Basel’s Principle 3 of Managing Credit Risk).

Portfolio Management is an integral part of the credit process that enables the Bank to manage concentrations, volatility, liquidity and achieve optimum earnings. It does so through portfolio strategies and planning, performance assessment and reporting functions into one comprehensive management process.

The module is fully configurable and user friendly. PIT ratings can be generated using 6 Sigma’s CRMS or imported from third parties. Outputs are on screen with summarized IRB and Standardized Capital Adequacy, RAROC, PRR by both Authorized and Outstanding. In addition to concentration listing, and breakdown of exposures by industries, countries, portfolios, product and collateral types. Export of data is availbale for good measure.

Overview

The module is fully configurable and user friendly. PIT ratings can be generated using 6 Sigma’s CRMS or imported from third parties. Outputs are on screen with summarized IRB and Standardized Capital Adequacy, RAROC, PRR by both Authorized and Outstanding. In addition to concentration listing, and breakdown of exposures by industries, countries, portfolios, product and collateral types. Export of data is availbale for good measure.

- ORR and FRR

- RAROC and RORAC both Authorized and Outstanding

- Concentration Authorized and Outstanding

- Capital Adequacy (IRB and STD) and PRR measurement

- Breakdown by Industry, Facility, Collateral, Country etc.

- Stress Test the results.

In a user-friendly, efficient, and accurate manner. Essentially the steering wheel of a bank.

Resources

Brief PRR Presentation 2023

ISV Assessments/Awards

ESG & Enterprise Readiness Assessment Scores for 6 Sigma conducted by The Disruption House

| Category | Award | Date |

| Business Resiliency Accreditation | Builder | October 2023 |

| Sustainability Accreditation | Builder | October 2023 |

| Business Resiliency Accreditation | Builder | December 2024 |

| Sustainability Accreditation | Builder | December 2024 |

Interested in the full 6 Sigma report? Click here to buy it now.

Request a Demo

BankHedge, the back-to-front automated hedging platform for banks, lets you build and control your hedging business and deliver a uniquely rich yet simple self-service hedging to SMEs.

BankHedge lets banks enrich their offering with a simple yet comprehensive self-service FX hedging experience for SMEs, including FX forwards and options, margin credit, and transparent in-trade pricing. BankHedge is cloud-based, designed for easy integration, and automates all key processes, facilitating product line expansion with minimal upfront and recurring costs, enabling banks to generate lucrative new revenue streams.

Overview

Customer Loyalty

Increase income and loyalty from your SME customers by making previously hard-to-access FX hedging solutions accessible and affordable to them, at virtually zero cost-of-acquisition (CAC), in the familiar context of your SME banking UX.

Product Expansion

Enrich and diversify your offering with automated FX hedging solutions for SMEs, including high-margin products such as FX options, access to margin credit, multi-currency accounts and payments in 30+ currencies – opening up new market segments for yourself.

Brand Enhancement

Make your SME clients’ life easier by making previously hard-to-access FX hedging solutions accessible and afforable via a simple, transparent, self-service digital FX hedging experience, available 24/7.

Cost Optimization

Keep GTM risks, upfront costs and recurring expenses to a bare minimum thanks to cloud-based deployment, cutting-edge entreprise architecture and full process automation.

Rich hedging solutions, simple UX

Unrivalled product offering: FX options/forwards/spot in 30+ currencies, multi-currency accounts/wallets/payments, margin credit. Bank portal to control product catalogue, mark-ups & fees, client comms, beneficiaries/transactions/notifications, user-access, permissions, real-time reporting. SME self-service portal: automated quotes, transparent T&Cs, in-trade pricing, embedded learning materials.

Cutting-edge Architecture

The platform’s layers are seamlessly integrated yet decoupled, and its underlying capabilities are organised into modular domains which support seamless growth as well as expansion beyond FX hedging into other asset classes. API for embedding services in any UI.

Efficiency & Scalability

100% automated end-to-end processes, including for more complex transactions (e.g. FX options) from self-service UX all the way to settlement; cloud-based SaaS deployment; end-user self-service UX.

Agility & Flexibility

Modular and easily-configurable solution with pre-integrated connectivity to liquidity providers and flexible risk warehousing; easy to integrate with your back-office and risk management systems, and with any liquidity providers you wish to use.

Request a Demo

HID Global – Identity Verification Service

An AI powered Identity Verification Solution for Digital Onboarding and Beyond.

HID Identity Verification Solution – An AI powered solution for seamless digital onboarding and beyond

HID’s Identity Verification Service (IDV) is an AI-powered solution for smooth digital onboarding and beyond. It is ideal for highly regulated industries such as banking.

The HID IDV is an industry-leading, all-in-one solution to fight against ID theft, fraud, and money laundering. This solution can be used to support compliance with various regulations such as KYC. Built on AI-powered decision-making technology with a 3-step automated process, IDV offers the smoothest and most secure identity verification journey available in the market today.

Our IDV solution goes beyond an onboarding solution, addressing multiple use-case scenarios for new and returning customers such as account reactivation, expired document renewal, updating primary account details, registering a new device and much more. It comes with a multitude of options ranging from a simple out-of-the-box option to highly customizable and rebranding alternatives.

What sets HID apart?

Pre-Integrated Features and Capabilities

Get a faster and more efficient implementation through HID’s 15 years of experience with the Temenos banking platform. HID’s consumer authentication solutions provide secure multi-factor authentication for login and transaction signing as well as risk-based authentication capabilities for banks using the Temenos banking platform ecosystem. HID is pre-integrated with the Temenos banking ecosystem and offers predefined workflows based on the very best banking practices to offer a superior user experience without compromising on security. The components can also be used to build a fully customized workflow should you choose to do so.

Partner Services

HID’s Identity and Access Management (IAM) Partner Services’ team are true Temenos banking platform experts. Their focus is on shortening the customer time to value realisation within the Temenos banking ecosystem. Following an agile delivery methodology, the team enables implementation partners by onboarding, training and supporting them on their Temenos integration journey. Partnering with HID for your Temenos integration will not only ensure that you have experts on your side to offer the best user experience, but also significantly shorten your time to market.

Enable the right security for the right user with massive scalability

Tailor your unique user journey through flexible and customizable authentication solutions that can be seamlessly integrated in your Temenos banking environment. Our approach is to secure today’s modern banking journeys through flexible workflows that have been rigorously tested to fit your end-to-end user needs.

Beyond traditional authentication that meets evolving banking needs

HID offers full authentication coverage to provide an end-to-end customer journey with some of the market’s broadest range of authentication solutions and form factors. Our authentication platform is backed with AI-based identity verification and real-time threat detection for true fraud prevention. By leveraging diverse modern authentication capabilities, including passwordless, phishing-resistant, risk-based, and adaptive authentication, HID’s authentication solutions are easy to deploy and flexible to grow with your business needs. The authentication services offered by HID are deployable in the public or private cloud and on premise and are highly interoperable with open standards and frameworks.

Delivered by a trusted industry leader

HID is your global security and identity expert. Benefit from the deep expertise of a proven leader in identity technology, trusted by financial institutions and other highly regulated industries around the world, to enable compliance with stringent data privacy, industry mandates and strong consumer authentication (SCA) relating to Open Banking.

Overview

Seamless User Experience

- An intuitive and convenient workflow for end-customers and businesses to securely submit their identity information anytime, anywhere in less than 1 minute.

- A Business Portal provides streamlined workflow for business to review and approve submissions

Ease of implementation

- Integrated into the existing workflows within a day

- Instantly customisable to the needs of the customer

- Fully branded with the business colours and logo in a few clicks

Robust Compliance

- Meet AML & KYC requirements without the complexity, cost, timelines and risk

- Industry-leading biometric, document and database checks verify that documents have not been forged or tampered with

Reduced Customer Dropoff

The seamless and convenient customer experience significantly reduces the number of customers that don’t complete the onboarding process

Reduced integration time

- Pre-integrated into Temenos Infinity and Temenos Transact, creating the user profile in T24 after the identity verification process

- Can be delivered with HID Authentication and HID Risk Management Solutions for a secure and consistent, end-to-end digital identity lifecycle

Reduced Risk of Identity Fraud

Each customer submission is thoroughly verified and authenticated using a suite of industry-leading technologies, thus reducing the risk of identity fraud for the business.

Resources

Executive Brief: HID Identity Verification Service

Request a Demo

HID Global – Risk Management Solution

One cohesive solution powered by AI-based behavioral intelligence for real-time threat detection and bank fraud prevention.

HID Risk Management Solution for real-time threat detection and fraud prevention

Introducing the HID Risk Management Solution (RMS) — a comprehensive approach to safeguarding all online banking channels and empowering organizations to effectively identify, assess, mitigate and monitor risks. This powerful solution offers a holistic defense against fraud thanks to its AI powered behavioral intelligence, the solution ensuring a secure and trustworthy digital experience for banks and other financial services providers. With HID RMS in place, organizations gain the tools and capabilities to build a seamless and reliable digital experience for their users. By implementing this cutting-edge solution, they can stay one step ahead of potential threats and create a safe environment, protecting both their users and their valuable assets.

What sets HID apart?

Pre-Integrated Features and Capabilities

Get a faster and more efficient implementation through HID’s 15 years of experience with the Temenos banking platform. HID’s consumer authentication solutions provide secure multi-factor authentication for login and transaction signing as well as risk-based authentication capabilities for banks using the Temenos banking platform ecosystem. HID is pre-integrated with the Temenos banking ecosystem and offers predefined workflows based on the very best banking practices to offer a superior user experience without compromising on security. The components can also be used to build a fully customized workflow should you choose to do so.

Partner Services

HID’s Identity and Access Management (IAM) Partner Services’ team are true Temenos banking platform experts. Their focus is on shortening the customer time to value realisation within the Temenos banking ecosystem. Following an agile delivery methodology, the team enables implementation partners by onboarding, training and supporting them on their Temenos integration journey. Partnering with HID for your Temenos integration will not only ensure that you have experts on your side to offer the best user experience, but also significantly shorten your time to market.

Enable the right security for the right user with massive scalability

Tailor your unique user journey through flexible and customizable authentication solutions that can be seamlessly integrated in your Temenos banking environment. Our approach is to secure today’s modern banking journeys through flexible workflows that have been rigorously tested to fit your end-to-end user needs.

Beyond traditional authentication that meets evolving banking needs

HID offers full authentication coverage to provide an end-to-end customer journey with some of the market’s broadest range of authentication solutions and form factors. Our authentication platform is backed with AI-based identity verification and real-time threat detection for true fraud prevention. By leveraging diverse modern authentication capabilities, including passwordless, phishing-resistant, risk-based, and adaptive authentication, HID’s authentication solutions are easy to deploy and flexible to grow with your business needs. The authentication services offered by HID are deployable in the public or private cloud and on premise and are highly interoperable with open standards and frameworks.

Delivered by a trusted industry leader

HID is your global security and identity expert. Benefit from the deep expertise of a proven leader in identity technology, trusted by financial institutions and other highly regulated industries around the world, to enable compliance with stringent data privacy, industry mandates and strong consumer authentication (SCA) relating to Open Banking.

Resources

HID Risk Management Solution (RMS) Executive Brief

HID Fraud Advisory and Mitigation Services Executive Brief

Request a Demo

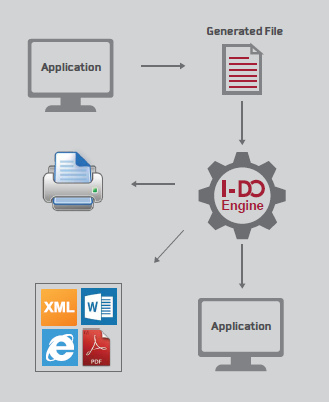

Integrated Data Output

Design, customize, and generate your own report, from multiple data sources. Are you looking for an easy solution to design and generate customized reports? We have the right solution for you. Our Output Management solution is a powerful free-form report designing business tool, to create custom template layouts at will. The solution provides customers with the capability of designing, formatting, editing, and generating reports and templates quickly and easily, interfacing with Microsoft Office. This is possible through our partnership with Windward, a provider of template design tools.

Overview

Business Oriented

Any business user, such as marketers, can easily create and design custom report templates.

Techies are out!

Your developers need not waste their time on designing reports for business units.

Integration is Key

Integrate your systems into one application in a reduced time, without the monotonous manual intervention.

It’s Alive

Transform your Multiple data sources into lively graphs and charts.

Embrace Management

I-DO does not only integrate with T24, but also with current and potential software solutions such as ERP, CRM, etc.

It’s all about Security

Manage your print output securely according to the data, conditions, and confidentiality.

Time is of the Essence

Reduce delays by applying automatic schedules and email distribution rules.

Features

Our state-of-the-art solution allows you to create report templates in Microsoft Office. The interface permits you to:

- Select only the data you wish to view on your report with simple drag and drop actions, using the XML file generated as data source.

- Add calculations and text fields

- Repeat parts and include conditional parts of the document

- Sort the data in any desired manner

- I-DO design tool comes as an Office plugin, it adds a ribbon to Word, Excel, PowerPoint…

- I-DO design tool is user friendly: no need for experienced developers to design an output

IMS IDO Rules Engine will provide:

- The ability to set parametric conditions on each report

- The ability to print locally in each branch

- The ability to set rule-based printing actions by report, including but not limited to:

- Method of printing

- Ability to invoke more than one report based on the data provided by T24

- Ability to group more than one output file from T24 into one document to be printed

- The ability to hold or suspend the printing of a document based on details available within the data provided

- Maintaining document security and regulatory compliance by implementing rules that can prevent confidential documents from being printed or inform the user when they are printed

I-DO integrates with T24 or any other software application installed using common integration interfaces.

- I-DO works using multiple data source formats utilizing several integration types: Directory based, Web services, Database Listeners, etc.

- I-DO acts as a listener for one or several applications at the same time.

After the report is generated in the desired format, it can be delivered by various means:

- I-DO generates reports in many formats such as PDF, DOCX, XLSX, PPTX

- I-DO can then store and print reports

I-DO is a fully-automated tool

- I-DO will be triggered automatically and will deliver the output at runtime in a glance

I-DO helps you transform your complex reports into charts and graphs.

- With I-DO, users and clients can easily analyze significant patterns, trends, and correlations that might go undetected in text-based or tabular formats

- Users can easily use the generated graphs to compare data and to track changes over time

The below features classify I-DO as your right solution:

- E-Statement

- Customer Independence: Client does not need to revert back to vendor while developing reports

I-DO is in constant growth! Below are our upcoming features:

- Interactive E-Statement

- Additional Plug and Play templates

- API to retrieve statistical data on the executes jobs by I-DO